Global Bean Pasta Market

Market Size in USD Million

CAGR :

%

USD

522.60 Million

USD

1,048.23 Million

2025

2033

USD

522.60 Million

USD

1,048.23 Million

2025

2033

| 2026 –2033 | |

| USD 522.60 Million | |

| USD 1,048.23 Million | |

|

|

|

|

Bean Pasta Market Size

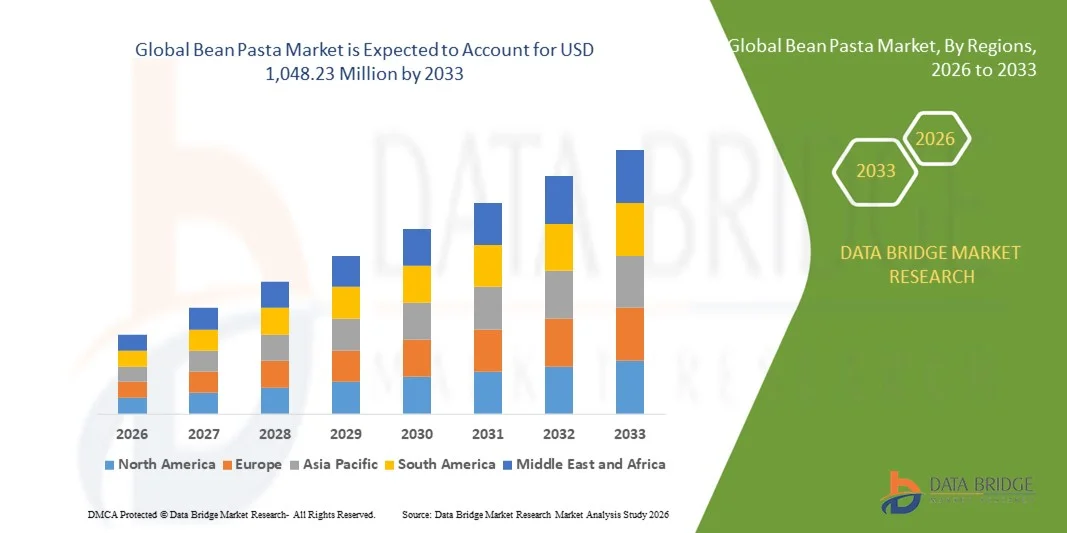

- The global bean pasta market size was valued at USD 522.60 million in 2025 and is expected to reach USD 1,048.23 million by 2033, at a CAGR of 9.09% during the forecast period

- The market growth is largely fuelled by the rising consumer preference for high-protein, gluten-free, and fiber-rich foods, as well as the increasing demand for plant-based diets

- Growing awareness of health and wellness trends, along with innovations in bean pasta flavors and formats, is driving adoption across different consumer segments

Bean Pasta Market Analysis

- The market is witnessing strong growth due to the convergence of dietary trends, such as veganism and low-carb diets, which favor alternative pasta products

- Manufacturers are focusing on product differentiation, clean-label formulations, and convenience-oriented packaging to attract health-conscious consumers

- North America dominated the global bean pasta market with the largest revenue share of 38.45% in 2025, driven by rising health consciousness, growing demand for gluten-free and high-protein diets, and increasing consumer awareness regarding plant-based nutrition

- Asia-Pacific region is expected to witness the highest growth rate in the global bean pasta market, driven by rising health awareness, expanding retail infrastructure, and growing adoption of plant-based diets across urban populations

- The conventional segment held the largest market revenue share in 2025, driven by widespread availability, lower cost, and established supply chains. Conventional bean pasta products are widely consumed across households and restaurants, offering familiar taste profiles and easy integration into traditional recipes

Report Scope and Bean Pasta Market Segmentation

|

Attributes |

Bean Pasta Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bean Pasta Market Trends

