Global Battery Materials Market

Market Size in USD Billion

CAGR :

%

USD

61.86 Billion

USD

141.22 Billion

2025

2033

USD

61.86 Billion

USD

141.22 Billion

2025

2033

| 2026 –2033 | |

| USD 61.86 Billion | |

| USD 141.22 Billion | |

|

|

|

|

Battery Materials Market Size

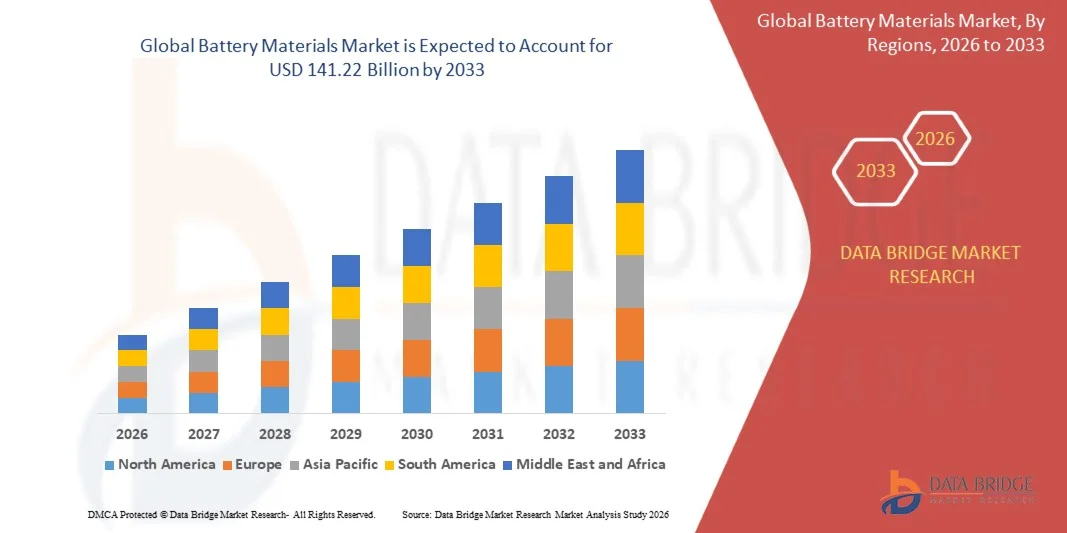

- The global battery materials market size was valued at USD 61.86 billion in 2025 and is expected to reach USD 141.22 billion by 2033, at a CAGR of 10.87% during the forecast period

- The market growth is largely fueled by the rapid adoption of electric vehicles, renewable energy storage systems, and portable electronic devices, which are driving strong demand for high-performance battery materials such as cathodes, anodes, and electrolytes

- Furthermore, increasing investments in next-generation battery technologies, including high-nickel cathodes, silicon-based anodes, and solid-state electrolytes, are enhancing energy density, durability, and safety, accelerating adoption and production of advanced battery materials, thereby significantly boosting the industry's growth

Battery Materials Market Analysis

- Battery materials, including cathode, anode, electrolyte, and separator components, are critical for the performance, efficiency, and longevity of lithium-ion, nickel-based, and other battery chemistries used in automotive, electronics, and energy storage applications

- The escalating demand for battery materials is primarily fueled by the global shift toward electric mobility, increasing consumer electronics penetration, and growing focus on renewable energy integration, coupled with rising investments in research and development to improve material performance and sustainability

- Asia-Pacific dominated the battery materials market in 2025, due to rapid adoption of electric vehicles, expanding consumer electronics production, and a strong presence of battery material manufacturing hubs

- North America is expected to be the fastest growing region in the battery materials market during the forecast period due to increasing EV adoption, expansion of renewable energy storage systems, and robust demand for lithium-ion and advanced battery chemistries

- Lithium-Ion segment dominated the market with a market share of 55.5% in 2025, due to its high energy density, long cycle life, and versatility across consumer electronics, electric vehicles, and energy storage applications. The segment benefits from strong investment in research and production by key battery manufacturers, enabling continuous performance improvements and cost reductions. Lithium-ion batteries are favored in portable devices and automotive sectors due to their lightweight design and rapid charging capabilities

Report Scope and Battery Materials Market Segmentation

|

Attributes |

Battery Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Battery Materials Market Trends

“Rising Demand for High-Energy Density Battery Materials”

