Global Beet Root Sugar Market

Market Size in USD Billion

CAGR :

%

USD

3.97 Billion

USD

6.27 Billion

2024

2032

USD

3.97 Billion

USD

6.27 Billion

2024

2032

| 2025 –2032 | |

| USD 3.97 Billion | |

| USD 6.27 Billion | |

|

|

|

|

Beet Root Sugar Market Size

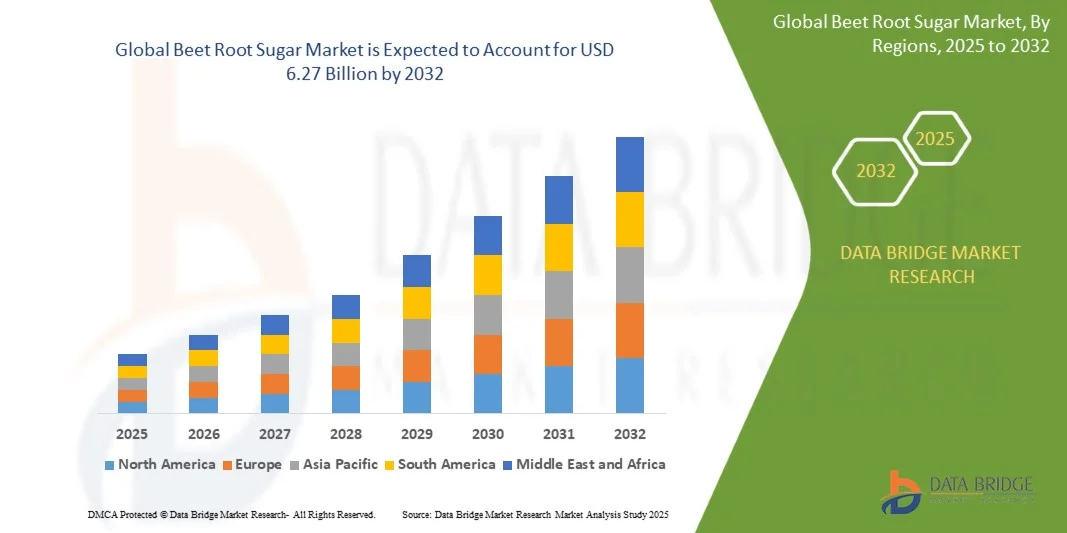

- The global beet root sugar market size was valued at USD 3.97 billion in 2024 and is expected to reach USD 6.27 billion by 2032, at a CAGR of 5.9% during the forecast period

- The market growth is largely fueled by the increasing demand for natural, non-GMO sweeteners and the expanding use of beet sugar across the food and beverage industry. Consumers’ growing preference for sustainable and plant-based ingredients is driving manufacturers to adopt beet-derived sugar due to its lower carbon footprint and efficient production process compared to cane sugar. Technological advancements in beet cultivation and processing are also improving yield efficiency and product consistency, further propelling market expansion

- Furthermore, the rising emphasis on eco-friendly farming practices and government support for sustainable agricultural initiatives are strengthening beet sugar production, particularly across Europe and Asia-Pacific. These factors, combined with the growing use of beet sugar in bakery, beverages, and cosmetics, are contributing to a steady increase in global market demand

Beet Root Sugar Market Analysis

- Beet root sugar, derived from the processing of sugar beets, plays a crucial role in food, beverage, and industrial applications due to its purity, neutral flavor, and versatile functional properties. The market is witnessing strong momentum driven by sustainability trends, innovations in refining technologies, and the transition toward natural sweetening solutions

- The escalating demand for beet root sugar is primarily fueled by its growing use in clean-label and organic food products, the shift from cane to beet cultivation in certain regions, and the expansion of domestic processing capacities in developing markets. These trends collectively position beet root sugar as a key component in the evolving global sweetener landscape

- Europe dominated the beet root sugar market with a share of 65.5% in 2024, due to its long-standing history of beet cultivation, advanced processing infrastructure, and strong demand from food and beverage manufacturers

- Asia-Pacific is expected to be the fastest growing region in the beet root sugar market during the forecast period due to increasing urbanization, rising disposable incomes, and the expanding food processing industry

- White segment dominated the market with a market share of 72.5% in 2024, due to its extensive use in food processing, confectionery, and beverage manufacturing. White beet sugar is favored for its high purity, neutral flavor, and ability to dissolve easily, making it ideal for large-scale industrial applications. Its wide acceptance among both household and commercial consumers, coupled with the continuous supply from major European producers, further reinforces its market dominance. In addition, its cost-effectiveness and consistent quality standards make it the preferred choice over other variants

