Global Battery Coating Market

Market Size in USD Million

CAGR :

%

USD

360.94 Million

USD

919.55 Million

2025

2033

USD

360.94 Million

USD

919.55 Million

2025

2033

| 2026 –2033 | |

| USD 360.94 Million | |

| USD 919.55 Million | |

|

|

|

|

What is the Global Battery Coating Market Size and Growth Rate?

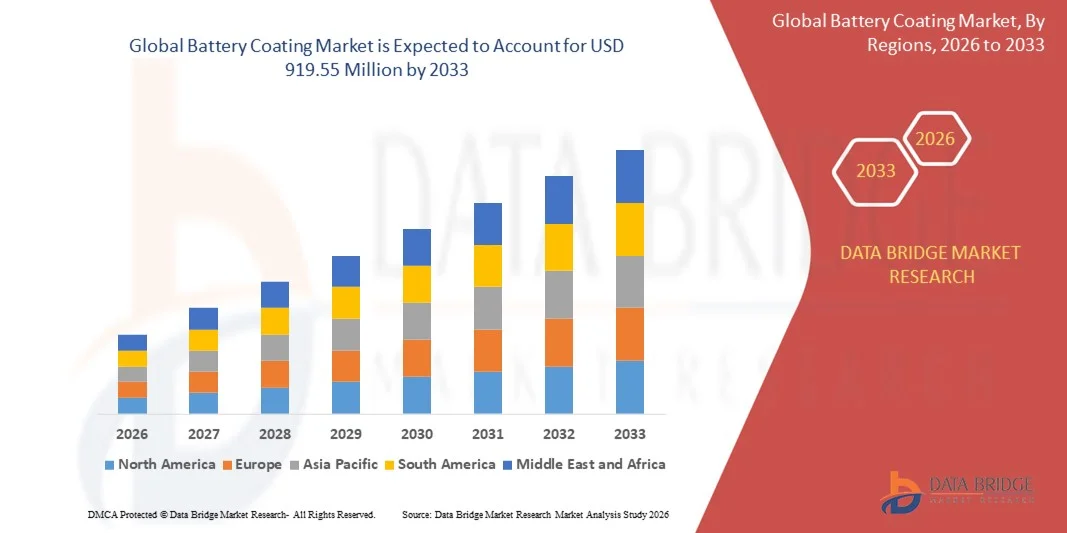

- The global battery coating market size was valued at USD 360.94 million in 2025 and is expected to reach USD 919.55 million by 2033, at a CAGR of 12.40% during the forecast period

- Increase in need for high performance batteries, rising demand of the product due to high production of electric vehicles, increasing preferences towards the usages of smart devices, rising number of applications in automobile and renewable energy sectors, increasing prevalence of stringent environmental norms, rising usages of the product to increase durability, decreases degradation mechanism and improves the safety and working efficiency of the battery are some of the major as well as vital factors which will likely to augment the growth of the battery coating market

What are the Major Takeaways of Battery Coating Market?

- Increasing use of batteries in energy storage devices along with rising number of innovation and technological advances in battery materials which will further contribute by generating massive opportunities that will lead to the growth of the battery coating market

- High cost of technology along with technical trend for solid electrolytes which will likely to act as market restraints factor for the growth of the battery coating

- Europe dominated the battery coating market with a 38.2% revenue share in 2025, driven by strong demand for advanced battery coatings in Germany, the U.K., France, and the Netherlands

- Asia-Pacific is projected to register the fastest CAGR of 8.2% from 2026 to 2033, led by rising EV production, industrial battery demand, and renewable energy projects in China, India, Japan, and Southeast Asia

- The ALD segment dominated the market with a revenue share of 44.2% in 2025, owing to its precision in depositing ultra-thin coatings, enhanced uniformity, and superior electrode stability

Report Scope and Battery Coating Market Segmentation

|

Attributes |

Battery Coating Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Battery Coating Market?