- A significant trend in the battery materials market is the increasing demand for high-energy density materials that can improve the performance, longevity, and safety of batteries used in electric vehicles, consumer electronics, and energy storage systems. Manufacturers and end-users are prioritizing materials that enable longer driving ranges, faster charging, and higher power outputs, driving innovation in cathode, anode, and electrolyte technologies

- For instance, CATL is investing in nickel-rich NMC cathode materials to enhance energy density in electric vehicle batteries, strengthening the performance and competitiveness of its EV battery portfolio. Such materials are essential for meeting rising consumer expectations for longer-lasting, high-capacity batteries

- The adoption of advanced silicon-based anodes is increasing rapidly as they allow higher capacity and faster charge cycles, positioning these materials as critical enablers of next-generation lithium-ion batteries

- Battery manufacturers are focusing on high-voltage and high-stability electrolytes that improve battery efficiency and thermal management, particularly under extreme operating conditions

- The renewable energy sector is driving demand for energy storage solutions that require batteries with higher energy density to store electricity from solar and wind generation. This is encouraging large-scale adoption of advanced battery materials for grid-scale storage applications

- Research and development in solid-state and hybrid battery chemistries are rising, supported by investments from global leaders such as BASF and Umicore, aiming to produce safer, more energy-dense, and longer-lasting materials for electric vehicles and industrial storage applications

Battery Materials Market Dynamics

Driver

“Growing Adoption of Electric Vehicles and Energy Storage Systems”

- The growing global shift toward electric mobility and renewable energy storage is driving unprecedented demand for high-performance battery materials. This trend is supported by stricter emission regulations, government incentives, and increasing consumer preference for sustainable transportation and energy solutions

- For instance, Tesla’s Gigafactories rely heavily on advanced cathode and anode materials supplied by companies such as Panasonic and CATL to scale EV battery production, enabling longer driving ranges and faster charging capabilities. The strategic collaboration between automakers and battery material suppliers is accelerating innovation and adoption across the industry

- Rising electrification in public transport and commercial fleets is boosting demand for large-format battery packs that require optimized material compositions. Battery materials that provide high energy density and thermal stability are crucial to meeting these operational requirements

- Increasing deployment of stationary energy storage systems for residential, commercial, and utility applications is further stimulating demand for advanced battery materials. Materials that enable long cycle life and reliability under continuous charge-discharge cycles are particularly valued in this segment

- The integration of battery materials into emerging technologies such as solid-state batteries, hybrid EVs, and portable electronics reinforces the market driver, as manufacturers seek solutions that improve efficiency, reduce cost, and increase adoption rates

Restraint/Challenge

“Supply Chain Dependence on Critical Raw Materials”

- The battery materials market faces significant challenges due to dependence on critical raw materials such as lithium, cobalt, nickel, and graphite, which are geographically concentrated and subject to price volatility. This dependence creates supply risks and potential bottlenecks in large-scale battery production

- For instance, Umicore and Zhejiang Huayou Cobalt have experienced supply chain constraints impacting cobalt availability for cathode materials. Such disruptions can increase costs and delay production timelines for battery manufacturers

- Extraction and processing of these raw materials require substantial capital investment, regulatory compliance, and environmental management, which increase operational complexity. Manufacturers must navigate geopolitical, trade, and environmental challenges while securing a stable supply of high-quality materials

- High competition for raw materials among battery manufacturers, EV makers, and electronics companies can drive up prices and create market uncertainty, impacting profit margins and scalability of battery production

- The market continues to encounter constraints related to recycling and reuse of critical materials. While companies such as BASF are advancing battery recycling technologies, scaling these solutions to meet global demand remains a challenge, adding pressure on the supply chain and material availability

Battery Materials Market Scope

The market is segmented on the basis of material type, battery type, and application.

- By Material Type

On the basis of material type, the battery materials market is segmented into cathode, anode, electrolyte, separator, and others. The cathode segment dominated the market with the largest revenue share in 2025, driven by its critical role in determining battery energy density, lifespan, and overall performance. Manufacturers often prioritize high-quality cathode materials for lithium-ion batteries due to their direct impact on battery efficiency and safety. The market sees strong demand for advanced cathodes as automakers and electronics producers seek longer-lasting and higher-capacity energy storage solutions. Cathode materials such as lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP) are widely adopted across electric vehicles and consumer electronics, further cementing their market dominance. Cost optimization and improved production methods have also accelerated adoption in large-scale battery manufacturing.

