Global Battery Production Machine Market

Market Size in USD Billion

CAGR :

%

USD

13.77 Billion

USD

44.21 Billion

2024

2032

USD

13.77 Billion

USD

44.21 Billion

2024

2032

| 2025 –2032 | |

| USD 13.77 Billion | |

| USD 44.21 Billion | |

|

|

|

|

Battery Production Machine Market Size

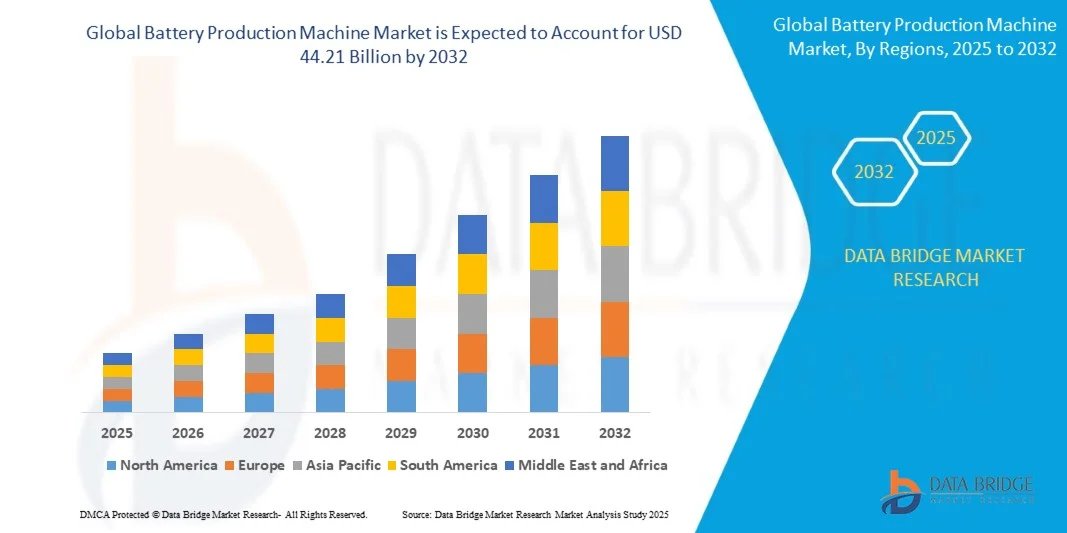

- The global battery production machine market size was valued at USD 13.77 billion in 2024 and is expected to reach USD 44.21 billion by 2032, at a CAGR of 15.70% during the forecast period

- The market growth is largely fuelled by the increasing adoption of electric vehicles (EVs), rising demand for energy storage solutions, and advancements in battery manufacturing technologies

- Expansion of renewable energy infrastructure and the shift toward sustainable power sources are further accelerating the need for efficient and high-capacity battery production machines

Battery Production Machine Market Analysis

- Increasing automation and precision in battery manufacturing processes are enhancing production efficiency, quality, and safety, creating higher demand for advanced machinery

- Continuous innovations in lithium-ion, solid-state, and other next-generation battery technologies are prompting manufacturers to upgrade production lines, thereby boosting the market

- North America dominated the battery production machine market with the largest revenue share in 2024, driven by the growing demand for electric vehicles (EVs), renewable energy storage systems, and advanced electronics manufacturing

- Asia-Pacific region is expected to witness the highest growth rate in the global battery production machine market, driven by expansion of EV markets, growing renewable energy initiatives, and rising demand for consumer electronics and industrial batteries

- The laminators segment held the largest market revenue share in 2024, driven by their critical role in ensuring uniform electrode coating and high-quality battery cell production. Laminators enhance manufacturing precision, reduce defects, and improve overall battery performance, making them indispensable for large-scale production of lithium-ion and other advanced batteries

Report Scope and Battery Production Machine Market Segmentation

|

Attributes |

Battery Production Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Battery Production Machine Market Trends

“Increasing Automation and Efficiency in Battery Manufacturing”

- The growing adoption of advanced battery production machines is transforming the battery manufacturing landscape by enabling high-precision, automated production. These machines improve cell consistency, reduce defects, and accelerate production timelines, enhancing overall output quality and operational efficiency. In addition, advanced machines allow real-time monitoring and predictive maintenance, further minimizing downtime and operational risks while ensuring consistent product quality across large-scale operations

