Global Battery Simulation Software Market

Market Size in USD Billion

CAGR :

%

USD

1.81 Billion

USD

4.69 Billion

2025

2033

USD

1.81 Billion

USD

4.69 Billion

2025

2033

| 2026 –2033 | |

| USD 1.81 Billion | |

| USD 4.69 Billion | |

|

|

|

|

Battery Simulation Software Market Size

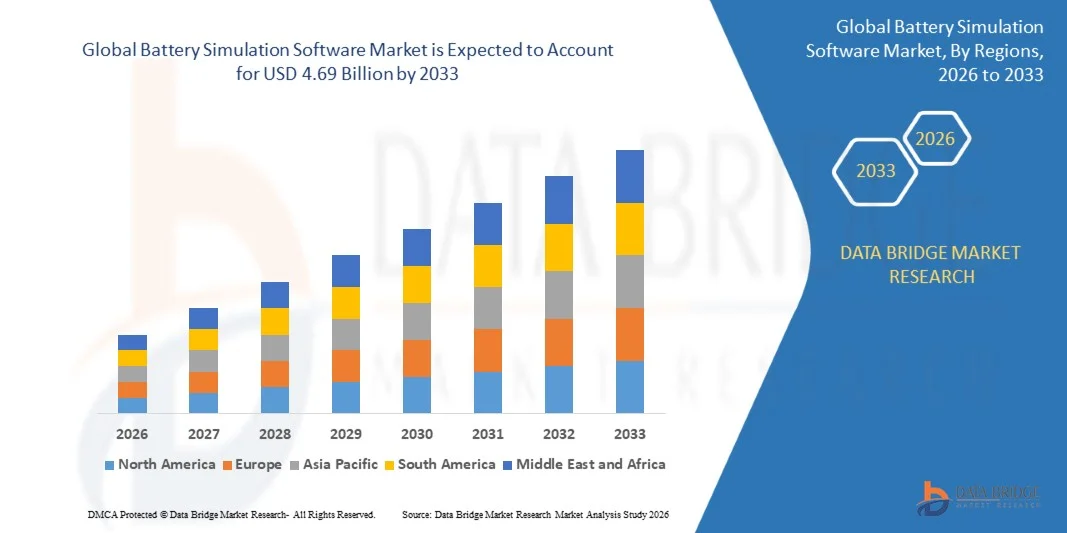

- The global battery simulation software market size was valued at USD 1.81 billion in 2025 and is expected to reach USD 4.69 billion by 2033, at a CAGR of 12.64% during the forecast period

- The market growth is largely fuelled by the increasing adoption of electric vehicles and the need for efficient battery management systems

- Growing investments in renewable energy storage solutions and the rising focus on battery performance optimization are further driving the market

Battery Simulation Software Market Analysis

- Increasing demand for advanced simulation tools among EV manufacturers and automotive OEMs is boosting market adoption

- Advancements in AI and machine learning integration with battery simulation software are enabling predictive modeling and faster product iterations

- North America dominated the battery simulation software market with the largest revenue share in 2025, driven by the growing adoption of electric vehicles, renewable energy projects, and advanced battery R&D initiatives.

- Asia-Pacific region is expected to witness the highest growth rate in the global battery simulation software market, driven by rising demand for electric vehicles, growing industrial automation, and expanding government incentives for clean energy technologies

- The electrochemical simulation segment held the largest market revenue share in 2025, driven by the growing need for accurate modeling of battery reactions, performance prediction, and lifecycle estimation. Electrochemical simulations enable designers to optimize battery chemistry, enhance safety, and reduce development costs for automotive and energy storage applications

Report Scope and Battery Simulation Software Market Segmentation

|

Attributes |

Battery Simulation Software Key Market Insights |

|

Segments Covered |

• By Simulation Type: Electrochemical, Thermal, Structural & Mechanical, and Electrical & Circuit |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Battery Simulation Software Market Trends

“Rise of Advanced Battery Modeling and Simulation”

