Global Battery Manufacturing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

14.07 Billion

USD

51.14 Billion

2025

2033

USD

14.07 Billion

USD

51.14 Billion

2025

2033

| 2026 –2033 | |

| USD 14.07 Billion | |

| USD 51.14 Billion | |

|

|

|

|

Battery Manufacturing Equipment Market Size

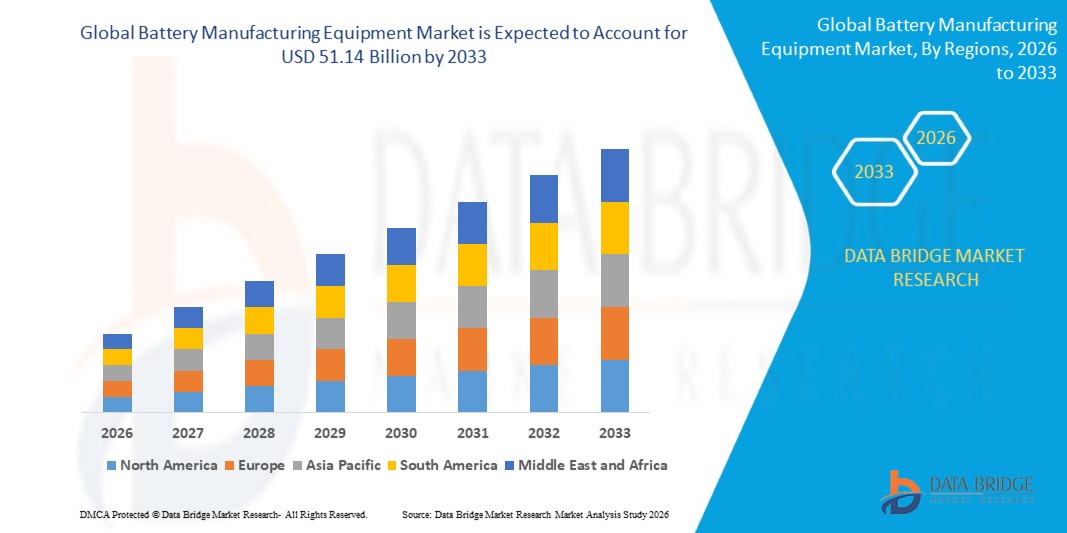

- The global battery manufacturing equipment market size was valued at USD 14.07 billion in 2025 and is expected to reach USD 51.14 billion by 2033, at a CAGR of 17.50% during the forecast period

- The battery manufacturing equipment market is primarily driven by the rapid expansion of electric mobility and the rising deployment of renewable energy storage systems, which are creating strong demand for large-scale, high-precision battery production lines

- Increasing investments in gigafactories and the global shift toward electrification across automotive, industrial, and energy sectors are further accelerating equipment adoption. Growing emphasis on automation, efficiency enhancement, and cost reduction in cell manufacturing is reinforcing the need for advanced production machinery across major battery-producing regions

Battery Manufacturing Equipment Market Analysis

- Battery manufacturing equipment, covering processes from electrode preparation to cell assembly and formation, is becoming central to the global transition toward electric vehicles and advanced energy storage due to its critical role in enabling high-performance, scalable, and cost-efficient battery production. Demand continues to rise as manufacturers prioritize improved energy density, longer lifecycle performance, and enhanced safety in lithium-ion and next-generation batteries

- The market’s growth trajectory is shaped by increasing investments in gigafactories, supply-chain localization initiatives, and the adoption of automation and solvent-free production technologies, all of which enable higher throughput and reduced operational costs. Rising governmental support for clean energy and EV adoption is further strengthening the equipment demand outlook, positioning battery manufacturing machinery as a fundamental enabler of the global electrification ecosystem

- Asia-Pacific dominated the battery manufacturing equipment market with a share of 55% in 2025, due to large-scale lithium-ion battery production, expanding EV manufacturing capacity, and a strong presence of cell and component suppliers

- North America is expected to be the fastest growing region in the battery manufacturing equipment market during the forecast period due to major investments in EV battery production, grid-scale energy storage, and domestic supply chain strengthening

- Lithium-ion batteries segment dominated the market with a market share of 46.3% in 2025, due to high adoption in electric vehicles, portable electronics, and energy storage systems. For instance, companies such as Tesla and Panasonic are investing in automated lithium-ion production lines to meet rising demand. The segment benefits from high energy density, longer lifespan, and government incentives promoting EVs and renewable storage

