Global Bakery And Confectionery Inclusions Market

Market Size in USD Billion

CAGR :

%

USD

2.47 Billion

USD

4.44 Billion

2025

2033

USD

2.47 Billion

USD

4.44 Billion

2025

2033

| 2026 –2033 | |

| USD 2.47 Billion | |

| USD 4.44 Billion | |

|

|

|

|

Bakery and Confectionery Inclusions Market Size

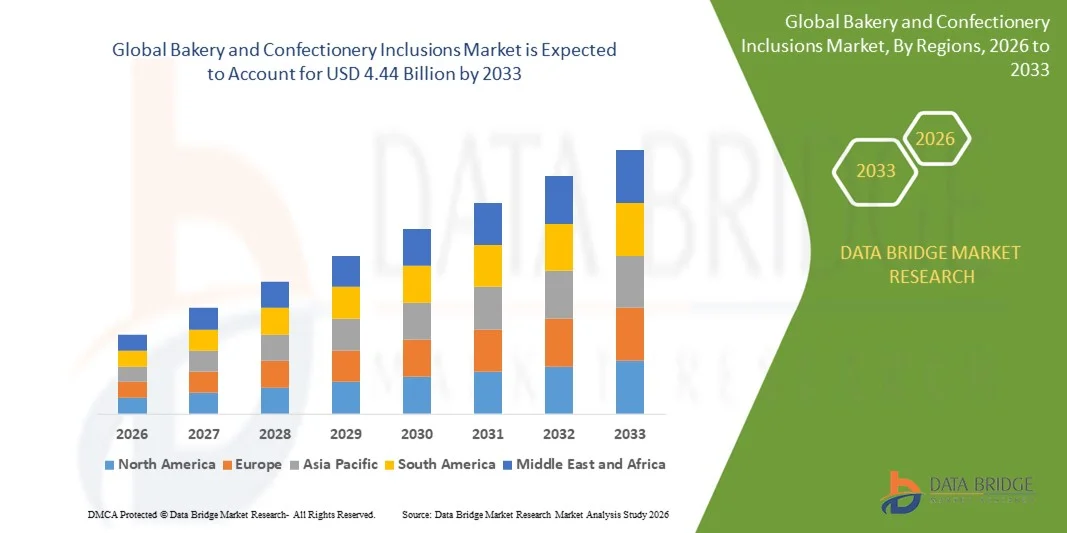

- The global bakery and confectionery inclusions market size was valued at USD 2.47 billion in 2025 and is expected to reach USD 4.44 billion by 2033, at a CAGR of 7.60% during the forecast period

- The market growth is largely fuelled by the increasing demand for premium and flavored inclusions in bakery and confectionery products

- Rising consumer preference for natural, clean-label, and functional ingredients is further driving adoption across bakery and confectionery segments

Bakery and Confectionery Inclusions Market Analysis

- The market is witnessing growing incorporation of inclusions in baked goods and confectionery items to enhance texture, flavor, and visual appeal

- Increasing demand from food service, retail bakeries, and packaged goods manufacturers is supporting market expansion, along with rising awareness of premium and indulgent ingredients

- North America dominated the bakery and confectionery inclusions market with the largest revenue share in 2025, driven by high consumer demand for premium, indulgent, and functional bakery products, as well as well-established distribution networks

- Asia-Pacific region is expected to witness the highest growth rate in the global bakery and confectionery inclusions market, driven by expanding food processing industry, rising popularity of western-style bakery products, and increasing health and premium product awareness

- The cake segment held the largest market revenue share in 2025, driven by the growing incorporation of inclusions such as nuts, chocolate chips, and fruits to enhance texture, taste, and visual appeal. Cake products with premium and functional inclusions are increasingly preferred in both retail and food service sectors, boosting adoption across the market

Report Scope and Bakery and Confectionery Inclusions Market Segmentation

|

Attributes |

Bakery and Confectionery Inclusions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Cargill, Incorporated (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bakery and Confectionery Inclusions Market Trends

Rise of Premium and Functional Inclusions in Bakery and Confectionery

- The growing preference for premium and functional inclusions is transforming the bakery and confectionery landscape by enhancing flavor, texture, and visual appeal. Ingredients such as nuts, chocolate chips, fruits, and seeds allow manufacturers to create differentiated products that cater to evolving consumer tastes and dietary preferences. This trend is also encouraging innovation in flavor combinations and seasonal offerings, giving brands the ability to refresh product lines regularly. The increased focus on indulgence and health benefits is driving consumer willingness to pay a premium for such enhanced products

