Global Bakeware Market

Market Size in USD Billion

CAGR :

%

USD

2.97 Billion

USD

4.29 Billion

2024

2032

USD

2.97 Billion

USD

4.29 Billion

2024

2032

| 2025 –2032 | |

| USD 2.97 Billion | |

| USD 4.29 Billion | |

|

|

|

|

Bakeware Market Size

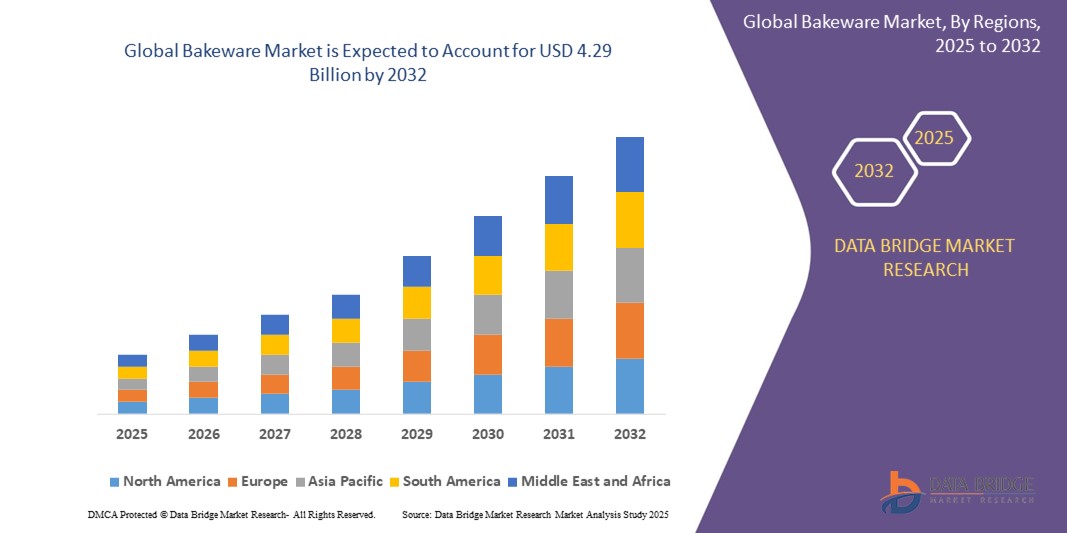

- The global bakeware market size was valued at USD 2.97 billion in 2024 and is expected to reach USD 4.29 billion by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is primarily driven by the increasing popularity of home baking, rising consumer interest in innovative and eco-friendly bakeware materials, and the expansion of e-commerce platforms enhancing product accessibility

- Growing demand for premium, non-stick, and sustainable bakeware solutions in both household and commercial settings is further propelling market expansion, with consumers prioritizing durability, ease of use, and aesthetic appeal

Bakeware Market Analysis

- Bakeware, encompassing tools and equipment used for baking, is a critical segment of the kitchenware industry, driven by rising consumer interest in culinary arts, home cooking, and professional baking applications

- The surge in demand is fueled by trends such as the growing popularity of baking as a hobby, increased adoption of advanced materials such as silicone and ceramic for enhanced performance, and the convenience of online purchasing

- Europe dominated the bakeware market with the largest revenue share of 38.5% in 2024, attributed to a strong baking culture, high demand for premium bakeware, and the presence of established manufacturers. Countries such as Germany, France, and the U.K. lead due to their culinary traditions and consumer preference for high-quality kitchen tools

- North America is expected to be the fastest-growing region during the forecast period, driven by rising disposable incomes, the popularity of baking shows, and increasing demand for innovative bakeware products in the U.S. and Canada

- The pans and dishes segment dominated with a 36.37% market share in 2024, attributed to its versatility in preparing well-browned or crispy crust food products and its dual functionality for baking and serving

Report Scope and Bakeware Market Segmentation

|

Attributes |

Bakeware Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Bakeware Market Trends

“Increasing Integration of Smart Technology and Eco-Friendly Materials”

- The global bakeware market is experiencing a significant trend toward integrating smart technology and eco-friendly materials to enhance functionality and sustainability

- Smart bakeware, equipped with sensors for precise temperature control and monitoring, is gaining traction, particularly among commercial bakeries and tech-savvy home bakers, improving baking consistency and efficiency

- For instance, companies such as American Pan have introduced innovations such as the SMART Pan Tracking System in 2024, which optimizes commercial baking processes by monitoring pan usage and performance

- The use of eco-friendly materials, such as PFAS-free non-stick coatings and green steel, is growing, driven by consumer demand for sustainable and health-conscious products. An instances is Guardini’s XBake line, launched in 2024 with ArcelorMittal’s XCarb green steel, unveiled at the Ambiente fair in Frankfurt

- Advanced materials such as silicone and ceramic provide improved durability, non-stick properties, and uniform heat distribution, catering to both aesthetic and functional consumer preferences

- Social media platforms, such as Instagram and TikTok, are fueling demand for visually appealing bakeware, with influencers showcasing creative baking designs that encourage the use of specialized molds and pans

