Global Baggage Scanner Market

Market Size in USD Billion

CAGR :

%

USD

9.35 Billion

USD

15.58 Billion

2024

2032

USD

9.35 Billion

USD

15.58 Billion

2024

2032

| 2025 –2032 | |

| USD 9.35 Billion | |

| USD 15.58 Billion | |

|

|

|

|

Baggage Scanner Market Size

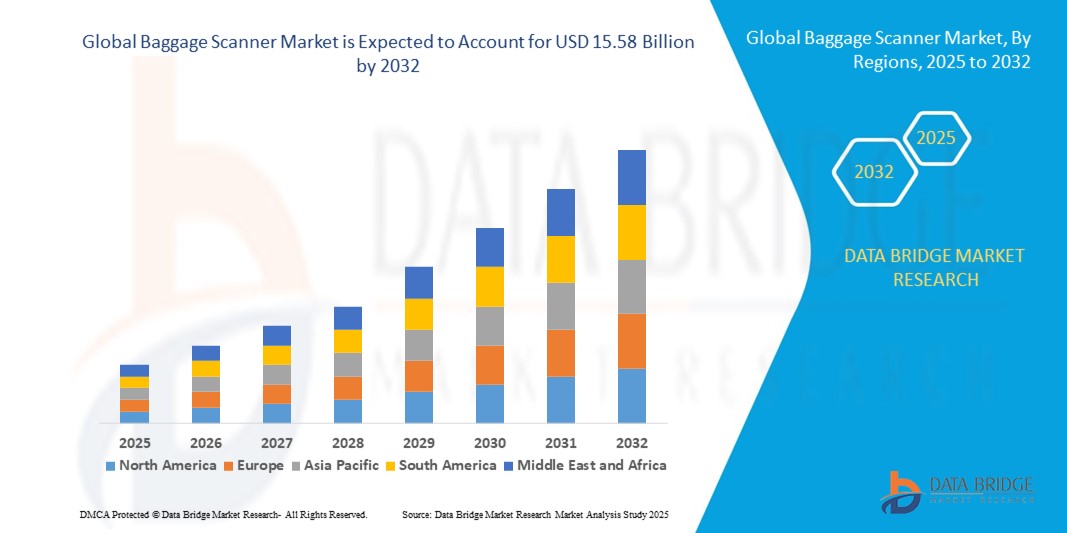

- The global baggage scanner market size was valued at USD 9.35 billion in 2024 and is expected to reach USD 15.58 billion by 2032, at a CAGR of 6.58% during the forecast period

- The market growth is largely fueled by increasing global air and rail passenger traffic, stringent security regulations, and the rising need for advanced threat detection systems at transportation hubs

- Furthermore, the integration of AI, machine learning, and real-time monitoring features into modern baggage scanners is enhancing operational efficiency and accuracy, prompting widespread adoption across airports, rail terminals, and other high-traffic environments. These factors are collectively accelerating the deployment of smart baggage scanning solutions, thereby driving sustained growth across the industry

Baggage Scanner Market Analysis

- Baggage scanners are advanced security screening systems that use X-ray, computed tomography (CT), or AI-enhanced imaging to inspect luggage for prohibited or dangerous items in public and transportation infrastructures

- The increasing demand for baggage scanners is driven by heightened global security concerns, evolving regulatory frameworks, and the need for faster, more accurate, and automated screening solutions in high-throughput environments such as airports, rail stations, and border checkpoints

- North America dominated the baggage scanner market with a share of 36.34% in 2024, due to high air travel volume, strict aviation security regulations, and continued investments in airport infrastructure

- Asia-Pacific is expected to be the fastest growing region in the baggage scanner market during the forecast period due to expanding airport and rail networks, increasing international travel, and heightened focus on security infrastructure in emerging economies

- Barcode segment dominated the market with a market share of 70.2% in 2024, due to its low cost, easy implementation, and compatibility with existing systems. Barcodes are widely used across the air and rail transport sectors for tracking baggage from check-in to reclaim. They support basic routing and identification and are well-suited for legacy infrastructure. The widespread availability of barcode scanners and printers supports their continued dominance

Report Scope and Baggage Scanner Market Segmentation

|

Attributes |

Baggage Scanner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Baggage Scanner Market Trends

Growing Technological Advancements

- The global baggage scanner market is rapidly evolving with the integration of next-generation technologies such as AI-powered threat detection, real-time data analytics, facial biometrics, and blockchain-based data trails—reshaping how security screening is handled at airports, railway stations, and checkpoints