Growing Adoption of Advanced Coating Technologies for Enhanced Battery Performance

- The Battery Coating market is witnessing a key trend of increasing adoption of advanced coating materials, including polymeric, ceramic, and nano-based coatings, to improve energy density, cycle life, thermal stability, and safety of lithium-ion and other rechargeable batteries. This trend is driven by rising global demand for electric vehicles (EVs), energy storage systems, and high-performance portable electronics

- For instance, BASF and Solvay have developed next-generation cathode and anode coatings that enhance electrode stability and extend battery lifespan, supporting high-energy and fast-charging applications

- Growing focus on EV adoption, grid storage, and portable device usage is accelerating demand for durable, conductive, and thermally stable coatings

- Battery manufacturers are integrating advanced polymeric, ceramic, and hybrid coatings to reduce electrode degradation, improve charge-discharge efficiency, and enhance safety in lithium-ion and solid-state batteries

- Increased R&D on nano-structured coatings, conductive additives, and eco-friendly materials is fostering product innovation across global battery markets

- As consumers and OEMs prioritize performance, longevity, and safety, advanced battery coatings are expected to remain central to next-generation energy storage technologies

What are the Key Drivers of Battery Coating Market?

- Rising demand for EVs, portable electronics, and grid energy storage is a major growth driver for battery coatings, emphasizing performance enhancement, safety, and long-term reliability

- For instance, in 2025, 3M and Umicore expanded their battery coating portfolios to support high-capacity lithium-ion and solid-state battery production for automotive and energy storage applications

- Adoption of advanced coatings to improve charge-discharge efficiency, thermal management, and electrode stability is fueling integration across North America, Europe, and Asia-Pacific

- Technological advancements in nano-coatings, polymer electrolytes, and surface engineering are enabling manufacturers to achieve higher energy density, reduced internal resistance, and improved battery safety

- Increased investment in R&D, EV supply chains, and energy storage systems is supporting the development of specialized coatings tailored to diverse battery chemistries

- With ongoing focus on performance optimization, sustainability, and safety, the global Battery Coating market is expected to maintain strong growth momentum through 2033

Which Factor is Challenging the Growth of the Battery Coating Market?

- High production costs of advanced coating materials, specialized application processes, and R&D-intensive formulations limit large-scale adoption, particularly in cost-sensitive battery segments

- For instance, fluctuations in raw material availability, such as lithium, cobalt, and conductive polymers during 2024–2025, affected coating production volumes

- Stringent environmental, safety, and quality regulations across regions increase operational complexity and compliance costs for manufacturers

- Limited awareness among smaller battery manufacturers regarding benefits of advanced coatings, especially for specialty or high-performance applications, slows adoption

- Competition from alternative electrode and surface modification technologies creates pricing pressures and impacts coating adoption across lithium-ion, solid-state, and other battery types

- To overcome these challenges, market players are investing in cost-effective coating technologies, supply chain optimization, eco-friendly materials, and technical training to ensure scalable, high-performance, and reliable battery coating solutions

How is the Battery Coating Market Segmented?

The market is segmented on the basis of technology type, component, material type, and end use industry.

- By Technology Type

On the basis of technology type, the battery coating market is segmented into Atomic Layer Deposition (ALD), Plasma Enhanced Chemical Vapor Deposition (PECVD), and Chemical Vapor Deposition (CVD). The ALD segment dominated the market with a revenue share of 44.2% in 2025, owing to its precision in depositing ultra-thin coatings, enhanced uniformity, and superior electrode stability. ALD coatings improve cycle life, thermal stability, and charge efficiency in lithium-ion and solid-state batteries, making them highly preferred by EV, electronics, and energy storage manufacturers.

The PECVD segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption in high-volume industrial battery production and cost-effective surface modification. Innovations in plasma-assisted deposition enable faster coating application, scalability, and improved adhesion properties, accelerating adoption across automotive, renewable energy, and portable electronics industries. Continuous R&D is further driving performance and reliability enhancements.

