Global Bean To Bar Chocolate Market

Market Size in USD Billion

CAGR :

%

USD

14.60 Billion

USD

34.15 Billion

2024

2032

USD

14.60 Billion

USD

34.15 Billion

2024

2032

| 2025 –2032 | |

| USD 14.60 Billion | |

| USD 34.15 Billion | |

|

|

|

|

Bean-To-Bar Chocolate Market Size

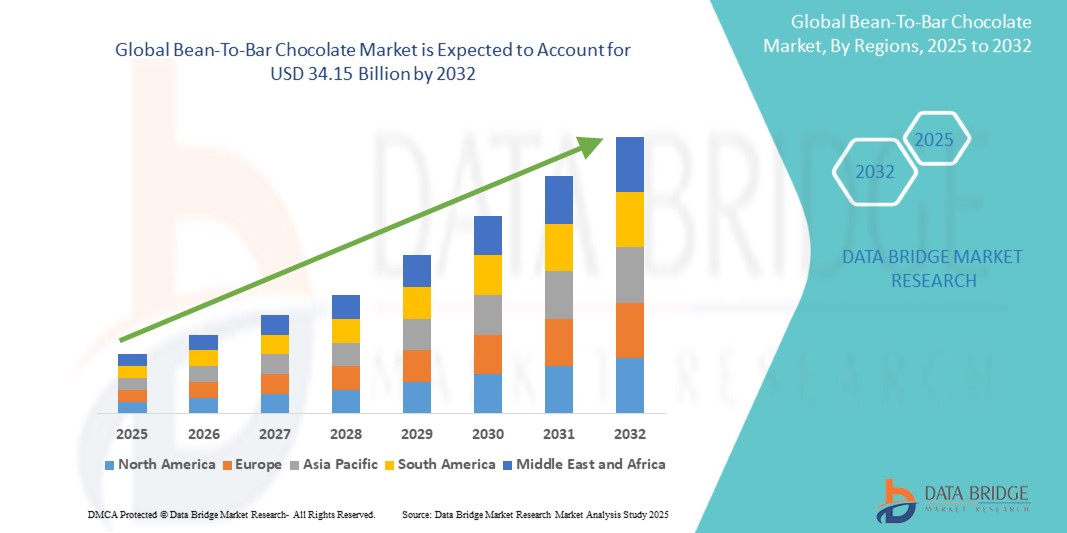

- The global bean-to-bar chocolate market was valued at USD 14.60 billion in 2024 and is expected to reach USD 34.15 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.20%, primarily driven by increasing consumer demand for premium, organic, and ethically sourced chocolates

- This growth is driven by rising awareness about sustainable cocoa farming practices and growing preferences for artisanal and craft chocolates over mass-produced alternatives

Bean-To-Bar Chocolate Market Analysis

- The bean-to-bar chocolate market has gained significant popularity due to increasing consumer demand for premium, ethically sourced chocolates, rising awareness of sustainable cocoa farming, and the growing preference for artisanal and craft chocolates over mass-produced alternatives. Its rich flavor profiles and unique production methods play a crucial role in attracting chocolate enthusiasts and health-conscious consumers

- The market is primarily driven by expanding applications in organic and fair-trade certifications, increasing investments in direct trade partnerships, and advancements in bean processing techniques. In addition, growing research validating the health benefits of dark chocolate is further accelerating market expansion

- Europe dominates the Bean-To-Bar Chocolate market due to its long-standing chocolate-making tradition, strong consumer preference for high-quality handcrafted chocolates, and rising demand for sustainable cocoa sourcing

- For instance, in Switzerland and Belgium, the demand for Bean-To-Bar Chocolate is increasing due to growing awareness of ethical cocoa sourcing and transparent supply chains, contributing to sustained market expansion

- Globally, Bean-To-Bar Chocolate remains a key player in the premium chocolate segment, with innovations such as single-origin chocolates, low-sugar formulations, and unique flavor infusions driving industry transformation and supporting the shift toward high-quality, artisanal confections

Report Scope and Bean-To-Bar Chocolate Market Segmentation

|

Attributes |

Bean-To-Bar Chocolate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Bean-To-Bar Chocolate Market Trends

“Rising Demand for Premium and Ethically Sourced Chocolates”

- The increasing consumer preference for high-quality, artisanal chocolates is driving demand for Bean-To-Bar Chocolate, known for its ethical sourcing and unique flavor profiles

