Global Bed Monitoring System And Baby Monitoring System Market

Market Size in USD Million

CAGR :

%

USD

812.35 Million

USD

1,417.83 Million

2025

2033

USD

812.35 Million

USD

1,417.83 Million

2025

2033

| 2026 –2033 | |

| USD 812.35 Million | |

| USD 1,417.83 Million | |

|

|

|

|

Bed Monitoring System and Baby Monitoring System Market Size

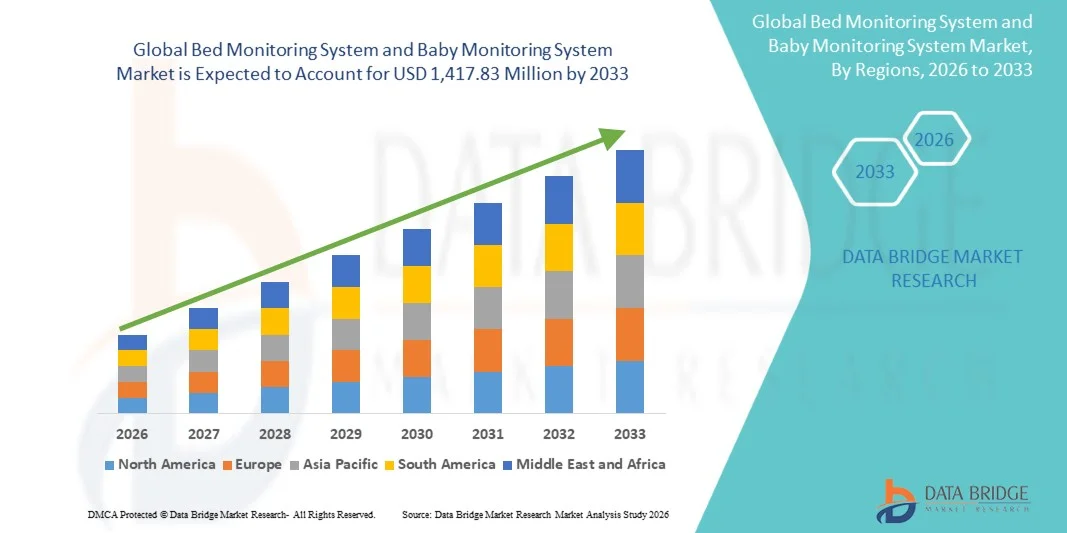

- The global bed monitoring system and baby monitoring system market size was valued at USD 812.35 million in 2025 and is expected to reach USD 1,417.83 million by 2033, at a CAGR of 7.21% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within AI‑ and IoT‑enabled monitoring devices, leading to increased digitalization in both home-care and childcare settings

- Furthermore, rising consumer demand for secure, user-friendly, and real-time monitoring solutions for infants and elderly individuals is establishing bed and baby monitoring systems as the modern choice for home and healthcare safety

Bed Monitoring System and Baby Monitoring System Market Analysis

- Bed and baby monitoring systems, offering real-time monitoring of vital signs, sleep patterns, and movement for infants and elderly individuals, are increasingly vital components of modern home-care and childcare solutions in both residential and healthcare settings due to their enhanced safety, remote access capabilities, and seamless integration with connected home and healthcare ecosystems

- The escalating demand for bed and baby monitoring systems is primarily fueled by the growing adoption of AI- and IoT-enabled monitoring devices, increasing awareness of infant and elderly safety, and a rising preference for convenient, remote monitoring solutions

- North America dominated the bed and baby monitoring system market with the largest revenue share of 40.6% in 2025, characterized by early adoption of smart healthcare devices, high disposable incomes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in both home-care and infant monitoring solutions, driven by innovations from established medical device companies and tech startups focusing on AI, remote monitoring, and wearable integration

- Asia-Pacific is expected to be the fastest growing region in the bed and baby monitoring system market during the forecast period due to increasing urbanization, rising disposable incomes, and greater awareness of infant and elderly safety

- Baby monitors segment dominated the market with a market share of 45.2% in 2025, driven by its established reputation for infant safety, ease of use, and integration with smartphones and smart home devices

Report Scope and Bed Monitoring System and Baby Monitoring System Market Segmentation

|

Attributes |

Bed Monitoring System and Baby Monitoring System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Bed Monitoring System and Baby Monitoring System Market Trends

“Enhanced Convenience Through AI and Remote Monitoring Integration”

- A significant and accelerating trend in the global bed and baby monitoring system market is the deepening integration with artificial intelligence (AI) and remote monitoring technologies via smartphones and cloud platforms. This fusion of technologies is significantly enhancing user convenience and real-time health tracking

