Global Barware Market

Market Size in USD Billion

CAGR :

%

USD

7.06 Billion

USD

9.81 Billion

2025

2033

USD

7.06 Billion

USD

9.81 Billion

2025

2033

| 2026 –2033 | |

| USD 7.06 Billion | |

| USD 9.81 Billion | |

|

|

|

|

Barware Market Size

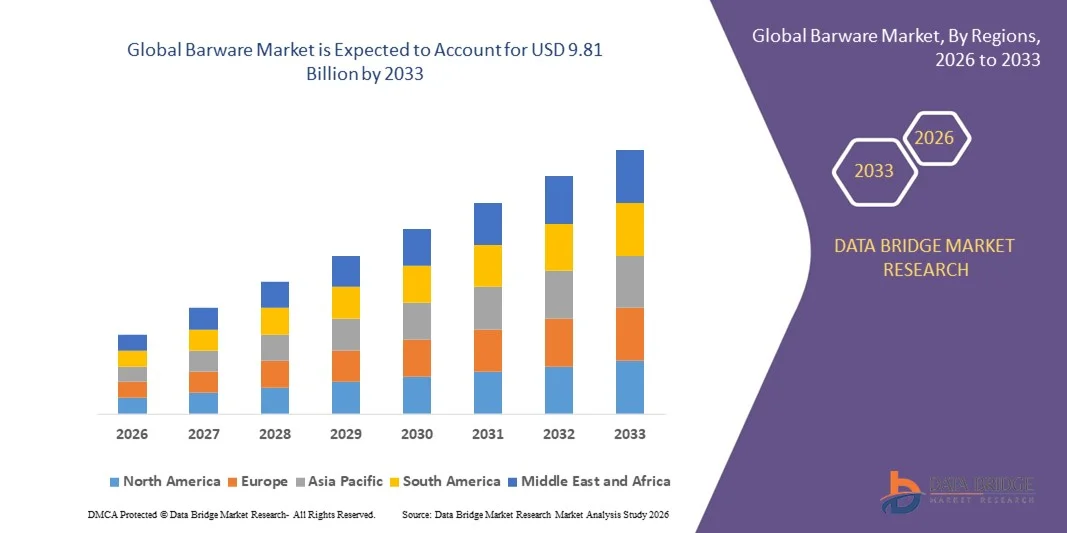

- The global barware market size was valued at USD 7.06 billion in 2025 and is expected to reach USD 9.81 billion by 2033, at a CAGR of 4.20% during the forecast period

- The market growth is largely fueled by rising consumer interest in home entertainment, mixology, and premium drinking experiences, driving demand for high-quality and stylish barware in both residential and commercial settings

- Furthermore, increasing disposable incomes, urbanization, and the influence of lifestyle trends and social media are encouraging consumers to invest in designer and themed barware collections. These factors are boosting sales of premium glassware, cocktail tools, and accessories, thereby significantly accelerating the growth of the barware industry

Barware Market Analysis

- Barware, encompassing products such as glassware, cocktail shakers, decanters, and drink accessories, is becoming an essential component of home and professional bars due to its role in enhancing drink presentation, functionality, and overall drinking experience

- The rising demand for barware is primarily driven by the growth of home mixology, increasing popularity of cocktails and craft beverages, and a trend toward experiential and aesthetically pleasing drinking setups in households, restaurants, and hospitality venues

- Europe dominated barware market in 2025, due to a strong culture of dining and entertainment, increasing premiumization of alcoholic beverages, and rising consumer preference for home bartending and mixology

- Asia-Pacific is expected to be the fastest growing region in the barware market during the forecast period due to rising disposable incomes, urbanization, and growing Western lifestyle adoption in countries such as China, Japan, and India

- Glass segment dominated the market with a market share of 45.5% in 2025, due to its premium feel, clarity, and versatility across various beverage types. Consumers often prefer glass barware for its aesthetic appeal, ability to showcase drink presentation, and compatibility with temperature-sensitive drinks such as cocktails and wines. Glass barware also supports a wide range of designs and engravings, enhancing its appeal for both personal use and gifting purposes. Its long-standing presence in traditional and modern bar setups reinforces its dominance