- Chocolate manufacturers are focusing on direct trade partnerships, organic certifications, and transparent supply chains to cater to ethically conscious consumers

- The rising focus on sustainability, fair-trade cocoa, and small-batch production is accelerating the adoption of Bean-To-Bar Chocolate across global markets

For instance,

- In June 2024, Lindt & Sprüngli introduced a single-origin dark chocolate collection, emphasizing traceable cocoa sourcing and bean fermentation techniques

- In February 2024, Raaka Chocolate launched a limited-edition stone-ground cacao bar, reflecting the growing demand for unroasted, minimally processed chocolates

- In September 2023, Dandelion Chocolate expanded its direct trade cocoa network, ensuring fair pricing and sustainable farming practices for its handcrafted bars

- As the demand for authentic, craft chocolates continues to grow, the incorporation of sustainable sourcing, transparent labeling, and innovative flavor infusions will expand, meeting consumer expectations for premium chocolate experiences

Bean-To-Bar Chocolate Market Dynamics

Driver

“Expansion of Direct Trade and Farm-to-Bar Initiatives”

- Chocolate makers are increasingly sourcing cocoa beans directly from farmers, ensuring higher profit margins for growers and better-quality control for producers

- Shoppers prefer farm-to-bar chocolates, valuing direct trade relationships that ensure transparency and fair compensation for farmers

- Companies are adopting blockchain technology and other traceability measures to verify ethical sourcing and reduce supply chain inefficiencies

For instance,

- In 2023, Dandelion Chocolate expanded its direct trade program, strengthening partnerships with cocoa farmers in Belize and the Philippines

- In 2022, Beyond Good built a chocolate factory in Madagascar, working directly with local farmers to cut out intermediaries and improve wages

- As direct trade and farm-to-bar models gain traction, brands that integrate transparency and sustainability into their supply chains will experience higher consumer trust and brand loyalty

Opportunity

“Expanding Market for Vegan and Plant-Based Bean-to-Bar Chocolate”

- Consumers, especially those with lactose intolerance or following vegan diets, seek high-quality dairy-free chocolates

- Brands are innovating with oat milk, almond milk, and coconut milk to create creamy textures without dairy

- Vegan chocolates align with the growing demand for sustainability, as they reduce carbon footprint compared to dairy-based options

For instance,

- In 2023, Lindt expanded its vegan Excellence line, using oat milk to maintain a creamy texture

- In 2022, Hu Kitchen introduced vegan, bean-to-bar chocolates made with organic cacao and coconut sugar, targeting health-conscious consumers

- The vegan bean-to-bar chocolate segment is expected to grow significantly, driven by health-conscious consumers and the rise of plant-based diets. Brands investing in dairy alternatives and ethical positioning will capture a loyal customer base

Restraint/Challenge

“Supply Chain Disruptions and Limited Access to High-Quality Cocoa Beans”

- The increasing global demand for Bean-To-Bar Chocolate has intensified challenges in securing premium cocoa beans, leading to supply chain disruptions and fluctuating production costs

- Climate change, deforestation, and inconsistent harvesting cycles affect the yield and quality of cocoa beans, impacting market stability and pricing

- Heavy reliance on West Africa and Latin America for cocoa bean sourcing creates logistical constraints, price volatility, and ethical concerns related to child labor and fair trade practices

For instance,

- In March 2024, the Ivory Coast government introduced stricter sustainability regulations, affecting cocoa exports and raising production costs for Bean-To-Bar Chocolate manufacturers

- In October 2023, severe droughts in Ghana led to a 15% drop in cocoa yields, causing raw material shortages for premium chocolate brands

- In June 2022, rising shipping costs and port delays in Latin America disrupted supply chains, increasing transportation expenses for chocolate makers

- To address these challenges, companies must diversify sourcing regions, invest in climate-resilient cocoa farming, and strengthen ethical supply chain partnerships to ensure long-term sustainability in the Bean-To-Bar Chocolate market

Bean-To-Bar Chocolate Market Scope

The market is segmented on the basis of type and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

Bean-To-Bar Chocolate Market Regional Analysis

“Europe is the Dominant Region in the Bean-To-Bar Chocolate Market”

- Europe leads the global Bean-To-Bar Chocolate market, driven by increasing consumer demand for premium artisanal chocolates, rising awareness of ethical sourcing, and expanding applications in luxury confectionery