- For instance, the Nanit Pro Baby Monitor integrates AI-powered sleep tracking with smartphone notifications, allowing caregivers to monitor infants remotely. Similarly, EarlySense Live Bed Sensor enables continuous vital-sign monitoring for elderly individuals in healthcare and home settings

- AI integration in monitoring systems enables features such as learning user or patient sleep and movement patterns to provide predictive alerts and personalized recommendations. For instance, Owlet Smart Sock utilizes AI to monitor infant oxygen levels and sleep patterns, sending notifications if unusual activity is detected. Furthermore, smartphone connectivity allows caregivers to access real-time data and alerts from anywhere, enhancing convenience and safety

- The seamless integration of bed and baby monitoring systems with smartphones, tablets, and broader smart home or healthcare platforms facilitates centralized monitoring of multiple health parameters. Through a single interface, users can track sleep quality, heart rate, breathing, and movement, creating a unified and automated care experience

- This trend towards more intelligent, intuitive, and interconnected monitoring solutions is fundamentally reshaping caregiver expectations for home and healthcare safety. Consequently, companies such as Snuza and Miku are developing AI-enabled monitors with features such as automatic alerts, pattern recognition, and remote data access via smartphone apps

- The demand for monitoring systems that offer seamless AI and remote access integration is growing rapidly across both home-care and childcare sectors, as consumers increasingly prioritize convenience, real-time oversight, and comprehensive monitoring functionality

Bed Monitoring System and Baby Monitoring System Market Dynamics

Driver

“Growing Need Due to Rising Safety Concerns and Adoption of Smart Health Devices”

- The increasing prevalence of infant and elderly safety concerns, coupled with the accelerating adoption of AI- and IoT-enabled monitoring devices, is a significant driver for the heightened demand for bed and baby monitoring systems

- For instance, in March 2025, Owlet announced an update to its Smart Sock 4.0, integrating improved AI algorithms for more accurate oxygen and heart rate tracking, which is expected to drive market growth in the forecast period

- As caregivers become more aware of potential health risks and seek enhanced protection for infants or elderly individuals, monitoring systems offer advanced features such as real-time alerts, historical trend analysis, and predictive notifications, providing a compelling upgrade over traditional analog monitors

- Furthermore, the growing popularity of connected healthcare devices and desire for centralized monitoring are making these systems an integral component of home-care and childcare solutions, offering seamless integration with smartphones and cloud platforms

- The convenience of remote monitoring, automated alerts for unusual activity, and the ability to track multiple parameters in real time are key factors propelling the adoption of bed and baby monitoring systems across residential and healthcare sectors. The trend towards user-friendly devices and app-based management further contributes to market growth

Restraint/Challenge

“Connectivity Concerns and Affordability Hurdles”

- Concerns surrounding the reliability and security of connected monitoring devices pose a significant challenge to broader market penetration. As these systems rely on network connectivity and software, they are susceptible to technical failures and potential data privacy issues, raising anxieties among caregivers

- For instance, reports of Wi-Fi disruptions causing temporary loss of real-time alerts have made some consumers hesitant to adopt AI-enabled monitoring systems for infants or elderly care

- Addressing these connectivity and privacy concerns through robust encryption, secure data protocols, and reliable wireless performance is crucial for building consumer trust. Companies such as Nanit and EarlySense emphasize secure cloud storage and encrypted transmission in their marketing to reassure potential buyers. In addition, the relatively high cost of advanced monitoring systems compared to traditional monitors can be a barrier for price-sensitive consumers, particularly in developing regions or for budget-conscious households

- While more affordable models from brands such as Snuza have become available, premium features such as AI-powered predictive alerts, comprehensive sleep analysis, or multi-parameter monitoring often come at a higher price

- Overcoming these challenges through enhanced connectivity, data security measures, consumer education on safe device usage, and the development of more affordable AI-enabled monitoring solutions will be vital for sustained market growth

Bed Monitoring System and Baby Monitoring System Market Scope

The market is segmented on the basis of type and end-users.

- By Type

On the basis of type, the bed and baby monitoring system market is segmented into baby monitor, pressure ulcer monitor, elderly monitor, and sleep monitor. The baby monitor segment dominated the market with the largest market revenue share of 45.2% in 2025, driven by the rising demand for infant safety and remote caregiving. Parents increasingly prefer baby monitors to track vital signs, sleep patterns, and movement, providing peace of mind when they are not physically present. The integration of AI and smartphone connectivity in these devices has further enhanced their popularity, allowing real-time alerts and trend analysis. The segment also benefits from high adoption in urban areas, where both parents often juggle work and childcare responsibilities. Technological advancements such as audio/video monitoring, breathing sensors, and mobile notifications continue to drive strong consumer preference. Moreover, the availability of a wide range of products catering to different price points makes baby monitors a core subsegment within the market.

