Global Banknote Printing Machine Market

Market Size in USD Billion

CAGR :

%

USD

12.85 Billion

USD

18.27 Billion

2024

2032

USD

12.85 Billion

USD

18.27 Billion

2024

2032

| 2025 –2032 | |

| USD 12.85 Billion | |

| USD 18.27 Billion | |

|

|

|

|

Banknote Printing Machine Market Size

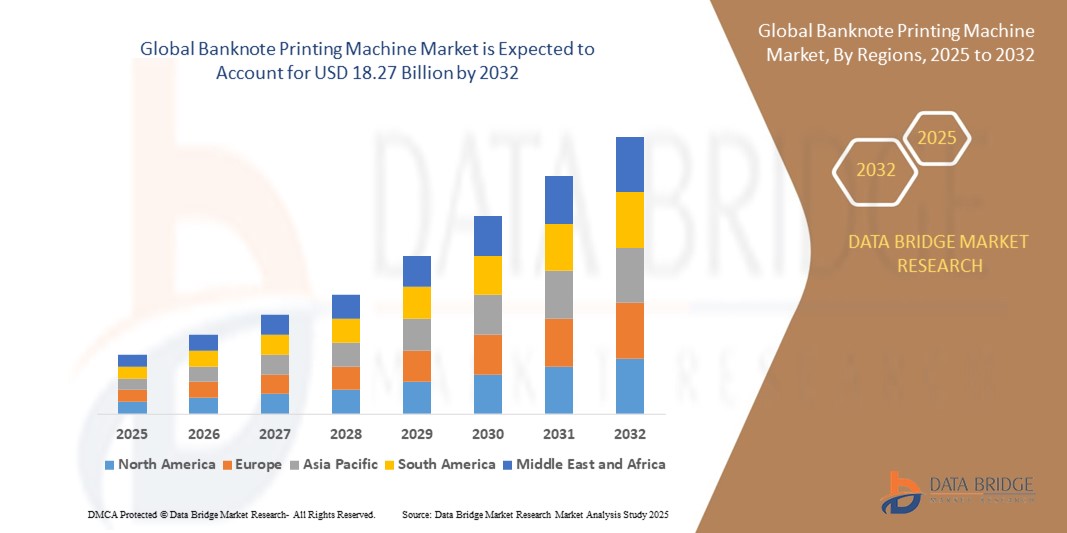

- The global banknote printing machine market size was valued at USD 12.85 billion in 2024 and is expected to reach USD 18.27 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for secure currency printing, rising counterfeiting threats, and the need for modernized banking infrastructure across developing and developed economies

- Advancements in printing technologies, such as intaglio, offset, and hybrid printing systems, are further driving adoption, enabling higher efficiency, precision, and anti-counterfeit features

Banknote Printing Machine Market Analysis

- The market is characterized by technological innovations, rising security concerns, and increasing government spending on currency printing solutions

- Market participants are focusing on R&D for advanced anti-counterfeit features, automation, and faster production capabilities to meet global demand

- North America dominated the banknote printing machine market with the largest revenue share in 2024, driven by increasing investments in secure currency production, modernization of central bank printing facilities, and the growing need to prevent counterfeiting

- Asia-Pacific region is expected to witness the highest growth rate in the global banknote printing machine market, driven by rapid economic growth, increasing demand for secure currency, and modernization of banknote production in countries such as China, Japan, and South Korea. Investments in advanced printing technologies and growing awareness about counterfeit prevention are key factors accelerating market adoption

- The Solution segment held the largest market revenue share in 2024, driven by the demand for advanced printing technologies, including high-security inks, substrates, and specialized software for designing and producing currency. These solutions are essential for ensuring anti-counterfeiting measures and improving production efficiency across mints and printing authorities.

Report Scope and Banknote Printing Machine Market Segmentation

|

Attributes |

Banknote Printing Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand For Secure And Advanced Currency Printing Solutions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Banknote Printing Machine Market Trends

Innovation and Automation in Banknote Printing

• The growing integration of automation and advanced printing technologies is transforming the banknote printing landscape by enhancing production efficiency and reducing counterfeiting risks. Modern machines enable high-speed, precise, and secure printing processes, improving overall currency quality. In addition, the adoption of digital controls and predictive maintenance reduces operational downtime, ensuring smooth production cycles and cost-effectiveness for central banks

• The rising demand for anti-counterfeit solutions in emerging and developed economies is accelerating the adoption of high-security banknote printing machines. These systems incorporate features such as holograms, watermarks, color-shifting inks, and microtext, providing multiple layers of security. The trend is further supported by increasing regulatory requirements for secure currency circulation and financial fraud prevention measures

• Ease of integration with existing currency production lines and reduced operational errors make modern banknote printing machines attractive for central banks and currency printing authorities. This results in cost savings and improved reliability in banknote supply. Furthermore, scalable designs allow for flexible production volumes, enabling authorities to efficiently manage currency demand fluctuations

