Global Battery Swapping Market

Market Size in USD Billion

CAGR :

%

USD

1.46 Billion

USD

12.13 Billion

2024

2032

USD

1.46 Billion

USD

12.13 Billion

2024

2032

| 2025 –2032 | |

| USD 1.46 Billion | |

| USD 12.13 Billion | |

|

|

|

|

Battery Swapping Market Size

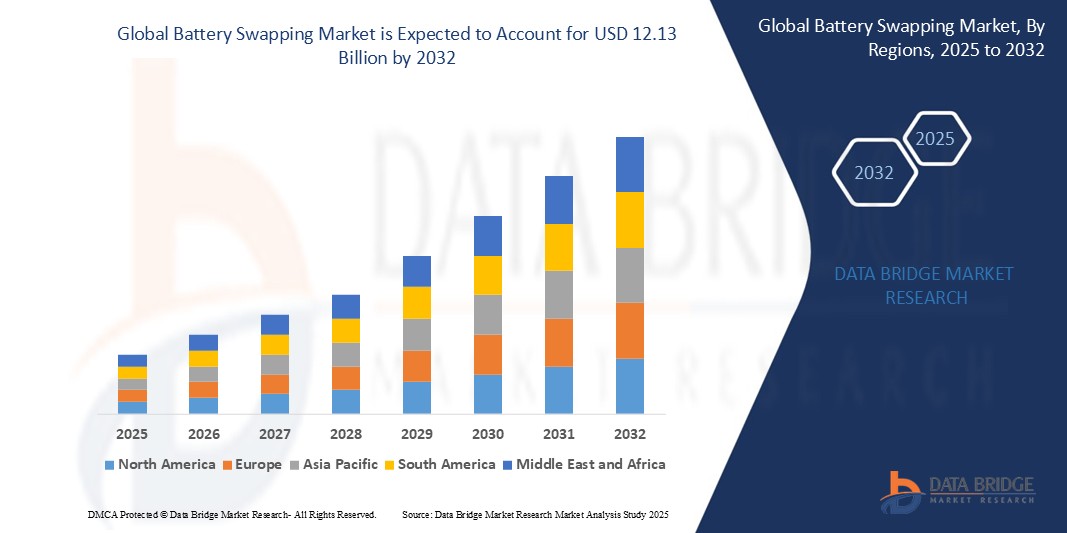

- The global battery swapping market size was valued at USD 1.46 billion in 2024 and is expected to reach USD 12.13 billion by 2032, at a CAGR of 30.30% during the forecast period

- This growth is driven by factors such as the increasing adoption of electric vehicles (EVs), demand for quick and convenient charging solutions, and growing government support for clean energy initiatives

Battery Swapping Market Analysis

- The battery swapping market refers to the industry that involves the exchange of depleted batteries in electric vehicles (EVs) with fully charged ones at specialized stations. Instead of waiting for an EV to charge, users can quickly swap their vehicle’s battery for a charged one, significantly reducing the time it takes for an EV to get back on the road.

- This system is particularly useful for electric two-wheelers, three-wheelers, and even commercial EVs, especially in areas where charging infrastructure is limited or where time constraints are critical.

- Asia-Pacific is expected to dominate the battery swapping’s market due to national policies provide incentives for electric vehicle adoption and battery swapping infrastructure development

- Europe is expected to be the fastest growing region in the battery swapping market during the forecast period due to implementing policies to promote electric vehicle adoption and battery swapping infrastructure

- 2-wheeler segment is expected to dominate the market with a market share due to the cost-effective, have lower energy consumption, and are ideal for urban environments, making them the preferred choice for consumers in densely populated areas

Report Scope and Battery Swapping Market Segmentation

|

Attributes |

Battery Swapping Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Battery Swapping Market Trends

“Increased Adoption of Swapping Stations”

- The global battery swapping market is witnessing a significant shift toward standardization and increased adoption of swapping stations as part of an effort to address the limitations of traditional charging infrastructure for electric vehicles (EVs)

