Global Bancassurance Market

Market Size in USD Billion

CAGR :

%

USD

1,506.54 Billion

USD

2,312.06 Billion

2024

2032

USD

1,506.54 Billion

USD

2,312.06 Billion

2024

2032

| 2025 –2032 | |

| USD 1,506.54 Billion | |

| USD 2,312.06 Billion | |

|

|

|

|

What is the Global Bancassurance Market Size and Growth Rate?

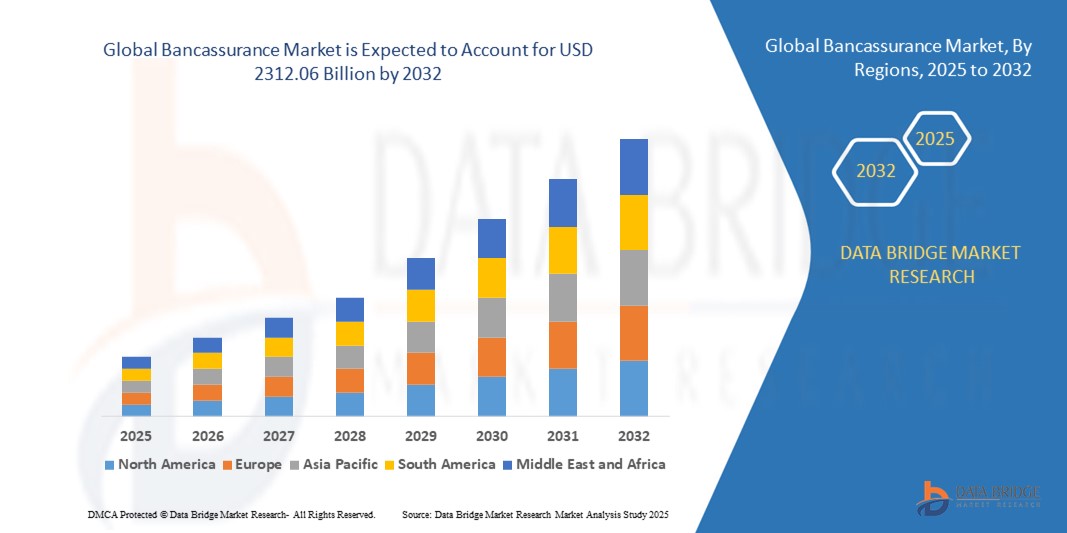

- The global bancassurance market size was valued at USD 1506.54 billion in 2024 and is expected to reach USD 2312.06 billion by 2032, at a CAGR of 5.50% during the forecast period

- The global bancassurance market encompasses partnerships between banks and insurance companies to offer a wide range of insurance products and financial services to customers. Bancassurance leverages the distribution network and customer base of banks to market insurance products effectively. It provides customers with convenient access to insurance solutions while enabling insurance companies to expand their market reach and enhance customer engagement

What are the Major Takeaways of Bancassurance Market?

- Increasing consumer awareness about financial planning and risk management drives the demand for insurance products offered through bancassurance channels. Customers seek comprehensive financial solutions that address their insurance and investment needs, fostering the growth of bancassurance partnerships

- Digitalization and technological advancements enable banks and insurance companies to enhance customer experience through personalized services, online platforms, and digital distribution channels. Investments in digital infrastructure and data analytics enhance bancassurance capabilities, enabling seamless integration of banking and insurance services

- North America dominated the bancassurance market with the largest revenue share of 42.47% in 2024, supported by the widespread adoption of digital banking, robust insurance penetration, and strong collaboration between banks and insurance providers

- Asia-Pacific bancassurance market is poised to grow at the fastest CAGR of 12.14% during 2025–2032, driven by rapid urbanization, increasing disposable incomes, and growing digital adoption in banking and insurance

- The Life Bancassurance segment dominated the market with the largest revenue share of 61.5% in 2024, driven by the rising demand for long-term savings products, increasing awareness about financial protection, and the integration of insurance solutions within banking services

Report Scope and Bancassurance Market Segmentation

|

Attributes |

Bancassurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Bancassurance Market?

AI-Driven Personalization and Digital Integration

- A major trend in the global bancassurance market is the adoption of artificial intelligence (AI) and advanced digital platforms to personalize insurance offerings and improve customer engagement. AI enables banks to analyze customer data, anticipate needs, and recommend tailored insurance solutions in real time

- For instance, Allianz has deployed AI-driven chatbots within its bancassurance channels to provide instant policy information and claims guidance, significantly improving customer experience. Similarly, AXA integrates machine learning into partner banks’ apps to suggest relevant insurance products based on customer profiles

- The use of AI-powered analytics helps bancassurers optimize cross-selling strategies, reduce policy lapses, and enhance fraud detection. In addition, digital integration allows seamless onboarding, eKYC, and policy issuance directly through banking apps, making the process faster and more transparent

- This trend is reshaping bancassurance from a traditional sales model to a customer-centric, tech-enabled ecosystem, where personalized and data-driven offerings create stronger long-term customer relationships and higher conversion rates

What are the Key Drivers of Bancassurance Market?

