Global Baler Market

Market Size in USD Billion

CAGR :

%

USD

7.68 Billion

USD

15.75 Billion

2025

2033

USD

7.68 Billion

USD

15.75 Billion

2025

2033

| 2026 –2033 | |

| USD 7.68 Billion | |

| USD 15.75 Billion | |

|

|

|

|

Baler Market Size

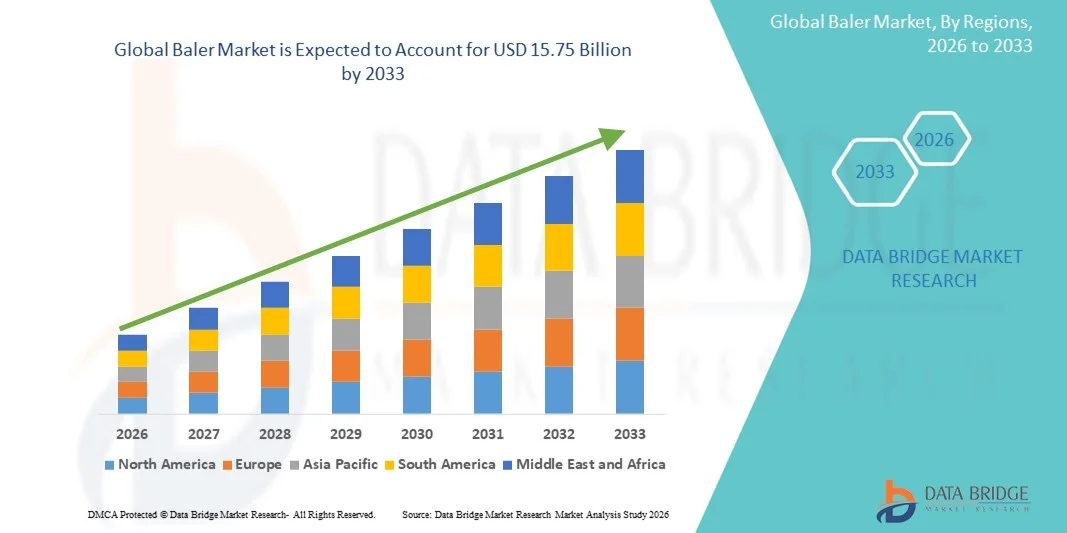

- The global baler market size was valued at USD 7.68 billion in 2025 and is expected to reach USD 15.75 billion by 2033, at a CAGR of 9.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of agricultural mechanization and advancements in baling technologies that enhance efficiency in crop residue and fodder management. Growing awareness among farmers about sustainable farming practices and the benefits of mechanized residue handling is further driving the demand for modern balers across both developed and developing regions

- Furthermore, rising demand for high-quality forage and biomass for livestock feeding and bioenergy production is supporting the adoption of advanced baling equipment. These factors, combined with government initiatives promoting farm mechanization and subsidies for equipment purchases, are significantly boosting the growth of the baler market

Baler Market Analysis

- Balers, designed for compressing and packaging materials such as hay, straw, and cotton into compact bales, play a critical role in improving storage, transportation, and waste management efficiency across agriculture and related industries. The technology’s importance is growing due to its ability to reduce post-harvest losses, support sustainable residue utilization, and optimize fodder production for livestock

- The escalating demand for balers is primarily driven by expanding agricultural activities, increasing labor shortages, and the global shift toward precision and automated farming. Manufacturers are focusing on developing energy-efficient, connected, and high-capacity balers to meet evolving farm operation needs, reinforcing the market’s steady upward trajectory

- Asia-Pacific dominated the baler market with a share of 39.9% in 2025, due to expanding agricultural activities, increasing mechanization across farming operations, and government initiatives promoting modern equipment adoption

- North America is expected to be the fastest growing region in the baler market during the forecast period due to increasing investments in agricultural automation, sustainable farming practices, and high demand for hay and biomass balers