- France, Belgium, and Switzerland dominate the region due to their strong chocolate-making traditions, a well-established craft chocolate industry, and increasing investments in bean-to-bar production

- Supportive regulatory frameworks, advancements in cocoa processing technology, and growing awareness about sustainable farming practices have further strengthened market growth

- In addition, the presence of major artisanal chocolate brands, expanding direct-to-consumer sales, and increasing consumer spending on high-quality chocolates contribute to the region’s market dominance

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the Bean-To-Bar Chocolate market, driven by increasing demand for premium artisanal chocolates, growing consumer preference for ethically sourced cocoa, and rising awareness of sustainable chocolate production

- India and China are emerging as key markets due to strong government support for cocoa farming initiatives, increasing investments in craft chocolate brands, and expanding exports of single-origin chocolate products

- India leads the region in Bean-To-Bar Chocolate production, with significant investments in organic cocoa farming and the rising adoption of direct trade practices to ensure high-quality yields

- China is witnessing strong market growth due to increasing research in fermentation techniques, rising demand for luxury chocolates, and growing consumer trust in premium handcrafted confections

- Expanding e-commerce platforms, strategic collaborations between chocolate makers and cocoa farmers, and rising global demand for authentic bean-to-bar products further contribute to Asia-Pacific’s market expansion

Bean-To-Bar Chocolate Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- THE HERSHEY COMPANY (U.S.)

- Nestlé (Switzerland)

- Mondelez International (U.S.)

- Chocoladefabriken Lindt & Sprüngli AG (Switzerland)

- Lotte India (India)

- Blommer Chocolate Company (U.S.)

- Ferrero (Italy)

- GODIVA (Belgium)

- TCHO (U.S.)

- Endangered Species Chocolate (U.S.)

- Taza Chocolate (U.S.)

- Stivii Corp (U.S.)

- Alter Eco Foods (U.S.)

- NuGo Nutrition (U.S.)

- Dr. Oetker (Germany)

- The J.M. Smucker Company (U.S.)

- Nutkao Srl (Italy)

- Kickstarter, PBC (U.S.)

Latest Developments in Global Bean-To-Bar Chocolate Market

- In October 2024, Döhler, a German food manufacturing specialist, invested in Nukoko's bean-to-bar cocoa-free chocolate, aiming to scale up production ahead of its planned market launch in 2025

- In July 2022, Blue Gourmet, an India-based company, announced plans to launch a new bean-to-bar chocolate in September. With operations in Kerala, the company benefits from a geographical advantage, ensuring quality control from the cocoa-growing stage

- In April 2022, Whole Truth Foods introduced dark bean-to-bar chocolate sweetened with dates, made using locally sourced cocoa and Non-GMO dates

- In April 2022, The Whole Truth Foods (TWT) launched India’s first dark chocolate sweetened ONLY with dates, establishing its in-house bean-to-bar chocolate factory in Mumbai

- In July 2021, Latitude Craft Chocolate, a certified B Corporation producing chocolate in Uganda, partnered with U.S. distributor Bar & Cocoa to expand its market presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BEAN-TO-BAR CHOCOLATE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL BEAN-TO-BAR CHOCOLATE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 NEW PRODUCT LAUNCH STRATEGY

5.3.1 NUMBER OF NEW PRODUCT LAUNCH

5.3.1.1. LINE EXTENSION

5.3.1.2. NEW PACKAGING

5.3.1.3. RE-LAUNCHED

5.3.1.4. NEW FORMULATION

5.3.2 DIFFERENTIAL PRODUCT OFFERING

5.3.3 MEETING CONSUMER REQUIREMENTS

5.3.4 PACKAGE DESIGNING

5.3.5 PRICING ANALYSIS

5.3.6 PRODUCT POSITIONING

5.4 LABELING AND CLAIMS

5.5 FACTORS INFLUENCING THE PURCHASE

5.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

6 REGULATORY FRAMEWORK AND GUIDELINES

7 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET BY TYPE

7.1 OVERVIEW

7.2 DARK CHOCOLATE

7.3 MILK CHOCOLATE

7.4 WHITE CHOCOLATE

7.5 OTHERS

8 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET BY CATEGORY

8.1 OVERVIEW

8.2 ORGANIC

8.3 CONVENTIONAL

9 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET BY FORTIFICATION

9.1 OVERVIEW

9.2 REGULAR

9.3 FORTIFIED

10 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET, BY NATURE

10.1 OVERVIEW

10.2 GMO

10.3 NON-GMO

11 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET, BY PACKAGING SIZE

11.1 OVERVIEW

11.2 250 ML

11.3 500ML

11.4 750 ML

11.5 1000 ML

11.6 OTHERS

12 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 SUPERMARKETS/HYPERMARKETS