Report Scope and Barware Market Segmentation

|

Attributes |

Barware Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Barware Market Trends

Rising Popularity of Home Mixology

- The barware market is experiencing strong growth driven by the increasing popularity of home mixology, as consumers show heightened interest in recreating bar-like experiences within their homes. This shift has been influenced by social media trends, lifestyle changes, and the growing availability of premium spirits and cocktail essentials through e-commerce channels. As a result, consumers are investing in quality bar tools, glassware, and accessories to enhance at-home entertainment experiences

- For instance, companies such as Williams Sonoma and Crate & Barrel have expanded their home bar product lines by offering curated barware kits, professional glass sets, and mixology tools designed for amateur enthusiasts. In addition, brands such as Riedel and Luigi Bormioli are promoting premium glassware collections crafted for specific cocktail types, elevating the sophistication of home drinking rituals

- Consumers’ increasing exposure to online cocktail tutorials and home bartending content is fueling demand for functional yet stylish barware. The use of shakers, jiggers, strainers, and infusion tools has become more widespread among millennials and younger consumers seeking personalized and creative experiences. This evolving interest in craft mixology is blurring the line between home and professional bar setups

- Manufacturers are also focusing on design innovation and sustainability, introducing products made from recycled glass, stainless steel, and bamboo to appeal to eco-conscious customers. Such initiatives align with broader lifestyle trends emphasizing aesthetics, quality, and responsible consumption in home entertainment spaces

- The integration of smart or multifunctional barware, such as digital measuring tools or modular cocktail stations, is emerging as a niche yet influential subtrend. This development caters to urban consumers who value both convenience and modern design in their kitchen and dining setups

- Overall, the growing culture of home mixology is reshaping the demand landscape for barware, encouraging manufacturers and retailers to innovate with premium materials, sustainable design, and immersive consumer experiences aimed at replicating professional-quality bartending within domestic spaces

Barware Market Dynamics

Driver

Growing Consumer Preference for Premium and Designer Barware

- The increasing preference for premium and designer barware among consumers is a key driver of market expansion. With heightened exposure to global lifestyle trends and luxury home décor, buyers are seeking high-quality materials, artistic craftsmanship, and aesthetic appeal in their barware purchases

- For instance, Fiskars Group, through its premium brand Iittala, has launched glassware collections that combine Scandinavian design with durability, catering to consumers looking for both elegance and function. In addition, companies such as Waterford Crystal and Nachtmann are revitalizing heritage craftsmanship by blending modern designs with traditional glass-making techniques, attracting collectors and gifting buyers

- Premium barware is increasingly being valued as a reflection of personal taste and social status, often used as a centerpiece in home bars or entertainment areas. The focus on product uniqueness, design collaboration with mixologists, and limited-edition releases has made barware a significant segment in lifestyle and gifting categories

- Growing urbanization and higher disposable incomes are further accelerating the purchase of luxury barware in residential and hospitality spaces. Consumers are drawn to pieces that complement interior aesthetics, making barware both a functional and decorative investment

- The ongoing shift towards experiential consumption—where customers value design quality, brand story, and craftsmanship over price—continues to propel premium barware demand. This trend is establishing a strong market foundation for long-term value addition and sustained growth in the global barware industry

Restraint/Challenge

Competition from Low-Cost and Unbranded Alternatives

- The availability of low-cost and unbranded barware products presents a significant challenge by exerting downward pressure on profit margins and reducing brand differentiation. Price-sensitive consumers, particularly in emerging markets, often choose inexpensive substitutes that cater to basic functionality over aesthetics or long-term durability

- For instance, several small-scale manufacturers in China and India produce generic stainless-steel and glass barware at considerably lower prices, offering retailers cost-effective options for mass-market segments. This influx of competitively priced goods creates stiff competition for established brands operating in mid-range and premium categories

- Unbranded alternatives often replicate the appearance of high-quality products, making it difficult for consumers to distinguish between genuine designer items and low-grade imitations. As a result, brand loyalty and perceived value can weaken, especially in regions lacking strong retail brand presence