• For instance, in 2023, several national mints in Europe and Asia upgraded their printing facilities with fully automated currency production machines, enabling faster turnaround times, enhanced security, and reduced labor costs. The implementation also helped optimize resource utilization, minimize human error, and enhance overall productivity

• While automation and technological enhancements are driving market adoption, ongoing innovation, staff training, and maintenance support remain critical for maximizing operational efficiency and ensuring sustained growth. In addition, continuous monitoring of evolving counterfeit techniques is pushing manufacturers to develop next-generation security solutions

Banknote Printing Machine Market Dynamics

Driver

Rising Demand for Secure Currency and Anti-Counterfeit Measures

• The increasing threat of counterfeit currency is prompting governments and central banks to invest in advanced banknote printing machines with enhanced security features. Adoption of these systems helps protect financial stability and maintain public trust in national currency. Governments are also introducing stricter anti-counterfeiting regulations, further driving demand for sophisticated printing technologies

• Rapid urbanization, expanding economies, and higher circulation of banknotes are driving demand for high-speed, automated printing solutions that can efficiently meet increasing currency requirements. This growth is reinforced by the need for consistent currency quality and large-volume production to support economic transactions and financial inclusion programs

• Supportive public sector initiatives, including modernization programs for national mints, are strengthening infrastructure and boosting the adoption of advanced banknote printing machines globally. The backing also includes funding for research and development of next-generation printing technologies, which enables authorities to implement innovative, secure, and eco-friendly currency production methods

• For instance, in 2022, the European Central Bank commissioned new high-security banknote printing machines, enabling the production of sophisticated anti-counterfeit currency while ensuring efficient supply across member nations. This initiative also facilitated improved operational efficiency, reduced production waste, and enhanced durability of banknotes in circulation

• While the demand for secure and reliable currency is rising, continuous technological upgrades, staff training, and compliance with regulatory standards are essential to sustain market growth. Strategic partnerships between machine manufacturers and central banks further accelerate innovation and adoption

Restraint/Challenge

High Capital Costs and Complex Maintenance Requirements

• Advanced banknote printing machines require substantial capital investment, which can restrict adoption, particularly in developing countries or smaller printing authorities. High initial costs limit large-scale deployment of modern systems, delaying modernization efforts. Smaller authorities may also struggle to secure financing or government approvals for large-scale procurement, further slowing adoption

• The complexity of machine operations and the need for trained personnel for maintenance and calibration pose challenges, potentially resulting in operational delays and increased downtime. Skilled technicians are often required for routine servicing, troubleshooting, and software updates, making workforce training essential. Any lack of qualified staff can reduce operational efficiency and increase the risk of errors during production

• Supply chain constraints, including limited availability of high-security inks, specialized substrates, and spare parts, can disrupt production and affect banknote supply. Dependence on a small number of specialized suppliers increases vulnerability to delays or geopolitical issues. Extended lead times for critical components can force mints to operate below full capacity, impacting currency circulation schedules

• For instance, in 2023, several mints in Africa and Southeast Asia experienced delays in installing upgraded printing machines due to high costs and logistical challenges, impacting local currency production schedules. These delays also affected the timely rollout of new security features and currency denominations. Governments were forced to rely on older machines, increasing risks of counterfeiting and operational inefficiencies

• Addressing cost, maintenance, and supply chain issues through modular machine designs, training programs, and reliable component sourcing is critical to ensuring consistent adoption and long-term market stability. In addition, strategic partnerships with global suppliers and investments in local manufacturing of key components can reduce dependency risks. Implementing predictive maintenance and digital monitoring can also improve operational uptime and reliability

Banknote Printing Machine Market Scope

The market is segmented on the basis of component, type, and application.

- By Component

On the basis of component, the global banknote printing machine market is segmented into Solution and Services. The Solution segment held the largest market revenue share in 2024, driven by the demand for advanced printing technologies, including high-security inks, substrates, and specialized software for designing and producing currency. These solutions are essential for ensuring anti-counterfeiting measures and improving production efficiency across mints and printing authorities.

The Services segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising need for maintenance, calibration, technical support, and training services. Service offerings help printing authorities optimize machine performance, reduce downtime, and extend equipment lifespan, thereby enhancing operational reliability and security in currency production.

- By Type

On the basis of type, the global banknote printing machine market is segmented into Intaglio Printing, Offset Printing, and Silk Screen Printing. The Intaglio Printing segment held the largest market revenue share in 2024 due to its superior ability to produce highly secure, intricate designs that are difficult to counterfeit. It is widely adopted by central banks and government authorities for high-denomination banknotes.

The Offset Printing segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness, high-speed production, and suitability for medium- to low-denomination notes. Growing demand for hybrid printing solutions that combine offset and intaglio techniques is also propelling market growth.

