Global Banking Bps Market

Market Size in USD Billion

CAGR :

%

USD

27.29 Billion

USD

51.76 Billion

2024

2032

USD

27.29 Billion

USD

51.76 Billion

2024

2032

| 2025 –2032 | |

| USD 27.29 Billion | |

| USD 51.76 Billion | |

|

|

|

|

Banking BPS Market Size

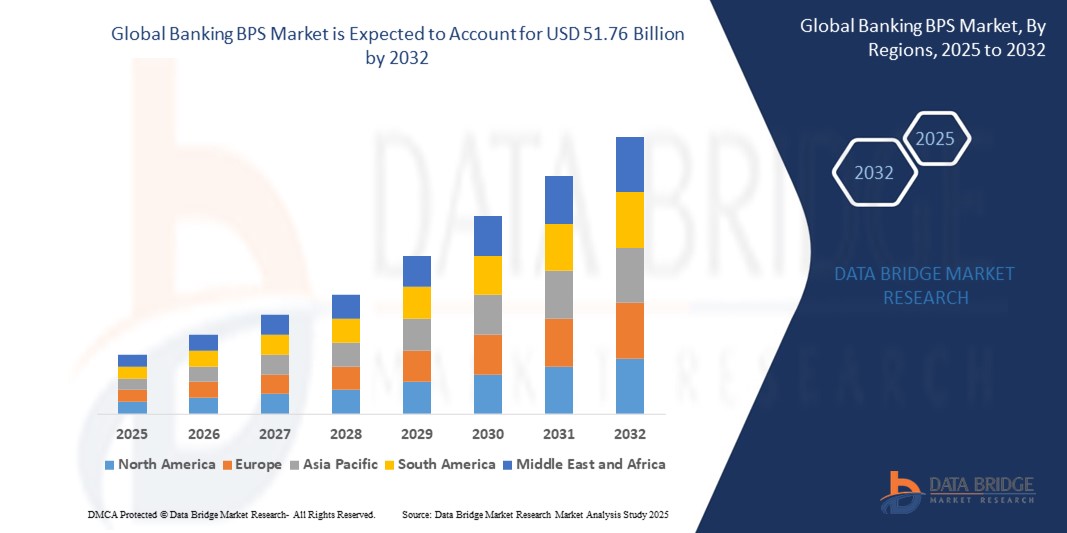

- The global Banking BPS market size was valued at USD 27.29 Billion in 2024 and is expected to reach USD 51.76 Billion by 2032, at a CAGR of8.33% during the forecast period

- Rise in the loans and deposition of money is a crucial factor accelerating the market growth, also increase in the acceptance of technological advancement and digitalization in the banking sector, rise in the overall digitalization, centralization, and competition in the banking sector across the world, increase in loans and deposition of money and acceptance of technological advancement and digitalization in the banking sector are the major factors among others boosting the banking BPS market.

Banking BPS Market Analysis

- The Banking BPS (Business Process Services) market refers to outsourced services that enable banks to streamline their operations, reduce costs, and focus on core banking functions. These services include front-office, middle-office, and back-office operations, encompassing customer management, payment processing, loan servicing, compliance, and analytics.

- Key drivers of the Banking BPS market growth include the rapid adoption of digital banking, increasing pressure to enhance operational efficiency, rising compliance and regulatory requirements, and the implementation of supportive government policies for digital transformation in the banking sector.

- North America dominates the Banking BPS market, holding the largest revenue share of 46.01% in 2025, due to a high concentration of financial institutions, advanced IT infrastructure, strong presence of key BPS vendors, and growing demand for cost-effective operational models across banks and credit unions.

- Asia-Pacific is projected to be the fastest-growing region in the Banking BPS market during the forecast period, driven by increasing banking penetration, expansion of digital financial services, outsourcing trends in countries like India and the Philippines, and government initiatives to modernize banking infrastructure.

- The Front Office segment is anticipated to hold the largest market share of 25.9% in the Banking BPS market during the forecast period. Growth is fueled by rising customer expectations, increased adoption of AI-based chatbots and virtual assistants, digital onboarding solutions, and demand for personalized banking experiences.