- This trend is especially prominent in regions such as Asia-Pacific, where countries such as China are leading the way with large-scale battery swapping networks. The adoption of battery swapping is also accelerating due to advancements in battery technology, making it easier to swap batteries quickly and efficiently, thus minimizing downtime for EVs

- Furthermore, the push for sustainable energy solutions and the increased need for faster turnaround times in high-traffic areas, such as fleet operations and public transportation, are contributing to the growth of this trend

- Companies such as NIO (China) and Gogoro (Taiwan) are already expanding their network of battery swapping stations, enhancing accessibility and encouraging the use of electric vehicles. The trend is also driven by government policies and subsidies that support the development of electric infrastructure and clean energy solutions

- For Instance, In the coming years, more partnerships between OEMs and energy providers are expected, further boosting the implementation of battery swapping stations, especially in urban areas with high vehicle density

Battery Swapping Market Dynamics

Driver

“Rising Demand for Fast and Convenient Charging Solutions”

- As electric vehicle adoption grows worldwide, traditional charging infrastructure, including slow-charging stations, is struggling to keep up with the increasing demand

- Battery swapping offers a unique solution by enabling vehicle owners to replace depleted batteries with fully charged ones in a matter of minutes, significantly reducing waiting times

- For Instance, In China, companies such as NIO have pioneered this model by establishing a vast network of battery swapping stations. This reduces the range anxiety associated with EVs, making them more attractive to consumers

- The lack of charging infrastructure in some regions also makes battery swapping an ideal alternative, particularly in densely populated cities where finding available charging stations can be challenging

- Additionally, with urban air quality concerns and government incentives pushing for cleaner transportation, the demand for electric vehicles and their supporting infrastructure, such as battery swapping, is expected to continue growing.

- Battery swapping is especially advantageous for fleet operators and shared mobility services who require a quick turnaround and frequent use of EVs

Opportunity

“Electric Vehicle Fleet Adoption”

- The global battery swapping market presents several opportunities, particularly in regions with high-density urban populations and electric vehicle fleet adoption

- For Instance, India is expected to see a massive expansion of battery swapping stations due to the government’s push for green mobility solutions and the country’s growing demand for electric two-wheelers and three-wheelers

- The market is ripe for OEMs (original equipment manufacturers) and energy providers to collaborate on building robust networks of battery swapping stations. As EV adoption increases, especially among commercial fleets, the demand for reliable, cost-effective, and efficient battery swapping infrastructure will also rise

- A significant opportunity exists in developing economies, where battery swapping offers a cost-effective solution to the challenges of limited access to fast-charging stations. Companies such as Gogoro and Battery Swapping Ventures are already capitalizing on the opportunity to expand their services across emerging markets

- Additionally, the development of swappable batteries that are standardized across various vehicle types could open up the market for smaller companies and startups, encouraging more competition and innovation

- As battery technologies improve, energy storage solutions associated with battery swapping will become even more efficient, further enhancing the value proposition of this business model for investors and operators

Restraint/Challenge

“Lack of Standardization”

- Despite the significant growth of the battery swapping market, there are several challenges that need to be addressed for its widespread adoption. One of the key constraints is the lack of standardization in battery design across different EV manufacturers

- This makes it difficult to create a universal swapping station that can cater to various EV models, thus limiting the scalability of the market

- For instance, NIO's battery swapping stations are designed specifically for their own vehicles, which restricts interoperability with other brands, making it harder for potential customers to adopt the service

- Furthermore, the high initial investment required to establish a battery swapping network, including the construction of swapping stations and the procurement of batteries, can be a major hurdle for new entrants into the market

- Another challenge is the technological complexity of battery swapping systems, which require highly efficient and automated stations to ensure the quick and smooth swapping of batteries. Battery degradation over time also poses an issue, as older batteries may not perform as well, potentially causing issues with the efficiency of swapping stations

- Moreover, the sustainability of battery production and disposal remains a concern, as the lifecycle of batteries continues to raise questions about the environmental impact of mass production and disposal. Lastly, regulatory hurdles in different regions can delay the development and expansion of battery swapping networks

Battery Swapping Market Scope

The market is segmented on the basis of vehicle type, operation, service type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Vehicle Type |

|

|

By Operation |

|

|

By Service Type |

|

|

By Application |

|

In 2025, the 2-wheeler is projected to dominate the market with a largest share in vehicle type segment

The 2-wheeler segment is expected to dominate the Battery Swapping market with the largest share in 2025 due to the cost-effective, have lower energy consumption, and are ideal for urban environments, making them the preferred choice for consumers in densely populated areas.

