Global Bambara Beans Market

Market Size in USD Million

CAGR :

%

USD

149.45 Million

USD

234.63 Million

2025

2033

USD

149.45 Million

USD

234.63 Million

2025

2033

| 2026 –2033 | |

| USD 149.45 Million | |

| USD 234.63 Million | |

|

|

|

|

What is the Global Bambara Beans Market Size and Growth Rate?

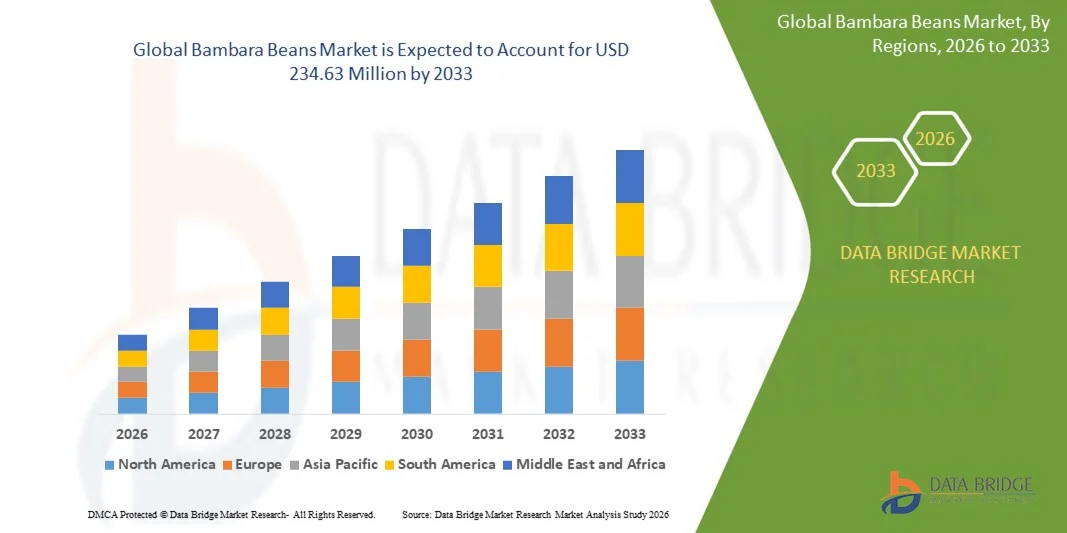

- The global bambara beans market size was valued at USD 149.45 million in 2025 and is expected to reach USD 234.63 million by 2033, at a CAGR of5.8% during the forecast period

- The major growing factor towards bambara beans market is the rapid change in the lifestyle. Furthermore, the rapidly evolving consumer trends and rise in preferences are also expected to heighten the overall demand for bambara beans market

What are the Major Takeaways of Bambara Beans Market?

- The rise in the demand for plant-based food products, veganism and large number of health-conscious consumers are also expected to serve as foremost drivers for the bambara beans market at a global level. In addition, the increase in the concerns regarding the negative effects of sugar on health is also lifting the growth of the bambara beans market

- However, the high uncertainty related to the weather is projected to act as a restraint towards the growth of Bambara beans market, whereas the lack in preference of the product can challenge the growth of the Bambara beans market

- North America dominated the bambara beans market with the largest revenue share of 41.36% in 2025, supported by rising consumer interest in plant-based proteins, sustainable crops, and nutrient-rich African legumes

- Asia-Pacific is projected to register the fastest CAGR of 11.69% from 2026 to 2033, fueled by rising demand for affordable plant proteins, expanding food-processing industries, and increasing cultivation interest across India, Southeast Asia, and Australia

- The Cultivated segment dominated the market with an estimated 68.3% share in 2025, driven by large-scale farming, improved seed varieties, and rising demand for consistent quality in food, nutraceutical, and processed ingredient applications

Report Scope and Bambara Beans Market Segmentation

|

Attributes |

Bambara Beans Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Bambara Beans Market?

