Global Banking Financial Services And Insurance Bfsi Security Market

Market Size in USD Billion

CAGR :

%

USD

69.17 Billion

USD

165.24 Billion

2024

2032

USD

69.17 Billion

USD

165.24 Billion

2024

2032

| 2025 –2032 | |

| USD 69.17 Billion | |

| USD 165.24 Billion | |

|

|

|

|

Banking, Financial Services and Insurance (BFSI) Security Market Analysis

BFSI security refers to the use of various security solutions and services by banking and insurance organizations to secure themselves or reduce the risk of data breaches. Since the introduction of digitalization and the spread of the internet has aimed to smoothen up operations across the industry, it has also opened the gates to cybersecurity risks and frauds, consequently acting as a stimulus for market growth over the next five years.

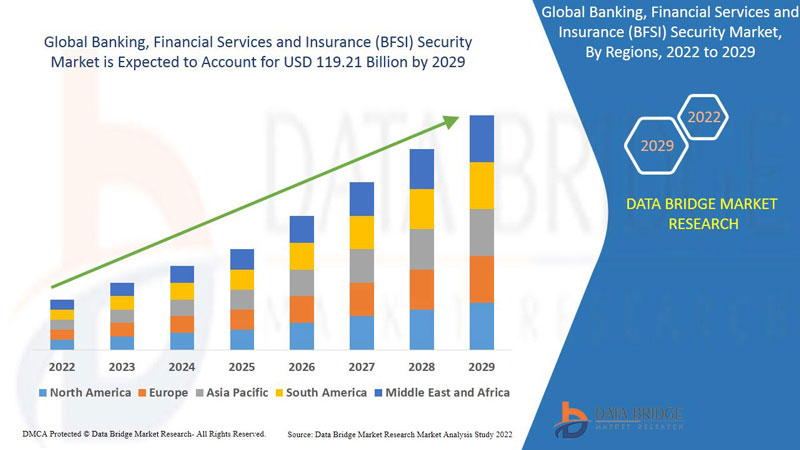

Banking, Financial Services and Insurance (BFSI) Security Market Size

Global Banking, Financial Services and Insurance (BFSI) Security Market size was valued at USD 69.17 billion in 2024 and is projected to reach USD 165.24 billion by 2032, with a CAGR of 11.50% during the forecast period of 2025 to 2032.

Banking, Financial Services and Insurance (BFSI) Security Market Security Market Trends

“Growing Demand for Advanced Cybersecurity Solutions”

One of the key trends in the global BFSI (Banking, Financial Services, and Insurance) security market is the increasing demand for advanced cybersecurity solutions. As cyberattacks become more sophisticated and prevalent, financial institutions are prioritizing robust security measures to protect sensitive customer data, financial transactions, and critical infrastructure. The adoption of technologies such as artificial intelligence (AI), machine learning (ML), and biometrics is gaining traction to detect and prevent fraud, ensure data privacy, and enhance customer trust. Additionally, the growing focus on regulatory compliance and data protection laws, such as GDPR and PSD2, is driving investments in security infrastructure. As the financial sector continues its digital transformation, the need for reliable and effective cybersecurity solutions is expected to increase, positioning the BFSI security market for significant growth.

Report Scope and Market Segmentation

|

Attributes |

Banking, Financial Services and Insurance (BFSI) Security Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Key Market Players |

IBM (US), Cisco Systems, Inc. (US), DXC Technology Company (US), Honeywell International, Inc. (US), Booz Allen Hamilton, Inc. (US), McAfee, LLC (US), Sophos Group Plc. (US), Broadcom (US), Trend Micro Incorporated (Japan), RSA Security LLC (US), FireEye, Inc (US), Hewlett Packard Enterprise Development LP (US), LogRhythm, Inc. (US), Fortinet, Inc (US), Huntsman International LLC. (US), Securonix, Inc. (US), Juniper Networks, Inc. (US), Hillstone Networks (China), Exabeam (US), Alert Logic, Inc (US), Forcepoint (US), Haystax (US) |

|

Market Opportunities |

|

Global Banking, Financial Services and Insurance (BFSI) Security Market Definition

Banking, financial services, and insurance (BFSI) is an industry phrase that refers to businesses that offer a variety of financial products and services. This includes universal banks that provide a variety of financial services and enterprises that operate in one or more of these financial industries. Insurance firms, commercial banks, non-banking financial companies, cooperatives, pension funds, mutual funds, and other smaller financial institutions make up the BFSI sector.

Banking, Financial Services and Insurance (BFSI) Security Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rise in internet penetration

The increasing internet penetration will propel the market's growth rate. The growing adoption of connected devices that enable convenient and safe financial transactions in developing regions is encouraging the banking, financial services, and insurance security markets to deploy threat management systems for securing payment gateways.