The subscription is expected to account for the largest share during the forecast period in service type market

In 2025, the subscription segment is expected to dominate the market with the largest market share due to the subscription models allow customers to pay a fixed monthly or annual fee for accessing battery swapping services, making it easier for users to manage their costs. This is especially beneficial for fleet operators who rely on electric vehicles for daily operations and want to avoid large upfront costs.

Battery Swapping Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Battery Swapping Market”

- Asia-Pacific holds the largest share of the global battery swapping market, accounting for nearly 59.5% of the market

- Companies such as NIO, Gogoro, Aulton, and Sun Mobility are leading the development of battery swapping infrastructure in countries such as China, India, and Taiwan

- National policies, such as China's FAME scheme, provide incentives for electric vehicle adoption and battery swapping infrastructure development

- China's CATL plans to establish 10,000 battery swapping stations, starting with 1,000 in 2025

- Battery swapping addresses challenges in densely populated areas with limited space for charging stations

“Europe is Projected to Register the Highest CAGR in the Battery Swapping Market”

- Europe is projected to be the fastest-growing market for battery swapping during the forecast period, with a significant increase in adoption rates

- Countries such as Germany, France, and the Netherlands are implementing policies to promote electric vehicle adoption and battery swapping infrastructure

- Companies such as NIO and Swobbee are expanding their battery swapping networks across Europe, focusing on urban mobility solutions

- The increasing need for efficient and quick charging solutions in urban areas is driving the growth of battery swapping in Europe

- Investment in battery swapping stations and partnerships between automakers and energy providers are accelerating the adoption of battery swapping in Europe

Battery Swapping Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Nio (China)

- RACE Energy Ltd. (India)

- Battery Smart (India)

- Gogoro (Taiwan)

- Esmito Solutions Pvt. Ltd. (India)

- IMMOTOR (China)

- Ample (U.S.)

- KWANG YANG MOTOR CO., LTD. (China)

- Battswap (U.S.)

- Sun Mobility (India)

- E-Chargeup Solutions Pvt Ltd. (India)

- Swap Energi Indonesia (Indonesia)

- Contemporary Amperex Technology Co., Limited. (China)

Latest Developments in Global Battery Swapping Market

- In November 2024, Ample (U.S.) announced a USD 25 million investment from Mitsubishi Corporation (Japan). This strategic collaboration goes beyond just a financial investment, where Mitsubishi Corporation will support Ample's ongoing efforts to expand its battery-swapping business

- In August 2024, SUN Mobility (India) and Veera Vahana (India) showcased India's first modular battery swapping technology for heavy commercial vehicles at Prawaas 4.0 held in Bengaluru, India. SUN Mobility has tied relations with bus manufacturer Veera Vahana to launch what is claimed to be India's first 10.5 meters to be India's first 10.5-meter battery-swappable buses for intercity, regional, and suburban routes

- In June 2024, CATL (China) Works with BAIC Group (China) to Develop Skateboard Chassis and Battery Swapping Business. Both company will work together to promote the development of battery swap models and swappable battery blocks, the circulation of swappable battery blocks and the management of battery-related data, as well as regional cooperation on battery swap stations

- In September 2024, Nio (China) has signed an agreement with Suzhou Energy Group (China). The two companies will work together on charging and battery swap network construction, virtual power plant construction and operation, and the creation of zero-carbon stations

- In July 2024, Gogoro (Taiwan) announced it has been certified to launch its battery swapping and Smartscooters in Singapore and plans to launch with its exclusive distribution partner, Cycle & Carriage (C&C) (Singapore). C&C also announced a partnership with Shell Recharge to launch battery swapping GoStations at Shell service stations in the Singapore market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.