Increasing Shift Toward Nutrient-Dense, Climate-Resilient, and Commercially Scalable Bambara Bean Products

- The bambara beans market is experiencing rapid adoption of high-protein, drought-resistant, and climate-smart crops, driven by rising demand for sustainable plant-based ingredients across food, nutraceutical, and functional beverage sectors

- Manufacturers and processors are introducing ready-to-eat, value-added, and minimally processed Bambara-based products such as flours, snacks, porridges, and dairy alternatives to enhance consumer acceptance and commercial viability

- Growing interest in regenerative agriculture, soil-improving legume crops, and indigenous African foods is pushing companies to integrate Bambara beans into innovative product formulations and global specialty food markets

- For instance, companies such as Yolélé, Savannah Fruits Company, GreenPath Food, and Sesajal have expanded their Bambara bean–based offerings to support clean-label foods, nutritional blends, and export-ready functional ingredients

- Increasing consumer focus on plant proteins, allergen-free crops, and climate-resilient ingredients is accelerating investment in Bambara bean processing technologies and global distribution channels

- As demand shifts toward sustainable proteins and climate-smart crops, Bambara beans are becoming a vital ingredient for future food security, nutrition enhancement, and resilient supply chains

What are the Key Drivers of Bambara Beans Market?

- Rising demand for affordable, nutrient-rich, and drought-resistant crops is pushing Bambara beans into mainstream food, functional ingredient, and nutritional supplement applications across Africa, Europe, and North America

- For instance, in 2025, companies such as Olivado, Proteco Gold, and Chosen Foods expanded their sourcing and processing initiatives to strengthen supply chains for premium Bambara bean–derived ingredients

- Growing adoption of plant-based diets, vegan protein alternatives, and gluten-free formulations is boosting demand for Bambara bean flour, protein concentrates, and health-focused consumer products

- Advancements in seed improvement, dehulling technology, milling efficiency, and value-chain digitization have enhanced yield quality, product uniformity, and processing capabilities

- Rising focus on food security, sustainable farming, and climate-adaptive crops is encouraging governments and private players to increase investments in Bambara bean cultivation and commercialization

- Supported by expanding agricultural R&D, export opportunities, and functional food innovation, the Bambara Beans market is projected to witness strong, long-term, globally driven growth

Which Factor is Challenging the Growth of the Bambara Beans Market?

- Limited commercial-scale processing facilities and relatively high production costs restrict large-scale adoption and reduce competitiveness compared to soy, chickpeas, and other mainstream legumes

- For instance, during 2024–2025, fluctuations in export logistics, seed availability, and smallholder production capacities increased supply inconsistencies for several African and international vendors

- Lack of awareness among global consumers regarding Bambara bean nutritional benefits, taste profile, and culinary versatility limits market penetration beyond regional use

- Complexities in post-harvest handling, dehulling, and standardized processing pose challenges for manufacturers aiming to scale Bambara-based product lines

- Competition from alternative plant proteins, high-protein pulses, and established functional ingredients creates pricing pressure and reduces Bambara bean uptake in certain markets

- To address these challenges, companies are focusing on value-added processing, farmer training, supply-chain strengthening, and nutrition marketing to enhance global adoption of Bambara beans

How is the Bambara Beans Market Segmented?

The market is segmented on the basis of product type, nature, form type, application, and end use application.

- By Product Type

The Bambara Beans market is segmented into Wild and Cultivated varieties. The Cultivated segment dominated the market with an estimated 68.3% share in 2025, driven by large-scale farming, improved seed varieties, and rising demand for consistent quality in food, nutraceutical, and processed ingredient applications. Cultivated Bambara beans offer higher yield stability, better seed uniformity, and predictable nutrient composition, making them the preferred choice for commercial processors and export markets. Their wider availability and lower supply-chain risk further strengthen adoption across Africa, Europe, and North America.

The Wild segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing interest in indigenous crop diversity, sustainable sourcing, and premium traditional food products. Wild Bambara beans are gaining attention among nutraceutical manufacturers and specialty food brands due to their higher micronutrient density, biodiversity value, and niche market positioning.

- By Nature

The market is segmented into Organic and Conventional Bambara beans. The Conventional segment dominated the market with a 72.6% share in 2025, driven by widespread cultivation practices, lower production costs, and strong use across processed foods, flour mills, animal feed, and bulk ingredient supply chains. Conventional Bambara beans benefit from mature farming ecosystems and stable yields, enabling reliable procurement for large processors and export distributors.

The Organic segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising consumer preference for chemical-free, nutrient-rich, and sustainably produced legumes. Increasing adoption of organic certification programs across sub-Saharan Africa and growing demand for clean-label proteins in Europe and North America are further accelerating this shift. Organic Bambara beans are gaining traction in health foods, specialty blends, and functional formulations, reinforcing strong long-term market expansion.