- By Application

On the basis of application, the global banknote printing machine market is segmented into Government Authorities, Private Enterprises, and Central Banks. The Government Authorities segment held the largest market revenue share in 2024, fueled by the need for secure and reliable currency production for national circulation. Strict regulatory requirements and adoption of advanced anti-counterfeiting technologies further support demand in this segment.

The Central Banks segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing investments in modernization of printing facilities and the adoption of technologically advanced machines to ensure higher security, efficiency, and traceability of banknotes across countries.

Banknote Printing Machine Market Regional Analysis

• North America dominated the banknote printing machine market with the largest revenue share in 2024, driven by increasing investments in secure currency production, modernization of central bank printing facilities, and the growing need to prevent counterfeiting

• The widespread adoption of advanced printing technologies and high-security features, combined with a well-established banking infrastructure, is boosting demand for upgraded banknote printing machines across the region

U.S. Banknote Printing Machine Market Insight

The U.S. banknote printing machine market held the largest revenue share within North America in 2024, fueled by the modernization of the U.S. Bureau of Engraving and Printing and rising investments in anti-counterfeit solutions. The increasing focus on enhancing security features and streamlining currency production processes is driving demand for high-precision, automated printing machines. Furthermore, government initiatives to replace worn-out banknotes and improve production efficiency are supporting market growth.

Europe Banknote Printing Machine Market Insight

The Europe banknote printing machine market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing modernization efforts in central banks and rising adoption of secure printing technologies. The focus on combating counterfeiting, coupled with technological advancements in printing and finishing processes, is fostering market expansion across the region. European countries are also upgrading existing facilities to integrate automated and high-speed printing systems.

U.K. Banknote Printing Machine Market Insight

The U.K. banknote printing machine market is expected to witness the fastest growth rate from 2025 to 2032, supported by initiatives to enhance the security of currency and streamline banknote production. Increased demand for advanced printing technologies and modernization of government-authorized printing facilities are expected to fuel market growth. The U.K.’s strong banking infrastructure and emphasis on anti-counterfeit measures further promote the adoption of sophisticated printing machines.

Germany Banknote Printing Machine Market Insight

The Germany banknote printing machine market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s focus on secure currency production and advanced printing technologies. German central banks and private enterprises are increasingly investing in modern equipment to prevent forgery and improve production efficiency. Integration of automated inspection systems and high-security features in banknotes is also contributing to market growth.

Asia-Pacific Banknote Printing Machine Market Insight

The Asia-Pacific banknote printing machine market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing modernization of central banks, rising demand for secure currency, and rapid economic growth in countries such as China, India, and Japan. The region’s focus on combating counterfeiting, along with investments in automated and high-speed printing systems, is boosting market adoption. In addition, emerging economies are upgrading printing infrastructure to meet the growing need for efficient and secure banknote production.

Japan Banknote Printing Machine Market Insight

The Japan banknote printing machine market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s emphasis on high-security currency production, technological advancements in printing, and modernization of central bank facilities. Rising investments in anti-counterfeiting measures and automation of printing processes are supporting market expansion. The integration of advanced inspection and quality control systems is further driving demand across government authorities and private enterprises.

China Banknote Printing Machine Market Insight

The China banknote printing machine market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by modernization of the People’s Bank of China printing facilities and increasing demand for secure currency. Rapid technological advancements, coupled with investments in automated, high-speed printing machines and anti-counterfeit solutions, are driving market growth. The focus on efficient currency production and the replacement of old banknotes are key factors propelling the market in China.

Banknote Printing Machine Market Share

The Banknote Printing Machine industry is primarily led by well-established companies, including:

- Pasaban S.A. (Spain)

- Konica Minolta, Inc. (Japan)

- SPS TechnoScreen GmbH (Germany)

- Focus Technology Co., Ltd (China)

- Komori Corporation (Japan)

- Cash Processing Solutions (CPS) (India)

- Security Printing & Minting Corporation of India Ltd. (India)

- Flint Group (Luxemburg)

- Koenig & Bauer AG (Germany)

- Heidelberger Druckmaschinen AG (Germany)

Latest Developments in Global Banknote Printing Machine Market

- In 2024, Konica Minolta, Inc. introduced specialized banknote printing solutions in collaboration with leading financial institutions. The development focused on enhancing security printing capabilities for central banks and high-security enterprises. By offering tailored solutions, the company aimed to improve printing precision, reduce counterfeiting risks, and streamline production processes, thereby strengthening its position in the global banknote printing machine market

- In 2024, SPS TechnoScreen GmbH launched integrated printing solutions for high-security documents, including passports and banknotes. This development enabled secure and efficient production of sensitive documents, reducing the risk of forgery and improving operational efficiency. The move reinforced SPS TechnoScreen’s market presence in the banknote and security printing segment while addressing the growing global demand for advanced anti-counterfeiting technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Banknote Printing Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Banknote Printing Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Banknote Printing Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.