Global Ballistic Protection Bulletproof Glass Market

Market Size in USD Billion

CAGR :

%

USD

2.43 Billion

USD

7.77 Billion

2024

2032

USD

2.43 Billion

USD

7.77 Billion

2024

2032

| 2025 –2032 | |

| USD 2.43 Billion | |

| USD 7.77 Billion | |

|

|

|

|

Ballistic Protection Bulletproof Glass Market Size

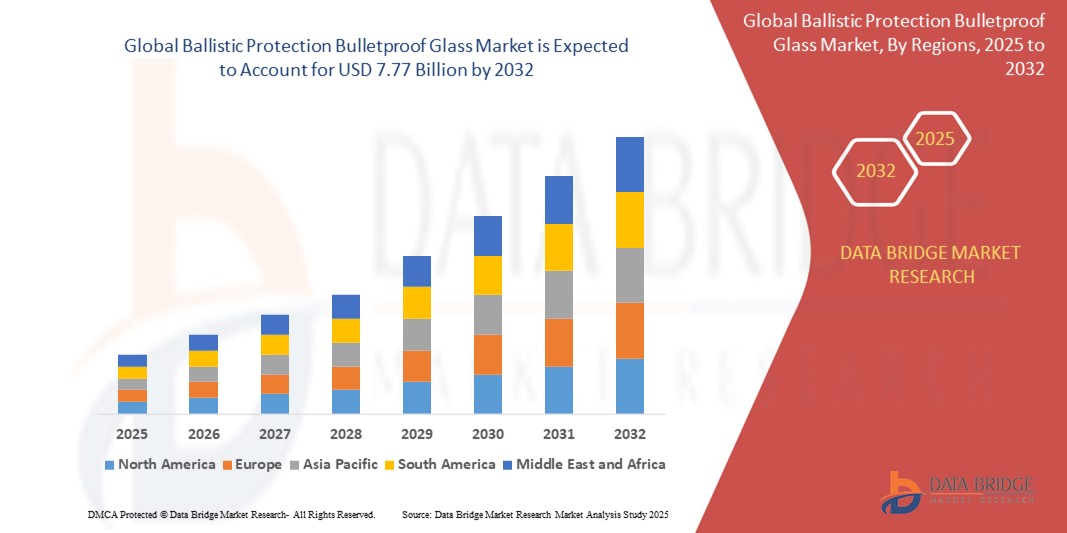

- The global ballistic protection bulletproof glass market was valued at USD 2.43 billion in 2024 and is expected to reach USD 7.77 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.60%, primarily driven by increasing demand from defense , security, and civilian sectors amid rising global safety concerns

- This growth is driven by factors such as rising geopolitical tensions, increasing demand for armored vehicles, growth in defense and security budgets, and technological advancements in glass materials and lamination processes

Ballistic Protection Bulletproof Glass Market Analysis

- Ballistic protection bulletproof glass is a crucial security component used across various sectors, including military, defense, law enforcement, banking, automotive, and commercial infrastructure. It is engineered to absorb and dissipate the energy of ballistic impacts, thereby preventing penetration and ensuring occupant safety

- The demand for ballistic protection glass is significantly driven by rising global security concerns, increased terrorist threats, and a surge in armed conflicts. Additionally, the expansion of high-risk zones, urbanization, and protection of critical infrastructure have further fueled the adoption of bulletproof glass

- The North America region stands out as one of the dominant regions in the ballistic protection bulletproof glass market, backed by strong defense spending, ongoing military modernization programs, and the widespread use of armored vehicles in both military and civilian applications

- For instance, the U.S. Department of Defense has ramped up investments in advanced armor systems, including transparent armor for vehicles and facilities. Private sector applications, especially in banking, VIP transport, and commercial security, have also accelerated growth in the region

- Globally, ballistic protection bulletproof glass is ranked among the top essential components in armored systems, alongside composite armor plating and blast-resistant structures. It plays a pivotal role in ensuring comprehensive protection against small arms fire, explosives, and forced entry, particularly in high-risk environments

Report Scope and Ballistic Protection Bulletproof Glass Market Segmentation

|

Attributes |

Ballistic Protection Bulletproof Glass Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ballistic Protection Bulletproof Glass Market Trends

“Increased Integration of Smart Glass Technologies and Lightweight Composites”

- One prominent trend in the global ballistic protection bulletproof glass market is the growing integration of smart glass technologies and the use of lightweight composite materials in glass manufacturing

- These advancements enhance both the functionality and performance of bulletproof glass by improving optical clarity, reducing weight, and enabling adaptive response features, such as tint change, heat insulation, and embedded sensors

- For instance, next-generation transparent armor systems now feature electrochromic layers that automatically adjust tint based on lighting conditions, providing better visibility and glare reduction for vehicle operators and building occupants in high-risk environments

