Global Beer Mug Market

Market Size in USD Billion

CAGR :

%

USD

13.62 Billion

USD

23.40 Billion

2024

2032

USD

13.62 Billion

USD

23.40 Billion

2024

2032

| 2025 –2032 | |

| USD 13.62 Billion | |

| USD 23.40 Billion | |

|

|

|

|

Beer Mug Market Size

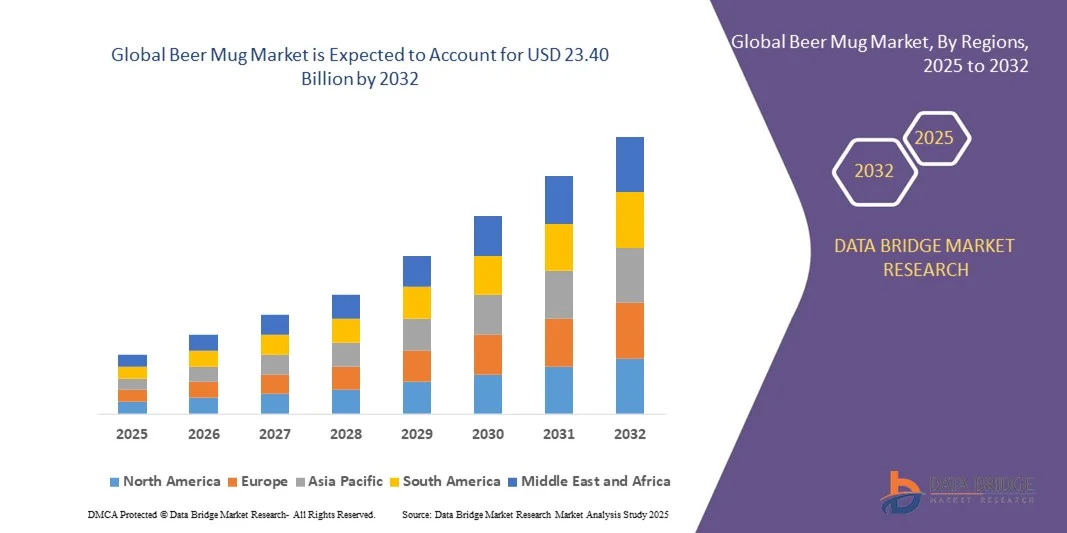

- The global beer mug market size was valued at USD 13.62 billion in 2024 and is expected to reach USD 23.40 billion by 2032, at a CAGR of 7.0% during the forecast period

- The market growth is largely fueled by increasing consumer preference for at-home drinking experiences, rising disposable incomes, and the expanding craft beer culture, which is driving higher demand for premium and specialty beer mugs in both household and commercial settings

- Furthermore, growing investments by breweries, bars, and restaurants in branded, durable, and aesthetically appealing drinkware are creating new opportunities for beer mug manufacturers. These converging factors are accelerating product adoption across retail and hospitality channels, thereby significantly boosting the overall market growth

Beer Mug Market Analysis

- Beer mugs, used for serving and enjoying beer, are gaining prominence in both households and commercial establishments due to their functionality, durability, and ability to enhance the drinking experience. The demand is particularly strong for materials that offer thermal insulation, break-resistance, and stylish design

- The escalating demand for beer mugs is primarily driven by rising interest in craft beers, personalized and branded drinkware, and growing consumer inclination toward premium and experience-oriented beverage consumption. Increased awareness of sustainable and eco-friendly materials is further contributing to market expansion

- Asia-Pacific dominated beer mug market with a share of 44.5% in 2024, due to rising disposable incomes, expanding hospitality and brewery sectors, and increasing popularity of craft beer culture

- North America is expected to be the fastest growing region in the beer mug market during the forecast period due to rising craft beer culture, expanding bar and brewery sectors, and increasing at-home consumption

- Glass segment dominated the market with a market share of 43% in 2024, due to its clarity, ease of cleaning, and classic appeal among consumers. Glass beer mugs are preferred for their ability to showcase the beverage’s color and carbonation, enhancing the drinking experience. In addition, their compatibility with most commercial beverage services and widespread availability in both household and hospitality settings contributes to strong demand. Consumers also value glass for its affordability and recyclability, reinforcing its market dominance

Report Scope and Beer Mug Market Segmentation

|

Attributes |

Beer Mug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Beer Mug Market Trends

Rising Demand for Premium and Personalized Beer Mugs

- The global beer mug market is experiencing notable growth propelled by increasing consumer interest in premium, customizable, and aesthetically appealing drinking glassware. Growing preferences for elevated beverage presentation and unique designs have encouraged manufacturers to introduce innovative styles and finishes in beer mugs

