Global Bank Kiosks Market

Market Size in USD Billion

CAGR :

%

USD

1.48 Billion

USD

9.24 Billion

2024

2032

USD

1.48 Billion

USD

9.24 Billion

2024

2032

| 2025 –2032 | |

| USD 1.48 Billion | |

| USD 9.24 Billion | |

|

|

|

|

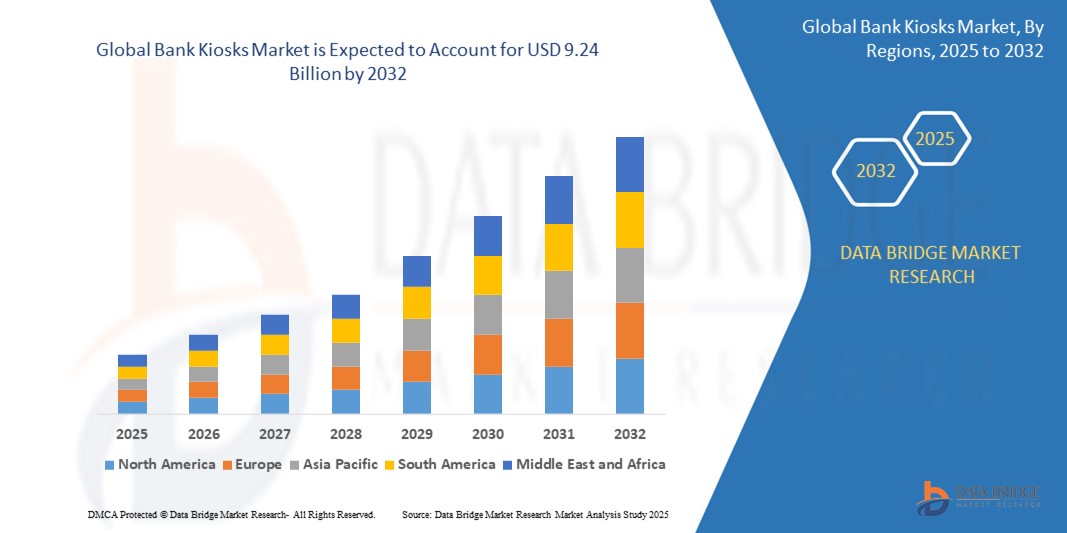

What is the Global Bank Kiosks Market Size and Growth Rate?

- The global bank kiosks market size was valued at USD 1.48 billion in 2024 and is expected to reach USD 9.24 billion by 2032, at a CAGR of 25.70% during the forecast period

- The bank kiosks market is experiencing significant growth, driven by advancements in touch-screen technology, biometric authentication, and AI integration. These kiosks offer enhanced customer service, reduce operational costs, and improve accessibility

- The latest methods include seamless self-service transactions and real-time data processing, ensuring efficient and secure banking experiences. This technological evolution is reshaping the banking landscape

What are the Major Takeaways of Bank Kiosks Market?

- Integration of bank kiosks with digital platforms enhances market competitiveness by offering customers a seamless banking experience. For instance, customers can initiate transactions at a kiosk and seamlessly continue on their mobile app for further banking needs, ensuring continuity and convenience

- This integration improves customer satisfaction and strengthens the bank's brand loyalty, driving adoption and growth in the kiosk market

- North America dominated the global bank kiosks market, accounting for the largest revenue share of 41.5% in 2024, driven by rising investments in banking automation, strong digital infrastructure, and the growing demand for efficient, self-service banking solutions

- Asia-Pacific bank kiosks market is projected to grow at the fastest CAGR of 15.33% from 2025 to 2032, driven by rapid urbanization, rising demand for banking automation, and increasing efforts to promote financial inclusion across developing economies

- The Multi-Function Kiosk segment dominated the bank kiosks market with the largest revenue share of 52.4% in 2024, driven by the growing demand for self-service solutions that offer a wide range of banking functions in one unit

Report Scope and Bank Kiosks Market Segmentation

|

Attributes |

Bank Kiosks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Bank Kiosks Market?

