Global Bariatric Patient Care Handling Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.31 Billion

USD

3.78 Billion

2025

2033

USD

2.31 Billion

USD

3.78 Billion

2025

2033

| 2026 –2033 | |

| USD 2.31 Billion | |

| USD 3.78 Billion | |

|

|

|

|

Bariatric Patient Care Handling Equipment Market Size

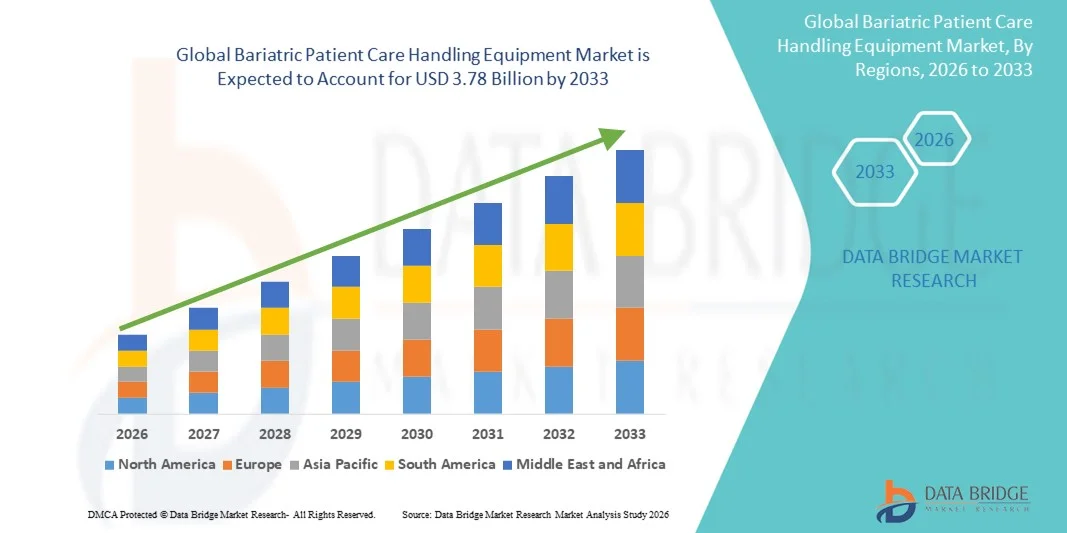

- The global bariatric patient care handling equipment market size was valued at USD 2.31 billion in 2025 and is expected to reach USD 3.78 billion by 2033, at a CAGR of 6.38% during the forecast period

- The market growth is largely fueled by the rising prevalence of obesity and the increasing geriatric population, which are driving higher demand for specialized bariatric patient care handling equipment across hospitals, long-term care facilities, and homecare settings

- Furthermore, growing awareness regarding caregiver safety, along with stringent workplace safety regulations and continuous technological advancements in patient handling equipment—such as powered lifts, adjustable bariatric beds, and ergonomic transfer systems—is accelerating the uptake of bariatric patient care handling equipment solutions, thereby significantly boosting the industry’s growth

Bariatric Patient Care Handling Equipment Market Analysis

- Bariatric patient care handling equipment, which includes specialized beds, lifts, transfer aids, and mobility devices designed to safely handle obese and overweight patients, has become increasingly essential across hospitals, long-term care facilities, and homecare settings due to its role in improving patient comfort, dignity, and caregiver safety

- The escalating demand for bariatric patient care handling equipment is primarily driven by the rising global prevalence of obesity, an expanding geriatric population, and growing emphasis on reducing caregiver injuries, alongside stricter workplace safety regulations and increasing investments in advanced healthcare infrastructure

- North America dominated the bariatric patient care handling equipment market with an estimated revenue share of around 36% in 2025, supported by high obesity rates, well-established healthcare systems, favorable reimbursement policies, and strong adoption of advanced patient handling technologies, with the U.S. accounting for a major portion of regional demand across acute and long-term care facilities

- Asia-Pacific is expected to be the fastest-growing region in the bariatric patient care handling equipment market during the forecast period, registering a CAGR in the high single digits, driven by improving healthcare infrastructure, rising awareness of caregiver safety, increasing obesity incidence, and growing investments in hospitals and elderly care facilities across countries such as China, India, and Japan