- The growing adoption of battery simulation software is transforming the battery design and testing landscape by enabling virtual testing, performance prediction, and real-time monitoring. The speed and accuracy of these tools allow engineers to optimize battery performance, improve safety, and reduce development costs. In addition, simulation software supports predictive maintenance, reduces material waste, and accelerates innovation in battery chemistry and pack design

- The increasing demand for high-performance batteries in electric vehicles (EVs) and renewable energy storage systems is accelerating the adoption of simulation platforms. These tools are particularly effective for predicting thermal, electrochemical, and structural behavior, helping reduce prototyping time and improving efficiency. They also allow integration with AI-driven analytics for performance optimization and failure prediction

- The affordability and accessibility of modern simulation software are making it attractive for both large OEMs and smaller startups. Users benefit from enhanced design accuracy, reduced testing expenses, and improved battery lifecycle management. Cloud-based platforms further enable collaborative design and remote testing across global R&D teams

- For instance, in 2023, several automotive manufacturers implemented advanced Li-ion battery simulation platforms, reporting faster development cycles, improved safety features, and optimized energy density in vehicle battery packs. These implementations also led to enhanced compliance with regulatory safety standards and reduced overall production costs

- While battery simulation software is enhancing design efficiency and safety, its impact depends on software capabilities, computational resources, and integration with physical testing. Developers must focus on scalable, high-fidelity, and user-friendly platforms to fully capitalize on growing demand. Integration with real-time IoT battery data further increases predictive accuracy and operational insights

Battery Simulation Software Market Dynamics

Driver

“Rising Demand for High-Performance Batteries in Electric Vehicles and Energy Storage”

- The growing adoption of electric vehicles and renewable energy storage solutions is pushing manufacturers to prioritize advanced battery simulation tools for design optimization. Accurate modeling ensures higher energy density, extended lifecycle, and enhanced safety. Simulation also allows early detection of design flaws, reducing recall risks and ensuring regulatory compliance

- Battery developers are increasingly aware of the operational and financial benefits of simulation software, including reduced prototyping costs, faster time-to-market, and improved battery reliability. This awareness is boosting adoption across automotive and industrial applications. Moreover, simulation enables testing of next-generation solid-state and lithium-sulfur batteries without costly physical prototypes

- Government initiatives supporting EV adoption and clean energy projects are encouraging investment in battery R&D and simulation platforms. Subsidies, incentives, and research grants are further driving market growth. In addition, governments are promoting standardization and benchmarking, which increases demand for robust simulation capabilities

- For instance, in 2022, several European and North American EV manufacturers invested in simulation platforms to optimize battery packs for high-performance electric vehicles, improving safety, efficiency, and regulatory compliance. These investments also enabled faster deployment of battery energy storage systems for grid stabilization projects

- While rising EV demand and government support are driving growth, there remains a need for high-performance computing, software integration, and real-world validation to sustain adoption. Integration with machine learning, cloud computing, and digital twins can further enhance predictive capabilities and operational performance

Restraint/Challenge

“High Cost of Advanced Simulation Software and Technical Complexity”

- The high price point of advanced battery simulation software makes it inaccessible for small-scale battery developers and startups. Premium licensing fees and hardware requirements limit widespread usage. In addition, subscription-based cloud models can increase recurring costs for smaller firms, restricting adoption

- In many regions, a lack of skilled engineers and expertise in battery modeling restricts effective utilization. Improper simulation or misinterpretation of results can lead to suboptimal designs and increased costs. Continuous training and certification programs are necessary to build workforce competency and ensure software effectiveness

- Integration challenges with physical testing, hardware-in-the-loop systems, and existing development workflows further limit adoption. Many developers still rely on traditional trial-and-error methods, which are less efficient. Coordination between simulation outputs and manufacturing processes remains a key barrier

- For instance, in 2023, several emerging EV startups in Asia-Pacific delayed implementation of advanced simulation software due to high costs and insufficient technical expertise. These delays impacted time-to-market and limited their ability to scale production of new battery technologies

- While simulation technology continues to evolve, addressing cost, usability, and skill gaps remains critical. Market stakeholders must focus on modular, user-friendly, and cost-efficient platforms to maximize adoption and long-term market potential. Partnerships between software providers and educational institutions could further strengthen market readiness and adoption rates

Battery Simulation Software Market Scope

The battery simulation software market is segmented on the basis of simulation type, battery type, and end-use industry.