- Rising demand for electric vehicles (EVs) and energy storage systems is accelerating the deployment of automated and flexible battery production lines. Manufacturers are increasingly investing in scalable, modular equipment that can adapt to different chemistries and cell formats. The integration of Industry 4.0 technologies, such as IoT-enabled sensors and AI-based process optimization, is further enhancing production efficiency and responsiveness to market fluctuations

- The affordability, precision, and ease of integration of modern battery production machines make them attractive for large-scale and specialized battery manufacturing. Companies benefit from higher throughput, lower labor costs, and improved yield consistency. Moreover, these machines support diverse product portfolios, including solid-state and lithium-ion batteries, helping manufacturers meet evolving energy storage and EV requirements

- For instance, in 2023, several EV battery manufacturers in China and Europe reported enhanced production efficiency and reduced defect rates after implementing fully automated coating and assembly machines, leading to faster time-to-market and better product reliability. The adoption of these machines also allowed manufacturers to scale operations quickly, accommodate larger production volumes, and maintain consistent battery performance standards, which is critical for OEM partnerships

- While automation and advanced machinery are driving growth, sustained market expansion depends on continued technological innovation, cost optimization, and skilled workforce training. Manufacturers must focus on modular, scalable, and energy-efficient solutions to fully capitalize on market demand. Furthermore, investment in after-sales service, predictive analytics, and remote monitoring solutions is becoming essential to maximize machine uptime and ROI, fostering long-term competitiveness in the global battery production machine market

Battery Production Machine Market Dynamics

Driver

“Rising Demand For Electric Vehicles And Energy Storage Solutions”

- Growing global adoption of EVs and renewable energy storage systems is driving investment in automated battery production machines. High-precision manufacturing ensures better battery performance, safety, and longevity. In addition, governments’ push for clean energy adoption and emission reduction policies is incentivizing manufacturers to expand and modernize production capabilities

- Expansion of grid-scale storage and portable electronics markets has fueled the need for reliable, high-volume battery production equipment. Producers are leveraging advanced machinery to meet increasing capacity and quality requirements. The flexibility of modern machines enables manufacturers to diversify battery chemistries and form factors to cater to multiple industries simultaneously

- Trends toward sustainable and energy-efficient production processes are promoting adoption of machines with lower energy consumption, minimal waste, and smart monitoring features. These sustainable practices also reduce operational costs and environmental impact, aligning with regulatory requirements and corporate ESG goals, which is increasingly valued by investors and end-users

- For instance, in 2023, a leading European battery manufacturer reported increased adoption of fully automated assembly and formation machines, enhancing production speed and reducing operational costs. The deployment of smart robotics and automated material handling further optimized labor utilization and minimized error rates, leading to higher throughput and improved product reliability

- While demand for advanced machines is increasing, ensuring equipment reliability, energy efficiency, and compatibility with emerging battery chemistries is critical for long-term adoption. Manufacturers also need to focus on modular upgrades, digital twin integration, and predictive maintenance capabilities to maintain competitiveness and meet evolving EV and energy storage requirements

Restraint/Challenge

“High Cost Of Advanced Machinery And Supply Chain Limitations”

- High capital investment for precision battery production machines, coupled with specialized components, limits accessibility for small and mid-sized manufacturers. Cost remains a key barrier for widespread deployment. Additional financial burden arises from installation, training, and integration of advanced software and automation technologies

- Supply chain disruptions, including semiconductor, motor, and coating material shortages, can delay equipment delivery and installation, affecting production schedules. Manufacturers are also impacted by geopolitical tensions and import/export restrictions, which may increase lead times and overall procurement costs

- Complex operation, maintenance, and calibration requirements add technical challenges for manufacturers. Improper handling can lead to defects, reduced efficiency, or safety hazards. Furthermore, continuous technological updates and staff upskilling are required to ensure optimal machine performance and adherence to quality standards

- For instance, in 2023, several North American and Asian battery manufacturers faced delays in commissioning automated assembly lines due to component shortages and high import costs, impacting production targets. These delays affected order fulfillment, slowed market expansion, and increased operational expenses

- While machinery technology continues to evolve, addressing cost, supply chain reliability, and workforce training is essential to ensure broader adoption and sustained growth of the global battery production machine market. Strategic partnerships with component suppliers, investment in local production facilities, and implementation of predictive maintenance solutions can mitigate challenges and enhance market resilience

Battery Production Machine Market Scope

The market is segmented on the basis of machine type, battery type, and application.