- Increasing demand for inclusions in ready-to-eat bakery and confectionery products is accelerating adoption of innovative fillings, coatings, and toppings. These inclusions improve product indulgence, support brand premiumization, and allow companies to target nutrition-focused or health-conscious consumers. Companies are leveraging inclusions to create visually appealing and Instagram-worthy products, enhancing marketing and social media presence. In addition, the use of functional ingredients such as antioxidant-rich nuts or fiber-packed fruits is contributing to perceived product value and brand loyalty

- The versatility and ease of incorporating inclusions are making them attractive for both large-scale manufacturers and small artisan bakeries, enabling a wider product variety without significant cost increases. This trend also supports higher consumer engagement and repeat purchases. The flexibility allows brands to create both seasonal limited editions and staple offerings, increasing shelf appeal and variety. It also enables smaller bakeries to compete with large manufacturers by offering premium, differentiated products with minimal investment in specialized equipment

- For instance, in 2023, several European bakeries reported higher sales after introducing chocolate and nut-based inclusions in their premium pastry lines, enhancing consumer satisfaction and boosting brand loyalty. The additions allowed bakeries to expand their product portfolios and target multiple consumer segments, including children, adults, and health-conscious individuals. These innovations also encouraged repeat purchases and word-of-mouth marketing, amplifying overall market growth in the region

- While inclusions are expanding product appeal, their impact depends on sourcing quality raw materials, maintaining consistency, and complying with food safety standards. Manufacturers must focus on innovation and supply chain optimization to fully capitalize on market demand. Collaboration with local suppliers and investment in ingredient traceability technologies are becoming increasingly important to maintain product quality and consumer trust. In addition, strategic marketing highlighting premium and functional aspects can help justify higher pricing and differentiate products in a competitive marketplace

Bakery and Confectionery Inclusions Market Dynamics

Driver

Rising Demand For Premium And Functional Ingredients

- Consumers are increasingly seeking bakery and confectionery products that offer indulgence, taste, and functional benefits, prompting manufacturers to use high-quality inclusions in formulations. This trend is further fueled by growing awareness of healthy eating and functional foods, which encourages inclusion of nutrient-dense ingredients. Brands are increasingly leveraging inclusions as a value proposition to appeal to both taste-driven and health-conscious segments simultaneously

- Growing preference for natural, clean-label, and nutrient-rich ingredients is driving adoption of nuts, fruits, and chocolate-based inclusions in both mass-market and premium products. Consumers are scrutinizing labels for artificial additives, making clean-label inclusions a key factor in purchase decisions. In response, manufacturers are reformulating products to replace synthetic flavors or colors with natural alternatives, aligning with global consumer demand for transparency and quality

- Food service operators and packaged goods manufacturers are expanding inclusion offerings to enhance product differentiation and cater to premiumization trends. Customizable inclusions allow bakeries, cafes, and dessert brands to meet unique consumer preferences and seasonal trends. These offerings also help brands maintain competitiveness in saturated markets, foster consumer loyalty, and boost incremental revenue through premium product lines

- For instance, in 2022, North American snack and bakery brands incorporated fruit and nut inclusions in confectionery bars, driving incremental revenue and strengthening brand positioning. The strategy not only enhanced product taste and texture but also communicated a functional and health-conscious message to consumers. Retailers reported increased sales velocity and higher margins on products featuring these premium inclusions, demonstrating market potential

- While demand for inclusions is growing, challenges such as ingredient sourcing, cost management, and compliance with regulatory standards must be addressed to ensure sustainable market expansion. Manufacturers are investing in supply chain resilience, traceability, and alternative ingredient sourcing to mitigate risks. Partnerships with certified suppliers and adoption of sustainable sourcing practices are increasingly critical to maintain product quality, consumer trust, and long-term profitability

Restraint/Challenge

High Cost Of Quality Raw Materials And Supply Chain Constraints

- The premium ingredients used as bakery and confectionery inclusions, such as nuts, dried fruits, and specialty chocolates, are expensive, which can limit adoption among smaller manufacturers and cost-sensitive markets. Price volatility in raw materials, due to seasonal fluctuations or climate impacts, further increases production costs. This often forces manufacturers to balance product quality and affordability, influencing pricing strategies and market penetration