- E-commerce marketplaces amplify this challenge by offering easily accessible and cheaper barware options, leading to increased price competition and reduced margins for organized players. These dynamics can discourage innovation and limit investment in product development or design enhancement

- To overcome this restraint, leading barware manufacturers are focusing on building brand authenticity, investing in storytelling marketing, and adopting anti-counterfeit strategies while maintaining competitive pricing structures. Strengthening consumer education and brand differentiation will be essential in mitigating the influence of low-cost competitors and sustaining premium market positioning

Barware Market Scope

The market is segmented on the basis of material, application, distribution channel, and product.

- By Material

On the basis of material, the barware market is segmented into glass, ceramic, plastic, and steel. The glass segment dominated the market with the largest market revenue share of 45.5% in 2025, driven by its premium feel, clarity, and versatility across various beverage types. Consumers often prefer glass barware for its aesthetic appeal, ability to showcase drink presentation, and compatibility with temperature-sensitive drinks such as cocktails and wines. Glass barware also supports a wide range of designs and engravings, enhancing its appeal for both personal use and gifting purposes. Its long-standing presence in traditional and modern bar setups reinforces its dominance.

The steel segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in commercial bars, restaurants, and home mixology enthusiasts seeking durable and long-lasting barware. For instance, stainless steel cocktail shakers and jiggers are favored for their resistance to breakage, ease of cleaning, and sleek modern appearance. The surge in cocktail culture and professional bartending training programs has further contributed to the increasing demand for steel-based barware products. Its combination of durability, hygiene, and premium perception positions it as a high-growth material segment in the market.

- By Application

On the basis of application, the barware market is segmented into commercial and residential. The commercial segment dominated the market with the largest market revenue share in 2025, driven by the rapid growth of the hospitality industry, including bars, restaurants, and hotels. Businesses prioritize high-quality and visually appealing barware to enhance customer experience and brand perception, encouraging repeat patronage. The demand for commercial-grade barware also stems from durability requirements, as products must withstand frequent use and rigorous cleaning. Establishments increasingly invest in specialized barware tools to support cocktail culture and professional bartending services.

The residential segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising trend of home entertaining and mixology at home. For instance, brands such as Libbey and Riedel have introduced elegant home barware collections to meet consumer demand for stylish and functional glassware and accessories. Increased disposable income and social media influence are encouraging homeowners to create sophisticated home bar setups. The segment’s growth is further supported by online tutorials, influencer trends, and gifting occasions, driving interest in premium and designer residential barware.

- By Distribution Channel

On the basis of distribution channel, the barware market is segmented into online and offline. The offline segment dominated the market with the largest market revenue share in 2025, driven by the established presence of specialty stores, supermarkets, and department stores. Consumers often prefer offline channels for the tactile experience of examining products before purchase, ensuring quality, weight, and design meet expectations. Retailers also provide personalized recommendations and bundled offers, enhancing the purchase experience. Brand visibility and in-store promotions play a significant role in maintaining dominance of offline distribution channels.

The online segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing e-commerce adoption, convenience, and wide product availability. For instance, platforms such as Amazon and Wayfair offer extensive barware selections, including designer and premium sets, with doorstep delivery. Online channels allow easy comparison of products, pricing, and customer reviews, helping consumers make informed decisions. The growth of subscription boxes and curated barware kits also contributes to the rising demand through digital channels. The segment benefits from global accessibility and the rise of digital marketing strategies targeting home bartenders.

- By Product

On the basis of product, the barware market is segmented into wine glasses, casual glasses, wine tools, and others. The wine glasses segment dominated the market with the largest market revenue share in 2025, driven by the growing culture of wine consumption and premium dining experiences. Wine enthusiasts and collectors often prioritize high-quality glasses for aroma preservation, flavor enhancement, and aesthetic presentation. Brands focus on innovating glass designs tailored for specific wine types, enhancing the overall drinking experience. Wine glasses also hold gifting appeal, making them popular for personal and celebratory purchases.

