Global Bagging Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.06 Billion

USD

4.57 Billion

2024

2032

USD

3.06 Billion

USD

4.57 Billion

2024

2032

| 2025 –2032 | |

| USD 3.06 Billion | |

| USD 4.57 Billion | |

|

|

|

|

Bagging Equipment Market Size

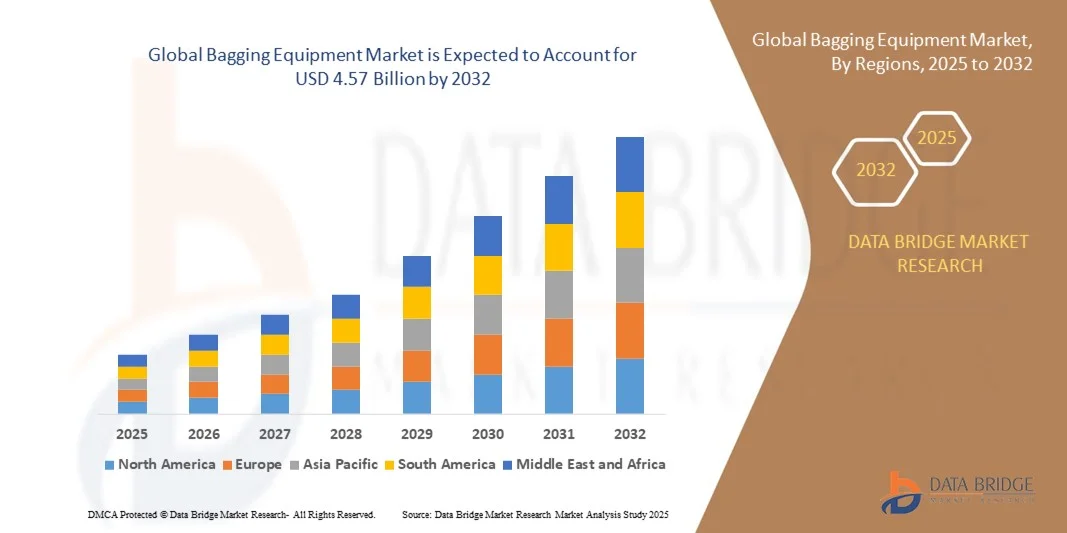

- The global bagging equipment market size was valued at USD 3.06 billion in 2024 and is expected to reach USD 4.57 billion by 2032, at a CAGR of 4.51% during the forecast period

- The market growth is largely fuelled by the increasing demand for efficient and automated packaging systems across industries such as food, agriculture, chemicals, and construction, aiming to enhance productivity and reduce manual labor

- The rising adoption of smart and energy-efficient bagging machines with integrated weighing, sealing, and labeling capabilities is further propelling market expansion

Bagging Equipment Market Analysis

- The global bagging equipment market is witnessing steady growth owing to the rising need for automation and cost optimization in packaging processes. Industries are increasingly replacing traditional manual packaging systems with automated solutions to achieve higher speed, accuracy, and operational efficiency

- The growing trend of sustainable packaging, coupled with innovations such as robotic bagging lines and IoT-enabled monitoring systems, is driving market modernization

- North America dominated the bagging equipment market with the largest revenue share in 2024, driven by advanced industrial automation, well-established manufacturing infrastructure, and the widespread adoption of smart packaging systems across food, agriculture, and construction sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global bagging equipment market, driven by rising manufacturing activities, increasing adoption of advanced packaging machinery, and supportive government initiatives promoting industrial automation

- The integrated bagging lines segment held the largest market revenue share in 2024, driven by their ability to automate multiple packaging processes including weighing, filling, sealing, and labeling within a single system. These systems are widely adopted in large-scale industrial facilities for their efficiency, consistency, and reduced labor dependency

Report Scope and Bagging Equipment Market Segmentation

|

Attributes |

Bagging Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Automated Packaging Systems, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bagging Equipment Market Trends