12.2.2 GROCERY STORES

12.2.3 CONVENIENCE STORES

12.2.4 SPECIALITY STORES

12.2.5 OTHERS

12.3 NON-STORE RETAILERS

12.3.1 VENDING MACHINE

12.3.2 ONLINE STORES

13 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS & PARTNERSHIP

13.8 REGULATORY CHANGES

14 SWOT AND DBMR ANALYSIS, GLOBAL BEAN-TO-BAR CHOCOLATE MARKET

15 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET, BY GEOGRAPHY

15.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE ISREPRESENTEDD IN THIS CHAPTER BY COUNTRY)

15.3 NORTH AMERICA

15.3.1 U.S.

15.3.2 CANADA

15.3.3 MEXICO

15.4 EUROPE

15.4.1 GERMANY

15.4.2 U.K.

15.4.3 ITALY

15.4.4 FRANCE

15.4.5 SPAIN

15.4.6 SWITZERLAND

15.4.7 NETHERLANDS

15.4.8 BELGIUM

15.4.9 RUSSIA

15.4.10 DENMARK

15.4.11 SWEDEN

15.4.12 POLAND

15.4.13 TURKEY

15.4.14 REST OF EUROPE

15.5 ASIA-PACIFIC

15.5.1 JAPAN

15.5.2 CHINA

15.5.3 SOUTH KOREA

15.5.4 INDIA

15.5.5 AUSTRALIA

15.5.6 SINGAPORE

15.5.7 THAILAND

15.5.8 INDONESIA

15.5.9 MALAYSIA

15.5.10 PHILIPPINES

15.5.11 NEW ZEALAND

15.5.12 VIETNAM

15.5.13 REST OF ASIA-PACIFIC

15.6 SOUTH AMERICA

15.6.1 BRAZIL

15.6.2 ARGENTINA

15.6.3 REST OF SOUTH AMERICA

15.7 MIDDLE EAST AND AFRICA

15.7.1 SOUTH AFRICA

15.7.2 UAE

15.7.3 SAUDI ARABIA

15.7.4 OMAN

15.7.5 QATAR

15.7.6 KUWAIT

15.7.7 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET, SWOT & DBMR ANALYSIS

17 GLOBAL BEAN-TO-BAR CHOCOLATE MARKET, COMPANY PROFILE

17.1 THE HERSHEY COMPANY

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHICAL PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 NESTLÉ GROUP

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHICAL PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 MONDELĒZ INTERNATIONAL.

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHICAL PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHICAL PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 LOTTE INDIA.

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHICAL PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 BLOMMER CHOCOLATE COMPANY

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHICAL PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 FERRERO

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHICAL PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 GODIVA

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHICAL PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 TCHO VENTURES, INC.

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHICAL PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 ENDANGERED SPECIES CHOCOLATE, LLC.

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHICAL PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 LINDTUSA

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHICAL PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 TAZA CHOCOLATE.

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHICAL PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 STIVII CORP

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHICAL PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 ALTER ECO

17.14.1 COMPANY OVERVIEW

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHICAL PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 NUGO NUTRITION

17.15.1 COMPANY OVERVIEW

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHICAL PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 DR. OETKER INDIA PVT LTD

17.16.1 COMPANY OVERVIEW

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHICAL PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 THE J.M. SMUCKER COMPANY

17.17.1 COMPANY OVERVIEW

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHICAL PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

17.18 NUTKAO S.R.L.

17.18.1 COMPANY OVERVIEW

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHICAL PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENTS

17.19 KICKSTARTER

17.19.1 COMPANY OVERVIEW

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHICAL PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENTS

17.2 PACARI

17.20.1 COMPANY OVERVIEW

17.20.2 REVENUE ANALYSIS

17.20.3 GEOGRAPHICAL PRESENCE

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 CONCLUSION

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.