Report Scope and Banking BPS Market Segmentation

|

Attributes |

Banking BPS Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Banking BPS Market Trends

““Transforming Banking Through Digitization and Process Efficiency”

• One of the most significant trends in the Banking BPS market is the rapid adoption of AI, machine learning, and robotic process automation (RPA). These technologies enable banks to automate repetitive tasks, enhance accuracy, and deliver faster customer service, leading to increased efficiency and reduced operational costs.

• The integration of cloud-based BPS platforms is gaining momentum, allowing financial institutions to scale services quickly, improve data security, and reduce IT infrastructure costs. Cloud-native solutions support seamless digital banking experiences and remote service delivery.

• There is a growing emphasis on compliance and risk management services within BPS offerings. With increasing regulatory scrutiny and complex financial regulations, banks are relying on BPS providers to ensure timely reporting, fraud detection, and regulatory adherence.

• The rise of omnichannel customer engagement is transforming front-office BPS services. Banks are focusing on delivering personalized experiences across mobile, web, and in-branch interactions, driving demand for analytics-driven customer service solutions.

Banking BPS Market Dynamics

Driver

“Growing Demand for Operational Agility and Cost Optimization”

- Banks are increasingly outsourcing non-core functions to BPS providers to remain agile in a competitive environment. This shift allows them to focus on strategic priorities like innovation, customer acquisition, and digital transformation.

- Rising operational costs and shrinking profit margins are pushing banks to adopt BPS solutions for cost optimization. Outsourced services offer economies of scale and access to specialized skills without the burden of in-house management.

- The expansion of digital banking ecosystems, driven by fintech collaboration and changing customer behavior, is increasing the demand for agile, scalable, and tech-enabled BPS services across retail, corporate, and investment banking segments..

Restraint/Challenge

“Data Privacy Concerns and Complex Regulatory Environments”

- The Banking BPS market faces challenges related to data privacy and cybersecurity. With growing volumes of sensitive financial data being handled by third-party providers, ensuring compliance with data protection laws such as GDPR and CCPA is critical.

- Diverse regulatory landscapes across regions add complexity for BPS providers. They must tailor solutions to meet local compliance requirements, which increases service customization costs and limits standardization.

- The reluctance of some financial institutions to fully outsource critical processes due to concerns over control, service quality, and reputational risks continues to be a barrier to broader BPS adoption, especially in risk-sensitive banking functions..

Banking BPS Market Scope

The market is segmented on the operation analysis and service analysis..

|

Segmentation |

Sub-Segmentation |

|

By Operation Analysis |

|

|

By Service Analysis |

|

Banking BPS Market Scope

The market is segmented on the basis operation analysis and service analysis.

- By Operation Analysis

On the basis of Operation Analysis, the Banking BPS market is segmented into front office, middle office, back office. The front office segment dominates the largest market revenue share of 75.9% in 2025, Front office BPS focuses on enhancing customer engagement through digital channels, CRM support, and contact center services. Increased demand for personalized banking, 24/7 assistance, and omnichannel experiences is driving banks to outsource customer-facing operations for greater efficiency and satisfaction.

The back office segment is anticipated to witness the fastest growth rate of 18.7% from 2025 to 2032, Back office BPS handles administrative, compliance, and processing tasks like reconciliation, data entry, and account servicing. The need to reduce operational costs, improve turnaround times, and ensure regulatory compliance is accelerating the outsourcing of these non-core but essential functions.

By service analysis

On the basis of service analysis the Banking BPS market is segmented into Core Banking BPS, Mortgage and Loan BPS, Payment Services BPS, Securities Processing BPS. The Core Banking BPS held the largest market revenue share in 2025. Core Banking BPS involves managing fundamental banking systems such as deposits, payments, and transaction processing. As banks modernize legacy infrastructure, demand grows for scalable, cloud-based core platforms supported by third-party providers to drive digital transformation and operational resilience.