Integration of Automation and Smart Technologies in Bagging Equipment

• The increasing integration of automation, robotics, and smart control systems is revolutionizing the bagging equipment market, enhancing precision, productivity, and efficiency in packaging operations. These advanced systems minimize human intervention, reduce errors, and optimize material handling, leading to improved output consistency and reduced operational downtime. With rising global competition, manufacturers are leveraging automation to meet growing consumer demand while maintaining cost efficiency and quality standards

• The growing adoption of Industry 4.0 and IoT-enabled systems allows manufacturers to monitor and control bagging operations remotely, improving process transparency and predictive maintenance. This digital connectivity ensures real-time data insights and facilitates energy-efficient operation, particularly beneficial for large-scale production facilities. Integration with AI-driven software also enables automated fault detection, real-time diagnostics, and optimization of equipment performance, leading to greater operational resilience

• Demand for automated bagging lines is expanding across sectors such as food, agriculture, and chemicals, where accuracy and speed are critical. Automated weighing, filling, and sealing systems are replacing traditional semi-automatic models, enabling higher throughput and lower labor dependency. These systems also support flexible packaging formats, helping companies cater to diverse product ranges and dynamic market requirements efficiently

• For instance, in 2024, several food packaging companies in the U.S. adopted AI-driven bagging systems capable of adjusting parameters automatically based on product type and weight, significantly reducing waste and increasing line efficiency. The deployment of machine-learning algorithms in these systems enhances quality control, ensuring uniform packaging and minimizing product rejection rates. This shift toward smart automation is setting new industry benchmarks for productivity and sustainability

• While automation drives innovation and productivity, the upfront cost of integrating smart bagging systems remains a challenge for small and medium enterprises. Continuous R&D, cost optimization, and modular system design are essential to enhance adoption and ensure long-term market growth. As more companies embrace automation, the development of scalable and plug-and-play systems is expected to democratize access to advanced packaging technologies globally

Bagging Equipment Market Dynamics

Driver

Rising Demand for Efficient and High-Speed Packaging Solutions

• Increasing demand for fast, accurate, and cost-effective packaging across industries is propelling the adoption of modern bagging equipment. Manufacturers are focusing on high-speed, automated solutions that reduce packaging time while maintaining quality and product integrity. These innovations cater to the needs of mass production facilities seeking to enhance output while minimizing waste and human error

• The rapid expansion of e-commerce, processed food, and bulk material handling sectors has intensified the need for efficient packaging systems capable of handling diverse bag sizes and materials. This trend is encouraging innovation in automated weighing, sealing, and labeling technologies. Companies are also incorporating advanced robotics and servo-controlled systems to ensure consistent packaging and seamless integration with logistics networks

• The shift toward minimizing product waste and enhancing throughput efficiency is driving companies to upgrade their packaging infrastructure. Advanced equipment enables precise filling and sealing, ensuring improved product presentation and extended shelf life. The integration of eco-friendly packaging materials into automated systems is further supporting sustainability goals across industries

• For instance, in 2023, a leading European agricultural firm reported a 25% increase in production efficiency after deploying automated bagging systems integrated with robotic palletizers and digital monitoring tools. This implementation not only improved operational throughput but also reduced energy consumption and human intervention, leading to substantial cost savings

• As industries prioritize output efficiency and sustainability, investment in advanced bagging systems will continue to rise, driving market growth across multiple end-use sectors globally. The evolution of compact, smart, and energy-efficient systems is expected to reshape the competitive landscape, with automation becoming a standard in modern packaging lines

Restraint/Challenge

High Initial Investment and Maintenance Costs

• The significant upfront cost of acquiring and installing automated bagging systems acts as a major restraint for small and mid-scale enterprises. These systems require substantial capital for equipment, integration, and customization, which can delay return on investment. In addition, frequent software updates and component upgrades add to the long-term financial burden on manufacturers