The elderly monitor segment is anticipated to witness the fastest growth rate of 20.8% from 2026 to 2033, fueled by the rising aging population and growing awareness of elderly care. These devices monitor vital signs, movement, and potential fall incidents, enabling real-time alerts to caregivers or healthcare providers. Integration with wearable devices, smartphones, and cloud-based monitoring platforms enhances the utility of elderly monitors, especially in home-care and assisted living environments. Increasing adoption in nursing homes and hospitals is further accelerating growth, driven by government initiatives promoting elderly safety and independent living. The growing need for preventive care, coupled with higher disposable incomes, encourages adoption of advanced monitoring solutions. Furthermore, the segment benefits from continuous innovations such as AI-powered predictive alerts and multi-parameter monitoring capabilities, making it a rapidly expanding category in the market.

- By End-Users

On the basis of end-users, the bed and baby monitoring system market is segmented into home care, hospitals, and nursing home & assisted living facilities. The home care segment dominated the market in 2025, driven by the increasing adoption of monitoring solutions among parents and caregivers for infants, as well as elderly individuals. Home-based monitoring provides convenience, real-time alerts, and enhanced safety without the need for constant physical supervision. Parents and family members increasingly rely on AI-enabled devices to track sleep patterns, breathing, and movement in infants, while home caregivers use similar technologies for elderly individuals. The growing penetration of connected smartphones and cloud-enabled monitoring apps has strengthened this segment’s market position. Moreover, the rising awareness of preventive healthcare and the desire for convenience are key factors maintaining its dominance.

The hospitals segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the rising demand for patient monitoring and real-time health analytics in healthcare facilities. Hospitals leverage bed and patient monitoring systems to improve care quality, reduce medical errors, and optimize workflow efficiency. These systems enable staff to remotely track multiple parameters simultaneously, facilitating proactive interventions. The integration of AI for predictive analytics, cloud connectivity, and automated alerts enhances operational efficiency. Increasing healthcare investments, expanding hospital networks, and the growing trend of smart hospital adoption are expected to propel growth. In addition, hospitals are focusing on advanced monitoring solutions for high-risk patients, further supporting the rapid adoption of these technologies.

Bed Monitoring System and Baby Monitoring System Market Regional Analysis

- North America dominated the bed and baby monitoring system market with the largest revenue share of 40.6% in 2025, characterized by early adoption of smart healthcare devices, high disposable incomes, and a strong presence of key industry players

- Consumers in the region highly value the convenience, real-time alerts, and seamless integration offered by monitoring systems with smartphones, tablets, and smart home or healthcare platforms

- This widespread adoption is further supported by high disposable incomes, a tech-savvy population, and the growing preference for remote caregiving and monitoring, establishing bed and baby monitoring systems as a preferred solution for both home care and healthcare facilities

U.S. Bed Monitoring System and Baby Monitoring System Market Insight

The U.S. Bed Monitoring System and Baby Monitoring System Market captured the largest revenue share of 82% in 2025 within North America, fueled by the rapid adoption of AI- and IoT-enabled monitoring devices and the growing trend of remote caregiving. Consumers are increasingly prioritizing infant safety and elderly care through real-time, connected monitoring solutions. The rising preference for home-based monitoring setups, combined with strong demand for smartphone integration and cloud-based notifications, further propels the market. Moreover, the increasing integration of monitoring systems with smart home and healthcare platforms, allowing real-time alerts and trend analysis, is significantly contributing to market expansion.

Europe Bed Monitoring System and Baby Monitoring System Market Insight

The Europe Bed Monitoring System and Baby Monitoring System Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of infant and elderly safety and the growing adoption of connected health devices. Urbanization, coupled with an increasing preference for smart home healthcare solutions, is fostering the adoption of monitoring systems. European consumers are drawn to the convenience, real-time alerts, and preventive care benefits these devices offer. The region is experiencing significant growth across home care, hospitals, and assisted living facilities, with monitoring systems being integrated into both new homes and renovated residences.

U.K. Bed Monitoring System and Baby Monitoring System Market Insight

The U.K. Bed Monitoring System and Baby Monitoring System Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing trend of home-based caregiving and a desire for enhanced safety and convenience. Concerns regarding infant health, elderly fall risks, and preventive care are encouraging both households and care facilities to adopt connected monitoring solutions. The U.K.’s robust healthcare infrastructure and high digital literacy, alongside strong e-commerce penetration for smart healthcare devices, are expected to continue stimulating market growth.

Germany Bed Monitoring System and Baby Monitoring System Market Insight

The Germany Bed Monitoring System and Baby Monitoring System Market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of infant and elderly safety and the adoption of technologically advanced monitoring solutions. Germany’s emphasis on innovation, infrastructure development, and sustainability promotes the uptake of connected monitoring devices in residential and healthcare facilities. Integration with smart home and hospital automation systems is becoming increasingly common, with a strong preference for secure, reliable, and privacy-focused monitoring aligning with local consumer expectations.