“Enhanced Banking Accessibility through AI and Self-Service Integration”

- A significant and evolving trend in the global bank kiosks market is the integration of artificial intelligence (AI), advanced software, and self-service technologies to enhance banking accessibility, operational efficiency, and customer convenience

- Modern bank kiosks now incorporate AI-driven features such as intelligent cash handling, real-time fraud detection, and predictive maintenance, ensuring seamless operation while reducing manual interventions. For instance, Diebold Nixdorf has introduced AI-powered kiosks that provide real-time diagnostics and automated software updates, minimizing downtime and enhancing customer experience

- Voice-assisted kiosks and biometric integrations are also gaining traction, with banks increasingly deploying kiosks equipped with facial recognition, fingerprint scanning, and voice commands to simplify transactions while improving security. This ensures faster, contactless, and more secure banking, especially in high-traffic environments

- The integration of kiosks with mobile apps and digital banking platforms offers customers a unified experience across channels, allowing them to perform deposits, withdrawals, bill payments, and other banking services conveniently, 24/7

- This trend reflects the industry's shift toward omnichannel banking, where kiosks play a vital role in extending services beyond traditional branches, particularly in remote or underserved areas. Consequently, companies such as NCR Atleos and KIOSK Information Systems are expanding their AI-driven kiosk offerings to meet growing demand across global markets

- The widespread emphasis on automation, personalized services, and branch transformation through intelligent kiosks is reshaping customer expectations for convenient, secure, and self-service banking worldwide

What are the Key Drivers of Bank Kiosks Market?

- The growing demand for self-service banking, branch automation, and enhanced customer convenience is a significant driver of the bank kiosks market worldwide. Financial institutions are investing heavily in kiosks to reduce operational costs, increase efficiency, and extend banking services beyond traditional locations

- For instance, in September 2024, Ashley Furniture Industries announced an USD 80 million investment to expand operations, reflecting broader industry trends where organizations are modernizing infrastructure and deploying kiosks to serve evolving consumer needs

- The rising emphasis on financial inclusion, particularly in emerging markets, is accelerating the adoption of bank kiosks that offer critical services such as account opening, cash deposits/withdrawals, and loan applications in both urban and rural areas

- The rapid expansion of digital banking, coupled with the need for contactless, 24/7 service delivery, further propels kiosk deployments. AI-powered functionalities and real-time customer assistance enable banks to offer efficient, secure, and user-friendly services, improving accessibility and satisfaction

- In addition, technological advancements such as biometric authentication, touchscreen interfaces, and video teller machines are making kiosks a central component of modern banking, especially for enhancing service delivery in high-footfall locations

Which Factor is challenging the Growth of the Bank Kiosks Market?

- Cybersecurity concerns and potential vulnerabilities in connected banking infrastructure remain a critical challenge for the widespread adoption of bank kiosks. As kiosks become more integrated with core banking systems and networks, they are increasingly exposed to data breaches, hacking, and system manipulation

- High-profile cyberattacks and concerns over customer data privacy have made financial institutions cautious about large-scale deployments without robust security measures. For instance, global reports of compromised IoT devices have highlighted the risks of insufficiently secured banking terminals

- To address these concerns, leading companies such as Diebold Nixdorf and Cisco are incorporating advanced encryption, secure authentication protocols, and real-time threat detection systems within kiosk networks to ensure secure transactions

- In addition, the high upfront costs associated with deploying advanced multifunctional kiosks, particularly in developing economies, pose a barrier for smaller banks or cost-sensitive institutions

- While prices are gradually decreasing due to technology maturation, the investment in hardware, software integration, and maintenance can deter banks in regions with limited infrastructure or low digital literacy

- Overcoming these challenges requires sustained focus on cybersecurity advancements, affordable kiosk solutions tailored for emerging markets, and continuous customer education to build trust in self-service banking channels

How is the Bank Kiosks Market Segmented?

The market is segmented on the basis of type, offering, distribution channel, location, and end-user.

- By Type

On the basis of type, the bank kiosks market is segmented into Single-Function Kiosk, Multi-Function Kiosk, and Virtual/Video Teller Machine. The Multi-Function Kiosk segment dominated the Bank Kiosks market with the largest revenue share of 52.4% in 2024, driven by the growing demand for self-service solutions that offer a wide range of banking functions in one unit. Multi-function kiosks are favored for providing services such as cash deposits, withdrawals, account inquiries, and bill payments, enhancing operational efficiency for banks and convenience for customers.

