Global Bariatric Surgery Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.31 Billion

USD

4.09 Billion

2024

2032

USD

2.31 Billion

USD

4.09 Billion

2024

2032

| 2025 –2032 | |

| USD 2.31 Billion | |

| USD 4.09 Billion | |

|

|

|

|

Bariatric Surgery Devices Market Size

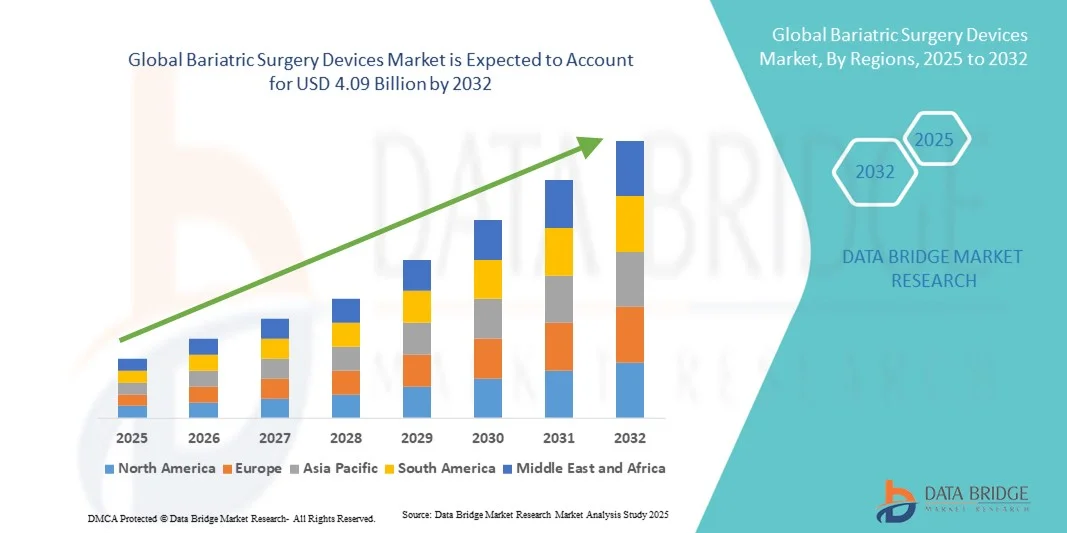

- The global bariatric surgery devices market size was valued at USD 2.31 billion in 2024 and is expected to reach USD 4.09 billion by 2032, at a CAGR of 7.38% during the forecast period

- The market growth is primarily driven by the rising prevalence of obesity and obesity-related comorbidities, coupled with increasing awareness about minimally invasive surgical interventions

- In addition, growing preference for advanced, safe, and efficient bariatric surgery devices among healthcare providers, along with technological innovations in surgical tools and procedures, is fueling market adoption. These factors are collectively propelling the demand for bariatric surgery devices, thereby significantly enhancing the industry's growth

Bariatric Surgery Devices Market Analysis

- Bariatric surgery devices, encompassing minimally invasive and non-invasive surgical tools, are increasingly crucial for managing obesity and related comorbidities, offering effective and safe weight loss solutions in hospitals, specialty centers, and bariatric clinics

- The rising demand for bariatric surgery devices is primarily driven by the growing prevalence of obesity worldwide, increasing awareness of surgical weight loss options, and preference for advanced, minimally invasive procedures that reduce recovery time and improve patient outcomes

- North America dominated the bariatric surgery devices market with the largest revenue share of 39.7% in 2024, supported by high obesity rates, strong healthcare infrastructure, favorable reimbursement policies, and the presence of leading device manufacturers, with the U.S. witnessing significant adoption of sleeve gastrectomy and gastric bypass procedures

- Asia-Pacific is expected to be the fastest-growing region in the bariatric surgery devices market during the forecast period due to rising obesity prevalence, expanding healthcare infrastructure, and increasing awareness of bariatric surgery among patients

- Minimally invasive surgical devices segment dominated the bariatric surgery devices market with a market share of 44.8% in 2024, driven by their advantages in reducing post-surgical complications, shortening hospital stays, and enhancing procedural efficiency

Report Scope and Bariatric Surgery Devices Market Segmentation

|

Attributes |

Bariatric Surgery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bariatric Surgery Devices Market Trends

Increased Adoption of Minimally Invasive and Robotic-Assisted Procedures

- A significant and accelerating trend in the global bariatric surgery devices market is the growing preference for minimally invasive and robotic-assisted surgical procedures, which offer reduced recovery times, lower complication rates, and enhanced precision