- Round balers segment dominated the market with a market share of 57.6% in 2025, due to their efficiency in producing dense, weather-resistant bales that are easy to transport and store. Farmers prefer round balers for their versatility in handling various crops such as hay, straw, and silage while reducing spoilage risks during storage. Their lower maintenance cost, enhanced automation features, and ability to operate efficiently on uneven terrain further strengthen their dominance in both small- and large-scale farming operations

Report Scope and Baler Market Segmentation

|

Attributes |

Baler Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Baler Market Trends

Integration of IoT and Automation in Baling Equipment

- The baler market is experiencing a major shift through the integration of IoT, automation, and advanced analytics, resulting in smarter and more efficient baling operations. Key manufacturers are deploying IoT-enabled sensors and telematics for real-time monitoring, predictive maintenance, and remote diagnostics, significantly reducing downtime and enhancing equipment longevity. Automation features such as automated bale tying, smart routing, and AI-driven optimization have become essential, enabling users to increase throughput and product consistency while reducing labor input and overall operational costs

- For instance, KUHN’s Baler Automation system—awarded for technological innovation in 2025—features GPS-controlled pick-up, Tractor-Implement Management (TIM), and fully automated bale handling functions, improving productivity and operator comfort. Brands such as John Deere, Claas, and Vermeer are also investing in digital platforms and automation systems that support decision-making and seamless integration with farm management software for mixed machinery fleets

- Precision controls and programmable settings for bale size, density, and tying pattern are becoming standard in next-generation balers. Sensors for moisture and crop readiness are integrated to minimize losses, enhance forage quality, and adapt quickly to varying field conditions, enabling a scalable response to diversified crop types and sustainable farming practices

- IoT connectivity allows operators to access performance data and machine status remotely, supporting intelligent scheduling, workflow planning, and data-driven fleet management. Energy-efficient drives and electrification are further addressed, with manufacturers emphasizing reduced fuel consumption and lower emissions to align with sustainability requirements across agriculture and recycling sectors

- Advancements in digital integration also support multi-crop and waste management baling, expanding application versatility from hay and straw to byproducts used in bioenergy and circular economy markets. Cross-platform interoperability and blockchain-based traceability are emerging areas, supporting compliance, certification, and transparent supply chains

- The continued development of IoT and automation is shaping a smart, connected baler industry that delivers tangible productivity, sustainability, and operational resilience benefits. These trends collectively reinforce the market's direction toward an integrated, technology-driven future driven by data insights and adaptive control across global agriculture and waste management ecosystems

Baler Market Dynamics

Driver

Rising Adoption of Farm Mechanization to Enhance Productivity

- Farm mechanization is a major driver in accelerating baler adoption globally, with farmers seeking to optimize efficiency, reduce manual labor, and support large-scale agricultural output. The growing use of tractors, harvesters, and balers is streamlining crop residue management and resource utilization while enabling faster and more uniform bale formation across expansive fields

- For instance, John Deere and Claas have significantly expanded their smart baler and automation product lines to meet rising demand for intelligent agricultural machinery that delivers both productivity and operational reliability. Both companies are prioritizing R&D investment, resulting in solutions tailored for varying crop types, operational conditions, and end-user needs

- Mechanized baling reduces harvest time and ensures the production of high-quality, uniform bales. These outcomes are important for modern supply chains and livestock feed processing, as consistency in bale integrity supports efficient storage, transport, and usage in downstream applications

- The trend is supported by rising land consolidation, labor shortages in rural regions, and a shift toward entrepreneurial farming models that prioritize scalability and output. Government incentives and credit schemes are also aiding small and medium-scale farms in adopting advanced machinery to meet food security and export market goals

- Incorporating mechanized baling equipment is strengthening resilience and sustainability in agricultural systems. As the global agricultural sector moves toward larger-scale, technology-enabled operations, mechanization is central to maximizing productivity gains, operational flexibility, and long-term competitiveness against traditional manual practices

Restraint/Challenge

High Initial Investment and Maintenance Costs for Advanced Balers

- The high upfront cost associated with purchasing advanced balers—especially those equipped with IoT, automation, and digital integration—remains a significant challenge for many small and medium-sized farming operations. Acquisition expenses are further compounded by the need for specialized maintenance, skilled labor, and technology upgrades to safeguard operational reliability over time