- Supply chain disruptions, seasonal variations, and quality inconsistencies in sourcing ingredients restrict production volumes and affect product availability. Delays or shortages in premium ingredients can disrupt manufacturing schedules and limit timely product launches. Manufacturers are increasingly focusing on diversifying suppliers and maintaining buffer inventories to ensure continuity and meet consumer demand without compromising quality

- Small and mid-sized bakeries often face logistical challenges in maintaining inclusion freshness and uniformity, leading to production inefficiencies. Inconsistent ingredient quality can negatively impact taste, appearance, and shelf life, affecting brand reputation. Investments in storage technology, temperature-controlled logistics, and training programs for handling premium inclusions are becoming necessary to maintain product consistency

- For instance, in 2023, several Latin American confectionery producers reported delays in product launches due to limited availability of high-quality chocolate and nut inclusions, impacting market growth. The shortages affected seasonal products and premium launches, reducing sales opportunities and constraining brand expansion plans. Manufacturers had to adapt production schedules, source alternative ingredients, or delay product introductions

- While inclusion innovation continues, manufacturers must optimize sourcing strategies, maintain quality control, and invest in supply chain resilience to sustain growth in the global bakery and confectionery inclusions market. Strategic planning, supplier collaboration, and adoption of technology-driven inventory management are crucial to overcome cost and supply challenges. Such measures enable consistent product availability, safeguard brand reputation, and capitalize on growing consumer demand for premium inclusions

Bakery and Confectionery Inclusions Market Scope

The global bakery and confectionery inclusions market is segmented on the basis of product type, ingredients, flavor, and distribution channel.

- By Product Type

On the basis of product type, the market is segmented into brownies, cake, cookies, and pastry. The cake segment held the largest market revenue share in 2025, driven by the growing incorporation of inclusions such as nuts, chocolate chips, and fruits to enhance texture, taste, and visual appeal. Cake products with premium and functional inclusions are increasingly preferred in both retail and food service sectors, boosting adoption across the market.

The brownie segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising trend of indulgent and ready-to-eat baked products. Brownies allow easy integration of chocolate chunks, nuts, and fruit inclusions, making them ideal for premium product positioning. Manufacturers are leveraging brownie inclusions to differentiate their offerings and cater to evolving consumer taste preferences.

- By Ingredients

On the basis of ingredients, the market is segmented into dried fruit pieces, chocolate and confectionery chunks, unique grains and seeds, crunchy nuts, and color nuggets and flakes. The chocolate and confectionery chunks segment held the largest market revenue share in 2025, owing to its widespread use in bakery and confectionery products to enhance flavor and texture. These inclusions are highly preferred in premium offerings and indulgent products, driving consistent demand across regions.

The dried fruit pieces segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing consumer preference for natural, clean-label, and nutrient-rich ingredients. Manufacturers are incorporating dried fruits into cookies, cakes, and pastries to enhance taste, nutritional value, and visual appeal, boosting product differentiation in the market.

- By Flavor

On the basis of flavor, the market is segmented into fruit, nut, savory, chocolate, and caramel. The chocolate flavor segment held the largest market share in 2025, attributed to its universal appeal in bakery and confectionery products. Chocolate inclusions enhance indulgence, texture, and consumer acceptance across multiple product categories, sustaining high demand globally.

The nut flavor segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising trend of premium and functional inclusions in baked goods. Nut-based flavors provide nutritional benefits, premium positioning, and product differentiation, appealing to health-conscious and taste-driven consumers alike.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales/B2B and indirect sales/B2C. The indirect sales/B2C segment held the largest market revenue share in 2025, fueled by the growing presence of supermarkets, hypermarkets, and online retail platforms offering a wide range of inclusions for bakery and confectionery products. Consumer accessibility and convenience are driving adoption in this channel.

The direct sales/B2B segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing collaborations between ingredient suppliers and food service operators. Bulk supply to bakeries, cafes, and confectionery manufacturers ensures consistent quality, supports product innovation, and strengthens market penetration.