- For instance, Smiths Detection has rolled out new dual-view and 3D CT scanning solutions with advanced AI threat recognition, enabling faster and more accurate detection of weapons and explosives in baggage, while Leidos is expanding its AI-enhanced 4D baggage scanners in leading international airports

- The shift toward touchless, automated scanning infrastructure is spurring demand for platform-as-a-service (PaaS) models, predictive security, and modular systems that can be upgraded with minimal disruption, fostering resilience in global supply chains

- Adoption of smart scanning technology is driven by growing passenger traffic, regulatory mandates for unified security protocols, and government investment in modernizing transportation hubs in high-growth regions such as Asia-Pacific

- Regulatory compliance trends are leading to the design of baggage scanners with privacy safeguards and integrated cybersecurity capabilities to address increasing concerns over data protection, especially in markets governed by strict standards such as GDPR

- Companies are investing in remote diagnostic and predictive maintenance features for baggage scanners, enabling real-time monitoring and rapid troubleshooting to minimize downtime and ensure continuous operation during peak travel periods

Baggage Scanner Market Dynamics

Driver

Significant Growth in Air Travelling

- Increased air travel and the rebound of global aviation post-pandemic are primary drivers of baggage scanner market demand, with passenger volumes at airports reaching new highs and requiring advanced, efficient screening systems to ensure safety and smooth operations

- For instance, Rapiscan Systems has partnered with major airports in India and the Middle East to deploy X-ray and CT-based scanners in response to rising passenger throughput and security requirements at expanded terminals and new airport facilities

- Enhanced security regulations implemented worldwide are compelling airports and transit hubs to upgrade to AI-powered, automated baggage screening solutions that offer improved accuracy and reduce processing times, meeting regulatory compliance

- Growing infrastructure investments by airport authorities and governments in both developed and emerging regions are supporting the adoption of smart security solutions, enabling integrated, real-time monitoring for streamlined passenger flows

- The increasing need to detect a wide array of threats, such as explosives, narcotics, and illicit goods, coupled with end-user demand for seamless, contactless experiences, is fostering innovation and market expansion for advanced baggage scanner technologies

Restraint/Challenge

High Cost Associated with Implementation

- Capital-intensive initial investment is a key restraint, as modern baggage scanner systems—especially multi-view CT and AI-integrated devices—require significant funding for procurement, installation, and integration with existing infrastructure

- For instance, deployment of advanced dual-view or quantum-enabled scanners by Nuctech and L3Harris Technologies at large international airports is often delayed or scaled due to high upfront costs and complex system compatibility requirements

- Maintenance complexity and the need for specialized technical know-how can further escalate lifetime costs, making it challenging for smaller airports, border posts, or public venues to justify such technology upgrades

- Regulatory variability, including differing compliance criteria for technology certifications across regions, creates additional hurdles, as manufacturers and end-users must navigate complex certification and equipment interoperability issues

- Privacy and data-protection concerns associated with increasingly sophisticated imaging and biometric-enabled scanners raise passenger anxieties, requiring vendors to invest in robust encryption, privacy safeguards, and transparent privacy policies to build trust and comply with mandates such as the GDPR

Baggage Scanner Market Scope

The market is segmented on the basis of mode of transport, solution, check-in services, conveying, and tracking.

- By Mode of Transport

On the basis of mode of transport, the baggage scanner market is segmented into airport, marine, and rail. The airport segment accounted for the largest market revenue share in 2024, supported by stringent security protocols, rising passenger traffic, and mandatory baggage screening regulations across international and domestic terminals. Airports require high-throughput, accurate scanning systems to manage increasing traveler volumes and to detect threats efficiently, which fuels adoption. Continuous infrastructure upgrades and the growing use of CT-based and automated screening systems further bolster demand in this segment. Airlines are prioritizing passenger safety and operational efficiency, pushing for smart baggage handling ecosystems. Government mandates, international aviation standards, and real-time detection systems also contribute to the segment's dominance. Increasing airport privatization and terminal expansions globally strengthen the revenue potential of this segment.