- For instance, while market leaders such as Vermeer and AGCO offer innovative baler solutions with enhanced features, they also cite that initial costs and recurring expenses for calibration, spare parts, and software subscriptions can deter greater adoption in cost-sensitive segments and low-income markets. Small-scale farmers often face financial constraints, limiting their ability to realize immediate returns from advanced mechanization

- Maintenance requirements for automated and sensor-equipped balers involve regular diagnostics checks, firmware updates, and expert servicing, which can raise total cost of ownership and necessitate partnerships with OEMs or local distributors for technical support. Farm operators may experience increased downtime and higher operational risks if timely service is inaccessible

- Cost barriers also extend to integration challenges with existing farm management systems, as legacy equipment may be incompatible with the latest digital controls and IoT platforms. Transitioning entire fleets to digital or connected balers demands capital investment, retraining, and adaptation of workflows for optimal use

- To address these limitations and ensure broader accessibility, manufacturers are exploring financing models, leasing options, and scalable feature sets for lower- and middle-income farming communities. Closing the gap on affordability and support infrastructure will be pivotal for market expansion as mechanization and technology inclusion continue to shape the industry’s future potential

Baler Market Scope

The market is segmented on the basis of product, application, end use, distribution channel, industry, and size.

- By Product

On the basis of product, the baler market is segmented into round balers and square balers. The round balers segment dominated the market with the largest revenue share of 57.6% in 2025, driven by their efficiency in producing dense, weather-resistant bales that are easy to transport and store. Farmers prefer round balers for their versatility in handling various crops such as hay, straw, and silage while reducing spoilage risks during storage. Their lower maintenance cost, enhanced automation features, and ability to operate efficiently on uneven terrain further strengthen their dominance in both small- and large-scale farming operations.

The square balers segment is anticipated to witness the fastest growth rate from 2026 to 2033, owing to increasing adoption in commercial and industrial applications where uniform bale shapes are preferred for easy stacking and transport. Square balers are ideal for large agricultural enterprises and livestock farms requiring high-volume bale production for feeding or export purposes. Technological advancements enabling high-capacity, large-format square balers and integration with telematics systems to monitor output and performance are expected to propel segment growth further.

- By Application

On the basis of application, the baler market is categorized into hay compressing, straw compressing, cotton compressing, and others. The hay compressing segment dominated the market in 2025, supported by growing demand for efficiently packed hay in dairy and livestock farming. Round and square hay balers play a critical role in preserving the nutritional content of fodder while enabling easier storage and transportation. The widespread use of advanced baling equipment in regions with large-scale forage production has also contributed to the dominance of this segment.

The cotton compressing segment is projected to register the fastest growth rate from 2026 to 2033, driven by expanding textile production and the growing need for efficient cotton handling and storage solutions. Cotton balers help reduce storage volume and streamline logistics, benefiting large cotton ginning facilities and exporters. The increasing adoption of hydraulic and automated cotton balers to enhance productivity and minimize manual handling risks is further propelling segment expansion across emerging economies.

- By End Use

On the basis of end use, the baler market is divided into individual and commercial. The commercial segment accounted for the largest market share in 2025, driven by high-volume usage across agricultural cooperatives, livestock farms, and industrial processing units. Commercial users prefer large-capacity balers for their ability to handle diverse materials and ensure consistent bale quality for resale or distribution. Continuous product innovations and the integration of smart sensors and IoT-enabled monitoring systems have further enhanced efficiency and reliability for commercial users.

The individual segment is expected to grow at the fastest rate during 2026–2033, fueled by the increasing adoption of compact and affordable balers by small-scale farmers and landowners. The rise of sustainable farming practices and government subsidies for mechanization are encouraging individual farmers to invest in baling machinery. Ease of operation, portability, and reduced dependency on labor are key advantages driving the popularity of this segment among individual users.

- By Distribution Channel

On the basis of distribution channel, the baler market is bifurcated into online and offline. The offline segment dominated the market in 2025, supported by the strong presence of established dealer networks, equipment rental agencies, and agricultural machinery outlets. Offline distribution provides buyers with personalized consultation, equipment demonstrations, and after-sales maintenance support, which remain critical in high-value machinery purchases. Farmers often prefer physical inspection and dealer-based financing options before investing in baling equipment.