The Virtual/Video Teller Machine segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand for remote banking services and interactive customer support. These kiosks combine video conferencing and banking transactions, enabling banks to provide personalized services in areas lacking physical branches while optimizing operational costs.

- By Offering

On the basis of offering, the bank kiosks market is segmented into Hardware, Software, and Service. The Hardware segment held the largest market revenue share of 61.8% in 2024, owing to substantial demand for physical kiosks, screens, cash dispensers, biometric devices, and other components critical to kiosk functionality. Banks continue to invest heavily in upgrading hardware infrastructure to enhance customer experiences and security.

The Service segment is anticipated to register the fastest growth rate during the forecast period, driven by the increasing need for maintenance, installation, managed services, and technical support for kiosk operations. As banks adopt advanced kiosks, ensuring uptime and service continuity becomes a top priority.

- By Distribution Channel

On the basis of distribution channel, the bank kiosks market is segmented into Rural, Semi Urban, Urban, and Metropolitan areas. The Urban segment accounted for the largest market revenue share of 46.3% in 2024, supported by high demand for modern banking infrastructure, dense population, and the growing preference for self-service banking options. Urban regions witness rapid adoption of kiosks across retail outlets, bank branches, and standalone banking hubs.

The Metropolitan segment is projected to exhibit the fastest CAGR from 2025 to 2032, driven by rising technological advancements, high consumer expectations, and the push towards fully automated, 24/7 banking services in large cities.

- By Location

On the basis of location, the bank kiosks market is segmented into On-site and Off-site kiosks. The On-site segment held the largest market revenue share of 58.9% in 2024, attributed to the widespread deployment of kiosks within bank branches to enhance customer service, reduce queues, and automate routine transactions. Banks leverage on-site kiosks to improve operational efficiency while maintaining a secure environment.

The Off-site segment is anticipated to grow at the fastest CAGR, driven by the increasing demand for banking services in high-traffic public areas such as malls, airports, transportation hubs, and retail locations, extending the reach of financial services beyond traditional branches.

- By End-user

On the basis of end-user, the bank kiosks market is segmented into BFSI and Government. The BFSI segment dominated the market with the largest revenue share of 74.5% in 2024, fueled by the sector's focus on digital transformation, enhancing customer service, and reducing branch operation costs. Financial institutions deploy kiosks to streamline transactions, promote self-service banking, and increase accessibility.

The Government segment is expected to witness notable growth during the forecast period, as public institutions increasingly adopt kiosks to deliver citizen-centric services such as tax payments, ID verification, and welfare disbursements, improving service efficiency and accessibility.

Which Region Holds the Largest Share of the Bank Kiosks Maret?

- North America dominated the global bank kiosks market, accounting for the largest revenue share of 41.5% in 2024, driven by rising investments in banking automation, strong digital infrastructure, and the growing demand for efficient, self-service banking solutions

- Financial institutions across the region are rapidly adopting bank kiosks to reduce operational costs, enhance customer convenience, and offer 24/7 service availability. The widespread use of AI-driven kiosks, cash recyclers, and virtual teller machines reflects the region's commitment to digital transformation in the banking sector

- The high penetration of smart banking technologies, coupled with increasing consumer demand for contactless services and branch automation, continues to strengthen North America’s position as a global leader in the bank kiosks market

U.S. Bank Kiosks Market Insight

The U.S. bank kiosks market dominated the revenue share within North America in 2024, supported by the country’s large banking sector, early adoption of advanced self-service technologies, and a strong focus on enhancing customer experience. Major banks and credit unions are investing in multifunction kiosks to streamline operations, offer remote banking services, and reduce reliance on physical branches. In addition, the growing demand for financial inclusion, especially in underserved areas, further fuels the deployment of kiosks equipped with video teller capabilities and AI-powered support systems.

Europe Bank Kiosks Market Insight

The Europe bank kiosks market is poised for steady growth, driven by stringent regulatory standards, increased banking digitization, and the rising preference for secure, efficient, and automated banking services. The integration of smart kiosks in both urban and rural banking networks is expanding, supported by consumer demand for self-service capabilities, enhanced transaction security, and seamless digital experiences. Countries such as Germany, France, and the U.K. are witnessing strong deployments of ATMs, video teller machines, and multifunctional kiosks across the financial landscape.