- The growing digital transformation in banking and the rising demand for personalized financial products are key drivers of the bancassurance market. Banks leverage their customer base to distribute insurance efficiently, while insurers gain access to vast retail and corporate segments

- For instance, in May 2024, BNP Paribas Cardif partnered with ING Group to enhance AI-powered bancassurance solutions, offering life and health insurance through digital banking channels. Such collaborations between banks and insurers continue to expand market penetration

- The increasing focus on financial inclusion in emerging economies further accelerates bancassurance adoption, as banks provide insurance access to underinsured populations through branch networks and digital platforms

- In addition, the rising demand for life, health, and retirement solutions, coupled with customers’ preference for convenience and bundled financial products, drives the growth of bancassurance globally

Which Factor is Challenging the Growth of the Bancassurance Market?

- One of the biggest challenges is the regulatory complexity and compliance requirements across different countries. Bancassurance involves financial and insurance regulators, often creating overlapping or conflicting rules that can slow down product approvals and distribution

- For instance, in 2024, regulatory scrutiny in Europe increased regarding the sale of investment-linked insurance through banks, raising concerns over mis-selling and compliance transparency. This highlights the need for strict governance and training of banking staff engaged in insurance distribution

- Another challenge is the lack of specialized insurance knowledge among banking staff, which can impact customer trust and lead to inefficiencies in explaining products. High dependency on third-party digital platforms also increases operational risks

- Moreover, cybersecurity risks in digital bancassurance platforms, coupled with rising concerns about data privacy, remain significant hurdles. Building stronger compliance frameworks, investing in staff training, and enhancing cyber protection will be crucial for overcoming these barriers and ensuring sustainable growth

How is the Bancassurance Market Segmented?

The market is segmented on the basis of type, distribution channel, and end-user.

- By Type

On the basis of type, the bancassurance market is segmented into Life Bancassurance and Non-Life Bancassurance. The Life Bancassurance segment dominated the market with the largest revenue share of 61.5% in 2024, driven by the rising demand for long-term savings products, increasing awareness about financial protection, and the integration of insurance solutions within banking services. Customers often prefer life insurance products sold through banks due to the trust factor, convenience, and bundled financial solutions.

The Non-Life Bancassurance segment is expected to witness the fastest growth rate of 18.9% from 2025 to 2032, supported by the growing adoption of health, motor, and property insurance policies. Increasing urbanization, regulatory support, and the rising need for short-term risk coverage are fueling demand for non-life policies across both retail and corporate segments.

- By Distribution Channel

On the basis of distribution channel, the bancassurance market is segmented into Banks and Insurance Companies. The Banks segment held the largest market revenue share in 2024, driven by their extensive customer base, established distribution networks, and ability to cross-sell insurance products alongside traditional banking services. Banks act as a trusted intermediary, leveraging their existing relationships to promote financial security solutions.

The Insurance Companies segment is anticipated to witness the fastest CAGR from 2025 to 2032, as insurers increasingly collaborate with digital banks and fintech platforms to expand their reach. The adoption of omni-channel distribution and digital onboarding is expected to fuel growth in this segment.

- By End-User

On the basis of end-user, the bancassurance market is segmented into Individuals and Corporates. The Individuals segment accounted for the largest revenue share in 2024, driven by the rising middle-class population, growing financial literacy, and demand for personalized financial products. Customers benefit from tailored life, health, and retirement insurance solutions offered conveniently through banking channels.

The Corporates segment is projected to register the fastest growth rate from 2025 to 2032, supported by increasing demand for employee benefit schemes, group insurance policies, and risk management solutions. The growing adoption of corporate insurance partnerships highlights the strategic value of bancassurance in the enterprise sector.

Which Region Holds the Largest Share of the Bancassurance Market?

- North America dominated the bancassurance market with the largest revenue share of 42.47% in 2024, supported by the widespread adoption of digital banking, robust insurance penetration, and strong collaboration between banks and insurance providers

- Consumers in the region value convenience, trust, and integrated financial solutions, which drive higher adoption of bancassurance products. The rising preference for hybrid banking models, coupled with increasing financial literacy, further fuels market expansion

- The region’s well-established financial infrastructure, high disposable incomes, and rapid adoption of digital channels continue to strengthen bancassurance as a preferred financial distribution model

U.S. Bancassurance Market Insight

The U.S. bancassurance market captured the largest revenue share in 2024 within North America, fueled by strong cross-selling opportunities and the growing trend of digital financial services. Consumers are increasingly inclined toward bundled financial products that integrate banking and insurance. The rapid adoption of AI-driven advisory platforms, mobile apps, and personalized insurance offerings further accelerates growth. Strategic alliances between leading banks and insurers, along with regulatory support, are enhancing the bancassurance landscape across the U.S.