- The Patient Lifts segment dominated the largest market revenue share of 34.8% in 2025, driven by the rising need for safe patient handling and injury prevention among caregivers

Report Scope and Bariatric Patient Care Handling Equipment Market Segmentation

|

Attributes |

Bariatric Patient Care Handling Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Invacare Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Bariatric Patient Care Handling Equipment Market Trends

Increasing Focus on Safe Patient Handling and Workplace Injury Reduction

- A significant and accelerating trend in the global bariatric patient care handling Equipment market is the growing emphasis on safe patient handling practices to reduce caregiver injuries and improve patient safety in healthcare settings

- Healthcare providers are increasingly adopting specialized bariatric equipment such as ceiling lifts, floor-based lifts, bariatric beds, and transfer aids to accommodate the rising obese patient population

- For instance, in 2024, several large hospital networks in the U.S. expanded their bariatric care programs by investing in high-capacity patient lifts and motorized transfer systems, aimed at reducing musculoskeletal injuries among nursing staff

- Regulatory bodies and healthcare associations are promoting safe handling guidelines, encouraging hospitals and long-term care facilities to replace manual lifting with mechanical solutions

- This trend is reshaping care delivery models by prioritizing ergonomics, patient dignity, and staff efficiency, thereby driving sustained demand for bariatric patient care handling equipment across acute and long-term care settings

Bariatric Patient Care Handling Equipment Market Dynamics

Driver

Rising Obesity Prevalence and Growing Demand for Specialized Healthcare Infrastructure

- The increasing prevalence of obesity worldwide is a major driver fueling demand for bariatric patient care handling equipment across hospitals, rehabilitation centers, and nursing homes

- Bariatric patients require specialized equipment to ensure safe mobility, positioning, and transfers, which traditional patient handling tools often cannot support

- For instance, in 2025, a leading European healthcare provider upgraded its facilities with bariatric beds and heavy-duty transfer chairs to meet growing admissions of obese and morbidly obese patient

- In addition, healthcare facilities are under pressure to reduce staff injuries and associated compensation costs, making investment in bariatric handling equipment a cost-effective long-term solution

- The expansion of healthcare infrastructure, particularly in emerging markets, further supports market growth as new hospitals increasingly incorporate bariatric-ready patient handling systems

Restraint/Challenge

High Equipment Costs and Limited Adoption in Resource-Constrained Settings

- The high initial cost of bariatric patient care handling equipment remains a key restraint, particularly for small hospitals, clinics, and long-term care facilities with limited budgets

- Advanced bariatric beds, powered lifts, and ceiling-mounted systems require substantial capital investment, along with ongoing maintenance and staff training expenses

- For instance, in 2023, several long-term care facilities in Southeast Asia delayed procurement of bariatric handling systems due to equipment costs exceeding USD 20,000–40,000 per unit

- Limited awareness and lack of standardized safe patient handling policies in certain regions also hinder adoption, forcing caregivers to rely on manual methods

- Addressing these challenges through government funding support, rental models, and cost-effective equipment innovations will be crucial for broader market penetration and sustained growth

Bariatric Patient Care Handling Equipment Market Scope

The market is segmented on the basis of type and end users.

- By Type

On the basis of type, the Bariatric Patient Care Handling Equipment market is segmented into Patient Transfer Devices, Patient Lifts, Slings, Air-Assisted Lateral Transfer Mattresses, Sliding Sheets, Accessories, Medical Beds, Mobility Devices, Wheelchairs and Mobility Scooters, Ambulatory Aids, Bathroom and Toilet Assist Equipment, Stretchers, and Transport Chairs. The Patient Lifts segment dominated the largest market revenue share of 34.8% in 2025, driven by the rising need for safe patient handling and injury prevention among caregivers. Bariatric patient lifts are widely adopted in hospitals due to their ability to support high-weight capacities and reduce manual lifting risks. Increasing incidence of obesity-related hospital admissions significantly contributes to segment dominance. These devices enhance patient dignity and comfort during transfers. Hospitals increasingly mandate mechanical lifting solutions to comply with workplace safety regulations. Technological advancements such as powered and ceiling-mounted lifts further boost adoption. High utilization in critical care and post-surgical settings supports demand. Patient lifts reduce musculoskeletal injuries among healthcare workers, lowering institutional costs. Favorable reimbursement policies in developed regions aid adoption. Growing bariatric surgery volumes further increase demand. Strong procurement by large healthcare facilities sustains dominance. These factors collectively position patient lifts as the leading segment.