The Mortgage and Loan BPS segment is expected to witness the fastest CAGR from 2025 to 2032, Mortgage and Loan BPS offers services like loan origination, underwriting, servicing, and collections. Rising loan volumes, regulatory complexity, and the need for faster processing timelines are prompting financial institutions to adopt automated, compliant outsourcing solutions to streamline end-to-end loan management.

Banking BPS Market Regional Analysis

- North America dominates the Banking BPS market with the largest revenue share of 45.01% in 2024, North America leads the Banking BPS market, driven by the presence of global banks, advanced IT infrastructure, and a mature outsourcing ecosystem. Regulatory complexity, rising digital transformation efforts, and a strong demand for cost-efficient operations continue to boost regional adoption.

U.S. Banking BPS Market Insight

The U.S. Banking BPS market captured the largest revenue share of 71.2% within North America in 2025, The U.S. dominates the North American market due to high banking digitization, strict regulatory compliance requirements, and the need for operational efficiency. Financial institutions are leveraging BPS to reduce overhead, improve scalability, and adapt to rapidly evolving customer expectations.

Europe Banking BPS Market Insight

The Europe Banking BPS market is projected to expand at a substantial CAGR throughout the forecast period, Europe’s Banking BPS market is expanding with strong emphasis on compliance, GDPR-driven data management, and digital banking. Financial institutions are outsourcing to navigate economic pressures, reduce costs, and meet diverse regulatory standards across multiple countries in a unified financial ecosystem.

Germany Banking BPS Market Insight

The Germany Banking BPS market is anticipated to grow at a noteworthy CAGR during the forecast period, Germany’s market growth is fueled by increased adoption of automation in banking, pressure to cut operating costs, and a high focus on regulatory adherence. German banks are embracing BPS for process optimization while maintaining strong data protection and security standards.

France Banking BPS Market Insight

The France Banking BPS market is expected to expand at a considerable CAGR during the forecast period, In France, digital banking adoption, regulatory reforms, and cost-efficiency imperatives are driving demand for BPS solutions. Banks are increasingly outsourcing back-office operations and compliance functions to adapt to shifting consumer expectations and streamline operational models in a competitive market.

Asia-Pacific Intelligence Systems Market Insight

The Asia-Pacific Banking BPS market is poised to grow at the fastest CAGR of over 25.1% in 2025, Asia-Pacific is the fastest-growing Banking BPS market, fueled by rising digital financial inclusion, rapid fintech adoption, and expanding outsourcing hubs like India and the Philippines. Local banks and global players seek scalable, tech-enabled BPS solutions to meet regional growth demands.

Japan Banking BPS Market Insight

The Japan Banking BPS market is fueled by strong focus on technological innovation and high-quality production. Japan’s Banking BPS market is growing due to digital transformation initiatives, an aging population driving demand for automated services, and a push toward operational modernization. Banks are outsourcing non-core tasks to focus on innovation and enhance customer service efficiency.

China Banking BPS Market Insight

The China Banking BPS market accounted for the largest market revenue share in Asia Pacific in 2025, China's Banking BPS growth is driven by rapid digital banking expansion, government support for fintech integration, and increasing automation in financial services. The demand for intelligent BPS solutions is rising as Chinese banks strive for speed, compliance, and improved customer engagement.

Banking BPS Market Share

The Banking BPS industry is primarily led by well-established companies, including:

- Atos SE

- Avaloq

- Capgemini

- Cognizant

- FirstSource

- HCL technologies Limited

- Hexaware Technologies

- Infosys Limited

- NIIT Technologies

- SLK software services Pvt Ltd

- Tata consultancy services Limited (TCS)

- Wipro Limited

- WNS (Holdings) Ltd

- Accenture

- EXL

- Tech Mahindra Business Process Services

- DXC Technology Company

- Conduent,

Latest Developments in Global Banking BPS Market

- In June 2023, Capgemini announced its strategic expansion into emerging markets, aiming to provide tailored Banking BPS solutions to underserved regions. This initiative focuses on leveraging local talent and infrastructure to deliver cost-effective and scalable services to financial institutions.