Rising Demand for Gluten-Free and High-Protein Pasta

- The growing preference for healthy and nutrient-rich diets is transforming the pasta segment by increasing the adoption of bean pasta. These products provide higher protein, fiber, and essential nutrients compared to traditional wheat pasta, supporting better digestive health and satiety. The trend is particularly strong among health-conscious and fitness-oriented consumers, driving innovation in flavors, shapes, and blends to appeal to a wider audience. Consumer focus on weight management and heart health is also bolstering demand

- The high demand for plant-based and gluten-free diets is accelerating the development and launch of innovative bean pasta products, including lentil, chickpea, and black bean varieties. These options cater to consumers with dietary restrictions, promoting wider adoption in both retail and foodservice channels. Manufacturers are increasingly experimenting with hybrid pasta formulations, blending different legumes to improve taste, texture, and nutritional content, enhancing market penetration

- The affordability, convenience, and versatility of bean pasta are making it attractive for households, restaurants, and meal-kit providers. Easy cooking, longer shelf life, and diverse flavor profiles are driving frequent usage, resulting in higher consumption and market expansion. In addition, the adaptability of bean pasta in ethnic and fusion recipes is expanding its culinary applications and acceptance among younger demographics

- For instance, in 2023, several food retailers in North America reported increased sales of chickpea and lentil pasta, driven by rising awareness of protein-rich diets and gluten intolerance. This trend improved revenue for both established and emerging brands. Collaborative marketing campaigns with nutritionists and fitness influencers further amplified consumer engagement, strengthening brand loyalty

- While bean pasta is gaining traction, its market growth depends on continued product innovation, taste optimization, and consumer education. Manufacturers must focus on recipe development, packaging convenience, and marketing initiatives to fully leverage the rising demand. Investment in sustainable sourcing and transparent labeling is also becoming a key differentiator in competitive markets

Bean Pasta Market Dynamics

Driver

Growing Health Awareness and Shift Toward Plant-Based Diets

- Rising awareness regarding the health benefits of high-protein, low-carb, and gluten-free diets is pushing consumers to explore alternatives to traditional wheat pasta. This shift is accelerating investment in bean pasta manufacturing and innovation. Growing media coverage, nutrition research, and social media influence are reinforcing the adoption of protein-rich diets globally

- Consumers are increasingly prioritizing sustainable and plant-based food choices, encouraging manufacturers to expand product portfolios with diverse bean-based pasta options. This trend is particularly strong among millennials and urban populations. The rise of veganism and flexitarian diets, combined with environmental concerns, is driving preference for legumes over animal-based products

- Retailers and foodservice operators are responding to this demand by stocking and promoting high-protein, plant-based pasta products. The combination of convenience, nutrition, and dietary inclusivity is boosting sales across multiple channels. Meal-kit services, online grocery platforms, and e-commerce channels are further enhancing accessibility and consumer trial

- For instance, in 2022, European supermarkets reported a surge in plant-based pasta sales, prompting brands to introduce lentil, chickpea, and black bean pasta variants to meet growing demand. Collaborations with health-conscious chefs and cooking influencers also helped demonstrate versatile usage, boosting product adoption in both home and commercial kitchens

- While consumer health awareness is driving the market, success depends on flavor, texture, and widespread availability. Market stakeholders must focus on quality, innovation, and marketing strategies to sustain growth. Investment in supply chain efficiency and packaging innovations is crucial to maintain product freshness and consumer satisfaction

Restraint/Challenge

Higher Cost Compared to Traditional Pasta and Taste Preferences

- Bean pasta products often come at a higher price point than conventional wheat pasta, limiting accessibility for price-sensitive consumers. Cost remains a key barrier to adoption, especially in emerging markets. The higher production cost, driven by sourcing premium pulses and specialized milling, contributes to the price difference

- In many regions, taste and texture preferences still favor traditional pasta. Consumers may be hesitant to switch due to unfamiliar flavor profiles or cooking differences, slowing market penetration. Overcoming textural challenges, such as graininess or reduced elasticity, is critical for broader acceptance

- Supply chain and production challenges, such as sourcing high-quality pulses and maintaining consistent product quality, can restrict market growth. Inconsistent availability can lead to lower consumer adoption rates. Seasonal fluctuations and climatic factors affecting pulse yields further complicate consistent production