The anode segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing research into silicon-based and graphite-silicon hybrid anodes that enhance battery capacity and charge cycles. For instance, companies such as BTR New Energy Materials are investing in next-generation anode technologies to support the rising demand for high-performance lithium-ion batteries. Growing electrification of transportation and expansion of portable electronics drive the need for advanced anode solutions, positioning this segment for robust growth in the forecast period.

- By Battery Type

On the basis of battery type, the market is segmented into lithium-ion, lead-acid, nickel metal hydride (NiMH), nickel-cadmium (Ni-Cd), and others. The lithium-ion segment dominated the market with the largest revenue share of 55.5% in 2025, driven by its high energy density, long cycle life, and versatility across consumer electronics, electric vehicles, and energy storage applications. The segment benefits from strong investment in research and production by key battery manufacturers, enabling continuous performance improvements and cost reductions. Lithium-ion batteries are favored in portable devices and automotive sectors due to their lightweight design and rapid charging capabilities. Enhanced safety features and evolving battery management systems have further reinforced market dominance. Growing adoption of renewable energy storage systems also supports the widespread deployment of lithium-ion technology.

The lead-acid segment is expected to witness the fastest growth from 2026 to 2033, driven by continued demand in automotive starter batteries and stationary energy storage. For instance, Exide Technologies continues to innovate in lead-acid solutions for industrial and backup power applications. The segment’s low production costs, recyclability, and established supply chain contribute to its growth potential, particularly in emerging economies where cost-efficiency is critical.

- By Application

On the basis of application, the battery materials market is segmented into portable devices, automotive, electronics items, power storages, and others. The automotive segment dominated the market with the largest revenue share in 2025, driven by the rapid expansion of electric vehicle production and government incentives supporting EV adoption. Automotive batteries demand high-performance materials to achieve longer driving ranges, faster charging, and enhanced safety, driving substantial investments in cathode, anode, and electrolyte technologies. Leading EV manufacturers such as Tesla and BYD are heavily investing in advanced battery chemistries and supply chains to secure high-quality materials, strengthening the automotive segment’s dominance. The increasing focus on vehicle electrification across Europe, North America, and Asia-Pacific further accelerates market growth.

The portable devices segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for smartphones, tablets, laptops, and wearable electronics. For instance, Samsung SDI continues to expand its battery material solutions for compact, high-capacity lithium-ion batteries in consumer electronics. The need for lightweight, efficient, and long-lasting batteries in portable applications drives rapid adoption of advanced cathode and anode materials, supporting strong growth in this segment.

Battery Materials Market Regional Analysis

- Asia-Pacific dominated the battery materials market with the largest revenue share in 2025, driven by rapid adoption of electric vehicles, expanding consumer electronics production, and a strong presence of battery material manufacturing hubs

- The region’s cost-effective manufacturing landscape, rising investments in lithium-ion and advanced battery material production, and growing exports of high-quality battery components are accelerating market expansion

- The availability of skilled labor, favorable government incentives for EV and energy storage projects, and rapid industrialization across developing economies are contributing to increased consumption of battery materials across automotive, electronics, and energy storage sectors

China Battery Materials Market Insight

China held the largest share in the Asia-Pacific battery materials market in 2025, owing to its position as a global leader in lithium-ion battery production and EV adoption. The country's strong industrial base, extensive supply chain for battery raw materials, and government policies supporting clean energy and EV manufacturing are major growth drivers. Demand is also bolstered by continuous investments in cathode, anode, and electrolyte production facilities for both domestic and international markets.

India Battery Materials Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapidly expanding EV adoption, increasing electronics manufacturing, and rising investments in battery material infrastructure. Government initiatives such as the National Electric Mobility Mission and incentives for domestic battery production are strengthening the demand for high-quality battery materials. In addition, growing R&D in advanced battery chemistries and increasing export potential of lithium-ion components are contributing to robust market expansion.

Europe Battery Materials Market Insight

The Europe battery materials market is expanding steadily, supported by strict regulatory frameworks, rising demand for high-performance EV batteries, and growing investments in sustainable energy storage solutions. The region emphasizes environmental compliance, advanced battery design, and high-quality material sourcing, particularly for automotive and industrial energy storage applications. Increasing focus on circular economy practices, including battery recycling, is further enhancing market growth.

Germany Battery Materials Market Insight

Germany’s battery materials market is driven by its leadership in EV manufacturing, strong chemical and materials industry heritage, and export-oriented production model. The country has well-established R&D networks and collaboration between academic institutions and battery material manufacturers, fostering continuous innovation in cathode, anode, and electrolyte technologies. Demand is particularly strong for use in high-capacity lithium-ion batteries and emerging solid-state battery applications.

