Global Battery Cyclers Market

Market Size in USD Billion

CAGR :

%

USD

600.00 Billion

USD

1,084.00 Billion

2024

2032

USD

600.00 Billion

USD

1,084.00 Billion

2024

2032

| 2025 –2032 | |

| USD 600.00 Billion | |

| USD 1,084.00 Billion | |

|

|

|

|

Battery Cyclers Market Size

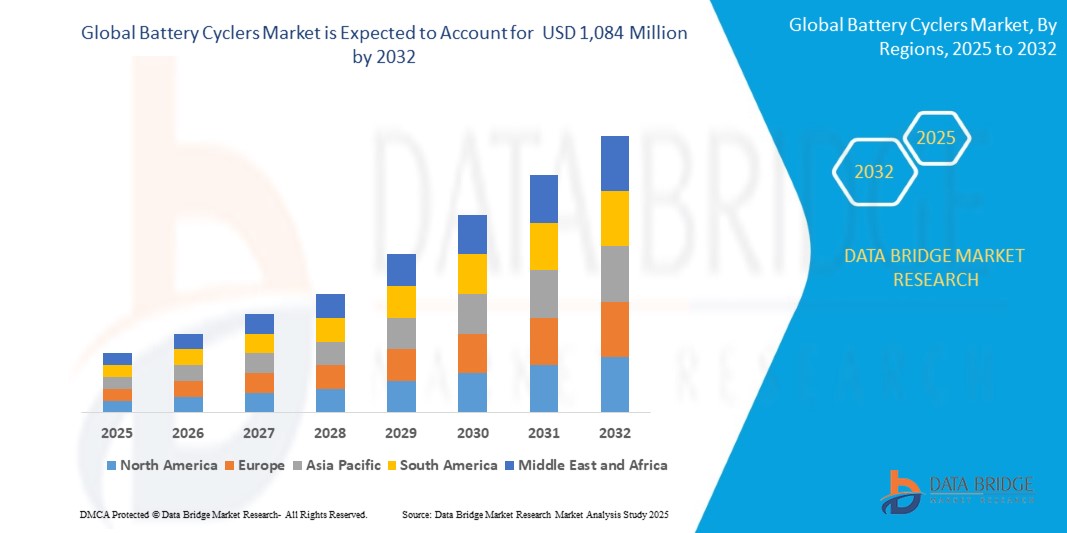

- The global battery cyclers market size was valued at USD 600 million in 2024 and is expected to reach USD 1,084 million by 2032, at a CAGR of 7.68% during the forecast period

- The market growth is primarily driven by the increasing demand for efficient battery testing solutions, fueled by the rapid expansion of electric vehicles (EVs), renewable energy storage systems, and advancements in consumer electronics

- The rising focus on sustainable energy solutions and the need for precise battery performance testing to ensure safety and reliability are key factors accelerating the adoption of battery cyclers across various industries

Battery Cyclers Market Analysis

- Battery cyclers, critical for testing and validating battery performance, are essential in ensuring the reliability, safety, and efficiency of batteries used in electric vehicles, consumer electronics, and energy storage systems

- The demand for battery cyclers is propelled by the global shift toward clean energy, growing adoption of electric vehicles, and increasing investments in research and development for next-generation battery technologies, such as solid-state batteries

- Asia-Pacific dominated the battery cyclers market with the largest revenue share of 42.5% in 2024, driven by the region’s robust manufacturing base for batteries, significant investments in EV production, and the presence of key industry players in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, fueled by increasing government support for renewable energy, advancements in battery technology, and rising demand for EVs in the U.S. and Canada

- The Lithium-ion segment dominated the largest market revenue share of 44.0% in 2024, driven by its widespread adoption in electric vehicles (EVs), consumer electronics, and energy storage systems due to high energy density, long lifespan, and efficiency

Report Scope and Battery Cyclers Market Segmentation

|

Attributes |

Battery Cyclers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Battery Cyclers Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global battery cyclers market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing, offering deeper insights into battery performance, degradation patterns, and predictive maintenance requirements