• Maintenance and technical servicing of advanced bagging equipment demand skilled labor and periodic component replacements, increasing overall operational expenditure. Small manufacturers often struggle to justify such costs, especially in competitive, low-margin industries. Inadequate access to technical expertise and lack of localized support services further complicate system maintenance and performance optimization

• The complexity of integrating new systems with existing production lines can lead to downtime and compatibility challenges, further hindering adoption. Limited access to technical expertise in developing regions also constrains smooth operation and after-sales service. Furthermore, supply chain disruptions can affect spare part availability, resulting in costly delays and production inefficiencies

• For instance, in 2023, several small manufacturers in Southeast Asia cited high installation and maintenance costs as a primary barrier to adopting automated packaging machinery, opting instead for semi-automated alternatives. The lack of flexible financing options and limited government support for automation also restrict technological advancement in emerging markets

• Overcoming these challenges will require cost-effective modular systems, leasing options, and after-sales service support to make automation accessible to smaller players and sustain long-term market expansion. As manufacturers explore collaborative financing and shared-service models, the overall cost burden is expected to ease, encouraging wider adoption across developing economies

Bagging Equipment Market Scope

The market is segmented on the basis of product type, automation type, capacity, machine type, and end use.

- By Product Type

On the basis of product type, the bagging equipment market is segmented into integrated bagging lines and standalone equipment. The integrated bagging lines segment held the largest market revenue share in 2024, driven by their ability to automate multiple packaging processes including weighing, filling, sealing, and labeling within a single system. These systems are widely adopted in large-scale industrial facilities for their efficiency, consistency, and reduced labor dependency.

The standalone equipment segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its flexibility, lower installation cost, and adaptability across diverse production environments. Small and mid-scale manufacturers prefer standalone units due to their modular setup, ease of operation, and ability to integrate with existing packaging lines without extensive system overhauls.

- By Automation Type

On the basis of automation type, the market is segmented into automatic and semi-automatic. The automatic segment dominated the market in 2024, owing to its ability to provide high-speed operations, precision in filling and sealing, and minimal human intervention. Automatic systems are increasingly deployed in sectors demanding high throughput and uniform packaging standards, such as food processing and agriculture.

The semi-automatic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its affordability and suitability for small and medium-sized enterprises. These systems offer a balance between cost-efficiency and performance, allowing gradual automation adoption while maintaining manual control over certain processes.

- By Capacity

Based on capacity, the bagging equipment market is categorized into <500 bags/hr, 500–1000 bags/hr, 1001–2000 bags/hr, and >2000 bags/hr. The 1001–2000 bags/hr segment accounted for the largest share in 2024, attributed to its widespread adoption in mid-to-large production facilities that prioritize both volume and precision. Equipment in this range offers optimal efficiency for high-demand sectors such as chemicals, fertilizers, and food grains.

The >2000 bags/hr segment is expected to grow at the fastest rate from 2025 to 2032, driven by increasing industrial automation and demand for ultra-high-speed packaging solutions. Manufacturers are investing in these systems to enhance productivity and meet the rising demand for bulk material handling in logistics and manufacturing sectors.

- By Machine Type

On the basis of machine type, the market is divided into horizontal baggers and vertical baggers. The vertical baggers segment held the dominant share in 2024 due to their compact design, versatility, and suitability for packaging granular and powdered materials. These machines are widely utilized across food and chemical industries for their efficient use of space and high sealing accuracy.

The horizontal baggers segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing adoption in the packaging of larger or irregularly shaped products. Their ability to handle diverse packaging materials and configurations makes them ideal for construction materials, pharmaceuticals, and personal care products.

- By End Use

Based on end use, the bagging equipment market is segmented into food industry, construction, pharmaceuticals, homecare, personal care and cosmetics, and others. The food industry segment captured the largest market share in 2024, fuelled by the rising demand for packaged food products, ready-to-eat meals, and processed grains. Advanced bagging systems are increasingly used to ensure product freshness, hygiene, and extended shelf life.