- In August 2024, Infosys launched an AI-driven automation platform designed to streamline core banking operations. This solution enhances efficiency, reduces operational costs, and improves compliance by automating routine tasks, allowing banks to focus on strategic initiatives.

- In May 2025, Genpact introduced a comprehensive digital transformation framework tailored for financial institutions. This initiative integrates advanced analytics, cloud computing, and process automation to modernize banking operations, enhance customer experiences, and drive sustainable growth.

- In January 2025, Avaloq Group launched a suite of cloud-based Banking BPS solutions aimed at providing banks with scalable, secure, and flexible platforms. This move supports financial institutions in their digital transformation journeys, enabling them to offer innovative services to customers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BANKING BPS MARKET

1.4 CURRENCY AND PRICING

1.5 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

1.5.1 PRICE IMPACT

1.5.2 IMPACT ON DEMAND

1.5.3 IMPACT ON SUPPLY CHAIN

1.5.4 CONCLUSION

1.6 LIMITATION

1.7 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL BANKING BPS MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL BANKING BPS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW AND INDUSTRY TRENDS

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 TECHNOLOGY IMPACT

5.1.1 ARTIFICIAL INTELLIGENCE

5.1.2 BLOCKCHAIN

6 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTER MATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT/PRICING ANALYSIS

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL BANKING BPS MARKET, BY OFFERING