- AI-powered battery cyclers facilitate proactive issue detection, identifying potential battery failures or inefficiencies before they result in system downtime or safety concerns

- For Instances, companies are developing AI-driven platforms that analyze battery charge-discharge cycles to optimize energy storage systems or predict battery lifespan for electric vehicles (EVs) and renewable energy applications

- This trend enhances the value of battery cyclers, making them increasingly essential for manufacturers, researchers, and fleet operators in ensuring battery reliability and efficiency

- AI algorithms can evaluate a wide range of battery parameters, such as voltage fluctuations, temperature variations, and cycle life, to improve testing accuracy and efficiency

Battery Cyclers Market Dynamics

Driver

“Rising Demand for Electric Vehicles and Energy Storage Systems”

- The growing consumer and industrial demand for electric vehicles (EVs), hybrid electric vehicles (HEVs), and renewable energy storage solutions is a key driver for the global battery cyclers market

- Battery cyclers are critical for testing and validating battery performance, ensuring safety, durability, and reliability in applications such as EVs and grid-scale energy storage

- Government mandates, particularly in regions such as Asia-Pacific and Europe, promoting clean energy and zero-emission vehicles, are accelerating the adoption of battery cyclers

- The proliferation of IoT and advancements in 5G technology enable faster and more precise data collection during battery testing, supporting the development of sophisticated energy storage solutions

- Manufacturers are increasingly integrating advanced battery cyclers into gigafactories to meet the rising demand for high-performance lithium-ion and emerging solid-state batteries

Restraint/Challenge

“High Cost of Advanced Testing Equipment and Data Security Concerns”

- The significant initial investment required for advanced battery cyclers, including hardware, software, and integration, poses a barrier to adoption, particularly for small-scale manufacturers and in emerging markets

- Implementing high-precision, multi-channel battery cyclers for testing diverse battery chemistries, such as lithium-ion and solid-state, can be complex and costly

- Data security and privacy concerns are major challenges, as battery cyclers collect sensitive data on battery performance and usage, raising risks of breaches or misuse

- The lack of standardized global regulations for data handling in battery testing creates compliance challenges for manufacturers and service providers operating internationally

- These factors may hinder market growth in cost-sensitive regions or areas with heightened data privacy awareness

Battery Cyclers market Scope

The market is segmented on the basis of battery type, application, function, and industry.

- By Battery Type

On the basis of battery type, the Global Battery Cyclers Market is segmented into Lithium-ion, Lead-Acid, Nickel-based, and Solid-State. The Lithium-ion segment dominated the largest market revenue share of 44.0% in 2024, driven by its widespread adoption in electric vehicles (EVs), consumer electronics, and energy storage systems due to high energy density, long lifespan, and efficiency. The rising demand for EVs and renewable energy integration further fuels this segment's dominance.

The Solid-State segment is expected to witness the fastest growth rate of 18.5% from 2025 to 2032, propelled by advancements in battery technology promising higher energy density, improved safety, and faster charging capabilities. Increasing R&D investments in solid-state batteries for next-generation EVs and portable electronics are key growth drivers.

- By Application

On the basis of application, the Global Battery Cyclers Market is segmented into End-of-Line Testing, Research and Development, and Battery Testing. The End-of-Line Testing segment accounted for the largest market revenue share of 38.5% in 2024, driven by its critical role in ensuring battery quality, reliability, and safety during production, particularly in gigafactories for EVs and consumer electronics.

The Research and Development segment is anticipated to experience the fastest growth rate of 17.2% from 2025 to 2032, fueled by the need for rigorous testing of new battery chemistries, such as lithium-sulfur and solid-state batteries, to enhance performance, safety, and longevity. The integration of advanced technologies such as AI and Electrochemical Impedance Spectroscopy (EIS) further accelerates R&D adoption.