The pharmaceuticals segment is expected to witness the fastest growth rate from 2025 to 2032, supported by strict packaging regulations and the growing need for precise, contamination-free packaging solutions. Automated bagging systems are being increasingly adopted to maintain product integrity and comply with global safety standards.

Bagging Equipment Market Regional Analysis

- North America dominated the bagging equipment market with the largest revenue share in 2024, driven by advanced industrial automation, well-established manufacturing infrastructure, and the widespread adoption of smart packaging systems across food, agriculture, and construction sectors

- The region’s focus on efficiency, precision, and sustainability has accelerated the demand for automated bagging lines that enhance productivity while reducing material waste and labor dependency

- High investments in packaging innovation, coupled with the presence of leading equipment manufacturers, continue to support market expansion, making North America a key hub for advanced packaging technology adoption

U.S. Bagging Equipment Market Insight

The U.S. bagging equipment market accounted for the largest revenue share in North America in 2024, supported by the strong presence of food processing, chemical, and agricultural industries. Manufacturers are increasingly adopting automated and robotic bagging systems to improve operational speed and reduce human error. The demand for high-speed, customizable systems integrated with IoT and data monitoring tools is also growing. Furthermore, a strong emphasis on product standardization and sustainable packaging solutions is fostering continuous technological innovation in the U.S. market.

Europe Bagging Equipment Market Insight

The Europe bagging equipment market is expected to witness significant growth from 2025 to 2032, driven by the rising focus on eco-friendly packaging, stringent sustainability regulations, and modernization of production lines. European industries are adopting energy-efficient and recyclable packaging systems to comply with environmental standards. The region also benefits from a robust industrial base and strong investment in smart manufacturing. Increased adoption of automated and hybrid systems in sectors such as food and construction is expected to further stimulate market growth.

U.K. Bagging Equipment Market Insight

The U.K. bagging equipment market is expected to witness significant growth from 2025 to 2032 due to the nation’s focus on automation, innovation, and high production efficiency. The country’s food and construction sectors are increasingly embracing automated bagging lines to minimize labor costs and improve throughput. Furthermore, the shift towards sustainable and recyclable packaging materials is driving equipment upgrades. The presence of several packaging R&D centers and growing interest in modular machinery designs are also supporting market expansion in the U.K.

Germany Bagging Equipment Market Insight

The Germany bagging equipment market is expected to witness strong growth from 2025 to 2032, fuelled by the country’s advanced engineering capabilities, focus on industrial automation, and sustainable manufacturing practices. German industries are rapidly adopting smart and robotic bagging systems that offer precision, flexibility, and connectivity. The strong presence of packaging machinery manufacturers and innovation-driven industrial policies continues to enhance the market landscape. Moreover, the country’s push towards carbon-neutral operations is encouraging the use of energy-efficient bagging technologies.

Asia-Pacific Bagging Equipment Market Insight

The Asia-Pacific bagging equipment market is projected to register the fastest growth rate from 2025 to 2032, driven by rapid industrialization, expanding food processing and construction sectors, and the increasing adoption of automation across emerging economies such as China, India, and Japan. Government initiatives promoting manufacturing efficiency and digital transformation are strengthening market prospects. The region’s position as a global manufacturing hub is further enhancing the production and export of cost-effective bagging equipment.

Japan Bagging Equipment Market Insight

The Japan bagging equipment market is expected to experience robust growth from 2025 to 2032, supported by technological innovation, strong automation culture, and an emphasis on production accuracy. Japan’s packaging sector is rapidly adopting smart bagging systems integrated with AI and IoT technologies to ensure high-speed and precise operations. The country’s growing focus on sustainable materials and compact machinery design aligns with its commitment to environmental efficiency and industrial modernization.