- By Form Type

Based on form type, the market is divided into Whole, Flour, and Split. The Whole segment dominated the market with a 51.4% share in 2025, supported by its extensive use in traditional cooking, household consumption, and bulk distribution across African and Asian markets. Whole Bambara beans are favored due to longer shelf life, minimal processing needs, and high suitability for both home cooking and small-scale food service applications.

The Flour segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising incorporation of Bambara bean flour in gluten-free baked goods, protein blends, infant foods, and ready-to-eat health products. Growing demand for plant-based protein ingredients and clean-label formulations is further boosting flour-based applications. The Split segment maintains steady adoption in quick-cooking foods and processed meal products but expands slower than flour due to limited processing investments.

- By Application

The Bambara Beans market is segmented into Home Uses, Processed Foods & Oil, Animal Feed, Medicinal Use, and Others. The Processed Foods & Oil segment dominated the market with a 34.8% share in 2025, driven by increasing use of Bambara beans in flours, snacks, porridges, dairy alternatives, and specialty protein ingredients. Food processors prefer Bambara beans for their high protein content, functional starch properties, and clean-label appeal.

The Medicinal Use segment is expected to grow at the fastest CAGR from 2026 to 2033, due to rising research interest in Bambara beans’ antioxidant activity, anti-diabetic properties, and micronutrient-rich profile. Nutraceutical and herbal supplement manufacturers are increasingly using Bambara extracts for digestive health, immune support, and therapeutic formulations. The Animal Feed and Home Uses segments show steady demand, especially in rural markets, while the Others category includes emerging applications in beverage mixes and fortified foods.

- By End Use Application

The market is segmented into B2B, Household/Retail, Food Service, and Institutional. The B2B segment dominated the market with a 57.9% share in 2025, driven by large-scale procurement across food processors, flour manufacturers, feed producers, and nutraceutical ingredient suppliers. Consistent demand for flour, protein concentrates, and processed Bambara derivatives supports strong B2B volume growth.

The Food Service segment is projected to grow at the fastest CAGR from 2026 to 2033, as restaurants, cafés, and specialty food chains increasingly incorporate Bambara bean–based dishes, plant-protein meals, and gluten-free menu items. Rising popularity of African cuisine, plant-based bowls, and functional meals is accelerating adoption. The Household/Retail segment maintains steady growth driven by rising health awareness, while the Institutional segment expands through school feeding programs and government-supported nutrition initiatives.

Which Region Holds the Largest Share of the Bambara Beans Market?

- North America dominated the bambara beans market with the largest revenue share of 41.36% in 2025, supported by rising consumer interest in plant-based proteins, sustainable crops, and nutrient-rich African legumes. Increasing demand for high-fiber, gluten-free, and climate-resilient foods across the U.S. and Canada continues to boost imports of Bambara beans for use in flour blends, snacks, functional foods, and alternative protein formulations

- Food manufacturers are actively incorporating Bambara bean derivatives into dairy alternatives, protein powders, fortified meals, and ready-to-cook mixes, strengthening regional adoption

- Growing awareness of climate-resilient crops, expansion of ethnic food markets, and rising preference for nutrient-dense ingredients further reinforce North America’s market leadership. Continuous innovation in plant-protein processing, clean-label product development, and sustainable sourcing partnerships supports long-term growth

U.S. Bambara Beans Market Insight

The U.S. remains the largest contributor to the North American market due to strong demand for plant-based proteins, gluten-free flours, and nutrient-rich legumes. Rising innovation in functional foods, bakery blends, beverage mixes, and alternative proteins is driving increased incorporation of Bambara bean flour and concentrates. Food-tech startups, nutraceutical manufacturers, and specialty food brands are increasingly exploring Bambara beans for their high protein, amino acid profile, and low glycemic index. Moreover, growing consumer awareness of eco-friendly and climate-smart crops is boosting popularity in retail chains, ethnic stores, and online platforms. The presence of leading clean-label product developers and strong investment in plant-based R&D further accelerates U.S. market expansion.

Canada Bambara Beans Market Insight

Canada contributes significantly to regional growth, driven by rising adoption of healthy legume-based foods, increasing demand for sustainable protein sources, and strong interest in African superfoods. Food processors and health-food manufacturers are integrating Bambara beans into high-protein snacks, flour mixes, soups, and value-added nutritional products. Supportive government initiatives promoting plant-based protein innovation, strong consumer preference for organic and minimally processed ingredients, and expanding retail penetration reinforce market development. Growing university-led research on climate-resilient crops also enhances awareness and future adoption.