Asia-Pacific Bed Monitoring System and Baby Monitoring System Market Insight

The Asia-Pacific Bed Monitoring System and Baby Monitoring System Market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by rising urbanization, increasing disposable incomes, and advancements in AI- and IoT-enabled monitoring technologies in countries such as China, Japan, and India. The region’s growing inclination toward smart homes and connected healthcare solutions, supported by government initiatives promoting digitalization and preventive care, is driving adoption. In addition, APAC’s emergence as a manufacturing hub for smart monitoring devices is improving affordability and accessibility, expanding the consumer base.

Japan Bed Monitoring System and Baby Monitoring System Market Insight

The Japan Bed Monitoring System and Baby Monitoring System Market is gaining momentum due to the country’s high-tech culture, urbanization, and demand for convenient, real-time monitoring solutions. The Japanese market places significant emphasis on infant and elderly safety, and adoption is driven by the growing number of smart homes and connected care facilities. Integration of monitoring systems with IoT devices, smartphones, and alert platforms is fueling growth. Moreover, Japan’s aging population is expected to further drive demand for easier-to-use, secure monitoring solutions in both residential and healthcare sectors.

India Bed Monitoring System and Baby Monitoring System Market Insight

The India Bed Monitoring System and Baby Monitoring System Market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the expanding middle class, rapid urbanization, and high rates of technological adoption. India is emerging as a key market for smart home and healthcare monitoring devices, with growing demand in residential, hospital, and assisted living applications. Government initiatives supporting smart cities, coupled with the availability of affordable monitoring devices and strong domestic manufacturing, are key factors propelling market growth in India.

Bed Monitoring System and Baby Monitoring System Market Share

The Bed Monitoring System and Baby Monitoring System industry is primarily led by well-established companies, including:

- Owlet Baby Care, Inc., (U.S.)

- Nanit (U.S.)

- VTech Holdings Ltd. (Hong Kong)

- Angelcare Monitors Inc. (Canada)

- Hubble Connected (U.S.)

- Infant Optics (U.S.)

- iBaby Labs, Inc. (U.S.)

- Summer Infant, Inc. (U.S.)

- Motorola Mobility LLC (U.S.)

- Arlo Technologies, Inc (U.S.)

- Hisense Ltd. (China)

- Withings (France)

- Snuza (South Africa)

- Cubo AI (Taiwan)

- Lorex Technology Inc. (Canada)

- BabySense (Israel)

- Dorel Industries Inc. (Canada)

- Lollipop (Taiwan)

- Samsung Electronics Co., Ltd. (South Korea)

What are the Recent Developments in Global Bed Monitoring System and Baby Monitoring System Market?

- In October 2025, Owlet revealed that its newest video monitoring device, Dream Sight, became the first baby monitor to receive the SGS Cybersecurity Mark reflecting the highest international standards in cybersecurity and data privacy. Dream Sight supports 2K HD video streaming (with night vision), motion and sound detection, two‑way audio, temperature and humidity tracking, and, when paired with Dream Sock, provides live wellness data

- In September 2024, Owlet announced expanded availability of its medically-certified Dream Sock across several European countries, including Poland, Greece, and the Czech Republic. This expansion after CE and UKCA marking under EU and UK medical device regulations broadened access to medically certified infant monitoring technology in new geographies, indicating global scaling and growing demand for such devices

- In January 2024, Owlet formally launched two FDA‑cleared devices Dream Sock and BabySat making at‑home, medical‑grade infant monitoring broadly available. BabySat is the first prescription‑based pulse‑oximetry sock aimed at infants with acute or chronic medical conditions; it allows customizing alarm thresholds for oxygen saturation and pulse rate under physician supervision

- In November 2023, Owlet announced that its Dream Sock became the first and only over‑the‑counter infant pulse‑oximeter with a formal clearance under U.S. Food and Drug Administration (FDA) De Novo classification. The Dream Sock monitors a baby’s live health readings pulse rate and oxygen saturation and delivers real‑time health notifications. The clearance reflects that the device was clinically tested in both hospital and home environments and validated for medical‑grade accuracy

- In September 2023, VTech launched the V-Care VC2105 Smart Nursery Baby Monitor a Wi‑Fi video baby monitor with on‑device AI capabilities for sleep analytics, face detection, rollover detection, and danger‑zone alerts. The product offers both a physical parent‑unit display and remote monitoring via smartphone, aiming to give parents better insight into infant sleep behavior and safety. This launch underscores growing interest in smart‑monitoring devices beyond traditional audio/video monitors, emphasizing AI‑enabled features for improved safety and user convenience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.