Report Scope and Battery Manufacturing Equipment Market Segmentation

|

Attributes |

Battery Manufacturing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Battery Manufacturing Equipment Market Trends

“Rising Adoption of Dry-Coating and Solvent-Free Electrode Manufacturing”

- A major trend shaping the battery manufacturing equipment market is the increasing transition toward dry-coating and solvent-free electrode production, driven by the need to reduce energy consumption, manufacturing time, and environmental impact. This shift is transforming electrode fabrication into a more cost-efficient and sustainable process that eliminates the need for drying ovens and large-scale solvent recovery systems

- For instance, Dürr AG and Lead Intelligent Equipment Co., Ltd. have introduced advanced dry-coating systems that enable high-throughput, solvent-free electrode production optimized for gigafactory-scale requirements. These systems support cleaner manufacturing while improving operational efficiency and reducing total production costs

- The rising adoption of dry-coating technologies is also accelerating innovation across machine design, as equipment manufacturers aim to offer precision, uniformity, and scalability for large-format electrodes. This positions dry-coating as a key enabler of next-generation battery production where manufacturers seek higher energy density and faster throughput

- Industries transitioning to sustainable manufacturing practices are increasingly prioritizing equipment that lowers carbon emissions and minimizes waste generation across electrode lines. This trend strengthens the role of eco-efficient production technologies in shaping the future landscape of battery factories

- The growing demand for electric vehicles and energy storage systems is amplifying the need for faster, cleaner, and more automated electrode production processes. As dry-coating adoption accelerates, battery manufacturers are shifting toward equipment platforms capable of supporting large-scale, high-quality output

- This widespread shift toward solvent-free production is reinforcing global competitiveness among equipment suppliers and positioning dry-coating as a defining technological upgrade in advanced lithium-ion and next-generation battery manufacturing

Battery Manufacturing Equipment Market Dynamics

Driver

“Growing Global Investments in Gigafactories and EV Battery Production”

- The rapid global expansion of gigafactories dedicated to electric vehicle and energy storage battery production is a primary driver of demand for advanced battery manufacturing equipment. These large-scale facilities require high-speed, fully automated machinery for processes such as mixing, coating, calendaring, cell assembly, and formation

- For instance, companies such as CATL, Panasonic, and Tesla continue to expand capacity across Asia, Europe, and North America, increasing orders for precision manufacturing lines that support higher output and improved battery performance. This creates strong and sustained demand for equipment suppliers offering scalable and efficient production technologies

- Governments worldwide are supporting electrification initiatives, leading to strategic investments in localized battery manufacturing to reduce import dependency. This is accelerating the adoption of advanced equipment for both lithium-ion and emerging battery chemistries

- As EV penetration grows, manufacturers focus on optimizing line efficiency, reducing operational downtime, and enhancing cell quality—driving strong adoption of automation-focused machinery

- The rising need for diversified chemistries such as LFP, NCM, and solid-state batteries is prompting manufacturers to upgrade equipment infrastructures to support flexible production lines. This driver continues to strengthen as global battery demand surges, reinforcing equipment manufacturing as a foundational pillar of the energy transition and electrification ecosystem

Restraint/Challenge

“Complex Integration of Advanced Production Lines”

- The battery manufacturing equipment market faces challenges associated with integrating sophisticated, multi-step production lines that require precise synchronization across coating, calendaring, stacking, assembly, and formation processes. These systems involve extensive automation and must maintain extremely tight tolerances to ensure cell uniformity and safety.

- For instance, companies integrating high-speed stacking or formation equipment must align multiple manufacturing stages while maintaining consistent quality and output, often requiring advanced control systems and specialized engineering expertise. This complexity increases implementation timelines and creates coordination challenges

- Manufacturers struggle with logistical and technical hurdles when scaling production lines, particularly for gigafactory-level operations where even minor errors can impact thousands of cells. This increases the need for high-precision installation, testing, and commissioning

- The challenge is amplified by the introduction of emerging technologies such as dry-coating, advanced electrode designs, and solid-state battery production, all of which require equipment upgrades and new process calibration

- These complexities collectively raise operational risk and implementation cost for manufacturers, making the integration of advanced production lines one of the most significant constraints in scaling global battery manufacturing capacity

Battery Manufacturing Equipment Market Scope

The market is segmented on the basis of battery type, machine type, and end use.