- By Component

Based on component, the battery coating market is segmented into Electrode Coating, Separator Coating, and Battery Pack Coating. The Electrode Coating segment dominated the market with a revenue share of 49.5% in 2025, supported by growing demand for high-energy-density electrodes with improved stability, conductivity, and extended cycle life. Electrode coatings play a crucial role in enhancing cathode and anode performance for lithium-ion, solid-state, and next-generation batteries used in EVs and consumer electronics.

The Battery Pack Coating segment is projected to register the fastest CAGR from 2026 to 2033, owing to rising demand for thermal management, safety, and corrosion protection at the pack level. Growing EV penetration, renewable energy storage, and stricter safety standards are fueling adoption of protective pack coatings globally, with manufacturers focusing on innovative insulating, fire-resistant, and lightweight coating solutions.

- By Material Type

On the basis of material type, the battery coating market is segmented into PVDF (Polyvinylidene Fluoride), Ceramic, Alumina, Oxide, Carbon, and Others. The PVDF segment dominated the market with a revenue share of 47.8% in 2025, driven by its high chemical stability, excellent adhesion, and electrochemical compatibility with lithium-ion electrodes. PVDF-based coatings enhance electrode longevity, thermal resistance, and charge-discharge efficiency, making them essential in EVs, grid storage, and portable electronics.

The Ceramic segment is projected to grow at the fastest CAGR during 2026–2033, supported by rising adoption in solid-state and high-temperature battery applications. Ceramic coatings improve ion conductivity, reduce thermal runaway risks, and provide mechanical strength, while R&D innovations in nano-ceramics and hybrid formulations are further boosting market expansion.

- By End Use Industry

Based on end-use industry, the battery coating market is segmented into Oil and Gas, Renewable Energy, Automobiles, Electronics, and Others. The Automobiles segment dominated the market with a revenue share of 41.9% in 2025, owing to rapid EV adoption and growing demand for high-performance, long-lasting battery systems. Coatings in automotive batteries improve thermal stability, cycle life, and safety compliance, making them critical for passenger vehicles, commercial EVs, and hybrid applications.

The Renewable Energy segment is projected to register the fastest CAGR from 2026 to 2033, driven by expanding grid storage, solar, and wind energy projects. Coatings for renewable energy batteries enhance reliability, reduce maintenance, and enable higher energy density, supporting sustainable energy storage solutions globally. Increasing government incentives and large-scale infrastructure projects further propel growth in this segment.

Which Region Holds the Largest Share of the Battery Coating Market?

- Europe dominated the Battery Coating market with a 38.2% revenue share in 2025, driven by strong demand for advanced battery coatings in Germany, the U.K., France, and the Netherlands

- High adoption of EVs, renewable energy storage systems, and industrial batteries supports market leadership. Manufacturers are investing in innovative coating technologies such as ALD, CVD, and PECVD to enhance battery performance, safety, and cycle life

- Government incentives for clean energy, stringent environmental regulations, and focus on high-performance energy storage further strengthen regional dominance. Urbanization, advanced infrastructure, and sustainability initiatives are also boosting adoption of premium coatings across key industries

Germany Battery Coating Market Insight

Germany leads the European Battery Coating market, supported by widespread EV adoption, industrial energy storage expansion, and high-performance electronics manufacturing. Coatings that improve electrode stability, separator insulation, and battery pack safety are widely deployed. Companies are investing in R&D to develop durable, efficient, and lightweight coatings. Distribution through industrial suppliers and specialty channels ensures accessibility. Continuous innovation in ALD, ceramic, and PVDF coatings enhances Germany’s market position. Government policies promoting clean mobility and energy efficiency further reinforce growth in premium battery coatings.

U.K. Battery Coating Market Insight

The U.K. market is expanding steadily, driven by increasing EV production, renewable energy storage adoption, and industrial electronics growth. Battery coatings enhancing thermal stability, cycle life, and safety are in high demand. Manufacturers are innovating with PVDF, ceramic, and oxide-based coatings to improve performance. Government regulations, incentives for low-emission technologies, and rising awareness of energy efficiency support market growth. Strong distribution networks, including industrial suppliers and online platforms, facilitate adoption. Clean energy initiatives, urbanization, and technological innovation continue to drive the U.K. battery coating market.