- For instance, the da Vinci Surgical System enables surgeons to perform sleeve gastrectomy and gastric bypass procedures with improved accuracy and smaller incisions, minimizing post-operative pain and hospitalization duration

- Advancements in device ergonomics, imaging, and AI-assisted surgical planning are enhancing procedural efficiency, allowing surgeons to optimize patient outcomes while reducing operation times

- The integration of real-time monitoring and robotic assistance into bariatric procedures is facilitating greater control over complex surgeries, enabling safer interventions for high-risk patients

- This trend toward technologically advanced, minimally invasive devices is reshaping surgical expectations, driving demand for next-generation bariatric surgery solutions across hospitals and specialty centers

- The demand for devices supporting robotic-assisted and laparoscopic bariatric surgeries is growing rapidly, as healthcare providers seek to improve surgical outcomes while meeting patient preferences for less invasive treatments

Bariatric Surgery Devices Market Dynamics

Driver

Rising Obesity Prevalence and Increasing Awareness of Surgical Options

- The increasing prevalence of obesity and associated comorbidities, coupled with growing awareness about bariatric surgery as an effective weight-loss solution, is a significant driver for the heightened demand for bariatric surgery devices

- For instance, in March 2024, Medtronic expanded its portfolio of minimally invasive bariatric instruments, aiming to address the rising number of patients eligible for surgical weight-loss interventions

- As patients become more conscious of obesity-related health risks, the preference for surgical interventions such as sleeve gastrectomy, gastric bypass, and adjustable gastric banding is driving device adoption

- Furthermore, advancements in surgical tools that reduce procedure complexity and recovery time are making bariatric surgery more accessible and appealing to a broader patient population

- The availability of comprehensive training programs for surgeons and awareness campaigns by hospitals and specialty centers further contributes to the growing adoption of bariatric surgery devices

Restraint/Challenge

High Procedure Costs and Regulatory Compliance Challenges

- The relatively high cost of bariatric surgery procedures and associated devices, particularly robotic-assisted systems, poses a significant challenge to broader market penetration, limiting accessibility for some patient populations

- For instance, patients in developing regions may face financial barriers to accessing minimally invasive or robotic-assisted bariatric surgeries due to device and hospital charges

- Regulatory compliance requirements, including approvals from agencies such as the FDA and CE marking, add complexity and time to device development and market entry, challenging smaller manufacturers

- In addition, concerns about post-operative complications, device safety, and long-term effectiveness require rigorous clinical validation, which can delay adoption and increase costs

- Overcoming these challenges through cost-effective device innovations, streamlined regulatory processes, and improved patient education on surgical benefits and risks will be vital for sustained market growth

Bariatric Surgery Devices Market Scope

The market is segmented on the basis of type, procedure, and end user.

- By Type

On the basis of type, the bariatric surgery devices market is segmented into minimally invasive surgical devices and non-invasive surgical devices. The minimally invasive surgical devices segment dominated the market with the largest revenue share of 44.8% in 2024, driven by its advantages of reduced post-operative complications, shorter hospital stays, and faster recovery times. Surgeons increasingly prefer laparoscopic and robotic-assisted instruments for procedures such as sleeve gastrectomy and gastric bypass due to their precision and improved patient outcomes. Hospitals and specialty centers favor these devices for high patient throughput and better procedural efficiency. In addition, minimally invasive devices are supported by growing technological advancements, including enhanced imaging systems and AI-assisted surgical tools, further strengthening their market position. The segment also benefits from strong awareness among patients seeking less invasive solutions.

The non-invasive surgical devices segment is expected to witness the fastest growth rate of 20.8% from 2025 to 2032, fueled by rising adoption of non-invasive bariatric procedures such as endoscopic sleeve gastroplasty. These devices appeal to patients hesitant to undergo conventional surgery, providing weight-loss solutions with minimal recovery time and reduced procedural risks. Non-invasive devices also support outpatient and ambulatory surgical setups, broadening accessibility. Market growth is further boosted by innovations in device design, improved safety profiles, and increasing insurance coverage for non-surgical interventions. Rising patient awareness and preference for less invasive weight-loss options drive rapid adoption in emerging markets.

- By Procedure

On the basis of procedure, the bariatric surgery devices market is segmented into sleeve gastrectomy, gastric bypass, revision bariatric surgery, non-invasive bariatric surgery, adjustable gastric banding, mini-gastric bypass, and biliopancreatic diversion with duodenal switch. The sleeve gastrectomy segment dominated the market with the largest revenue share in 2024, attributed to its simplicity, effectiveness, and lower complication rates compared to more complex procedures. This procedure has gained widespread acceptance among surgeons and patients due to its predictable weight-loss outcomes and suitability for a broad range of BMI categories. Hospitals and specialty centers increasingly prefer sleeve gastrectomy as the first-line surgical option, contributing to high device demand. Advanced surgical instruments for stapling, dissection, and suturing further enhance procedural efficiency. The growing prevalence of obesity and rising awareness of surgical weight-loss options continue to strengthen this segment.