- The incorporation of composite layering techniques, such as combining polycarbonate, acrylic, and specialized polymers with traditional glass, results in materials that are significantly lighter without compromising ballistic resistance—an essential feature for armored vehicles and aircraft where weight is critical

- This trend is revolutionizing the security and defense landscape, making ballistic glass more adaptable, energy-efficient, and operationally effective. It is also expanding its applications into luxury vehicles, smart buildings, and public infrastructure, further boosting market demand and encouraging innovation

Ballistic Protection Bulletproof Glass Market Dynamics

Driver

“Growing Need for Enhanced Security Amid Rising Global Threats”

- The rising incidence of armed conflicts, terrorist activities, and civil unrest across multiple regions is significantly contributing to the growing demand for ballistic protection bulletproof glass. As safety concerns intensify in both public and private sectors, the implementation of high-performance bulletproof glass in vehicles, infrastructure, and personnel protection systems has become a strategic priority

- Government agencies, law enforcement, banks, embassies, and private organizations are actively adopting ballistic glass solutions to safeguard people and critical assets, particularly in high-risk urban zones and politically unstable regions

- The modernization of military fleets and infrastructure security is further boosting demand for advanced transparent armor capable of withstanding a range of ballistic threats while offering optical clarity and lighter weight

For instance,

- In February 2023, Saint-Gobain Sekurit, a leading player in the advanced glazing market, announced the launch of a new generation of lightweight ballistic glass for defense and armored vehicles. The glass is designed to meet STANAG 4569 protection levels while reducing vehicle weight, improving fuel efficiency, and maintaining clear visibility for tactical operations

- In August 2022, AGC Inc. (Asahi Glass Company) expanded its defense-grade product line with the development of a multi-hit capable transparent armor system for use in military command posts and VIP transport. This product was tailored to meet rising demand from Asia-Pacific and Middle Eastern countries, which are seeing increased defense spending amid regional tensions

- As a result of these escalating threats and the consistent launch of advanced, mission-ready ballistic glass solutions, the global market continues to grow rapidly—driven by the need for next-generation security technologies across both defense and civilian applications

Opportunity

“Advanced Composites Enhance Ballistic Glass Performance”

- The global ballistic protection bulletproof glass market is witnessing a major opportunity in the integration of advanced materials and smart technologies, aimed at enhancing strength, transparency, and functionality

- Emerging technologies like nanotechnology, electrochromic coatings, embedded sensors, and hybrid composite layers are creating new possibilities for multi-functional ballistic glass that goes beyond traditional protection

- These innovations enable ballistic glass to provide real-time structural feedback, adaptive tinting for glare reduction, and enhanced energy absorption, opening up opportunities for deployment in next-generation military vehicles, critical infrastructure, luxury armored cars, and smart buildings

- The development of lightweight transparent armor using nanocomposite interlayers and advanced polymers also allows for reduced weight without compromising ballistic performance—essential for air, naval, and light tactical vehicles

For instance,

- In October 2023, PPG Industries unveiled its next-gen transparent armor solution, integrating nanocomposite interlayers that increase impact resistance by over 30% while reducing weight by 20%. This technology is designed specifically for military ground and aerial platforms, addressing growing demand for lightweight ballistic protection in NATO countries

- In June 2022, Isoclima Group announced the launch of Vision Systems SmartShield, a bulletproof glass solution embedded with electrochromic technology that allows dynamic tint adjustment and improved energy efficiency. The product is being piloted in diplomatic vehicles and government buildings across Europe and the Middle East, targeting enhanced operational control and occupant comfort in high-threat environments

- These developments signal a significant opportunity for market expansion as end users across defense, automotive, banking, and civil security sectors look to upgrade their security infrastructure with multi-functional, intelligent ballistic glass solutions

Restraint/Challenge

“High Manufacturing and Installation Costs Hindering Market Penetration”

- The high cost associated with the production and installation of ballistic protection bulletproof glass remains a significant challenge, particularly in price-sensitive markets and developing regions. This financial barrier affects adoption across civil, commercial, and small-scale law enforcement sectors, where budget constraints often prevent large-scale procurement

- Ballistic glass involves complex multi-layered lamination, use of advanced materials like polycarbonate, borosilicate, and specialty polymers, and rigorous compliance with international ballistic standards (e.g., NIJ, STANAG)—all contributing to high production costs

- Moreover, the weight and customization needs of bulletproof glass (especially for curved or automotive applications) increase logistics and retrofitting expenses, making it difficult for smaller clients or emerging economies to invest in such solutions

For instance,

- In May 2023, according to a report by Armormax, the cost of ballistic glass for civilian armored vehicles ranges from USD 20,000 to USD 50,000 per vehicle, depending on the protection level and surface area, significantly limiting adoption among private security companies and civilian consumers