The wine tools segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising interest in mixology and home bartending. For instance, companies such as OXO and Barcraft have launched specialized wine openers, aerators, and decanters, meeting the needs of both residential and commercial users. Consumers increasingly seek professional-grade tools to enhance beverage preparation, presentation, and storage. Social media trends and online tutorials further stimulate the adoption of wine tools. The combination of functionality, design, and aspirational value positions wine tools as a high-growth product segment in the market.

Barware Market Regional Analysis

- Europe dominated the barware market with the largest revenue share in 2025, driven by a strong culture of dining and entertainment, increasing premiumization of alcoholic beverages, and rising consumer preference for home bartending and mixology

- Consumers in the region highly value design, functionality, and brand heritage when selecting barware products such as cocktail shakers, glassware, and decanters

- This widespread adoption is further supported by high disposable incomes, growing urbanization, and the trend of experiential dining, making premium and artisanal barware a preferred choice across households, bars, and restaurants

U.K. Barware Market Insight

The U.K. barware market captured the largest revenue share in Europe in 2025, fueled by the rising trend of home mixology and craft cocktails. Consumers are increasingly investing in premium glassware, shakers, and accessories to replicate bar-quality experiences at home. The growing popularity of cocktail culture, coupled with lifestyle-focused e-commerce platforms, continues to drive demand. Moreover, the influence of bars, pubs, and hospitality sectors promoting signature drinks enhances the adoption of branded and designer barware.

Germany Barware Market Insight

The Germany barware market is projected to expand at a significant CAGR during the forecast period, driven by strong consumer inclination toward premium beverages and gifting culture. German consumers seek high-quality, durable, and aesthetically appealing barware items, particularly for entertaining guests and social occasions. The country’s emphasis on craftsmanship, combined with rising disposable incomes and a thriving hospitality industry, contributes to the growth of the barware market. In addition, sustainability-conscious consumers are increasingly favoring eco-friendly and reusable products.

France Barware Market Insight

The France barware market is expected to witness steady growth due to a strong cocktail and wine culture, coupled with increased interest in home mixology. French consumers are focusing on design, functionality, and the heritage of brands when purchasing barware items. Premiumization trends and the rising number of bars and restaurants offering curated drink experiences further support market expansion. Innovative and stylish barware that enhances the presentation of drinks is highly sought after in both residential and commercial settings.

North America Barware Market Insight

The North America barware market is poised to grow at a moderate CAGR, supported by a strong culture of home entertainment and cocktail preparation. For instance, companies such as Libbey and Riedel are driving demand with premium glassware and cocktail sets. Consumers are drawn to functional, durable, and aesthetically pleasing barware, and the rise of online retailing platforms ensures accessibility to a wide range of products. The U.S. continues to lead the regional market due to its large population of cocktail enthusiasts and growing interest in home bartending.

U.S. Barware Market Insight

The U.S. barware market accounted for the largest revenue share of 82% in North America in 2025, fueled by the popularity of home cocktail preparation and mixology kits. Consumers are increasingly purchasing premium and branded glassware, shakers, and bar accessories to enhance home entertainment experiences. Rising interest in DIY cocktails, coupled with influencer-driven trends on social media, further stimulates market demand. Integration of barware with home décor trends and gifting culture is expected to continue supporting market growth.

Asia-Pacific Barware Market Insight

The Asia-Pacific barware market is set to grow at the fastest CAGR during the forecast period, driven by rising disposable incomes, urbanization, and growing Western lifestyle adoption in countries such as China, Japan, and India. The region’s expanding hospitality sector, coupled with increased home entertainment culture, fuels demand for premium and designer barware. For instance, the influence of international cocktail culture and bars promoting signature drinks encourages consumers to purchase quality barware sets. The growth of e-commerce platforms is also improving accessibility to diverse products across APAC.

China Barware Market Insight

The China barware market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rising urban populations, the growing middle class, and increased interest in home entertainment and cocktail culture. Consumers are investing in stylish, functional, and branded barware items to support home mixology trends. The expansion of bars, restaurants, and hotels serving curated drink experiences further fuels demand. Domestic manufacturers offering affordable and premium-quality products strengthen the market’s growth trajectory.