Bakery and Confectionery Inclusions Market Regional Analysis

- North America dominated the bakery and confectionery inclusions market with the largest revenue share in 2025, driven by high consumer demand for premium, indulgent, and functional bakery products, as well as well-established distribution networks

- Consumers in the region increasingly prefer products with added nuts, chocolate chunks, dried fruits, and specialty inclusions that enhance taste, texture, and visual appeal

- The widespread adoption is further supported by rising disposable incomes, increasing health awareness, and the growing trend of on-the-go and ready-to-eat bakery items, establishing inclusions as a key factor in product differentiation

U.S. Bakery and Confectionery Inclusions Market Insight

The U.S. bakery and confectionery inclusions market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of premium bakery products and growing consumer interest in functional and indulgent inclusions. Manufacturers are increasingly using chocolate, nuts, and fruit-based inclusions to cater to evolving taste preferences and dietary trends. The growing popularity of ready-to-eat baked goods, coupled with innovative product launches and strong retail penetration, is significantly contributing to market growth.

Europe Bakery and Confectionery Inclusions Market Insight

The Europe bakery and confectionery inclusions market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing demand for premium and artisanal bakery products. Consumers are gravitating toward products with natural, clean-label, and nutrient-rich inclusions, while rising urbanization and changing lifestyles foster adoption. The region is seeing growth across retail, foodservice, and packaged goods channels, with inclusions enhancing product differentiation and indulgence.

U.K. Bakery and Confectionery Inclusions Market Insight

The U.K. bakery and confectionery inclusions market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer preference for premium, functional, and visually appealing bakery items. Health-conscious and indulgence-seeking consumers are driving manufacturers to incorporate nuts, chocolate, dried fruits, and specialty inclusions. The country’s robust retail and e-commerce infrastructure, along with high awareness of product quality and innovation, is further supporting market expansion.

Germany Bakery and Confectionery Inclusions Market Insight

The Germany bakery and confectionery inclusions market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer interest in artisanal, premium, and functional baked goods. German consumers are highly inclined toward natural, high-quality ingredients and innovative inclusions, enhancing product texture, flavor, and appeal. The strong presence of modern retail chains, coupled with growing trends in convenience and indulgence, is further encouraging market adoption.

Asia-Pacific Bakery and Confectionery Inclusions Market Insight

The Asia-Pacific bakery and confectionery inclusions market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rapid urbanization, rising disposable incomes, and increasing exposure to global bakery trends. Consumers in countries such as China, Japan, and India are adopting premium and functional inclusions in bakery and confectionery products. Government initiatives supporting food innovation, coupled with a growing bakery retail sector, are expanding product availability and driving market growth.

Japan Bakery and Confectionery Inclusions Market Insight

The Japan bakery and confectionery inclusions market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high demand for premium, indulgent, and visually appealing bakery products. Japanese consumers emphasize quality, functional benefits, and innovative inclusions, including chocolate, nuts, and dried fruits. The rise of ready-to-eat baked goods, coupled with advanced retail networks and an aging population seeking convenient, high-quality products, is driving market expansion.

China Bakery and Confectionery Inclusions Market Insight

The China bakery and confectionery inclusions market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing middle class, and increased interest in indulgent and functional bakery products. Consumers are increasingly seeking products with nuts, chocolate, dried fruits, and unique inclusions. The expansion of modern retail channels, coupled with a growing bakery culture and innovation in product formulations, is significantly propelling market growth across the country.

Bakery and Confectionery Inclusions Market Share

The Bakery and Confectionery Inclusions industry is primarily led by well-established companies, including:

• Cargill, Incorporated (U.S.)

• ADM (U.S.)

• Barry Callebaut (Switzerland)

• Kerry (Ireland)

• Tate & Lyle (U.K.)

• AGRANA Beteiligungs-AG (Austria)

• Sensient Colors LLC (U.S.)

• PURATOS (Belgium)

• Balchem Inc. (U.S.)

• GEORGIA NUT COMPANY (U.S.)

• Inclusion Technologies (U.S.)

• Dawn Food Products, Inc. (U.S.)

• Nimbus Foods Ltd (U.K.)

• Chaucer Foods Ltd (U.K.)

• Meadow Foods (U.K.)

• IBK TROPIC, S.A (Costa Rica)

• FoodFlo International Ltd (U.K.)

• Mother Murphy's Laboratories, Inc. (U.S.)

• Confection by Design (U.S.)

• Pecan Deluxe Candy Company (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bakery And Confectionery Inclusions Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bakery And Confectionery Inclusions Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bakery And Confectionery Inclusions Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.