- In December 2022, a market analysis by Global Security Glazing highlighted that custom-manufactured architectural bullet-resistant glass installations in government and commercial buildings can exceed USD 300 per square foot, posing a challenge for widespread implementation, especially in budget-constrained public infrastructure projects

- As a result, these high costs can lead to slower adoption rates, particularly in non-military sectors, limiting the broader deployment of ballistic protection glass and hampering market expansion in emerging markets

Ophthalmic Operational Microscope Market Scope

The market is segmented on the basis of product type, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

Ballistic Protection Bulletproof Glass Market Regional Analysis

“North America is the Dominant Region in the Ballistic Protection Bulletproof Glass Market”

- North America dominates the global ballistic protection bulletproof glass market, primarily driven by robust defense spending, advanced security infrastructure, and early adoption of high-performance protective technologies

- The U.S., in particular, accounts for a significant market share due to its extensive military modernization programs, stringent safety regulations, and growing demand for armored vehicles and secure facilities in both public and private sectors

- The presence of key market players such as AGC Inc., Saint-Gobain, PPG Industries, and Guardian Glass, combined with continued investments in R&D and government-backed innovation programs, further solidify the region’s leadership position

- Moreover, North America benefits from large-scale implementation of ballistic glass in government buildings, banks, embassies, police vehicles, and critical infrastructure. The growing need for mass shooter protection, riot control, and terrorism mitigation has driven significant installations in schools, courthouses, and airports

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global ballistic protection bulletproof glass market, driven by rising geopolitical tensions, increasing defense budgets, urban security concerns, and infrastructure modernization initiatives across emerging economies

- Countries such as China, India, South Korea, and Australia are rapidly expanding their defense capabilities and investing in modern protective solutions to counter growing internal and external threats. This includes the use of ballistic glass in armored vehicles, police force equipment, VIP transport, and public infrastructure

- India and China, with their expanding urban centers and high population density, are investing in security upgrades for public spaces, including bullet-resistant glass installations in transportation systems, financial institutions, and government buildings

- Japan and South Korea are driving innovation with local manufacturers focusing on lightweight ballistic composites and smart glass technologies, contributing to regional advancements in material science and application-specific protective systems.

Ballistic Protection Bulletproof Glass Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Saint-Gobain (France)

- DuPont (U.S.)

- AGC Inc. (Japan)

- PPG Industries Ohio, Inc. (U.S.)

- Schott (Germany)

- BASF SE (Germany)

- Nippon Sheet Glass Co., Ltd (Japan)

- Glass Solutions (France)

- Da Di Glass (S) Pte Ltd. (U.S.)

- The Haartz Corporation (U.S.)

- Kaiser Aluminum (U.S.)

- Guardian Industries Holdings (U.S.)

- Kuraray (Germany)

- FUJIFILM Manufacturing Europe B.V. (Netherlands)

- Sevco (Canada)

Latest Developments in Global Ballistic Protection Bulletproof Glass Market

- In May 2022, TenCate Advanced Armor was awarded a contract by the Naval Surface Warfare Center to provide maritime buoyant plates for the Antiterrorism Afloat Equipage Program. This initiative is designed to strengthen maritime security by equipping naval forces with advanced protective gear to counter evolving threats. The contract supports efforts to enhance safety measures for personnel operating in high-risk environments at sea. Work under this agreement is expected to be completed by June 2023, with potential extensions until June 2025

- In March 2022, BAE Systems secured a $34.9 million contract from the U.S. Marine Corps to design and develop the Amphibious Combat Vehicle Recovery (ACV-R) variant. This new addition to the ACV family is intended to replace the legacy Assault Amphibious Vehicle recovery variant (AAVR7A1), providing direct field support, maintenance, and recovery capabilities. The contract marks the first phase of the program, focusing on design and development over a 20-month period, followed by production test vehicles for evaluation

- In March 2022, BAE Systems secured a contract from the U.S. Army Contracting Command to manufacture and deliver M109A7 self-propelled howitzers and M992A3 ammunition carriers. This agreement is part of a broader effort to modernize military assets, ensuring troops have access to advanced combat vehicles for enhanced operational readiness. The contract supports the Army’s Armored Brigade Combat Teams (ABCT) by providing improved firepower, mobility, and survivability. Work is being carried out across multiple U.S. locations, with completion expected by January 2029

- In February 2022, TenCate Advanced Armor partnered with Mack Defense to develop a force protection system for the Mack Granite-based M917A3 Heavy Dump Truck (HDT) and other Mack Defense vehicle platforms. This system enhances occupant safety in hostile environments by integrating advanced armor solutions, blast protection, and active blast mitigation. The armored cab provides customizable protection kits, ensuring adaptability to various threat levels. The initiative strengthens military vehicle survivability while maintaining mobility and operational efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ballistic Protection Bulletproof Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ballistic Protection Bulletproof Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ballistic Protection Bulletproof Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.