Europe Bancassurance Market Insight

The Europe bancassurance market is projected to expand at a notable CAGR throughout the forecast period, primarily driven by stringent regulatory frameworks, mature banking networks, and a rising focus on customer-centric services. The demand for integrated financial solutions is growing across both urban and rural populations. European banks are increasingly adopting digital bancassurance platforms, enabling consumers to access customized insurance products. This trend is particularly visible in France, Spain, and Italy, where bancassurance remains a dominant distribution channel.

U.K. Bancassurance Market Insight

The U.K. bancassurance market is anticipated to grow steadily, supported by digitally advanced banking systems, a strong insurance culture, and rising financial awareness among consumers. Banks are increasingly collaborating with insurers to provide tailored wealth management and protection products. Growing concerns over financial security, combined with a rising demand for convenient online platforms, continue to fuel bancassurance adoption in both retail and corporate segments.

Germany Bancassurance Market Insight

The Germany bancassurance market is expected to witness healthy growth, driven by consumer trust in traditional banks, technological innovation, and rising demand for sustainable financial products. Germany’s emphasis on eco-conscious investments and digital banking solutions is reshaping bancassurance offerings. The strong integration of insurance products within banking systems and a preference for transparent, regulated financial solutions further support market expansion.

Which Region is the Fastest Growing in the Bancassurance Market?

Asia-Pacific bancassurance market is poised to grow at the fastest CAGR of 12.14% during 2025–2032, driven by rapid urbanization, increasing disposable incomes, and growing digital adoption in banking and insurance. Government-led digitalization programs and the rise of emerging markets such as India, China, and Southeast Asia are fueling growth. Moreover, APAC’s position as a fintech and insurtech hub is enhancing affordability and accessibility, expanding bancassurance penetration across diverse consumer groups.

Japan Bancassurance Market Insight

The Japan bancassurance market is gaining momentum owing to the country’s aging population, advanced digital ecosystem, and demand for retirement-focused financial products. Bancassurance in Japan is being increasingly integrated with mobile banking and robo-advisory platforms, making financial planning more accessible. The focus on elderly-friendly and long-term insurance solutions positions bancassurance as a key growth driver in the Japanese financial sector.

China Bancassurance Market Insight

The China bancassurance market accounted for the largest share in Asia-Pacific in 2024, propelled by its expanding middle class, rapid financial digitalization, and government-backed insurance reforms. China is witnessing a surge in online insurance distribution, mobile payment integration, and smart banking platforms, which are reshaping bancassurance delivery. The country’s push towards financial inclusion and smart city initiatives further accelerates bancassurance adoption across urban and rural segments.

Which are the Top Companies in Bancassurance Market?

The bancassurance industry is primarily led by well-established companies, including:

- Allianz (Germany)

- AXA (France)

- Banco Santander (Spain)

- BNP Paribas (France)

- BMO Financial Group (Canada)

- Crédit Agricole Group (France)

- HSBC Holdings plc (U.K.)

- ICICI Bank Limited (India)

- ING Group (Netherlands)

- Société Générale (France)

- Standard Chartered (U.K.)

- Sun Life Financial Inc. (Canada)

- Wells Fargo & Company (U.S.)

- Zurich Insurance Company Ltd (Switzerland)

What are the Recent Developments in Global Bancassurance Market?

- In March 2025, YES Bank and Axis Max Life Insurance marked the 20th anniversary of their bancassurance partnership, which has assisted nearly 3.62 lakh customers, processed over 3,725 claims, and disbursed claims worth more than Rs 267 crore. This milestone highlights their consistent efforts in delivering seamless insurance solutions and strengthening financial security for clients across India

- In February 2025, Oman Arab Bank entered into a strategic alliance with Takaful Oman Insurance, enabling customers to access Takaful Oman’s comprehensive insurance services through OAB’s extensive branch network and advanced digital platforms. This collaboration is set to revolutionize the financial services landscape by ensuring clients experience more convenient, efficient, and integrated solutions

- In January 2025, FWD Hong Kong signed a long-term bancassurance collaboration with Bank SinoPac, aiming to broaden its footprint in high-net-worth and business segments. By leveraging SinoPac’s strong client base, the partnership will provide tailored insurance offerings for asset distribution and legacy planning, ultimately strengthening FWD’s market presence

- In March 2023, Haption SA introduced its advanced surface haptics technology platform, delivering next-generation tactile feedback for virtual reality and simulation applications. This innovation reinforces the company’s commitment to enhancing immersive experiences across industries

- In February 2023, Tanvas Inc. launched a new series of surface haptics controllers designed for smartphones and tablets, offering customizable tactile responses to elevate user engagement. This development underscores the company’s focus on advancing touch-based interaction technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.