- For instance, companies such as Libbey Inc. and Rastal GmbH have expanded their collections to include high-end handcrafted and laser-etched glass beer mugs. These designs cater to both hospitality businesses and individual consumers seeking premium and personalized drinking experiences

- Customization trends driven by personalization technologies, including laser engraving and decal printing, are significantly transforming the market landscape. Consumers are showing interest in bespoke designs featuring names, logos, or thematic graphics, particularly for gifting or event-related uses

- In addition, the expansion of brewpubs, craft breweries, and home brewing setups has fueled the demand for distinctive beer presentation options. Premium materials such as crystal glass, stainless steel, and eco-friendly alternatives are gaining traction owing to their durability and sophisticated visual appeal

- E-commerce platforms and direct-to-consumer sales channels have amplified accessibility to diverse beer mug varieties. Increasing global exposure to culture-driven beverage experiences is further encouraging consumers to collect custom glassware reflecting regional or brand-specific identities

- This rising shift toward luxury, personalization, and sustainable production underscores the evolving nature of the beer mug market. The combination of aesthetic value, consumer individuality, and sustainable craftsmanship is anticipated to reinforce the market’s long-term appeal in both residential and commercial segments

Beer Mug Market Dynamics

Driver

Growing Craft Beer Culture and At-Home Drinking Experiences

- The widespread popularity of craft beer and the growing trend of at-home social drinking occasions are major drivers boosting demand for beer mugs. Consumers are increasingly seeking high-quality, distinct glassware that enhances flavor and elevates the overall drinking experience

- For instance, companies such as Bormioli Rocco and Arc International have collaborated with breweries to design specialized beer glasses and mugs tailored to craft beer varieties. These partnerships improve product differentiation while promoting brand identity among craft brewers and consumers

- The proliferation of microbreweries, taprooms, and home brewing activities has created sustained demand for durable, functional, and ergonomically designed beer mugs. Product innovation aimed at emphasizing aroma retention and carbonation performance supports market momentum across different beverage segments

- In addition, the growing influence of beer festivals, tasting events, and online beer communities has increased consumer awareness about proper beer presentation. This awareness drives preference toward branded or uniquely shaped mugs corresponding to specific beer types

- As global consumers embrace premium drinking experiences at home and in hospitality settings, demand for both functional and decorative beer mugs continues to rise. The convergence of lifestyle enhancement, craft brewing expansion, and e-commerce accessibility is set to drive steady growth throughout the forecast period

Restraint/Challenge

Stringent Environmental and Safety Regulations for Materials

- The beer mug market faces significant challenges due to the tightening of environmental and material safety regulations. Manufacturers must comply with global standards governing lead content, recyclability, and production emissions, which increase operational costs and limit design flexibility

- For instance, under European Union REACH regulations and U.S. FDA guidelines, companies such as Libbey Inc. and Arc International must ensure that glass formulations, coatings, and decorative prints meet food contact safety norms. This compliance demands continuous testing and process verification throughout production

- The shift toward eco-friendly manufacturing techniques involves investment in cleaner melting technologies and sustainable raw materials such as lead-free glass and recycled cullet. These adjustments, while essential, increase production complexities and capital requirements for manufacturers

- In addition, balancing aesthetic appeal with durability and regulatory compliance can limit creative flexibility in design and color composition. The use of certain decorative enamels, heavy metals, or bonding agents is restricted, impacting traditional and artisanal glassmaking approaches

- To overcome these challenges, companies are investing in green production technologies and introducing eco-labeled, certified sustainable beer mugs. Collaborative efforts between regulatory bodies, industry associations, and manufacturers will be critical in ensuring safety compliance without compromising innovation and product quality in the market

Beer Mug Market Scope

The market is segmented on the basis of material, application, distribution channel, and capacity.

- By Material

On the basis of material, the beer mug market is segmented into glass, wood, stainless steel, metal, and ceramic. The glass segment dominated the market with the largest market revenue share of 43% in 2024, driven by its clarity, ease of cleaning, and classic appeal among consumers. Glass beer mugs are preferred for their ability to showcase the beverage’s color and carbonation, enhancing the drinking experience. In addition, their compatibility with most commercial beverage services and widespread availability in both household and hospitality settings contributes to strong demand. Consumers also value glass for its affordability and recyclability, reinforcing its market dominance.