Bakeware Market Dynamics

Driver

“Rising Popularity of Home Baking and Health-Conscious Cooking”

- The surge in home baking, amplified by social media, cooking shows, and the post-COVID-19 trend of home-cooked meals, is a major driver for the global bakeware market

- Consumers are increasingly seeking bakeware that supports healthier cooking methods, such as non-stick coatings that reduce oil use and materials free from harmful chemicals such as PFOA and PTFE

- The proliferation of e-commerce and online platforms has made diverse bakeware products more accessible, boosting demand for innovative designs such as silicone molds and ceramic pans

- The growing popularity of modular kitchens and aesthetic kitchenware, particularly in urban households, is driving demand for stylish and multifunctional bakeware, such as pans and dishes that can be used for both baking and serving

- Europe, as the dominating region, benefits from a strong baking culture and high demand for premium bakeware, with countries such as the U.K. and Germany leading in consumption

Restraint/Challenge

“High Production Costs and Environmental Regulations”

- The high cost of advanced materials, such as high-quality silicone and eco-friendly non-stick coatings, along with the investment required for smart technology integration, can be a barrier to adoption, particularly in cost-sensitive emerging markets

- Manufacturing eco-friendly bakeware, such as products made from recycled or green steel, often involves complex and expensive processes, increasing production costs

- Environmental regulations and sustainability concerns pose challenges, as manufacturers must comply with stringent standards for non-toxic materials and sustainable production practices, which can vary across regions and complicate global operations

- The fragmented regulatory landscape, especially regarding chemical safety and waste management, creates compliance challenges for international manufacturers, potentially limiting market expansion

- In North America, the fastest-growing region, cost sensitivity and varying consumer awareness of sustainable practices can hinder adoption despite strong market growth driven by health-conscious trends and online retail

Bakeware market Scope

The market is segmented on the basis of material, product type, end user, and distribution channel.

- By Material

On the basis of material, the global bakeware market is segmented into aluminum, steel, glass, ceramic, silicon, and others. The aluminum segment held the largest market revenue share of 26.84% in 2024, driven by its excellent heat conductivity, quick heating and cooling, resistance to rust and corrosion, and affordability. Aluminum's lightweight nature makes it a preferred choice for both commercial and household applications.

The silicone segment is expected to witness the fastest growth rate from 2025 to 2032, with a projected CAGR of 7.8%. This growth is fueled by its flexibility, non-stick properties, ease of cleaning, and increasing consumer preference for eco-friendly and non-toxic materials, aligning with health and sustainability trends.

- By Product Type

On the basis of product type, the global bakeware market is segmented into pans and dishes, tins and trays, cups, rolling pins, and others. The pans and dishes segment dominated with a 36.37% market share in 2024, attributed to its versatility in preparing well-browned or crispy crust food products and its dual functionality for baking and serving. This segment's widespread use in both household and commercial settings drives its dominance.

The tins and trays segment is anticipated to experience the fastest growth from 2025 to 2032, with a CAGR of 7.5%. The rising popularity of customizable baking options and the convenience of baking multiple items simultaneously fuel demand, particularly in household kitchens influenced by social media and baking trends.

- By End User

On the basis of end user, the global bakeware market is segmented into commercial and household end users. The commercial segment held the largest market revenue share of 60% in 2024, driven by the increasing number of bakeries, cafes, and restaurants requiring diverse bakeware tools such as muffin pans and cake molds to meet consumer demand for varied baked goods.

The household segment is expected to grow rapidly from 2025 to 2032, with a CAGR of 6.3%. The surge in home baking, influenced by social media, cooking shows, and a preference for healthier homemade options, drives demand for innovative and high-quality bakeware products.

- By Distribution Channel

On the basis of distribution channel, the global bakeware market is segmented into offline and online distribution channels. The offline segment accounted for the largest revenue share of 65% in 2024, driven by the enhanced shopping experience offered through retail outlets, allowing instant product testing and selection. Promotional activities in shopping malls and supermarkets further boost offline sales.

The online segment is projected to witness the fastest growth from 2025 to 2032, with a CAGR of 8.0%. The expansion of e-commerce platforms, increasing consumer convenience, and access to a wide variety of bakeware products drive this segment's growth, particularly in regions with rising internet penetration.

Bakeware Market Regional Analysis

- Europe dominated the bakeware market with the largest revenue share of 38.5% in 2024, attributed to a strong baking culture, high demand for premium bakeware, and the presence of established manufacturers. Countries such as Germany, France, and the U.K. lead due to their culinary traditions and consumer preference for high-quality kitchen tools

- Consumers prioritize bakeware for durability, non-stick properties, and versatility, particularly in regions with diverse baking traditions and increasing home baking trends

- Growth is supported by advancements in material technology, including non-stick coatings, eco-friendly silicone, and ceramic options, alongside rising adoption in both commercial and household segments

U.K. Bakeware Market Insight

The U.K. market for bakeware is expected to witness significant growth, driven by increasing consumer interest in home baking and demand for aesthetically pleasing, functional bakeware. Rising awareness of eco-friendly materials, such as silicone and ceramic, encourages adoption. In addition, evolving consumer preferences for premium bakeware and the expansion of online distribution channels influence market growth, balancing quality with accessibility.