Japan Barware Market Insight

The Japan barware market is experiencing growth due to a high appreciation for craftsmanship, design, and quality in drinkware. Consumers are increasingly interested in home cocktail making and curated drink presentations. Urban lifestyle trends, rising disposable incomes, and the influence of premium beverage culture encourage adoption. Moreover, for instance, the integration of barware with traditional Japanese aesthetics and modern design principles attracts both residential and commercial consumers.

Barware Market Share

The barware industry is primarily led by well-established companies, including:

- Anhui Deli Daily Glass Co., Ltd (China)

- Arc Holdings (U.S.)

- Bormioli Rocco S.p.A. (Italy)

- Libbey (U.S.)

- Present Ocean Glass Public Company Limited (Thailand)

- RONA USA (U.S.)

- Steelite International (U.K.)

- Oneida Ltd. (U.S.)

- EuroCave UK (U.K.)

- Fiskars Group (Finland)

- Lifetime Brands, Inc. (U.S.)

- True Brands (U.S.)

- Zwiesel Crystal Glass (Germany)

- Nambé, LLC (U.S.)

- KegWorks (U.S.)

- Rabbit (U.S.)

- Carlisle FoodService Products (U.S.)

- Cocktail Kingdom LLC (U.S.)

- Cresimo (U.S.)

- Vacu Vin B.V. (Netherlands)

- American Metalcraft, Inc. (U.S.)

- Chenimage (China)

Latest Developments in Global Barware Market

- In October 2025, Williams Sonoma, Pottery Barn, and Pottery Barn Teen launched a collaborative collection of exclusive home furnishings and kitchen products, including barware, inspired by the film Wicked: For Good. This collection integrates opulent Art Deco elements and whimsical storybook designs, offering consumers unique, themed drinking accessories. The partnership demonstrates an innovative approach to product development in the global barware market, as it leverages popular culture to enhance product differentiation, attract niche customer segments, and stimulate demand for collectible and visually distinctive barware items

- In February 2025, Zwiesel Glas introduced its "Up" series, the company’s first wine tumbler collection made from machine-crafted Tritan crystal. These versatile tumblers are designed to provide optimal aeration for different wines while being highly durable, break-resistant, and dishwasher-safe. This launch strengthens the brand’s presence in the modern barware segment by catering to contemporary consumer preferences for multifunctional, sustainable, and high-quality glassware in both residential and commercial applications, enhancing Zwiesel Glas’s competitive positioning

- In 2024, Riedel unveiled its GRAPE@RIEDEL collection, a line of wine glasses designed specifically to enhance the tasting characteristics of various wine types. With distinct glasses for Cabernet and Merlot, white wines and champagne, and Pinot Noir and Nebbiolo, the collection reinforces the company’s philosophy that precise glass shapes improve the drinking experience. This launch reinforces Riedel’s dominance in the premium barware market by emphasizing technical innovation, catering to wine enthusiasts, connoisseurs, and professional sommeliers, and strengthening brand authority in specialized glassware

- In July 2024, Luigi Bormioli expanded its barware portfolio with the Jazz and Optica collections, showcasing advancements in proprietary glass technologies. The Jazz collection features curved Art Deco designs suitable for sophisticated beverages, while the Optica range merges 1920s retro aesthetics with contemporary wine and cocktail glass styles. In addition, Luigi Bormioli highlighted its Sparkx glass for enhanced impact resistance and SON.hyx high-tech crystal capable of maintaining brilliance through repeated industrial dishwashing. These innovations enhance the brand’s reputation for durable, high-quality barware and strengthen its position in both the premium residential and hospitality markets

- In May 2024, Schott Zwiesel introduced the “Sense” collection, a new line of ergonomically designed cocktail and wine glassware aimed at improving handling, comfort, and visual appeal. The collection combines modern aesthetics with functionality, emphasizing ease of use for both home bartenders and hospitality professionals. This development impacts the barware market by responding to rising consumer demand for user-friendly and stylish drinkware, expanding the premium segment, and encouraging adoption in upscale bars and restaurants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.