• By Battery Type

On the basis of battery type, the battery manufacturing equipment market is segmented into lead-acid batteries, lithium-ion batteries, nickel-metal hydride, nickel-cadmium, and others. The lithium-ion batteries segment dominated the market with the largest share of 46.3% in 2025, driven by high adoption in electric vehicles, portable electronics, and energy storage systems. For instance, companies such as Tesla and Panasonic are investing in automated lithium-ion production lines to meet rising demand. The segment benefits from high energy density, longer lifespan, and government incentives promoting EVs and renewable storage.

The lead-acid batteries segment is expected to witness the fastest growth from 2026 to 2033 due to demand in automotive starter batteries, backup power, and industrial applications. Advanced formation and assembly equipment, lower raw material costs, and established recycling infrastructure support this growth.

• By Machine Type

On the basis of machine type, the market is segmented into mixing machines, coating & drying machines, calendaring machines, slitting machines, electrode stacking machines, assembly & handling equipment, and formation & testing machines. The coating & drying machines segment dominated in 2025, as it ensures uniform electrode quality essential for high-capacity battery production. For instance, companies such as Manz AG and Bühler focus on advanced coating technologies for EV and renewable energy batteries.

The assembly & handling equipment segment is expected to witness the fastest growth from 2026 to 2033, driven by automation and high-throughput assembly requirements. Robotic handling systems improve production speed, quality, and reduce labor dependency.

• By End Use

On the basis of end use, the market is segmented into automotive, renewable energy, industrial, consumer electronics, and others. The automotive segment dominated in 2025, fueled by EV adoption and hybrid vehicles. For instance, LG Energy Solution and CATL are expanding production lines to meet OEM demand. Strong government policies supporting green mobility further reinforce this dominance.

The renewable energy segment is expected to witness the fastest growth from 2026 to 2033, driven by solar and wind storage systems. Falling battery costs, efficient production equipment, and government incentives accelerate adoption in grid-scale energy storage.

Battery Manufacturing Equipment Market Regional Analysis

- Asia-Pacific dominated the battery manufacturing equipment market with the largest revenue share of 55% in 2025, driven by large-scale lithium-ion battery production, expanding EV manufacturing capacity, and a strong presence of cell and component suppliers

- The region’s cost-efficient manufacturing ecosystem, rising investments in gigafactory development, and growing exports of battery components are accelerating market expansion

- The availability of skilled labor, supportive government policies, and rapid industrialization across developing economies are contributing to increased adoption of battery production machinery across automotive and energy storage sectors

China Battery Manufacturing Equipment Market Insight

China held the largest share in the Asia-Pacific battery manufacturing equipment market in 2025, supported by its leadership in lithium-ion cell production, well-established supply chains, and extensive industrial infrastructure. Strong government incentives promoting EV deployment and advanced energy storage further enhance demand. Continuous investments in high-capacity gigafactories and advanced automation technologies are reinforcing China’s position as a global center for battery manufacturing.

India Battery Manufacturing Equipment Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by increasing EV adoption, expanding domestic battery production initiatives, and rising investments in advanced manufacturing infrastructure. The “Make in India” program and growing emphasis on self-reliance in energy storage technologies are strengthening demand for battery manufacturing equipment. Growing renewable energy deployment and industrial modernization are further accelerating market expansion.

Europe Battery Manufacturing Equipment Market Insight

The Europe battery manufacturing equipment market is expanding steadily due to strong regulatory support for clean mobility, rising investment in local gigafactories, and high demand for advanced energy storage solutions. The region emphasizes quality, sustainability, and next-generation cell chemistries, particularly for EVs and grid-scale storage. Increasing adoption of automation and precision manufacturing technologies is further supporting industry growth.

Germany Battery Manufacturing Equipment Market Insight

Germany’s market is driven by its leadership in automotive engineering, strong industrial base, and advanced battery R&D networks. The country’s focus on electric mobility, high standards for manufacturing quality, and strong collaboration between OEMs and technology providers support demand for cutting-edge battery production equipment. Growth is reinforced by ongoing investments in local gigafactory development and precision machinery.