- By Function

On the basis of function, the Global Battery Cyclers Market is segmented into Cell Testing, Module Testing, and Pack Testing. The Pack Testing segment held the largest market revenue share of 40.0% in 2024, attributed to its essential role in validating battery packs for EVs and energy storage systems during end-of-line production, ensuring compliance with safety and performance standards.

The Module Testing segment is expected to register the fastest growth rate of 16.8% from 2025 to 2032, driven by the need to identify and resolve issues at the module level before assembling larger battery packs. This reduces production costs and enhances efficiency, particularly in high-volume EV manufacturing.

- By Industry

On the basis of industry, the Global Battery Cyclers Market is segmented into Automotive, Consumer Electronics, and Energy. The Automotive segment dominated with a market revenue share of 45.5% in 2024, propelled by the rapid rise in EV adoption and the need for precise battery testing to ensure performance, safety, and reliability in automotive applications. The expansion of battery gigafactories further supports this segment's growth.

The Energy segment is anticipated to witness the fastest growth rate of 18.0% from 2025 to 2032, driven by increasing demand for renewable energy storage solutions. Battery cyclers are critical for testing batteries used in grid-scale energy storage, stabilizing power grids, and managing peak loads, particularly for lithium-ion and flow batteries.

Battery Cyclers Market Regional Analysis

- Asia-Pacific dominated the battery cyclers market with the largest revenue share of 42.5% in 2024, driven by the region’s robust manufacturing base for batteries, significant investments in EV production, and the presence of key industry players in countries such as China, Japan, and South Korea

- Consumers and industries prioritize battery cyclers for ensuring battery performance, safety, and longevity, especially for lithium-ion and solid-state batteries used in electric vehicles (EVs) and energy storage systems

- Growth is supported by technological advancements in battery cyclers, including high-precision testing for cell, module, and pack levels, and rising adoption in both research and development (R&D) and end-of-line testing applications

Japan Battery Cyclers Market Insight

Japan’s battery cyclers market is expected to witness rapid growth due to strong consumer and industry preference for high-precision testing equipment that ensures battery safety and performance. The presence of major automotive and electronics manufacturers accelerates market penetration, with cyclers integrated into OEM and R&D processes. Rising interest in solid-state battery development also contributes to growth.

China Battery Cyclers Market Insight

China dominates the Asia-Pacific battery cyclers market, propelled by rapid urbanization, increasing EV ownership, and growing demand for energy storage solutions. The country’s expanding middle class and focus on sustainable mobility support the adoption of advanced battery cyclers for lithium-ion and solid-state batteries. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

North America Battery Cyclers Market Insight

North America is expected to witness the fastest growth rate in the global battery cyclers market, driven by increasing investments in EV production and renewable energy storage. The region’s focus on technological innovation, particularly in the U.S. and Canada, supports the adoption of advanced cyclers for battery testing in automotive, consumer electronics, and energy industries. Stringent safety and performance standards further boost market expansion.

U.S. Battery Cyclers Market Insight

The U.S. battery cyclers market is expected to witness significant growth, fueled by strong demand in the automotive sector, particularly for EV battery testing, and growing investments in renewable energy storage solutions. The trend towards sustainable energy and stringent safety regulations drives the adoption of advanced battery cyclers. Integration of cyclers in R&D for next-generation batteries, such as solid-state, complements the growing aftermarket for testing equipment.

Europe Battery Cyclers Market Insight

The Europe battery cyclers market is expected to witness significant growth, supported by regulatory emphasis on sustainable energy and EV adoption. Industries seek cyclers that ensure high performance and safety for lithium-ion and nickel-based batteries. Growth is prominent in both R&D and end-of-line testing, with countries such as Germany and France showing substantial uptake due to expanding EV manufacturing and energy storage initiatives.

U.K. Battery Cyclers Market Insight

The U.K. market for battery cyclers is expected to witness rapid growth, driven by demand for reliable battery testing in EVs and consumer electronics. Increased focus on energy efficiency and safety standards encourages adoption. In addition, government initiatives promoting clean energy and advancements in battery technology influence the market, balancing performance testing with regulatory compliance.