The stainless steel segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand in outdoor, commercial, and premium settings. Stainless steel mugs are highly durable, resistant to breakage, and suitable for maintaining beverage temperature, making them ideal for bars, restaurants, and breweries. For instance, companies such as YETI and BrüMate are promoting insulated stainless steel beer mugs that combine durability with modern design aesthetics. The rise of craft beer culture and consumer preference for long-lasting, stylish drinkware further supports the growth of this segment.

- By Application

On the basis of application, the beer mug market is segmented into household and commercial. The household segment held the largest market revenue share in 2024, driven by the widespread adoption of at-home drinking culture and social gatherings. Consumers prefer owning versatile beer mugs suitable for casual use, entertaining guests, and personal collections. The convenience of easy-to-clean, aesthetically pleasing mugs for daily home use supports strong demand in this segment.

The commercial segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the expansion of bars, breweries, and restaurants globally. Commercial establishments require high-quality, durable, and design-forward mugs to enhance customer experience. For instance, companies such as Libbey and Rastal supply premium commercial beer mugs that combine brand recognition with functionality. Growing consumer demand for a premium drinking experience and barware innovation further accelerates the adoption of beer mugs in commercial spaces.

- By Distribution Channel

On the basis of distribution channel, the beer mug market is segmented into online and offline. The offline segment dominated the market with the largest revenue share in 2024, driven by the long-standing preference for in-store purchasing where consumers can physically examine quality, design, and weight. Specialty retail stores, kitchenware shops, and bars provide easy access to diverse beer mug designs, contributing to offline dominance. Consumer confidence in in-person purchases and the availability of branded collections reinforce the segment’s market share.

The online segment is expected to witness the fastest growth from 2025 to 2032, fueled by the convenience of e-commerce platforms and the rise of direct-to-consumer sales. Online channels offer a wider variety of materials, sizes, and premium collections, often with home delivery and personalized options. For instance, platforms such as Amazon and Wayfair have expanded their curated beer mug selections, increasing consumer adoption. The growing digital shopping trend, coupled with easy price comparison and product reviews, drives the rapid growth of online distribution.

- By Capacity

On the basis of capacity, the beer mug market is segmented into 2–13 fluid ounces, 14–20 fluid ounces, 21–35 fluid ounces, and 1 liter. The 14–20 fluid ounces segment dominated the market in 2024, driven by its optimal size for standard servings, household use, and bar service. This capacity balances portability with adequate volume for casual and social drinking occasions. Consumers prefer this range for its versatility across different beer types and serving contexts.

The 21–35 fluid ounces segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing popularity of large-format mugs for commercial and social events. Larger capacity mugs are ideal for draft beer service, beer festivals, and shared drinking experiences. For instance, companies such as Spiegelau and Durobor produce oversized beer mugs catering to both premium commercial establishments and beer enthusiasts. Rising consumer preference for immersive beer experiences and celebratory drinking occasions contributes to the rapid adoption of this capacity segment.

Beer Mug Market Regional Analysis

- Asia-Pacific dominated the beer mug market with the largest revenue share of 44.5% in 2024, driven by rising disposable incomes, expanding hospitality and brewery sectors, and increasing popularity of craft beer culture

- The region’s cost-effective manufacturing, growing domestic production of glassware and stainless steel mugs, and increasing exports are accelerating market expansion

- The availability of skilled labor, supportive government policies, and rapid urbanization across developing economies are contributing to higher consumption of beer mugs in both household and commercial settings

China Beer Mug Market Insight

China held the largest share in the Asia-Pacific beer mug market in 2024, owing to its robust manufacturing base, strong export capabilities, and active domestic hospitality industry. The country’s extensive production of glass and stainless steel mugs, combined with cost-efficient supply chains, supports high market demand. Rising urbanization, growing craft beer consumption, and increasing popularity of premium barware further strengthen China’s market position.

India Beer Mug Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding food and beverage industry, rising disposable income, and growing demand for home barware. Government initiatives promoting domestic manufacturing and small-scale breweries are supporting market expansion. In addition, increasing consumer preference for premium and aesthetically designed beer mugs is contributing to strong growth.

Europe Beer Mug Market Insight

The Europe beer mug market is expanding steadily, supported by high demand for premium barware, strong beer culture, and investments in hospitality and brewery sectors. The region emphasizes quality, design, and sustainability, particularly in glass and stainless steel mugs. Growing adoption of craft beer and specialty drinking experiences is further enhancing market growth.