• By Simulation Type

On the basis of simulation type, the market is segmented into electrochemical, thermal, structural & mechanical, and electrical & circuit. The electrochemical simulation segment held the largest market revenue share in 2025, driven by the growing need for accurate modeling of battery reactions, performance prediction, and lifecycle estimation. Electrochemical simulations enable designers to optimize battery chemistry, enhance safety, and reduce development costs for automotive and energy storage applications.

The thermal simulation segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing importance of thermal management in high-performance batteries. Thermal simulations help predict temperature distribution, prevent overheating, and improve battery longevity, making them essential for EVs and energy storage systems.

• By Battery Type

On the basis of battery type, the market is segmented into Li-ion, Lead-acid, and Solid-state. The Li-ion segment held the largest market revenue share in 2025, fueled by the widespread adoption of Li-ion batteries in electric vehicles and consumer electronics. Li-ion battery simulations provide accurate modeling for energy density optimization, safety enhancement, and performance efficiency.

The solid-state battery segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing R&D in next-generation batteries offering higher energy density and enhanced safety. Simulation tools for solid-state batteries are critical for predicting electrochemical performance, thermal stability, and mechanical reliability.

• By End-use Industry

On the basis of end-use industry, the market is segmented into EV manufacturers and automotive OEMs. The EV manufacturer segment held the largest market revenue share in 2025, driven by the rapid adoption of electric vehicles globally and the need to optimize battery packs for range, efficiency, and safety. Simulation software allows EV manufacturers to accelerate design cycles and reduce prototyping costs.

The automotive OEM segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increased integration of battery simulation software into vehicle production, testing, and energy management systems. OEMs are leveraging simulations to improve battery pack design, thermal management, and compliance with regulatory standards.

Battery Simulation Software Market Regional Analysis

- North America dominated the battery simulation software market with the largest revenue share in 2025, driven by the growing adoption of electric vehicles, renewable energy projects, and advanced battery R&D initiatives.

- Manufacturers and research institutions in the region highly value the accuracy, efficiency, and predictive capabilities offered by simulation software for battery design, testing, and lifecycle management.

- This widespread adoption is further supported by high investment in clean energy, government incentives for EV and storage projects, and a technologically skilled workforce, establishing simulation software as a key tool for both industrial and automotive applications

U.S. Battery Simulation Software Market Insight

The U.S. battery simulation software market captured the largest revenue share in 2025 within North America, fueled by rapid adoption of electric vehicles and advanced energy storage systems. Companies are increasingly prioritizing simulation platforms to optimize battery performance, improve safety, and reduce development costs. The rising trend of EV manufacturing, coupled with government incentives for sustainable energy solutions and strong R&D capabilities, is significantly contributing to market growth. Moreover, integration with high-performance computing and advanced analytics tools is further enhancing the adoption of simulation software across multiple sectors.

Europe Battery Simulation Software Market Insight

The Europe battery simulation software market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations and the increasing demand for high-performance electric vehicles. The push for clean energy, coupled with government-funded research initiatives and grants, is fostering the adoption of advanced battery modeling platforms. European manufacturers and research institutes are leveraging simulation tools to accelerate battery development, improve efficiency, and ensure compliance with safety and performance standards.

U.K. Battery Simulation Software Market Insight

The U.K. battery simulation software market is expected to witness the fastest growth rate from 2026 to 2033, driven by the expanding electric vehicle ecosystem, renewable energy projects, and government incentives for low-carbon technologies. Growing awareness of battery safety, efficiency, and lifecycle optimization is encouraging automotive OEMs and energy storage providers to adopt advanced simulation platforms. The U.K.’s emphasis on digitalization and smart manufacturing further supports the deployment of simulation tools across R&D and production workflows.