Germany Battery Cyclers Market Insight

Germany is expected to witness rapid growth in the battery cyclers market, attributed to its advanced automotive and energy sectors and high focus on battery efficiency and safety. German industries prefer cutting-edge cyclers for testing lithium-ion and solid-state batteries to support EV production and energy storage systems. The integration of cyclers in both OEM and R&D applications drives sustained market growth.

Battery Cyclers Market Share

The battery cyclers industry is primarily led by well-established companies, including:

- Arbin Instruments (U.S.)

- Chroma ATE Inc. (Taiwan)

- Maccor Inc. (U.S.)

- Bio-Logic Science Instruments (France)

- Keysight Technologies (U.S.)

- AMETEK Scientific Instruments (U.S.)

- Neware Technology Limited (China)

- Digatron Power Electronics (Germany)

- Hioki E.E. Corporation (Japan)

- Cadex Electronics Inc. (Canada)

- Bitrode Corporation (U.S.)

- Nebula Electronics (China)

- AVL List GmbH (Austria)

- HIOKI E.E. Corporation (Japan)

- PEC (Belgium)

What are the Recent Developments in Global Battery Cyclers Market?

- In December 2024, Ace Green Recycling announced a strategic merger with Athena Technology Acquisition Corp. II, positioning the company to go public and accelerate its global expansion. The deal supports Ace’s plan to develop a flagship battery recycling facility in Texas, focused on recovering critical materials from lead and lithium-ion batteries using fully electrified, zero-emission processes. This advancement in sustainable recycling infrastructure is expected to boost demand for battery cyclers and emulators—essential tools for evaluating the health and performance of recycled battery cells in second-life applications

- In February 2024, Volkswagen Group UK deepened its long-standing partnership with Ecobat to enhance electric vehicle (EV) battery recycling efforts. Building on a decade of collaboration, Ecobat will now collect and process high-voltage lithium-ion batteries from dealers and recycling centers using ADR-compliant vehicles. These batteries will be treated at Ecobat’s newly opened UK lithium-ion recycling facility—its third globally, alongside centers in Germany and Arizona. While the initiative centers on recycling, it underscores the importance of battery cyclers and emulators in assessing battery health and suitability for reuse, supporting a circular energy economy

- In September 2023, National Instruments (now NI) introduced the NHR 4800, a compact and high-density battery cycler and emulator designed for advanced battery testing and simulation. This versatile system supports multiple functions—including battery cycling, DC sourcing and loading, emulation, and power-level hardware-in-the-loop (PHIL) testing. With scalable power from 16.5 kW to 165 kW and output capabilities of up to 80 V and 400 A, the NHR 4800 is optimized for testing battery modules, fuel cells, and energy storage systems. Its modular design and integrated safety features make it ideal for automotive, aerospace, and renewable energy applications

- In September 2023, AMETEK Scientific Instruments expanded its battery testing portfolio with the launch of the SI-6200 Battery Analyzer, developed under its Solartron Analytical brand. Designed for early-stage testing of battery materials, coin cells, supercapacitors, and micro fuel cells, the SI-6200 offers advanced features typically found in high-end research-grade equipment. These include built-in electrochemical impedance spectroscopy (EIS) on every channel, high-resolution 24-bit ADCs, and fast data acquisition via Direct-to-Disk technology. Its modular design supports up to 120 channels per cabinet, making it ideal for scalable, multi-user environments in battery R&D

- In March 2022, Retriev Technologies, a leader in lithium-ion battery recycling, acquired Battery Solutions to form North America’s first fully integrated battery management solution. The merger combined Retriev’s expertise in processing and recycling with Battery Solutions’ logistics, sorting, and fulfillment capabilities—creating a circular supply chain for end-of-life batteries across sectors such as EVs, telecommunications, and consumer electronics. This comprehensive approach enhances traceability and efficiency in battery reuse and recycling, indirectly driving demand for battery cyclers and emulators to assess the viability of recovered cells for second-life applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Battery Cyclers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Battery Cyclers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Battery Cyclers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.