The online segment is projected to experience the fastest growth from 2026 to 2033, driven by the increasing digitization of agricultural equipment sales and the rise of e-commerce platforms offering machinery procurement solutions. Online channels provide access to a broader range of products, transparent pricing, and convenient delivery services, appealing to both small-scale farmers and large enterprises. Manufacturers are also expanding their digital presence through direct-to-consumer websites and online partnerships to strengthen brand accessibility.

- By Industry

On the basis of industry, the market is segmented into agriculture, livestock industry, and others. The agriculture segment dominated the market in 2025, driven by rising demand for mechanized baling solutions to enhance crop residue management and fodder preparation efficiency. The shift toward sustainable farming and the need to reduce post-harvest waste are further encouraging the use of balers in crop production. Government initiatives promoting farm mechanization and cost-effective machinery solutions are also fueling agricultural adoption.

The livestock industry segment is expected to record the fastest growth from 2026 to 2033 due to increasing emphasis on high-quality feed management and storage. Livestock farms increasingly use balers to prepare compact, easily stored bales for hay and silage, ensuring year-round feed availability. The growing adoption of high-efficiency balers that maintain fodder quality and reduce wastage is enhancing operational productivity and driving market expansion in this segment.

- By Size

On the basis of size, the baler market is segmented into bound with twine, strapping, netting, and wire. The bound with twine segment dominated the market in 2025, driven by its widespread use in small to medium-scale operations and compatibility with both round and square balers. Twine-bound bales offer cost-effectiveness and easy handling, making them suitable for varied agricultural applications. The availability of durable synthetic twine materials that enhance bale integrity and weather resistance further supports segment growth.

The netting segment is anticipated to witness the fastest growth rate from 2026 to 2033, owing to its efficiency in reducing baling time and improving bale protection during storage and transport. Netting systems provide better coverage, reducing losses due to spoilage and deformation. The increasing adoption of advanced net wrapping technologies in high-performance balers to improve operational throughput and minimize maintenance requirements is boosting demand across commercial and large-scale farming operations.

Baler Market Regional Analysis

- Asia-Pacific dominated the baler market with the largest revenue share of 39.9% in 2025, driven by expanding agricultural activities, increasing mechanization across farming operations, and government initiatives promoting modern equipment adoption

- The region’s large-scale production of crops such as rice, wheat, and hay has accelerated the need for efficient baling solutions

- Cost-effective manufacturing, supportive subsidy programs, and a growing focus on sustainable residue management are further propelling regional demand

China Baler Market Insight

China held the largest share in the Asia-Pacific baler market in 2025, owing to its extensive agricultural base, rising adoption of farm mechanization, and strong presence of domestic baler manufacturers. The government’s focus on improving crop residue management and promoting eco-friendly agricultural practices has driven demand for advanced baling equipment. Growing exports of agricultural machinery and increasing integration of automation and IoT in balers are also enhancing market growth.

India Baler Market Insight

India is witnessing the fastest growth in the Asia-Pacific baler market, fueled by the increasing need to manage crop residues efficiently and the rising adoption of mechanized farming practices. The government’s initiatives such as the “Sub-Mission on Agricultural Mechanization” and subsidies for baler purchases are encouraging widespread usage among small and medium-scale farmers. Expanding livestock and dairy industries, coupled with growing demand for fodder preservation, further strengthen India’s position as the fastest-growing market in the region.

Europe Baler Market Insight

The Europe baler market is expanding steadily, supported by strong emphasis on sustainable agriculture, efficient crop residue management, and widespread use of advanced farming technologies. The region’s well-established agricultural infrastructure and focus on high-quality fodder production are enhancing baler adoption across both individual and commercial users. Environmental regulations promoting biomass collection and recycling are also contributing to market growth.

Germany Baler Market Insight

Germany’s baler market is driven by its advanced agricultural machinery sector, extensive use of precision farming technologies, and emphasis on sustainability. The country’s large livestock and dairy industry demands high-performance balers for consistent hay and silage production. Strong R&D presence, innovation in automation and data-driven farming equipment, and export-oriented manufacturing further strengthen Germany’s market dominance in Europe.