U.K. Battery Materials Market Insight

The U.K. market is supported by a mature automotive and clean energy sector, growing efforts to localize EV battery supply chains post-Brexit, and increasing demand for high-performance battery materials. With rising focus on R&D, industrial-academic collaboration, and investments in next-generation battery materials, the U.K. continues to play a significant role in the European battery materials landscape.

North America Battery Materials Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing EV adoption, expansion of renewable energy storage systems, and robust demand for lithium-ion and advanced battery chemistries. Strong focus on technology innovation, government incentives for clean energy, and partnerships between automotive OEMs and battery material manufacturers are boosting demand. In addition, reshoring of battery production and strategic investments in material sourcing are supporting market expansion.

U.S. Battery Materials Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its extensive EV market, strong R&D infrastructure, and significant investment in battery material production. The country’s emphasis on sustainability, regulatory compliance, and innovation is encouraging the adoption of high-quality cathode, anode, and electrolyte materials for automotive and energy storage applications. Presence of leading battery manufacturers and a mature distribution network further solidify the U.S.'s leading position in the region.

Battery Materials Market Share

The battery materials industry is primarily led by well-established companies, including:

- Umicore Cobalt & Specialty Materials (CSM) (Belgium)

- NEI Corporation (U.K.)

- Shanghai Shanshan Technology Co., Ltd. (China)

- Ningbo Ronbay New Energy Technology Co., Ltd. (China)

- Asahi Kasei Corporation (Japan)

- Hitachi Energy Ltd. (Switzerland)

- CNGR Advanced Material Co., Ltd. (China)

- Zhejiang Huayou Cobalt Co., Ltd. (China)

- NICHIA CORPORATION (Japan)

- Gotion High-Tech Co., Ltd. (China)

- Mitsubishi Chemical Corporation (Japan)

- Kureha Corporation (Japan)

- BASF SE (Germany)

- Tokyo Chemical Industry Co Ltd (Japan)

- POSCO Future M Co., Ltd. (South Korea)

- TORAY INDUSTRIES, INC. (Japan)

Latest Developments in Global Battery Materials Market

- In November 2025, LG Chem and Sinopec entered into a strategic joint development agreement to advance key cathode and anode materials for sodium‑ion batteries. This collaboration aims to accelerate commercialization of sodium‑ion technology as an alternative to lithium‑ion, which can diversify the battery materials landscape. By developing efficient and high-performance sodium‑ion materials, the partnership is expected to expand production capabilities, reduce reliance on lithium, and create new opportunities in energy storage and electric vehicle applications, potentially reshaping material demand dynamics in the industry

- In November 2025, Nouveau Monde Graphite Inc. (NMG) updated its multiyear commercial agreement with Panasonic Energy to advance active anode material production. The company plans dedicated initial production capacity under Phase‑2 operations and secured binding offtake agreements for future volumes. This development strengthens supply chain certainty for critical anode materials, supports scaling of production to meet growing EV and energy storage demand, and enables higher-quality and more consistent materials, ultimately reinforcing the competitiveness of battery manufacturers globally

- In December 2024, China’s Contemporary Amperex Technology Co. Limited (CATL) began providing financial support to its battery materials and equipment suppliers to drive technology innovation and strengthen its supply chain. This initiative was designed to alleviate pressure amid intense EV price competition and ensure uninterrupted material supply. By supporting upstream suppliers, CATL is encouraging faster development of advanced cathode, anode, and electrolyte materials, improving production efficiency and lowering costs, which enhances its market leadership in global battery materials

- In June 2024, Asahi Kasei achieved proof of concept for lithium‑ion batteries using its proprietary high-ionic conductive electrolyte. The new technology improves battery durability at high temperatures and power output at low temperatures while enabling smaller and lower-cost battery packs. This advancement directly addresses key performance and energy density challenges of current LIBs, supporting wider adoption in automotive, portable devices, and energy storage applications, and positioning the company to provide more efficient and competitive battery materials in the market

- In April 2024, BASF commenced operations of its prototype metal refinery for battery recycling in Schwarzheide, Germany. This facility focuses on optimizing innovative recycling technologies for end-of-life lithium-ion batteries and production scrap. By recovering and reprocessing valuable metals such as lithium, nickel, and cobalt, BASF’s initiative contributes to material circularity, reduces dependency on virgin raw materials, and supports sustainable battery production, which is critical for meeting the growing demand in EVs and energy storage

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Battery Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Battery Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Battery Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.