The Air-Assisted Lateral Transfer Mattresses segment is expected to witness the fastest CAGR of 9.6% from 2026 to 2033, driven by increasing emphasis on non-invasive and frictionless patient transfer solutions. These mattresses significantly reduce physical strain on caregivers during lateral transfers. Hospitals prefer air-assisted systems for bariatric patients due to enhanced safety and reduced risk of pressure injuries. Rising adoption in intensive care units and emergency departments fuels growth. Technological improvements have enhanced durability and load-bearing capacity. Growing awareness regarding caregiver injury prevention supports adoption. Home healthcare settings are also beginning to adopt portable air-assisted systems. Increasing bariatric patient volumes globally accelerate demand. Integration with hospital beds enhances workflow efficiency. Favorable clinical outcomes and reduced transfer time boost acceptance. Emerging economies investing in modern healthcare infrastructure support growth. These factors collectively make this the fastest-growing type segment.

- By End Users

On the basis of end users, the Bariatric Patient Care Handling Equipment market is segmented into Hospitals, Home Care Settings, and Other End Users. The Hospitals segment accounted for the largest market revenue share of 57.3% in 2025, driven by the high concentration of bariatric patients requiring advanced handling equipment. Hospitals perform complex procedures such as bariatric surgeries, orthopedic operations, and critical care that necessitate specialized equipment. Stringent safety regulations mandate the use of mechanical patient handling devices. High patient inflow and long inpatient stays increase equipment utilization rates. Availability of trained professionals supports adoption of advanced bariatric solutions. Hospitals invest heavily in ceiling lifts, bariatric beds, and transport systems. Government funding and institutional budgets facilitate procurement. Rising obesity prevalence directly increases hospital-based demand. Equipment standardization and long-term contracts strengthen segment dominance. Hospitals focus on reducing caregiver injuries and liability risks. Technological upgrades further reinforce adoption. These factors collectively ensure hospitals remain the dominant end-user segment.

The Home Care Settings segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, driven by the growing preference for home-based care among bariatric patients. Aging populations and chronic obesity-related conditions increase demand for home care solutions. Patients prefer recovery and long-term care in familiar home environments. Advancements in compact, portable bariatric equipment support home use. Rising healthcare costs encourage early discharge from hospitals, boosting home care adoption. Family caregivers increasingly rely on mechanical aids to ensure safe handling. Government initiatives promoting home healthcare services support growth. Increased availability of rental bariatric equipment fuels accessibility. Improved product design enhances ease of installation and operation. Growing awareness of caregiver safety further drives demand. Expansion of home healthcare service providers accelerates adoption. These factors collectively make home care settings the fastest-growing end-user segment.

Bariatric Patient Care Handling Equipment Market Regional Analysis

- North America dominated the bariatric patient care handling equipment market, accounting for an estimated revenue share of around 36% in 2025, supported by high obesity prevalence, well-established healthcare systems, and favorable reimbursement frameworks for patient handling equipment

- The region demonstrates strong adoption of advanced bariatric beds, lifts, transfer devices, and mobility aids to improve patient safety and reduce caregiver injuries across hospitals, long-term care facilities, and home healthcare settings

- Growth is further reinforced by high healthcare spending, increasing emphasis on workplace safety for caregivers, and continuous technological advancements in ergonomic and powered patient handling solutions, positioning bariatric equipment as a critical component of modern healthcare infrastructure

U.S. Bariatric Patient Care Handling Equipment Market Insight

The U.S. bariatric patient care handling equipment market accounted for the largest revenue share within North America in 2025, driven by high obesity rates, increasing hospital admissions, and widespread implementation of safe patient handling programs. Healthcare providers are increasingly investing in bariatric beds, ceiling lifts, mobile hoists, and transfer aids to enhance patient comfort while minimizing musculoskeletal injuries among caregivers. Favorable reimbursement policies, strong presence of leading manufacturers, and rising demand from both acute and long-term care facilities continue to propel market growth in the U.S.