China Bagging Equipment Market Insight

The China bagging equipment market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid industrial growth, large-scale manufacturing, and extensive adoption of automated systems. The rise in domestic food processing, construction, and chemical industries has created a strong demand for advanced packaging machinery. China’s government-backed initiatives toward smart factories and sustainable production are propelling further adoption of high-capacity bagging systems. In addition, the availability of cost-effective manufacturing solutions continues to make China a key contributor to global market expansion.

Bagging Equipment Market Share

The Bagging Equipment industry is primarily led by well-established companies, including:

• Automated Packaging Systems, Inc. (U.S.)

• Innovative PackTech Machines Pvt Ltd (India)

• Technoweigh (India)

• POWERVAC (India)

• E-PAK Machinery, Inc. (U.S.)

• Rennco LLC (U.S.)

• Pakona (India)

• Matrix Packaging Machinery, LLC (U.S.)

• Autopack Machines Pvt. Ltd (India)

• SEPACK (India)

• CMD Corporation (U.S.)

• Alligator Automations (India)

• Syntegon Technology GmbH (Germany)

• STATEC BINDER GmbH (Austria)

• MONDIAL PACK (Italy)

• Choice Bagging Equipment Ltd. (U.K.)

• PAYPER (Spain)

• WOLF Verpackungsmaschinen GmbH (Germany)

• ISHIDA CO., LTD. (Japan)

• Italdibipack SpA (Italy)

• Audion Elektro B.V. (Netherlands)

• Cordano Packaging Engineers, L.L.C. (U.S.)

• Wenzhou Echo Machinery Co., LTD. (China)

• Optima Weightech Pvt. Ltd. (India)

• Adpro Automation Pvt. Ltd. (India)

• Blue Star Limited (India)

Latest Developments in Global Bagging Equipment Market

- In March 2024, Barry-Wehmiller announced the acquisition of DL Tech, a France-based company specializing in converting equipment for the packaging industry. This strategic move aims to expand Barry-Wehmiller’s product offerings and strengthen its footprint across the European market. The acquisition enhances the company’s technological capabilities and allows it to serve a broader customer base with integrated packaging solutions. This development is expected to boost competition and innovation in the regional packaging machinery sector

- In May 2024, Premier Tech completed the acquisition of M.J. Maillis, a global provider of packaging systems and solutions. The deal expands Premier Tech’s product portfolio and extends its geographical presence, particularly in Europe and emerging markets. This acquisition strengthens Premier Tech’s position in the industrial packaging segment and enables it to deliver more comprehensive end-of-line solutions. The move is likely to accelerate the company’s growth and increase its global market share

- In June 2024, I.M.A. Group acquired the packaging equipment business unit of Ilapak, a Swiss manufacturer known for its advanced flow wrapping and vertical packaging machines. The acquisition enhances I.M.A.’s product range, allowing it to cater to a wider variety of packaging applications across food, pharmaceuticals, and consumer goods. This move also boosts I.M.A.’s innovation capacity and market penetration in Europe. The expansion is expected to improve the company’s competitiveness and solidify its position as a global leader in packaging technology

- In August 2024, Nichrome introduced its new Sprint 250 PLUS range of pouch packaging machines designed for high-speed packaging of snacks, namkeen, and similar food products. The machines offer improved efficiency, flexibility, and accuracy, meeting the growing demand for advanced food packaging automation. This launch enhances Nichrome’s product portfolio and strengthens its presence in the fast-moving consumer goods (FMCG) packaging segment. The innovation is expected to attract food manufacturers seeking productivity gains and consistent packaging quality

- In October 2024, All-Fill launched its innovative Auger Filler Selector Tool on its official website, designed to help customers identify the most suitable auger filler for their specific applications. The tool simplifies the equipment selection process, saving time and improving user experience for manufacturers. This digital innovation aligns with the company’s focus on customer-centric solutions and digital transformation. The launch is expected to enhance customer engagement and support All-Fill’s growth in the automated packaging market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bagging Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bagging Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bagging Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.