The non-invasive bariatric surgery segment is expected to witness the fastest growth rate during the forecast period, driven by increasing patient preference for endoscopic and other non-surgical weight-loss interventions. Non-invasive procedures minimize hospital stays, reduce recovery time, and lower the risk of complications, making them appealing for both patients and healthcare providers. Technological advancements in endoscopic tools and energy-based devices are improving outcomes and procedural safety. Growing patient awareness, insurance coverage expansion, and favorable reimbursement policies support accelerated adoption. Emerging markets, where surgical infrastructure may be limited, also contribute to rapid growth in this segment.

- By End User

On the basis of end user, the bariatric surgery devices market is segmented into bariatric surgery clinics, hospitals, specialty centers, and ambulatory surgical centers. Hospitals dominated the market with the largest revenue share in 2024 due to their established infrastructure, high patient volumes, and ability to support complex bariatric procedures, including sleeve gastrectomy and gastric bypass. Hospitals benefit from access to advanced surgical devices, skilled surgeons, and comprehensive post-operative care, driving demand for both minimally invasive and non-invasive devices. The preference for hospitals is further strengthened by insurance reimbursements and patient trust in institutional healthcare facilities. High adoption of robotic-assisted and laparoscopic procedures within hospitals also supports market dominance.

Ambulatory surgical centers are expected to witness the fastest growth rate during the forecast period, fueled by the increasing shift toward outpatient bariatric procedures and cost-effective surgical solutions. These centers offer shorter procedural times, reduced hospitalization costs, and quicker recovery, attracting patients seeking convenience and affordability. The adoption of compact, easy-to-use surgical devices tailored for outpatient settings further accelerates market growth. Rising awareness of ambulatory care advantages among patients and healthcare providers is supporting the rapid expansion of this end-user segment.

Bariatric Surgery Devices Market Regional Analysis

- North America dominated the bariatric surgery devices market with the largest revenue share of 39.7% in 2024, supported by high obesity rates, strong healthcare infrastructure, favorable reimbursement policies, and the presence of leading device manufacturers

- Patients and healthcare providers in the region increasingly prefer minimally invasive and robotic-assisted bariatric procedures due to their efficiency, precision, and improved post-operative outcomes

- This widespread adoption is further supported by favorable reimbursement policies, availability of advanced surgical devices, and the presence of leading global manufacturers, establishing North America as a key market for both hospitals and specialty bariatric centers

U.S. Bariatric Surgery Devices Market Insight

The U.S. bariatric surgery devices market captured the largest revenue share of 82% in 2024 within North America, fueled by the rising prevalence of obesity and increasing awareness of surgical weight-loss interventions. Patients and healthcare providers are increasingly prioritizing minimally invasive and robotic-assisted procedures for better safety, precision, and faster recovery. The growing demand for outpatient and ambulatory bariatric procedures, combined with technological advancements in staplers, laparoscopic tools, and endoscopic devices, further propels the market. Moreover, strong reimbursement policies, established healthcare infrastructure, and the presence of leading device manufacturers significantly contribute to the market's expansion.

Europe Bariatric Surgery Devices Market Insight

The Europe bariatric surgery devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing obesity rates, stringent healthcare regulations, and growing awareness about the benefits of surgical weight-loss solutions. Rising urbanization and demand for advanced healthcare facilities are fostering the adoption of bariatric surgery devices. European patients and healthcare providers are also drawn to minimally invasive and robotic-assisted procedures for improved outcomes and shorter hospital stays. The region is witnessing notable growth across hospitals, specialty centers, and bariatric clinics, with devices being incorporated into both new and existing surgical setups.

U.K. Bariatric Surgery Devices Market Insight

The U.K. bariatric surgery devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing obesity prevalence and a growing focus on advanced, minimally invasive surgical procedures. Concerns regarding obesity-related health conditions are encouraging both patients and healthcare providers to adopt surgical interventions such as sleeve gastrectomy and gastric bypass. The U.K.’s well-developed healthcare infrastructure, adoption of robotic-assisted surgery, and strong awareness campaigns about bariatric procedures are expected to continue stimulating market growth.