Germany Bakeware Market Insight

Germany is expected to witness robust growth in the bakeware market, attributed to its advanced manufacturing sector and high consumer focus on quality and innovation. German consumers prefer technologically advanced bakeware, such as non-stick aluminium and ceramic pans, that offer durability and energy efficiency. The integration of these products in both commercial and household settings, along with strong offline and online distribution channels, supports sustained market growth.

North America Bakeware Market Insight

North America is expected to witness the fastest growth rate in the global bakeware market, fueled by a surge in home baking activities and growing consumer interest in high-quality, innovative bakeware. The U.S. dominates the region with the highest revenue share in 2024, driven by strong demand in both household and commercial segments. Trends toward baking as a hobby, coupled with increasing online distribution channels, further boost market expansion. The integration of eco-friendly and durable materials such as silicone and ceramic supports sustained growth.

Asia-Pacific Bakeware Market Insight

The Asia-Pacific region is expected to witness significant growth, driven by expanding culinary trends, rising disposable incomes, and increasing adoption of baking in countries such as China, India, and Japan. Growing awareness of premium bakeware materials, such as silicone and glass, boosts demand. Government initiatives promoting sustainable manufacturing and the rise of e-commerce platforms further encourage the use of advanced bakeware products.

Japan Bakeware Market Insight

Japan’s bakeware market is expected to witness strong growth due to consumer preference for high-quality, innovative bakeware that enhances baking precision and convenience. The presence of major manufacturers and the integration of advanced materials in both commercial and household products accelerate market penetration. Rising interest in baking as a lifestyle trend also contributes to growth.

China Bakeware Market Insight

China holds the largest share of the Asia-Pacific bakeware market, propelled by rapid urbanization, rising household baking trends, and increasing demand for durable and eco-friendly bakeware solutions. The country’s growing middle class and focus on modern kitchen appliances support the adoption of advanced materials such as silicone and ceramic. Strong domestic manufacturing capabilities and competitive pricing through online and offline channels enhance market accessibility.

Bakeware Market Share

The bakeware industry is primarily led by well-established companies, including:

- WMF (Germany)

- Reynolds Consumer Products (U.S.)

- Corelle Brands LLC. (U.S.)

- USA PAN (U.S.)

- Newell Brands (U.S.)

- Motiba Silicone Private Limited (India)

- Meyer Corporation (U.S.)

- Lodge Manufacturing Company (U.S.)

- Le Creuset UK Limited (U.K.)

- KAVALIERGLASS, a.s. (Prague)

- The Cookware Company (Belgium)

- ZWILLING J.A. Henckels AG (Germany)

- All-Clad (U.S.)

- Cuisinart (U.S.)

- Tramontina USA Inc. (U.S.)

- Nordic Ware (U.S.)

What are the Recent Developments in Global Bakeware Market?

- In June 2023, global kitchenware giant Meyer Corporation acquired Great Jones, a rising star in premium bakeware and cookware. The acquisition was designed to consolidate market share, enhance product diversity, and expand Meyer's global footprint in the bakeware segment. By integrating Great Jones’s vibrant product line and design-forward approach with Meyer’s operational scale and international reach, the merger aimed to streamline operations and unlock new growth opportunities in both retail and direct-to-consumer channels

- In February 2023, Guardini collaborated with ArcelorMittal, Cooper Coated Coil (CCC), and ILAG to launch XBake, a pioneering eco-friendly bakeware collection. Introduced at the Ambiente fair in Frankfurt, XBake features XCarb green steel certificates from ArcelorMittal and a PFAS-free non-stick coating developed by ILAG, applied to steel coils by CCC. This four-way partnership reflects a three-year development effort focused on reducing carbon emissions and eliminating harmful chemicals. The bakeware is also packaged using FSC-certified materials, reinforcing Guardini’s commitment to sustainability and innovation in kitchenware manufacturing

- In October 2021, Caraway expanded its product portfolio by launching a non-toxic bakeware collection featuring ceramic-coated, non-stick pans free from heavy metals, PFAS, PTFE, and other harmful chemicals. The line includes both 11-piece and 5-piece sets, thoughtfully designed to meet growing consumer demand for eco-conscious and health-safe baking solutions. Available in stylish hues such as Cream, Navy, Sage, Perracotta, and Slate, the bakeware is oven-safe up to 550°F and comes with smart storage organizers, combining functionality with aesthetic appeal

- In March 2020, WMF GmbH’s KAISER brand launched the CrispFlex collection, a line of innovative silicone baking pans designed for modern home bakers. Made from 100% platinum silicone, these pans feature KAISER’s signature CrispFlex perforation for evenly crispy baking results and an excellent non-stick coating for effortless cake and muffin release. Their collapsible design allows for up to 60% space savings during storage, while integrated metal edges ensure high form stability. With ergonomic handles and dishwasher-safe convenience, CrispFlex pans combine performance, practicality, and sleek design

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.