Germany Battery Simulation Software Market Insight

The Germany battery simulation software market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the country’s focus on industrial innovation, energy transition, and EV adoption. German automotive and battery manufacturers are increasingly utilizing simulation software to optimize battery packs, reduce development costs, and improve overall safety. Integration of advanced modeling platforms with Industry 4.0 practices and high-performance computing infrastructure is further driving market expansion.

Asia-Pacific Battery Simulation Software Market Insight

The Asia-Pacific battery simulation software market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing EV production, renewable energy deployment, and government incentives in countries such as China, Japan, and India. The region’s growing inclination toward clean energy, supported by large-scale battery R&D initiatives and digitalization efforts, is driving the adoption of simulation software. Furthermore, APAC emerging as a hub for battery manufacturing and technological innovation is expanding accessibility to advanced modeling tools.

Japan Battery Simulation Software Market Insight

The Japan battery simulation software market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high-tech culture, rapid urbanization, and strong focus on EV and energy storage technologies. Japanese manufacturers are leveraging simulation platforms to enhance battery performance, safety, and efficiency. The integration of simulation software with smart manufacturing and IoT-enabled energy systems is boosting adoption, while the aging population increases demand for reliable and safe energy solutions in both commercial and industrial sectors.

China Battery Simulation Software Market Insight

The China battery simulation software market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid EV adoption, expanding renewable energy infrastructure, and strong R&D capabilities. Chinese battery and automotive manufacturers are increasingly implementing simulation software to optimize performance, reduce costs, and accelerate product development. Government support for clean energy, smart grid projects, and technological innovation is further propelling market growth in China.

Battery Simulation Software Market Share

The Battery Simulation Software industry is primarily led by well-established companies, including:

- ANSYS, Inc. (U.S.)

- Siemens AG (Germany)

- AVL List GmbH (Austria)

- Dassault Systèmes SE (France)

- COMSOL AB (Sweden)

- Altair Engineering, Inc. (U.S.)

- Autonomie, Inc. (U.S.)

- TNO (Netherlands Organization for Applied Scientific Research) (Netherlands)

- National Renewable Energy Laboratory (NREL) (U.S.)

- BattMan Simulation Solutions Pvt. Ltd. (India)

Latest Developments in Global Battery Simulation Software Market

- In December 2024, Ansys entered a strategic partnership with Sony Semiconductor to advance autonomous vehicle perception testing. By integrating Ansys AVxcelerate Sensors with Sony's HDR Image Sensor Model, the collaboration enabled high-fidelity, scenario-based simulations of ADAS and autonomous driving systems. This partnership accelerated validation processes, reduced the need for extensive road testing, and enhanced safety and reliability for OEMs and Tier 1 suppliers, strengthening market adoption of simulation-driven AV development

- In October 2023, MathWorks collaborated with Altigreen to accelerate development of its flagship electric three-wheeler, NEEV. Leveraging MATLAB, Simulink, and Model-Based Design, Altigreen optimized its electric powertrain and improved overall simulation-driven design efficiency. The initiative reduced development time, enabled faster scaling of production, and reinforced the role of software-based modeling in EV innovation

- In November 2024, Siemens Digital Industries Software announced major enhancements to its Simcenter mechanical simulation suite. The updates streamlined electrification engineering, simplified durability testing, and improved aerospace safety margins. Features such as faster tire contact simulations, reduced airframe preprocessing, and additive manufacturing build process tools improved engineering efficiency and reinforced the market position of Simcenter in multi-industry simulation

- In September 2023, AVL partnered with Henkel to enhance battery development for electric vehicles, integrating end-to-end simulation and testing. AVL's tools and automation software facilitated real-time battery performance assessment at Henkel’s TISAX-certified Battery Engineering Center. The collaboration ensured reliable, sustainable production processes under diverse climatic and operational conditions, accelerating EV battery development and boosting market confidence in simulation-driven engineering solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.