Asia-Pacific Bambara Beans Market (Fastest Growing)

Asia-Pacific is projected to register the fastest CAGR of 11.69% from 2026 to 2033, fueled by rising demand for affordable plant proteins, expanding food-processing industries, and increasing cultivation interest across India, Southeast Asia, and Australia. Strong growth in gluten-free product manufacturing, fortified foods, and sustainable crop sourcing is accelerating adoption of Bambara beans in the region. High-volume consumption of legumes, growing health awareness, and rising demand for nutrient-dense traditional foods further support rapid market expansion. Increasing investment in drought-resistant crop research and government encouragement for climate-resilient agriculture are strengthening long-term growth prospects.

China Bambara Beans Market Insight

China is the largest contributor in Asia-Pacific, driven by a growing shift toward functional foods, high-protein flours, and alternative plant-based ingredients. Rising interest in African superfoods, rapid expansion of the health-food manufacturing sector, and strong government focus on food security and sustainable crops are boosting adoption. Domestic processors are increasingly exploring Bambara beans for usage in fortified snacks, infant foods, and nutritional powders, while competitive local sourcing options further support market penetration.

Japan Bambara Beans Market Insight

Japan demonstrates steady market growth supported by strong demand for premium-quality, nutrient-rich legumes, and innovative plant-based product development. Bambara beans are increasingly utilized in bakery formulations, health snacks, and functional food preparations due to their digestibility and amino acid balance. Japan’s emphasis on high-quality food processing, advanced nutrition science, and clean-label innovation drives adoption.

India Bambara Beans Market Insight

India is emerging as a high-potential growth hub owing to rising demand for drought-resistant crops, expanding flour processing industries, and strong cultural consumption of legumes. Food manufacturers are adopting Bambara bean flour and splits for snacks, bakery items, protein mixes, and traditional foods. Government-backed initiatives promoting climate-smart agriculture and increasing interest among startups in plant protein innovation further support market expansion.

South Korea Bambara Beans Market Insight

South Korea contributes significantly due to strong interest in high-protein, clean-label ingredients and rapid growth of plant-based food alternatives. Increasing development of nutrient-enriched snacks, health beverages, and functional food supplements is driving demand for Bambara bean flour and extracts. Technological innovation in food processing, rising adoption of African superfoods, and strong retail distribution channels support sustained market growth.

Which are the Top Companies in Bambara Beans Market?

The bambara beans industry is primarily led by well-established companies, including:

- NamZ (Singapore)

- Yolélé (U.S.)

- The Savannah Fruits Company (Ghana)

- ECOFI Agribusiness Ltd. (Nigeria)

- AgroTech Plus Ltd. (Kenya)

- Regen Organics (Kenya)

- AgriCure Global Ltd. (South Africa)

- Tree Crops and Agroforestry Network (Ghana)

- GreenPath Food (Ethiopia)

- Zenvus SmartFarm (Nigeria)

- ProClimate Foods (Germany)

- AgroTropic Ltd. (India)

- GreenPods Biotech (U.K.)

What are the Recent Developments in Global Bambara Beans Market?

- In June 2025, Senegal’s PRODAC initiative introduced an integrated modern agriculture model aimed at expanding orphan crop acreage and improving market access, including for Bambara beans. This development is expected to significantly enhance production capacity and strengthen value-chain efficiency

- In May 2025, Ethiopia announced the establishment of a new fertilizer plant designed to improve soil nutrient availability, which could increase Bambara bean yields through customized nutrient inputs. This initiative is anticipated to boost overall productivity and support local farming communities

- In February 2025, CHS expanded its processing infrastructure by adding new pulse processing lines, reflecting rising industrial interest in diverse legumes such as Bambara beans. This expansion is such asly to support greater supply scalability in the pulse industry

- In September 2024, Cargill and HarvestPlus launched NutriHarvest, a USD 3 million program supporting 119,000 farmers cultivating nutrient-rich legumes, including Bambara beans. This project is expected to enhance farmer incomes and promote nutritional security

- In July 2022, Sacoma introduced a new range of Bambara bean snacks in Europe, earning recognition for their rich nutritional profile and unique taste, while U.S.-based Specialty Produce expanded its catalog to include Bambara beans in response to rising health-conscious consumer demand. These initiatives are set to further elevate the global visibility and acceptance of Bambara-based products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bambara Beans Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bambara Beans Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bambara Beans Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.