Asia-Pacific Battery Coating Market Insight

Asia-Pacific is projected to register the fastest CAGR of 8.2% from 2026 to 2033, led by rising EV production, industrial battery demand, and renewable energy projects in China, India, Japan, and Southeast Asia. Rapid urbanization, increasing industrialization, and rising R&D investments in battery technology accelerate adoption. Coatings improving electrode performance, thermal management, and pack safety are gaining traction. Expanding manufacturing capabilities, strong government support for clean energy, and growing electronics and EV markets contribute to rapid growth. Product innovation and technological collaboration further strengthen the region’s expansion.

China Battery Coating Market Insight

China leads the Asia-Pacific Battery Coating market, supported by massive EV adoption, lithium-ion battery manufacturing, and industrial energy storage growth. Advanced coatings such as ALD, ceramic, and oxide-based solutions are used to enhance performance, safety, and longevity. Government incentives, R&D investments, and high production capacity reinforce market leadership. Distribution through industrial suppliers and OEM partnerships ensures wide accessibility. Rising focus on sustainable energy, electrification, and technological innovation continues to drive China’s battery coating market growth.

India Battery Coating Market Insight

India is emerging as a key contributor to Asia-Pacific growth, fueled by rising EV manufacturing, renewable energy storage projects, and electronics industry expansion. Battery coatings enhancing safety, cycle life, and performance are increasingly adopted. Government programs promoting clean energy, industrial modernization, and technology transfer support market growth. Manufacturers are introducing cost-effective and durable PVDF, ceramic, and carbon coatings for domestic and export markets. Urbanization, rising disposable incomes, and increasing industrialization are expected to sustain long-term expansion in India.

Which are the Top Companies in Battery Coating Market?

The battery coating industry is primarily led by well-established companies, including:

- APV Engineered Coatings (U.S.)

- Arkema (France)

- Solvay (Belgium)

- MITSUBISHI PAPER MILLS LIMITED (Japan)

- Asahi Kasei (Japan)

- SK Innovation Co., Ltd. (South Korea)

- Unifrax (U.S.)

- Targray Technology International Inc. (Canada)

- NEI Corporation. (U.S.)

- ALTEO (Hungary)

- NEXEON LTD. (U.K.)

- Beneq (Finland)

- Forge Nano Inc. (U.S.)

- ALD NanoSolutions, Inc. (U.S.)

- Wright Coating Technologies (U.S.)

- Rust Bullet Ltd (U.K.)

What are the Recent Developments in Global Battery Coating Market?

- In October 2024, Japan's UBE Corporation acquired LANXESS Urethane Systems, a specialty chemicals business, for an enterprise value of USD 500 million, including five manufacturing sites and application laboratories across the U.S., Europe, and China with around 400 employees. The deal, expected to close in the first half of 2025 pending regulatory approvals, supports UBE’s strategic expansion in polymer and battery materials, strengthening its global footprint

- In July 2024, Alteo and W-Scope signed an agreement to establish Europe’s largest separator production site, the region’s first fully electric facility, scheduled to begin operations in 2026, expected to create over 1,000 direct jobs and utilize Alteo’s high-performance SEPale aluminas. This collaboration strengthens the European EV battery supply chain and supports emerging gigafactory projects

- In November 2023, Durr Group partnered with LICAP Technologies, a U.S.-based coating expert, enhancing Durr’s expertise in electrode production and enabling the company to offer both wet coating and advanced dry coating technologies. This partnership positions Durr to provide more comprehensive solutions to battery manufacturers globally

- In April 2023, Arkema launched its Incellion range of sustainable waterborne acrylic solutions designed for high-capacity anodes, cathode primers, and ceramic-coated separators, advancing battery technology while supporting environmentally friendly and high-performance energy storage applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Battery Coating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Battery Coating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Battery Coating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.