- For instance, in 2023, several small retailers in Asia reported limited stock and lower sales of chickpea and lentil pasta due to production constraints and higher pricing. Disruptions in logistics and import-export restrictions also occasionally impacted timely deliveries, influencing consumer trust

- While bean pasta continues to gain popularity, addressing cost, taste, and supply chain challenges is critical. Manufacturers must focus on efficient production, flavor optimization, and consumer education to drive long-term growth. Investment in R&D for blended pulses, taste-masking technologies, and optimized extrusion processes is expected to strengthen product acceptance

Bean Pasta Market Scope

The market is segmented on the basis of nature, product type, pasta type, packaging type, and distribution channel.

- By Nature

On the basis of nature, the global bean pasta market is segmented into conventional and organic. The conventional segment held the largest market revenue share in 2025, driven by widespread availability, lower cost, and established supply chains. Conventional bean pasta products are widely consumed across households and restaurants, offering familiar taste profiles and easy integration into traditional recipes.

The organic segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising health consciousness and demand for chemical-free, natural food products. Organic bean pasta is gaining popularity among health-focused consumers seeking non-GMO and pesticide-free alternatives, supporting the expansion of premium product offerings.

- By Product Type

On the basis of product type, the global bean pasta market is segmented into black bean pasta, white bean pasta, soybean pasta, green bean pasta, and others. Black bean pasta held the largest market revenue share in 2025, driven by its high protein content, rich fiber, and widespread acceptance among health-conscious consumers. Black bean pasta is widely used in households, restaurants, and ready-to-eat meals, offering versatility and appealing taste profiles.

The soybean pasta segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of plant-based diets, gluten-free preferences, and innovative product launches. Soybean pasta is gaining traction for its nutritional value, protein richness, and suitability for various recipes, supporting market expansion across retail and foodservice channels.

- By Pasta Type

On the basis of pasta type, the global bean pasta market is segmented into fettuccine, spaghetti, rotini, penne, elbow, shell, and others. Spaghetti held the largest market revenue share in 2025, driven by its global familiarity, ease of cooking, and high household consumption. Spaghetti is a staple in homes, restaurants, and meal kits, making it a preferred choice among consumers.

The rotini segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing usage in restaurants, ready-to-eat meals, and premium culinary applications. Rotini pasta is gaining popularity due to its ability to hold sauces well, appeal in gourmet recipes, and inclusion in innovative bean pasta offerings.

- By Packaging Type

On the basis of packaging type, the global bean pasta market is segmented into pouches, cartons, and cans. Pouches held the largest market revenue share in 2025, driven by convenience, portability, and longer shelf life. Pouches are widely preferred for household use, retail distribution, and on-the-go consumption.

The cartons and cans segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by demand for bulk packaging, storage efficiency, and retail-ready solutions. Cartons and cans are increasingly used in supermarkets, online retail, and institutional settings, supporting wider market adoption.

- By Distribution Channel

On the basis of distribution channel, the global bean pasta market is segmented into convenience stores, supermarkets/hypermarkets, online, and others. Supermarkets and hypermarkets held the largest market revenue share in 2025, driven by wide product availability, brand visibility, and promotional campaigns. Supermarkets are preferred for their convenience, variety, and in-store marketing strategies.

The online segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing e-commerce adoption, digital penetration, and direct-to-consumer sales models. Online channels are gaining traction for their convenience, subscription-based sales, and access to premium and specialty bean pasta products.