The rail segment is projected to witness the fastest growth rate from 2025 to 2032, as governments and operators enhance railway security frameworks, especially across high-speed rail networks and urban transit hubs. Rising passenger traffic, especially in developing countries, is pushing rail authorities to adopt advanced baggage scanning solutions. Heightened concerns over terrorism, smuggling, and safety have triggered the deployment of integrated scanning systems in railway stations. Smart urban mobility plans and the expansion of metro and intercity rail infrastructure are accelerating the need for enhanced baggage screening. Scanners are being adopted for large-capacity luggage systems and high-frequency commuter trains. Real-time surveillance integration and low-latency alert systems also support adoption. Rail terminals are becoming critical nodes in national security, promoting consistent investment.

- By Solution

On the basis of solution, the baggage scanner market is segmented into check-in, screening and loading, conveying and sorting, and unloading and reclaim. The screening and loading segment dominated the market in 2024 owing to the critical importance of security threat detection in early baggage handling stages. Government regulations require efficient scanning before loading to mitigate risks and ensure passenger safety. Advanced scanning technologies such as dual-view X-rays and 3D CT scanners are deployed at this stage for accurate threat identification. Automation and AI-powered recognition systems are reducing false positives while improving speed and accuracy. The demand is also fueled by increasing global air travel and the need for centralized security infrastructure. Airlines are investing in high-throughput screening setups to reduce congestion. The inclusion of biometric-linked baggage loading adds to operational reliability.

The conveying and sorting segment is expected to grow at the highest CAGR from 2025 to 2032, driven by rising investments in automated baggage handling systems across modern airports. These systems reduce manual labor and increase throughput, improving passenger satisfaction and operational efficiency. AI and machine learning technologies are being used to optimize bag routes and avoid misplacement or delays. Integration with smart sensors and scanning nodes allows for seamless baggage identification, sorting, and redirection. Transport hubs are focusing on minimizing baggage transfer time and misrouting, especially for transit passengers. The rise of multi-terminal airports has further amplified the need for advanced conveying infrastructure. Automated failover systems and diagnostics improve system uptime and reliability. Digital twins and IoT integration are also emerging trends boosting adoption.

- By Check-In Services

On the basis of check-in services, the market is segmented into assisted service and self-service. The assisted service segment held the largest revenue share in 2024 due to its continued relevance in legacy systems and for high-security or special assistance passengers. These systems are widely used in developing countries or smaller transport hubs with limited digital infrastructure. Manual check-in counters allow for human verification and special baggage handling, including oversized or sensitive luggage. Airlines and transit authorities rely on these systems for exception management and passenger assistance. Many VIP and business class passengers also prefer human interaction during check-in. Assisted services are often integrated with document verification and security screening at the same point. Regulatory requirements for manual checks in certain regions sustain demand.

The self-service segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the rising adoption of digital and contactless technologies in airports and transport hubs. Self-check-in kiosks equipped with baggage scanners enable faster, low-touch passenger processing. These systems reduce queues, lower labor costs, and are well-suited for high-volume environments. Integration with biometric authentication and mobile apps improves the passenger experience and enhances operational efficiency. The COVID-19 pandemic accelerated the demand for touchless solutions, making self-service the preferred option in many regions. Airlines and airport authorities are actively rolling out fully automated self-bag-drop stations. Real-time system updates and auto-reconciliation reduce human error and improve data transparency. Sustainability and reduced paper usage also support this trend.

- By Conveying

On the basis of conveying, the baggage scanner market is segmented into conveyor and destination coded vehicle (DCV). The conveyor segment dominated the market in 2024 owing to its widespread deployment across airports and transport hubs. Conveyor belts provide an efficient, continuous flow of baggage and integrate well with various stages of scanning and sorting. They support high volumes and are reliable for both domestic and international terminals. Conveyors are easy to maintain and scalable, allowing for system upgrades and retrofits in existing terminals. Their ability to automate handoffs between check-in, screening, and loading reduces manual handling and operational errors. Compatibility with RFID, barcode, and imaging systems further enhances functionality. Smart conveyor systems with embedded diagnostics and predictive maintenance features are gaining traction.

The DCV segment is projected to witness the highest growth from 2025 to 2032, driven by its precision, speed, and automation capabilities. DCVs are autonomous vehicles that route individual bags intelligently to their destination using coded instructions. They enable flexible and modular baggage systems that minimize the need for large fixed infrastructure. DCVs can adapt to varying traffic volumes and reduce transfer times in large terminals or between terminals. These systems support better space utilization and are ideal for newly built smart airports and major transit hubs. Advanced tracking and low error rates make them attractive for high-value or time-sensitive luggage. Operators benefit from real-time updates, system redundancy, and quick scalability. Integration with centralized control systems and digital twins enhances coordination and efficiency.