• By Machine Type

On the basis of machine type, the battery production machine market is segmented into slitting machines, laminators, stackers, dryers, and formers. The laminators segment held the largest market revenue share in 2024, driven by their critical role in ensuring uniform electrode coating and high-quality battery cell production. Laminators enhance manufacturing precision, reduce defects, and improve overall battery performance, making them indispensable for large-scale production of lithium-ion and other advanced batteries.

The stackers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their ability to automate the stacking of electrodes and separators, ensuring consistency and reducing manual labor requirements. Stacker machines improve production efficiency, minimize errors, and are increasingly preferred in high-volume battery manufacturing lines.

• By Battery Type

On the basis of battery type, the market is segmented into lithium-ion batteries, lead-acid batteries, nickel-cadmium batteries, nickel-metal hydride batteries, and flow batteries. The lithium-ion segment held the largest revenue share in 2024, owing to high demand from electric vehicles, portable electronics, and renewable energy storage applications. Lithium-ion battery production requires precision machinery to ensure performance, safety, and long-term reliability.

The flow battery segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing adoption of grid-scale energy storage systems. Flow batteries demand specialized production machines capable of handling large electrolytes and modular cell assembly, enabling scalable and efficient energy storage solutions.

• By Application

On the basis of application, the battery production machine market is segmented into automotive industry, consumer electronics, energy storage, marine applications, and medical devices. The automotive segment held the largest revenue share in 2024, fueled by the rapid expansion of the electric vehicle market and government initiatives promoting green transportation. High-volume, high-precision machines are essential to meet the stringent quality standards required for automotive battery packs.

The energy storage segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing renewable energy integration, grid stabilization needs, and rising demand for reliable backup power. Production machines tailored for energy storage batteries support flexible cell formats and chemistries, enabling manufacturers to meet evolving market demands efficiently.

Battery Production Machine Market Regional Analysis

- North America dominated the battery production machine market with the largest revenue share in 2024, driven by the growing demand for electric vehicles (EVs), renewable energy storage systems, and advanced electronics manufacturing

- Manufacturers in the region highly value precision, automation, and scalable production offered by modern battery production machines, enabling higher throughput, reduced defects, and improved operational efficiency

- This widespread adoption is further supported by technological advancements, high R&D investment, and favorable government policies promoting EV adoption and energy storage infrastructure

U.S. Battery Production Machine Market Insight

The U.S. battery production machine market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of EVs and grid-scale energy storage projects. Companies are increasingly investing in fully automated, high-precision production equipment to enhance battery performance, quality, and safety. Strong demand for modular and flexible manufacturing lines, combined with government incentives for clean energy, is further propelling the market. Moreover, integration of smart monitoring and energy-efficient systems is significantly contributing to the expansion of battery manufacturing capacity in the U.S.

Europe Battery Production Machine Market Insight

The Europe battery production machine market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent regulations on automotive emissions and the push for electrification. Increasing adoption of EVs, along with expanding energy storage projects, is fostering demand for high-quality production machines. European manufacturers are also adopting energy-efficient and sustainable production technologies. The region is experiencing significant growth across automotive, consumer electronics, and renewable energy applications, with advanced machines being incorporated into both new and upgraded production lines.

U.K. Battery Production Machine Market Insight

The U.K. battery production machine market is expected to witness rapid growth from 2025 to 2032, driven by growing EV adoption, renewable energy integration, and government initiatives supporting clean energy manufacturing. The focus on localized battery production, combined with demand for high-performance and reliable machines, is encouraging manufacturers to upgrade production facilities. U.K. companies are also increasingly investing in automation, smart monitoring systems, and modular equipment to enhance efficiency and output quality.

Germany Battery Production Machine Market Insight

The Germany battery production machine market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s leadership in automotive innovation and renewable energy technology. Germany’s well-developed manufacturing infrastructure, emphasis on sustainability, and high technical expertise are promoting adoption of advanced machines. Integration of battery production lines with IoT-enabled monitoring and energy-efficient operations is becoming increasingly prevalent, ensuring higher throughput, reduced waste, and consistent quality.