Bean Pasta Market Regional Analysis

- North America dominated the global bean pasta market with the largest revenue share of 38.45% in 2025, driven by rising health consciousness, growing demand for gluten-free and high-protein diets, and increasing consumer awareness regarding plant-based nutrition

- Consumers in the region highly value the nutritional benefits, convenience, and versatility offered by bean pasta, which can easily replace traditional wheat pasta in a variety of meals

- This widespread adoption is further supported by strong retail penetration, robust e-commerce platforms, and the presence of leading health-focused brands, establishing bean pasta as a favored alternative for both households and foodservice applications

U.S. Bean Pasta Market Insight

The U.S. bean pasta market captured the largest revenue share in 2025 within North America, fueled by increasing preference for protein-rich, low-carb, and gluten-free foods. Consumers are shifting towards healthier meal options, driving demand for lentil, chickpea, and black bean pasta. The growing trend of meal kits, online grocery shopping, and home cooking is further propelling market growth. Moreover, product innovation in flavor, texture, and packaging is significantly contributing to market expansion.

Europe Bean Pasta Market Insight

The Europe bean pasta market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising health awareness, adoption of plant-based diets, and growing demand for gluten-free products. Increasing urbanization and busy lifestyles are promoting convenient, ready-to-cook meal options such as bean pasta. The region is experiencing growth across retail, foodservice, and e-commerce channels, with manufacturers introducing innovative varieties to cater to diverse consumer preferences.

U.K. Bean Pasta Market Insight

The U.K. bean pasta market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing consumer inclination toward healthier and sustainable food choices. Rising concerns over obesity, gluten intolerance, and protein deficiency are encouraging both households and restaurants to adopt bean pasta. The robust e-commerce ecosystem, combined with widespread retail availability, is expected to continue driving market expansion.

Germany Bean Pasta Market Insight

The Germany bean pasta market is expected to witness the fastest growth rate from 2026 to 2033, attributed to growing consumer awareness of nutritional diets and preference for plant-based proteins. The country’s well-established food retail network, along with innovative product launches by domestic and international brands, is promoting the adoption of bean pasta. Integration into meal plans and ready-to-cook solutions further supports growth, especially in urban areas with busy lifestyles.

Asia-Pacific Bean Pasta Market Insight

The Asia-Pacific bean pasta market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and growing health consciousness in countries such as China, India, and Japan. The region's expanding awareness of protein-rich, gluten-free diets and the emergence of health-focused food brands are boosting adoption. Furthermore, the growing presence of e-commerce platforms and modern retail chains is making bean pasta more accessible to a wider consumer base.

Japan Bean Pasta Market Insight

The Japan bean pasta market is expected to witness the fastest growth rate from 2026 to 2033 due to high consumer preference for nutritious, convenient, and plant-based foods. The Japanese market emphasizes dietary health and balanced nutrition, fueling demand for bean pasta varieties. Innovations in taste, texture, and portion-controlled packaging are driving adoption in both households and restaurants. The aging population is also expected to boost demand for easily digestible and protein-rich food alternatives.

China Bean Pasta Market Insight

The China bean pasta market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, rising middle-class population, and increased health awareness. China’s expanding retail and e-commerce infrastructure, combined with growing adoption of plant-based diets, is driving the popularity of bean pasta. Local manufacturing capabilities and innovative product launches, including lentil, chickpea, and black bean pasta, are further supporting market growth across residential and foodservice sectors.

Bean Pasta Market Share

The Bean Pasta industry is primarily led by well-established companies, including:

- Pedon SpA (Italy)

- LIVIVA (U.K.)

- The Only Bean (U.S.)

- NutriNoodle (U.S.)

- Bellabondonza (U.K.)

- Natural Health Organics (U.K.)

- Ekowarehouse Ltd. (U.K.)

- Hearthside Food Solutions LLC (U.S.)

- S R FOODS (India)

- Hebei Abiding Co., Ltd (China)

- Agastya Nutri Food (India)

- BIG FOODS PRIVATE LIMITED (India)

- United Agro Industries (India)

- MAX SPORT s.r.o. (Czech Republic)

- Choice Food of America, Inc. (U.S.)

- Pasta Foods Ltd (U.K.)

- DR TK FOODS PVT.LTD. (India)

- Conagra Brands, Inc. (U.S.)

- Kazidomi (Canada)

- Explore Cuisine (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bean Pasta Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bean Pasta Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bean Pasta Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.