- By Tracking

On the basis of tracking, the baggage scanner market is segmented into barcode and radio frequency identification (RFID). The barcode segment held the highest revenue share of 70.2% in 2024 due to its low cost, easy implementation, and compatibility with existing systems. Barcodes are widely used across the air and rail transport sectors for tracking baggage from check-in to reclaim. They support basic routing and identification and are well-suited for legacy infrastructure. The widespread availability of barcode scanners and printers supports their continued dominance. Staff familiarity, minimal training requirements, and interoperability make barcodes the default choice for many operators. Improvements in barcode quality and scanning accuracy further sustain usage. However, their limitations in real-time updates and durability in extreme conditions pose challenges.

The RFID segment is expected to register the fastest growth from 2025 to 2032, owing to its superior tracking accuracy, real-time monitoring, and automation potential. RFID tags enable continuous updates on baggage location and movement without line-of-sight scanning. Airlines and airports are rapidly adopting RFID to reduce baggage mishandling and improve passenger satisfaction. The integration of RFID with automated scanning and sorting systems enhances the visibility and speed of baggage operations. RFID also supports predictive analytics, allowing operators to preempt issues and optimize system performance. The technology’s compatibility with mobile apps and self-service kiosks offers passengers greater control over their baggage. Global air transport associations are pushing for industry-wide RFID adoption. Falling costs and standardization efforts are accelerating its deployment across all transport modes.

Baggage Scanner Market Regional Analysis

- North America dominated the baggage scanner market with the largest revenue share of 36.34% in 2024, driven by high air travel volume, strict aviation security regulations, and continued investments in airport infrastructure

- Transport hubs across the region are adopting advanced baggage scanning technologies such as CT and AI-powered X-ray systems to enhance throughput and reduce screening times

- The market is further supported by homeland security mandates, growing urban transit networks, and rapid integration of automated baggage handling systems, solidifying North America’s position as a key adopter of smart scanning solutions

U.S. Baggage Scanner Market Insight

The U.S. baggage scanner market captured the largest revenue share in 2024 within North America, attributed to stringent TSA standards, robust federal funding for aviation security, and the growing demand for smart airport systems. Major airports across the country are upgrading to next-generation screening equipment to manage rising passenger volumes while maintaining strict security compliance. The integration of machine learning algorithms for threat detection and the widespread use of RFID tracking are enhancing baggage scanning performance. Continued expansion in rail and maritime terminals also supports the need for efficient baggage inspection across different transport modes.

Europe Baggage Scanner Market Insight

The Europe baggage scanner market is projected to grow at a significant CAGR over the forecast period, propelled by rising concerns over terrorism, increasing cross-border travel, and the modernization of transportation infrastructure. The European Union's focus on standardizing aviation security and implementing advanced threat detection protocols is leading to the adoption of cutting-edge scanning technologies. Investments in intermodal transportation networks and the introduction of smart screening solutions in rail and marine terminals are expanding the scope of baggage scanning applications. The demand is also rising across commercial and government facilities requiring advanced screening systems.

U.K. Baggage Scanner Market Insight

The U.K. baggage scanner market is anticipated to grow at a strong CAGR during the forecast period, driven by airport modernization programs, regulatory upgrades in line with global standards, and the deployment of smart baggage handling systems. Major hubs such as Heathrow and Gatwick are incorporating CT scanners and AI-powered threat recognition tools to improve security and passenger flow. The country’s commitment to digital transformation and post-Brexit security enhancements is prompting increased investment in smart infrastructure across all modes of transport.

Germany Baggage Scanner Market Insight

The Germany baggage scanner market is expected to expand at a notable CAGR during the forecast period, supported by a well-developed transportation network and rising focus on security innovation. Germany’s major airports and rail terminals are embracing automation in baggage screening processes through the integration of smart scanning, conveying, and tracking solutions. Government efforts to bolster public safety and the integration of IoT into critical infrastructure are facilitating technology upgrades. The demand for energy-efficient and high-speed scanning systems aligns with Germany's emphasis on sustainability and operational efficiency.

Asia-Pacific Baggage Scanner Market Insight

The Asia-Pacific baggage scanner market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by expanding airport and rail networks, increasing international travel, and heightened focus on security infrastructure in emerging economies. Countries such as China, India, and Japan are heavily investing in smart baggage handling systems supported by national programs targeting transportation modernization and urban safety. The presence of global and domestic scanner manufacturers, along with falling technology costs, is making advanced scanning solutions accessible to a wider base of transit hubs. Rapid urbanization and the rise in intercity travel are also boosting demand for high-throughput, automated scanning technologies.