U.K. Battery Manufacturing Equipment Market Insight

The U.K. market is supported by a growing emphasis on EV production, increasing investment in battery research clusters, and an expanding ecosystem for cell development and pilot-scale manufacturing. Efforts to localize supply chains and strengthen domestic energy storage capabilities post-Brexit further contribute to demand. Rising collaboration between universities, research labs, and equipment manufacturers is enhancing technological advancement.

North America Battery Manufacturing Equipment Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by major investments in EV battery production, grid-scale energy storage, and domestic supply chain strengthening. Growing emphasis on reshoring manufacturing, increasing federal incentives, and rising demand for high-performance cells are boosting adoption of advanced equipment. Strong innovation in materials and production technologies is further accelerating market expansion.

U.S. Battery Manufacturing Equipment Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by a rapidly expanding EV ecosystem, strong technological capabilities, and significant investment in gigafactory projects. The country’s focus on high-efficiency production lines, energy security, and sustainable manufacturing is encouraging adoption of advanced battery equipment. Presence of key technology providers and a robust innovation environment further strengthens the U.S. position in the regional market.

Battery Manufacturing Equipment Market Share

The battery manufacturing equipment industry is primarily led by well-established companies, including:

- Bühler Group (Switzerland)

- Semco Infratech (India)

- Nordson Corporation (U.S.)

- Nagano Automation (China)

- Dürr Aktiengesellschaft (Germany)

- Targray (Canada)

- CKD Corporation (Japan)

- Lead Intelligent Equipment Co., Ltd. (China)

- Delta ModTech (U.S.)

- HIRANO TECSEED Co., Ltd. (Japan)

- ROSENDAHL NEXTROM (Austria)

- Hitachi, Ltd. (Japan)

- ANDRITZ (Austria)

- Lyric (China)

- DAIICHI JITSUGYO CO., LTD. (Japan)

Latest Developments in Global Battery Manufacturing Equipment Market

- In October 2025, Dürr AG introduced its X.Cellify DC dry-coating system, a breakthrough that significantly impacts the battery manufacturing equipment market by transforming electrode production efficiency. The technology eliminates solvents and drying ovens by creating a free-standing active material film, enabling lamination directly onto collector foils. This innovation reduces energy consumption by up to 70% and lowers space requirements by nearly 65%, positioning Dürr AG as a key driver of next-generation, eco-efficient manufacturing lines. Its waste-free process also strengthens industry movement toward sustainable and cost-optimized gigafactory operations

- In May 2025, Lead Intelligent Equipment Co., Ltd. launched a mass-production dry-coating system designed for industrial-scale lithium-ion battery manufacturing, reinforcing its leadership in advanced equipment solutions. The system enables solvent-free electrode production and supports wide electrode formats up to 1,000 mm, delivering throughputs of 80 m/min for anodes and 60 m/min for cathodes. This development directly accelerates gigafactory adoption of high-speed, environmentally friendly production lines, strengthening Lead’s competitive position in next-generation electrode equipment

- In January 2023, Recharge Industries Pty announced plans to construct a USD 210 million lithium-ion battery factory in Geelong, marking a substantial contribution to the market’s expansion in the Oceania region. The facility targets an initial annual capacity of 2 GWh with the potential to scale to 30 GWh, signaling long-term growth in regional equipment demand. The project enhances local battery manufacturing resilience and supports rising investments in domestic EV and energy storage supply chains

- In December 2022, Amara Raja Batteries Limited revealed plans for an advanced R&D hub and a greenfield lithium-ion manufacturing facility in Telangana, significantly boosting India’s role in the global battery manufacturing equipment market. The site includes a gigafactory with up to 16 GWh cell capacity and a 5 GWh pack assembly unit, creating strong demand for high-precision equipment across the value chain. The investment also stimulates regional technological development and employment, positioning India as a growing hub for lithium-ion production

- In December 2022, Hyundai Motor Group and SK On signed an MOU to establish a large-scale EV battery manufacturing facility in Georgia, enhancing North America’s manufacturing ecosystem. The USD 4–5 billion investment supports domestic supply chain localization and is expected to create over 3,500 jobs. The facility, targeted to begin operations in 2025, drives significant demand for advanced manufacturing equipment and reinforces North America’s rising prominence in EV battery production capacity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Battery Manufacturing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Battery Manufacturing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Battery Manufacturing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.