7.1 OVERVIEW

7.2 CORE BANKING BPS

7.2.1 DEPOSITS

7.2.2 LOANS

7.2.3 ENTERPRISE

7.2.4 CUSTOMER SOLUTIONS

7.3 MORTGAGE AND LOAN BPS

7.3.1 ORIGINATION SERVICES

7.3.2 MORTGAGE AND LOAN ADMINISTRATION

7.4 PAYMENT SERVICES BPS

7.4.1 CHEQUE PROCESSING

7.4.2 EFT SERVICES

7.4.3 CREDIT CARD PROCESSING

7.5 SECURITIES PROCESSING BPS

7.5.1 TRADE SERVICES

7.5.2 PORTFOLIO SERVICES

8 GLOBAL BANKING BPS MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISE

9 GLOBAL BANKING BPS MARKET, BY OPERATION

9.1 OVERVIEW

9.2 FRONT OFFICE

9.3 MIDDLE OFFICE

9.4 BACK OFFICE

10 GLOBAL BANKING BPS MARKET, BY ORGANIZATION MODE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SME’S

11 GLOBAL BANKING BPS MARKET, BY SERVICE TYPE

11.1 OVERVIEW

11.2 INSURANCE

11.2.1 CORE BANKING BPS

11.2.2 MORTGAGE AND LOAN BPS

11.2.2.1. ORIGINATION SERVICES

11.2.2.2. MORTGAGE AND LOAN ADMINISTRATION

11.2.3 PAYMENT SERVICES BPS

11.2.3.1. CHEQUE PROCESSING

11.2.3.2. EFT SERVICES

11.2.3.3. CREDIT CARD PROCESSING

11.2.4 SECURITIES PROCESSING BPS

11.2.4.1. TRADE SERVICES

11.2.4.2. PORTFOLIO SERVIC

11.3 DOCUMENT MANAGEMENT

11.3.1 CORE BANKING BPS

11.3.2 MORTGAGE AND LOAN BPS

11.3.2.1. ORIGINATION SERVICES

11.3.2.2. MORTGAGE AND LOAN ADMINISTRATION

11.3.3 PAYMENT SERVICES BPS

11.3.3.1. CHEQUE PROCESSING

11.3.3.2. EFT SERVICES

11.3.3.3. CREDIT CARD PROCESSING

11.3.4 SECURITIES PROCESSING BPS

11.3.4.1. TRADE SERVICES

11.3.4.2. PORTFOLIO SERVICES

11.4 SALES & MARKETING OUTSOURCING

11.4.1 CORE BANKING BPS

11.4.2 MORTGAGE AND LOAN BPS

11.4.2.1. ORIGINATION SERVICES

11.4.2.2. MORTGAGE AND LOAN ADMINISTRATION

11.4.3 PAYMENT SERVICES BPS

11.4.3.1. CHEQUE PROCESSING

11.4.3.2. EFT SERVICES

11.4.3.3. CREDIT CARD PROCESSING

11.4.4 SECURITIES PROCESSING BPS

11.4.4.1. TRADE SERVICES

11.4.4.2. PPORTFOLIO SERVICES

11.5 F&A OUTSOURCIING

11.5.1 CORE BANKING BPS

11.5.2 MORTGAGE AND LOAN BPS

11.5.2.1. ORIGINATION SERVICES

11.5.2.2. MORTGAGE AND LOAN ADMINISTRATION

11.5.3 PAYMENT SERVICES BPS

11.5.3.1. CHEQUE PROCESSING

11.5.3.2. EFT SERVICES

11.5.3.3. CREDIT CARD PROCESSING

11.5.4 SECURITIES PROCESSING BPS

11.5.4.1. TRADE SERVICES

11.5.4.2. PORTFOLIO SERVICES

11.6 PROCUREMENT

11.6.1 CORE BANKING BPS

11.6.2 MORTGAGE AND LOAN BPS

11.6.2.1. ORIGINATION SERVICES

11.6.2.2. MORTGAGE AND LOAN ADMINISTRATION

11.6.3 PAYMENT SERVICES BPS

11.6.3.1. CHEQUE PROCESSING

11.6.3.2. ET SERVICES

11.6.3.3. CREDIT CARD PROCESSING

11.6.4 SECURITIES PROCESSING BPS

11.6.4.1. TRADE SERVICES

11.6.4.2. PORTFOLIO SERVICES

11.7 CUSTOMER MANAGEMENT SERVICES

11.7.1 CORE BANKING BPS

11.7.2 MORTGAGE AND LOAN BPS

11.7.2.1. ORIGINATION SERVICES

11.7.2.2. MORTGAGE AND LOAN ADMINISTRATION

11.7.3 PAYMENT SERVICES BPS

11.7.3.1. CHEQUE PROCESSING

11.7.3.2. EFT SERVICES

11.7.3.3. CREDIT CARD PROCESSING

11.7.4 SECURITIES PROCESSING BPS

11.7.4.1. TRADE SERVICES

11.7.4.2. PORTFOLIO SERVICES

11.8 HEALTHCARE PROVIDERS BPS

11.8.1 CORE BANKING BPS

11.8.2 MORTGAGE AND LOAN BPS

11.8.2.1. ORIGINATION SERVICES

11.8.2.2. MORTGAGE AND LOAN ADMINISTRATION

11.8.3 PAYMENT SERVICES BPS

11.8.3.1. CHEQUE PROCESSING

11.8.3.2. EFT SERVICES

11.8.3.3. CREDIT CARD PROCESSING

11.8.4 SECURITIES PROCESSING BPS

11.8.4.1. TRADE SERVICES

11.8.4.2. PORTFOLIO SERVICES

12 GLOBAL BANKING BPS MARKET, BY BANKING TYPE

12.1 OVERVIEW

12.2 RETAIL BANKING

12.3 COMMERCIAL BANKING

12.3.1 PRIVATE BANK

12.3.2 PUBLIC BANK

12.4 LENDING SERVICES

12.5 INVESTMENT BANKING

12.6 OTHERS

13 GLOBAL BANKING BPS MARKET, BY GEOGRAPHY

13.1 GLOBAL BANKING BPS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1.1 NORTH AMERICA

13.1.1.1. U.S.

13.1.1.2. CANADA

13.1.1.3. MEXICO

13.1.2 EUROPE

13.1.2.1. GERMANY

13.1.2.2. FRANCE

13.1.2.3. U.K.

13.1.2.4. ITALY

13.1.2.5. SPAIN

13.1.2.6. RUSSIA

13.1.2.7. TURKEY