Asia-Pacific Battery Production Machine Market Insight

The Asia-Pacific battery production machine market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, growing EV markets, and energy storage expansion in countries such as China, Japan, South Korea, and India. Government incentives promoting battery manufacturing and infrastructure development are accelerating market adoption. In addition, APAC is emerging as a manufacturing hub for battery production machines, improving affordability and accessibility of advanced equipment for both local and international markets.

Japan Battery Production Machine Market Insight

The Japan battery production machine market is expected to witness rapid growth from 2025 to 2032 due to the country’s strong EV ecosystem, technological expertise, and focus on automation. Japanese manufacturers are adopting flexible, high-precision machines to meet evolving battery chemistries and production demands. Integration with smart monitoring and energy-efficient processes is enhancing operational efficiency and reliability, while the demand for compact and modular systems supports widespread adoption across automotive and electronics industries.

China Battery Production Machine Market Insight

The China battery production machine market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s dominance in EV production, expanding middle-class demand for electronics, and government support for clean energy initiatives. China serves as a major hub for battery manufacturing and component production, with advanced machinery enabling scalable, high-throughput, and energy-efficient operations. The push toward smart factories, domestic innovation, and affordable production solutions is further driving the growth of the battery production machine market in China.

Battery Production Machine Market Share

The Battery Production Machine industry is primarily led by well-established companies, including:

- ZSK Stickmaschinen GmbH (Germany)

- Manz AG (Germany)

- DMG MORI AG (Germany)

- Fristam Pumpen AG (Germany)

- Hanwha Precision Machinery Co., Ltd (South Korea)

- Tesla, Inc. (U.S.)

- KUKA AG (Germany)

- Fives Sylepse (France)

- Giga Presse GmbH (Germany)

- Arvigon AG (Switzerland)

- Shibaura Machine Co. Ltd. (Japan)

- Doosan Machine Tools (South Korea)

- Buhler AG (Switzerland)

- Beijing Jiarui Hengfeng Technology Development Co., Ltd. (China)

- KMT Waterjet Systems GmbH (Germany)

Latest Developments in Global Battery Production Machine Market

- In January 2025, Dürr Group secured a contract with FIB S.p.A to supply advanced coating systems and related equipment for a lithium-ion battery production facility in Italy. The installation will commence in fall 2025, supporting FIB’s European manufacturing operations and enabling production efficiency improvements expected to start in 2026, strengthening Europe’s battery supply chain

- In March 2024, Lead Intelligent Equipment Co., Ltd. launched a new generation of high-speed cutting and stacking machines for lithium-ion battery production, achieving a cycle time of 0.116 seconds per cell. This innovation enhances manufacturing throughput, reduces operational costs, and reinforces Lead’s leadership in battery production technology

- In November 2023, LEAD Intelligent introduced a state-of-the-art solid-state battery production line solution, integrating dry electrode technology, precision film formation, and ultra-thin coating systems. This advancement improves production efficiency, lowers operational expenses, and supports the industry transition toward high-performance, sustainable battery technologies

- In August 2022, Schuler Group acquired Sovema Group, an Italian battery engineering and mechanical company. The acquisition enables Schuler to expand mass-production capabilities for lithium-ion batteries, targeting automotive and industrial applications, and strengthens its footprint in the European battery market

- In April 2024, Lead Intelligent Equipment Co., Ltd. enhanced its strategic alliance with TÜV Rheinland to drive global expansion. The collaboration focuses on regulatory compliance, R&D advancement, supply chain optimization, and international market penetration, accelerating the adoption of sustainable energy solutions worldwide

- In November 2023, Dürr acquired Ingesal, a specialist in calendering systems for electrode materials. This acquisition enhances Dürr’s capability to supply critical equipment for lithium-ion battery production, improving manufacturing precision and supporting growth in the high-demand EV battery segment

- In April 2023, Manz AG secured a USD 27 million contract from ReneSys Energy Italia Srl to deliver a prismatic lithium-ion cell production line in Italy, enabling efficient large-scale battery manufacturing and contributing to the expansion of Europe’s energy storage capacity

- In July 2022, Hitachi High-Tech Corporation Ltd. introduced a remote diagnostic service for onboard automotive lithium-ion batteries, enabling real-time performance monitoring, early degradation detection, and improved battery lifecycle management, benefiting EV manufacturers and end-users alike

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Battery Production Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Battery Production Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Battery Production Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.