Germany Bariatric Surgery Devices Market Insight

The Germany bariatric surgery devices market is expected to expand at a considerable CAGR during the forecast period, fueled by rising obesity rates and increasing awareness of surgical weight-loss interventions. Germany’s emphasis on technological innovation, patient safety, and sustainable healthcare solutions promotes the adoption of advanced laparoscopic and robotic-assisted bariatric devices. Hospitals and specialty centers are integrating these devices into both standard and complex bariatric procedures. Furthermore, the demand for minimally invasive procedures, which reduce recovery time and post-operative complications, aligns with local healthcare priorities, driving market growth.

Asia-Pacific Bariatric Surgery Devices Market Insight

The Asia-Pacific bariatric surgery devices market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising obesity prevalence, expanding healthcare infrastructure, and increasing patient awareness in countries such as China, Japan, and India. The region’s growing inclination towards minimally invasive and robotic-assisted bariatric procedures, supported by government healthcare initiatives and training programs for surgeons, is driving device adoption. Furthermore, as APAC emerges as a hub for manufacturing bariatric surgical devices, affordability and accessibility are improving, expanding the market to a wider patient population.

Japan Bariatric Surgery Devices Market Insight

The Japan bariatric surgery devices market is gaining momentum due to the country’s high technological adoption, rising obesity rates, and demand for safe, minimally invasive surgical solutions. Japanese patients and healthcare providers are increasingly favoring laparoscopic and robotic-assisted procedures for better precision and faster recovery. The integration of advanced surgical devices with hospital digital systems and training programs for surgeons is fueling market growth. In addition, Japan’s aging population is such asly to drive demand for bariatric procedures that offer reduced post-operative risks and easier recovery, in both hospital and outpatient settings.

India Bariatric Surgery Devices Market Insight

The India bariatric surgery devices market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s growing obesity prevalence, rapid urbanization, and rising awareness about surgical weight-loss interventions. India stands as one of the fastest-growing markets for minimally invasive and robotic-assisted bariatric procedures, with increasing adoption in hospitals, specialty centers, and ambulatory surgical setups. The push towards modern healthcare infrastructure, availability of affordable surgical devices, and presence of domestic and international manufacturers are key factors propelling market growth in India.

Bariatric Surgery Devices Market Share

The Bariatric Surgery Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Intuitive Surgical Operations, Inc. (U.S.)

- Olympus Corporation (Japan)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

- Teleflex Incorporated (U.S.)

- CONMED Corporation (U.S.)

- Karl Storz SE & Co. KG (Germany)

- ReShape Lifesciences Inc. (U.S.)

- Allurion (U.S.)

- Spatz FGIA Inc. (U.S.)

- GI Dynamics Inc. (U.S.)

- Standard Bariatrics, Inc. (U.S.)

- Cousin Biotech (France)

- Fractyl Health Inc. (U.S.)

- USGI Medical Inc. (U.S.)

- Asensus Surgical US, Inc. (U.S.)

- Aspire Bariatrics Inc. (U.S.)

- Bariatric Solutions GmbH (Germany)

What are the Recent Developments in Global Bariatric Surgery Devices Market?

- In August 2025, Boston Scientific introduced its Endura Weight Loss Solutions, encompassing minimally invasive procedures such as Endoscopic Sleeve Gastroplasty (ESG) and intragastric balloon placement using the Orbera system. These interventions aim to provide effective weight loss options for individuals seeking alternatives to traditional surgery. The launch underscores a shift towards less invasive treatments in the bariatric field

- In June 2025, Nitinotes Surgical announced FDA Investigational Device Exemption (IDE) approval to initiate a pivotal U.S. trial of its EndoZip system. This device simplifies and speeds up endoscopic gastroplasty procedures, offering a widely available, minimally invasive, and effective solution for patients with obesity class I & II. The trial aims to evaluate the safety and efficacy of the EndoZip system for the treatment of obesity

- In June 2025, Novo Nordisk announced a collaboration with WeightWatchers to offer patients living with obesity access to FDA-approved Wegovy through NovoCare Pharmacy. This partnership aims to provide patients with comprehensive weight management solutions by combining pharmacological treatment with behavioral support

- In January 2024, Allurion expanded its strategic partnerships to enhance its digital platform, the Virtual Care Suite (VCS). The VCS now provides 24/7 coaching and guidance to patients across multiple modalities of care, including weight loss drugs, devices, and bariatric surgery. This expansion aims to improve patient engagement and outcomes in weight management

- In December 2023, Axios reported that weight-loss drugs, particularly GLP-1 agonists such as Wegovy, are increasingly being used in conjunction with bariatric surgery. This combination aims to enhance long-term weight loss outcomes, though it presents challenges related to insurance coverage and costs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.