13.1.2.8. BELGIUM

13.1.2.9. NETHERLANDS

13.1.2.10. SWITZERLAND

13.1.2.11. REST OF EUROPE

13.1.3 ASIA PACIFIC

13.1.3.1. JAPAN

13.1.3.2. CHINA

13.1.3.3. SOUTH KOREA

13.1.3.4. INDIA

13.1.3.5. AUSTRALIA

13.1.3.6. SINGAPORE

13.1.3.7. THAILAND

13.1.3.8. MALAYSIA

13.1.3.9. INDONESIA

13.1.3.10. PHILIPPINES

13.1.3.11. REST OF ASIA PACIFIC

13.1.4 SOUTH AMERICA

13.1.4.1. BRAZIL

13.1.4.2. ARGENTINA

13.1.4.3. REST OF SOUTH AMERICA

13.1.5 MIDDLE EAST AND AFRICA

13.1.5.1. SOUTH AFRICA

13.1.5.2. EGYPT

13.1.5.3. SAUDI ARABIA

13.1.5.4. U.A.E

13.1.5.5. ISRAEL

13.1.5.6. REST OF MIDDLE EAST AND AFRICA

13.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14 GLOBAL BANKING BPS MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL BANKING BPS MARKET , SWOT & DBMR ANALYSIS

16 GLOBAL BANKING BPS MARKET, COMPANY PROFILE

16.1 ATOS SE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 GEOGRAPHIC PRESENCE

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 HCL

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 GEOGRAPHIC PRESENCE

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 CAPGEMINI

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 GEOGRAPHIC PRESENCE

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 AVALOQ

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 GEOGRAPHIC PRESENCE

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 INFOSYS LTD

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 GEOGRAPHIC PRESENCE

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 COGNIZANT

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 GEOGRAPHIC PRESENCE

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 HEXAWARE TECHNOLOGY

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 GEOGRAPHIC PRESENCE

16.7.4 PRODUCT PORTFOLIO

16.7.5 RECENT DEVELOPMENTS

16.8 NIIT TECHNOLOGIES

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 GEOGRAPHIC PRESENCE

16.8.4 PRODUCT PORTFOLIO

16.8.5 RECENT DEVELOPMENTS

16.9 SLK SOFTWARE SERVICES PVT LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 GEOGRAPHIC PRESENCE

16.9.4 PRODUCT PORTFOLIO

16.9.5 RECENT DEVELOPMENT

16.1 FIRSTSOURCE

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 GEOGRAPHIC PRESENCE

16.10.4 PRODUCT PORTFOLIO

16.10.5 RECENT DEVELOPMENTS

16.11 TCS LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 GEOGRAPHIC PRESENCE

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 WIPRO LTD

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 GEOGRAPHIC PRESENCE

16.12.4 PRODUCT PORTFOLIO

16.12.5 RECENT DEVELOPMENTS

16.13 ACCENTURE

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 GEOGRAPHIC PRESENCE

16.13.4 PRODUCT PORTFOLIO

16.13.5 RECENT DEVELOPMENTS

16.14 WNS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 GEOGRAPHIC PRESENCE

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 EXL

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 GEOGRAPHIC PRESENCE

16.15.4 PRODUCT PORTFOLIO

16.16 DXC TECHNOLOGY

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 GEOGRAPHIC PRESENCE

16.16.4 PRODUCT PORTFOLIO

16.16.5 RECENT DEVELOPMENTS

16.17 CONDUENT, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 GEOGRAPHIC PRESENCE

16.17.4 PRODUCT PORTFOLIO

16.18 TECH MAHINDRA BUSINESS SERVICES

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 GEOGRAPHIC PRESENCE

16.18.4 PRODUCT PORTFOLIO

16.19 FIS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 GEOGRAPHIC PRESENCE

16.19.4 PRODUCT PORTFOLIO

16.2 CONCENTRIX

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 GEOGRAPHIC PRESENCE

16.20.4 PRODUCT PORTFOLIO

16.21 GENPACT

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 GEOGRAPHIC PRESENCE

16.21.4 PRODUCT PORTFOLIO

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 CONCLUSION

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.