U.K. Baler Market Insight

The U.K. baler market benefits from a well-developed agricultural ecosystem, rising adoption of automated farming solutions, and the growing need for efficient waste and residue management. Increasing government support for agricultural innovation and sustainability programs is encouraging farmers to invest in modern baling systems. Demand for high-efficiency round and square balers is rising, particularly among commercial farms focused on productivity and operational efficiency.

North America Baler Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing investments in agricultural automation, sustainable farming practices, and high demand for hay and biomass balers. Large-scale livestock farming, coupled with the expansion of bioenergy initiatives, is contributing to significant baler adoption. The presence of global manufacturers and advanced distribution networks further strengthens market expansion across the region.

U.S. Baler Market Insight

The U.S. accounted for the largest share in the North America baler market in 2025, supported by extensive hay and forage production and a strong focus on precision agriculture. Technological advancements in baling systems, such as real-time moisture sensors and telematics integration, are enhancing operational efficiency for farmers. The country’s well-established agricultural infrastructure, high mechanization rate, and increasing demand from the livestock industry reinforce its leading position in the region.

Baler Market Share

The baler industry is primarily led by well-established companies, including:

- AGCO Corporation (U.S.)

- CLAAS KGaA mbH (Germany)

- CNH Industrial N.V. (U.K.)

- Deere & Company (U.S.)

- IHI Corporation (Japan)

- KUHN SAS (France)

- KUBOTA Corporation (Japan)

- Maschinenfabrik Bernard KRONE GmbH & Co. KG (Germany)

- Mahindra Tractors (India)

- SDF S.p.A. (Italy)

- American Baler Company (U.S.)

- International Baler (U.S.)

- McHale (Ireland)

- Takakita Co., Ltd. (Japan)

- Carlos Mainero & Co. SAICFI (Argentina)

- Vermeer Corporation (U.S.)

- KARTAR Agro Industries Private Limited (India)

- Sitrex S.p.A. (Italy)

- Minos Agricultural Machinery (Turkey)

Latest Developments in Global Baler Market

- In November 2025, CLAAS KGaA mbH unveiled its next-generation square baler, the CUBIX, at Agritechnica 2025, featuring AI-supported bale density control, a double-loop knotter system, and an advanced drive mechanism delivering up to 70 tonnes of output per hour. This innovation is expected to enhance operational precision and productivity for large-scale farming operations, strengthening CLAAS’s competitive position in the premium baler segment and driving adoption of intelligent agricultural machinery in Europe

- In October 2025, John Deere introduced its new round baler equipped with “Weave Automation” technology, enabling autonomous windrow tracking and uniform bale production with minimal operator intervention. This development significantly improves efficiency and consistency in baling operations, positioning John Deere as a frontrunner in automation-led agricultural solutions and supporting the growing trend of smart, labor-efficient farming practices across global markets

- In August 2025, CNH Industrial N.V., through its New Holland brand, launched the Roll-Belt 1 Series variable-chamber round balers, integrating real-time bale data transmission and field performance mapping via built-in cellular connectivity. The introduction of connected baling technology is set to revolutionize precision farming by offering farmers enhanced control over yield quality and equipment performance, thereby expanding CNH Industrial’s footprint in digital agriculture solutions

- In June 2025, Loftness Manufacturing released a new grain-bag baler designed to simplify large-scale bag handling, capable of baling bags up to 500 feet in length. This innovation addresses a critical gap in grain storage and transport efficiency, particularly in high-output agricultural regions, and is expected to boost Loftness’s market share among large commercial grain producers adopting automated post-harvest systems

- In April 2025, Massey Ferguson introduced the SB.1436DB double small-square baler, enhancing bale density and operational flexibility for mid-size farms. The product’s advanced knotting mechanism and compact design improve overall productivity, reinforcing Massey Ferguson’s position in the mid-tier baler market and catering to the growing demand for efficient, durable equipment among small to medium-scale agricultural operators

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.