Japan Baggage Scanner Market Insight

The Japan baggage scanner market is gaining momentum due to the country’s emphasis on innovation, safety, and efficiency within public transit systems. With Tokyo and other metropolitan cities investing in smart transportation infrastructure, there is a growing adoption of compact, AI-enabled baggage scanning systems in airports and train stations. Japan’s aging population is driving demand for intuitive, user-friendly scanning equipment with minimal human intervention. Integration with automated ticketing and biometric entry systems is also fueling growth in the country’s baggage security ecosystem.

China Baggage Scanner Market Insight

The China baggage scanner market accounted for the largest revenue share in Asia-Pacific in 2024, driven by large-scale investments in airport expansion, high-speed rail development, and urban metro systems. The country is aggressively deploying advanced baggage scanning systems in response to rising passenger volumes and tightening security regulations. Strong domestic manufacturing capabilities and technological advancements in AI, 3D imaging, and RFID integration are accelerating the availability of cost-effective solutions. Government-backed smart city initiatives and the digitalization of transit infrastructure continue to propel the demand for high-performance baggage scanners across all transport modes.

Baggage Scanner Market Share

The baggage scanner industry is primarily led by well-established companies, including:

- Siemens (Germany)

- Daifuku Co., Ltd. (U.K.)

- Vanderlande Industries B.V. (Netherlands)

- Pteris Global Limited (U.S.)

- Logplan (Spain)

- Grenzebach Group (U.S.)

- G&S Airport Conveyer (U.S.)

- BEUMER GROUP (U.K.)

- Alstef Group (U.S.)

- Babcock International Group PLC (U.K.)

- DSA Detection (France)

- Scarabee Aviation Group B.V. (Netherlands)

- ICM Airport Technics (U.S.)

- Omega Aviation Services Inc (U.S.)

- SITA (Japan)

- Delite Systems Engineering Pvt Ltd (U.S.)

- Smiths Detection Group Ltd. (U.S.)

Latest Developments in Global Baggage Scanner Market

- In February 2023, Smiths Detection introduced the HI-SCAN 6040 CTiX Model S, a compact version of its widely adopted CT passenger checkpoint scanner, aiming to meet the growing demand for space-efficient, high-performance security systems. By delivering Computed Tomography capabilities in a smaller footprint, the new model expands Smiths Detection’s portfolio to address the needs of airports and facilities with limited space. This launch enhances the company's competitive edge in the global baggage scanner market and reinforces its leadership in CT-based threat detection technologies

- In January 2023, Smiths Detection launched the HI-SCAN 5030C X-ray scanner, targeting smaller security checkpoints such as schools, hotels, and government buildings. With high-resolution imaging and compact design, the scanner meets the rising need for reliable and cost-effective screening solutions in non-airport environments. This strategic product introduction broadens the company's market reach beyond aviation and addresses the growing security demands in urban, educational, and governmental infrastructures, thereby accelerating its presence in emerging verticals

- In December 2022, Hikvision India introduced one of the country’s earliest AI-based X-ray baggage scanners, featuring intelligent threat detection and real-time video monitoring capabilities. This launch signifies a major technological advancement in the Indian baggage scanner market, where the integration of AI is still nascent. By embedding intelligent features and operational flexibility such as variable speed, Hikvision is setting new benchmarks in smart security solutions, driving digital transformation and security automation across India’s public infrastructure and transportation sectors

- In November 2022, L3Harris Technologies unveiled a fully integrated baggage handling and security solution, designed to streamline airport operations by merging screening systems with advanced baggage logistics. This innovation offers a unified approach to threat detection and baggage management, enhancing operational efficiency and security compliance. The solution positions L3Harris as a major player in the global market by offering value-added integration services that address both passenger throughput and security effectiveness, helping airports future-proof their infrastructure

- In October 2022, OSI Systems secured a key contract to supply its advanced baggage scanning technologies to a major European airport, strengthening its footprint in the region’s aviation security market. The deal underscores the company’s continued success in deploying high-throughput, high-accuracy screening systems in one of the most regulated and competitive regions. This contract enhances OSI Systems' revenue potential and also reinforces its reputation as a trusted partner for mission-critical airport security infrastructure across Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Baggage Scanner Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Baggage Scanner Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Baggage Scanner Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.