U.K. Bank Kiosks Market Insight

The U.K. bank kiosks market is projected to grow at a promising CAGR, fueled by the country’s ongoing digital banking transformation, evolving customer expectations, and the need for enhanced financial accessibility. The banking sector's focus on automation, contactless services, and reducing branch dependency is accelerating kiosk adoption. In addition, rising demand for 24/7 banking and improved transaction security is encouraging banks to deploy advanced kiosks across both metropolitan and rural areas.

Germany Bank Kiosks Market Insight

The Germany bank kiosks market is expected to expand steadily, driven by the country's strong emphasis on technological innovation, secure banking solutions, and sustainable infrastructure development. German financial institutions are increasingly adopting AI-integrated kiosks, cash recyclers, and automated teller machines to optimize operations and meet growing consumer demand for self-service banking. In addition, the integration of kiosks with mobile banking and digital platforms is enhancing the overall customer experience across urban and suburban regions.

Which Region is the Fastest Growing in the Bank Kiosks Market?

Asia-Pacific bank kiosks market is projected to grow at the fastest CAGR of 15.33% from 2025 to 2032, driven by rapid urbanization, rising demand for banking automation, and increasing efforts to promote financial inclusion across developing economies. Government-led initiatives to expand banking access, especially in rural and semi-urban areas, are fueling the deployment of self-service kiosks, cash deposit machines, and video teller units. In addition, technological advancements and the growing presence of local kiosk manufacturers are making these solutions more affordable and accessible throughout the region.

China Bank Kiosks Market Insight

The China bank kiosks market held the largest revenue share in Asia-Pacific in 2024, driven by rapid digitization, the country's expanding middle class, and a high demand for smart, automated banking services. With a strong focus on smart cities, digital payments, and financial accessibility, China is witnessing widespread deployment of advanced kiosks across urban centers, rural areas, and fintech ecosystems. Domestic players and global manufacturers continue to innovate, offering affordable, AI-powered, and secure self-service banking solutions.

Japan Bank Kiosks Market Insight

The Japan bank kiosks market is experiencing steady growth, supported by the country's highly developed financial sector, technological advancements, and demand for user-friendly, contactless banking services. Bank kiosks equipped with biometric authentication, AI-driven support, and multilingual interfaces are becoming increasingly prevalent, offering secure and convenient access to banking services. Moreover, Japan’s aging population is driving demand for intuitive, accessible, and automated banking experiences across both urban and suburban regions.

Which are the Top Companies in Bank Kiosks Market?

The bank kiosks industry is primarily led by well-established companies, including:

- NCR Atleos (U.S.)

- Diebold Nixdorf, Incorporated (U.S.)

- Cisco (U.S.)

- Glory Global Solutions (International) Limited (Japan)

- Hyosung TNS Inc. (U.S.)

- GRGBanking (China)

- KAL ATM Software GmbH (U.K.)

- Auriga Spa (Italy)

- Hitachi Channel Solutions, Corp. (Japan)

- Slabb Kiosks (U.S.)

- Elite Microsystems Pvt. Ltd. (India)

- KIOSK Information Systems (U.S.)

- Phoenix Microsystems (India)

- Aldan Technology Sdn Bhd (Malaysia)

What are the Recent Developments in Global Bank Kiosks Market?

- In October 2023, State Bank of India (SBI) launched a 'Mobile Handheld Device' to enhance banking accessibility for financially inclusive customers. This initiative aims to bring kiosk banking directly to customers' doorsteps, offering convenience and flexibility to Customer Service Point (CSP) agents, ensuring better service reach for customers facing access challenges

- In August 2023, Northwest Bank announced plans for a new digital banking kiosk at 1081 Million Dollar Highway, St. Marys. The kiosk features a 24/7 drive-up ATM for withdrawals, transfers, and deposits, alongside a Video Teller Machine (VTM) for live interactions. This setup enables seamless transactions and personalized service such as check cashing and loan payments

- In September 2020, Hitachi-Omron Terminal Solutions developed a currency disinfector for bank cash centers and branch offices, ensuring hygienic handling of banknotes amidst public health concerns, providing a critical solution for maintaining cleanliness and safety in cash handling environments

- In June 2020, Auriga introduced Bank4Me, part of their 'NextGenBranch' solutions, enabling remote banking with full access to bank services in a secure, self-service mode. Customers can interact with bank experts via video support, ensuring personalized assistance and secure transactions from anywhere

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.