Germany Beer Mug Market Insight

Germany’s beer mug market is driven by its deep-rooted beer culture, premium craftsmanship, and strong bar and brewery sectors. High-quality manufacturing standards, R&D in glass and metal drinkware, and a focus on design innovation are boosting demand. German consumers prefer durable and aesthetically appealing mugs, particularly for commercial and festive uses.

U.K. Beer Mug Market Insight

The U.K. market is supported by a mature hospitality industry, growing pub culture, and increasing interest in craft beers and home barware. Rising consumer preference for innovative and personalized beer mugs, along with strong retail and e-commerce distribution networks, continues to fuel market growth. Investments in premium and designer mugs are enhancing adoption across households and commercial establishments.

North America Beer Mug Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising craft beer culture, expanding bar and brewery sectors, and increasing at-home consumption. Strong demand for premium, insulated, and designer mugs is boosting growth. In addition, rising e-commerce penetration, growing disposable income, and innovative product launches by key players are supporting market expansion.

U.S. Beer Mug Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its large craft beer industry, strong e-commerce presence, and growing consumer interest in premium and insulated beer mugs. The country’s focus on innovation, design, and quality, along with strong retail networks and brand presence, strengthens its leadership position in the region.

Beer Mug Market Share

The beer mug industry is primarily led by well-established companies, including:

- Libbey (U.S.)

- Arc International (France)

- Bormioli Rocco S.p.A. (Italy)

- Sisecam (Turkey)

- Zhejiang Chengtai Industry Co., Ltd. (China)

- Duralex (U.S.)

- Shandong Huapeng Glass Co., Ltd. (China)

- RONA (Canada)

- Ocean Glass Public Company Limited (Thailand)

- Femora (Italy)

- Stölzle Oberglas GmbH (Germany)

- Union Glass Co., Ltd. (U.S.)

- Vetreria di Borgonovo Spa (Italy)

- Vitria Glass Products (Pty) Ltd. (South Africa)

- Chen-Hao Plastic Industry Co., Ltd. (Taiwan)

- Illing Company (U.S.)

- Allied Specialty Co., Inc. (U.S.)

- G.E.T. Enterprises, LLC. (U.S.)

- Dallas China, Inc. (U.S.)

- Steelite International (U.K.)

Latest Developments in Global Beer Mug Market

- In April 2025, the European Union introduced new regulations requiring all beer mugs and glasses sold within the region to meet stringent safety and environmental standards, including a ban on lead crystal and a minimum recycled content of 25%. This regulatory change is expected to push manufacturers to reformulate production processes and adopt sustainable materials, thereby increasing demand for eco-friendly mugs. It also incentivizes innovation in design and material sourcing, strengthens consumer confidence in product safety, and positions environmentally responsible brands to gain a competitive advantage in both retail and commercial sectors across Europe

- In February 2025, North American brewery Molson Coors launched a customizable beer mug program, allowing consumers to personalize mugs with names, logos, or unique designs. This initiative is anticipated to drive higher direct-to-consumer engagement, create new revenue streams through premium pricing, and enhance brand loyalty. The trend toward personalized drinkware also caters to younger, experience-driven consumers who seek unique and memorable drinking experiences, thereby stimulating growth in both household and commercial segments of the market

- In January 2025, Anheuser-Busch InBev introduced a line of eco-friendly beer mugs made entirely from recycled materials. This sustainability-focused initiative strengthens the company’s corporate responsibility profile, appeals to environmentally conscious consumers, and encourages adoption of green manufacturing practices within the industry. It is expected to reshape market expectations for eco-friendly and socially responsible products, boost sales among environmentally aware buyers, and prompt competitors to innovate in sustainable product lines to maintain market relevance

- In May 2024, Heineken acquired a majority stake in Brazilian craft beer company Cervejaria Colorado, marking its strategic entry into the fast-growing Brazilian craft beer market. This acquisition expands Heineken’s product portfolio, increases its distribution reach, and creates opportunities to introduce branded and premium beer mugs alongside its craft offerings. The move also strengthens the company’s position in emerging markets, stimulates localized production and marketing initiatives, and supports growth in commercial and hospitality segments where premium drinkware is increasingly valued

- In March 2024, Diageo partnered with Olive & Oak to produce limited-edition, branded beer mugs for its popular beer brands. This strategic collaboration enhances Diageo’s brand visibility and allows it to differentiate its products in a crowded market. The partnership also targets collectors and enthusiasts, driving higher engagement and repeat purchases in both retail and commercial channels. By offering unique, branded drinkware, Diageo strengthens consumer loyalty, encourages premium pricing, and reinforces its position in lifestyle-oriented beer markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.