Europe Bariatric Patient Care Handling Equipment Market Insight

The Europe bariatric patient care handling equipment market is projected to grow at a steady CAGR during the forecast period, supported by increasing awareness of caregiver safety, stringent workplace safety regulations, and an aging population with rising obesity prevalence. European healthcare systems are emphasizing the adoption of bariatric patient handling solutions across hospitals, rehabilitation centers, and nursing homes to improve care quality and reduce staff injury rates. Ongoing investments in healthcare infrastructure further support market expansion.

U.K. Bariatric Patient Care Handling Equipment Market Insight

The U.K. bariatric patient care handling equipment market is anticipated to register a noteworthy CAGR over the forecast period, driven by National Health Service (NHS) initiatives promoting safe patient handling practices and growing demand for bariatric care solutions. Increasing obesity rates and a strong focus on occupational health and safety standards are encouraging healthcare facilities to upgrade bariatric lifting and transfer equipment across acute and community care settings.

Germany Bariatric Patient Care Handling Equipment Market Insight

The Germany bariatric patient care handling equipment market is expected to expand at a considerable CAGR, fueled by advanced healthcare infrastructure, rising demand for specialized bariatric care, and strong regulatory emphasis on caregiver safety. German healthcare providers are increasingly adopting technologically advanced and ergonomically designed patient handling systems, particularly in hospitals and elderly care facilities, to improve operational efficiency and patient outcomes.

Asia-Pacific Bariatric Patient Care Handling Equipment Market Insight

The Asia-Pacific bariatric patient care handling equipment market is expected to be the fastest-growing region during the forecast period, registering a CAGR in the high single digits. Growth is driven by improving healthcare infrastructure, rising awareness of caregiver safety, increasing obesity incidence, and expanding investments in hospitals and long-term care facilities. Countries such as China, India, and Japan are witnessing growing demand for bariatric beds, lifts, and mobility aids as healthcare systems modernize and patient volumes increase.

Japan Bariatric Patient Care Handling Equipment Market Insight

The Japan bariatric patient care handling equipment market is gaining traction due to the country’s rapidly aging population, increasing focus on elderly care, and rising demand for safe and efficient patient handling solutions. Japanese healthcare providers emphasize automation, ergonomic design, and space-efficient bariatric equipment to address caregiver shortages and improve patient safety in hospitals and long-term care facilities.

China Bariatric Patient Care Handling Equipment Market Insight

The China bariatric patient care handling equipment market accounted for the largest revenue share in Asia-Pacific in 2025, driven by expanding hospital infrastructure, rising obesity rates, and increasing healthcare expenditure. Government investments in healthcare modernization, coupled with growing awareness of caregiver safety and patient comfort, are accelerating the adoption of bariatric handling equipment across public and private healthcare facilities.

Bariatric Patient Care Handling Equipment Market Share

The Bariatric Patient Care Handling Equipment industry is primarily led by well-established companies, including:

• Invacare Corporation (U.S.)

• Stryker Corporation (U.S.)

• Drive DeVilbiss Healthcare (U.S.)

• Joerns Healthcare LLC (U.S.)

• Arjo AB (Sweden)

• Handicare Group AB (Sweden)

• Guldmann A/S (Denmark)

• Etac AB (Sweden)

• Medline Industries, Inc. (U.S.)

• Graham-Field Health Products, Inc. (U.S.)

• Sunrise Medical (U.K.)

• Carex Health Brands (U.S.)

• Span America Medical Systems (U.S.)

• Patient Handling Solutions GmbH (Germany)

• Invacare Europe (Ireland)

• Linet Group (Czech Republic)

• Drive DeVilbiss Healthcare Ltd. (U.K.)

• P&H Medical (U.S.)

Latest Developments in Global Bariatric Patient Care Handling Equipment Market

- In February 2021, Dynatronics launched the Bariatric Electric Stand-In Table with Patient Lift, a motorized bariatric table solution designed to support safe transfers from sitting to standing positions for bariatric patients, helping reduce caregiver strain in clinical settings

- In May 2022, Invacare introduced the Birdie Evo XPLUS Patient Lift to the U.S. market, featuring innovative design enhancements aimed at maximizing comfort and security for bariatric patient lifting and handling in post-acute care environments

- In April 2025, Arjo strengthened its position in patient handling with the launch of the Maxi Move 5 Patient Floor Lift — a next-generation lift designed for improved ergonomics, safety, and ease of use in moving bariatric patients across care settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.