- Increasing adoption of digitalization

The BFSI sector's rapid adoption of technology including artificial intelligence, machine learning, and blockchain has resulted in huge data security threats. Furthermore, as this industry becomes more digitalized, need for data security owing to cyber-attacks and thefts continues to rise in the BFSI security market. Moreover, banks, financial institutions, and other financing organizations are fast transitioning to digitalized business operations, resulting in a massive increase in the adoption and implementation of security solutions and services.

Furthermore, rising urbanization, and increasing level of disposable income will drive market value growth. Also, implementing regulatory standards and enhancing risk of data loss will cushion the growth rate of the banking, financial services, and insurance (BFSI) security market. Another significant factor influencing the market's growth rate is the growing adoption of cloud-based security solutions.

Opportunities

- Technological advancement

The surging technological advancement will boost new market opportunities for the market's growth rate. Various technical breakthroughs, such as the integration of connected devices with the internet of things (IoT), machine learning (ML), and artificial intelligence (AI) solutions, are promoting market expansion. These tools help with transaction monitoring, risk mitigation, financial crime tracking, fraud detection, and regulatory compliance management.

Moreover, rise in strategic collaborations and emerging new markets will act as market drivers and further boost beneficial opportunities for the market's growth rate.

Restraints/ Challenges Global Banking, Financial Services and Insurance (BFSI) Security Market

- Risk of third-party services

Because the BFSI industry is vulnerable to both external and internal security threats, it deploys security solutions and services. BFSI security firms, on the other hand, are generally third-party service providers who provide security solutions to a variety of industry verticals and clients at the same time. Furthermore, it may cause firms to have difficulty managing data from multiple companies. As a result, trust difficulties with security solutions and services and the possibility of third-party engagement, which could lead to the leaking of sensitive data, limit market growth.

On the other hand, complexity in security infrastructure and the dearth of awareness among consumers will hinder the banking, financial services and insurance (BFSI) security market growth rate. The negative impact of COVID-19 outbreak on supply chain and lack of interoperability between security products will act as market restraint and further challenge the market growth rate.

This banking, financial services and insurance (BFSI) security market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the banking, financial services and insurance (BFSI) security market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Banking, Financial Services and Insurance (BFSI) Security Market Scope

The banking, financial services and insurance (BFSI) security market is segmented on the basis of type, verticals and services. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Physical Security

- Virtual Security

Verticals

- Banking

- Insurance Companies

Services

- System Integration

- Maintenance

- Support

Banking, Financial Services and Insurance (BFSI) Security Market Regional Analysis

The banking, financial services and insurance (BFSI) security market is analyzed and market size insights and trends are provided by country, type, verticals and services as referenced above.

The countries covered in the banking, financial services and insurance (BFSI) security market report are U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Switzerland, Netherlands, Russia, Turkey, Belgium, Rest of Europe, Japan, China, South Korea, India, Australia & New Zealand, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, South Africa, Israel, U.A.E., Saudi Arabia, Egypt, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America dominates the banking, financial services and insurance (BFSI) security market in terms of market share and market revenue. It will continue to flourish its dominance during the forecast period. This is due to major key players and rising internet penetration in this region. Additionally, the increase in risk of data loss will propel the market's growth rate in this region.

On the other hand, Asia-Pacific is projected to exhibit the highest growth rate during the forecast period of 2025 to 2032 due to the rising adoption of advanced banking solutions in China, Japan, and India.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Banking, Financial Services and Insurance (BFSI) Security Market Share

The banking, financial services and insurance (BFSI) security market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to banking, financial services and insurance (BFSI) security market.

Banking, Financial Services and Insurance (BFSI) Security Market Leaders Operating in the Market Are:

- IBM (US)

- Cisco Systems, Inc. (US)

- DXC Technology Company (US)

- Honeywell International, Inc. (US)

- Booz Allen Hamilton, Inc. (US)

- McAfee, LLC (US)

- Sophos Group Plc. (US)

- Broadcom (US)

- Trend Micro Incorporated (Japan)

- RSA Security LLC (US)

- FireEye, Inc (US)

- Hewlett Packard Enterprise Development LP (US)

- LogRhythm, Inc. (US)

- Fortinet, Inc (US)

- Huntsman International LLC. (US)

- Securonix, Inc. (US)

- Juniper Networks, Inc. (US)

- Hillstone Networks (China)

- Exabeam (US)

- Alert Logic, Inc (US)

- Forcepoint (US)

- Haystax (US)

Latest Developments in Banking, Financial Services and Insurance (BFSI) Security Market

- In November 2022, Honeywell International Inc. launched new operational technology (OT) cybersecurity solutions designed to protect industrial control systems and enhance the availability, reliability, and safety of operations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.