Report Scope and Beet Root Sugar Market Segmentation

|

Attributes |

Beet Root Sugar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Beet Root Sugar Market Trends

“Rising Demand for Natural and Non-GMO Sweeteners”

- The beet root sugar market is witnessing notable growth driven by increasing global demand for natural and non-GMO sweeteners that align with clean-label and health-oriented consumption trends. Consumers are increasingly avoiding artificial and high-fructose sugars, strengthening the position of beet-derived products in both food and beverage applications

- For instance, Nordzucker AG and Südzucker AG have expanded their portfolio of non-GMO beet root sugar products for major food manufacturers, targeting applications in bakery, dairy, and beverage segments. These companies emphasize traceability and purity in their sourcing and production to cater to the evolving needs of health-conscious consumers

- The growing concern over chemical additives and genetically modified ingredients is driving food producers to reformulate their products using natural sweetening agents such as beet sugar. This supports both nutritional transparency and environmental sustainability, as beet-based products are derived from renewable and locally cultivated crops

- Beet root sugar is increasingly gaining traction across clean-label categories due to its compatibility with organic and vegan product formulations. It offers a neutral flavor profile, consistent texture, and easy integration into various culinary and industrial processes, enhancing its versatility in product development

- Manufacturers are investing in green processing technologies and sustainable cultivation practices to reduce carbon footprints and promote responsible farming. This approach strengthens supply chain sustainability while meeting demand for ethical and environmentally safe production methods

- The rising global interest in natural and non-GMO sweeteners reflects a broader market transition toward health-forward and sustainable food production. This movement positions beet root sugar as a key ingredient in the global shift away from synthetic sweeteners, serving as a bridge between functionality, purity, and consumer trust

Beet Root Sugar Market Dynamics

Driver

“Growing Preference for Sustainable, Plant-Based Ingredients”

- The increasing consumer inclination toward sustainable and plant-based ingredients is a major driver fueling the growth of the beet root sugar market. Rising awareness regarding environmental impact, ethical sourcing, and plant-derived nutrition has made beet sugar an appealing alternative to conventional and chemically processed sweeteners

- For instance, Cosun Beet Company has actively promoted its sugar production process as carbon-neutral, emphasizing its use of renewable energy and circular economy principles. This strategic approach supports the growing demand among food manufacturers for low-impact, plant-based sweetening solutions

- Beet sugar production demonstrates natural advantages such as the efficient use of agricultural land, minimal water consumption, and reduced pesticide dependency. These eco-friendly features position it strongly in line with sustainability goals and corporate social responsibility commitments of global food brands

- The wider adoption of beet sugar in plant-based and vegan food formulations underscores its adaptability in meeting dietary trends without compromising sweetness intensity or product quality. This has encouraged formulators across bakery, confectionery, and beverage industries to adopt it for new product launches

- Continuous advancements in sustainable agriculture practices and bio-processing are enhancing the overall productivity and environmental profile of beet-derived sugars. As industries prioritize low-emission and biodegradable ingredient sourcing, beet root sugar remains a cornerstone of sustainable nutrition innovation

Restraint/Challenge

“Competition from Alternative Sweeteners”

- The growing availability of alternative sweeteners such as stevia, agave syrup, and coconut sugar poses a key challenge for the beet root sugar market. These substitutes appeal to consumers seeking lower-calorie, low-glycemic, or plant-based options, intensifying market competition within the natural sweetener segment

- For instance, companies such as Cargill and PureCircle have expanded their stevia-based sweetener production capacities, promoting them as healthier alternatives to conventional sugars. This expansion is gradually diverting market share from beet and cane sugar producers toward new-generation plant-based substitutes

- Beet sugar, while natural, still faces perception challenges due to its caloric content and glycemic index, especially among diabetic and calorie-conscious consumers. This has encouraged food brands to blend or replace beet sugar with emerging sugar substitutes in their formulations

- The rapid innovation in next-generation sweeteners supported by food tech advancements and regulatory approvals is reshaping consumer preferences. As these products often promise functional advantages without compromising sweetness, they pose a strong competitive threat to traditional beet sugar adoption

- To address this challenge, beet sugar producers are focusing on differentiating through sustainability credentials, organic certifications, and reduced-environmental-impact farming. Strengthening the value proposition through premium branding and transparency will be crucial for maintaining competitiveness in an increasingly diversified sweetener landscape

Beet Root Sugar Market Scope

The market is segmented on the basis of product, application, and distribution channel.

• By Product

On the basis of product, the beet root sugar market is segmented into white, brown, and liquid sugar. The white sugar segment dominated the market with the largest revenue share of 72.5% in 2024, driven by its extensive use in food processing, confectionery, and beverage manufacturing. White beet sugar is favored for its high purity, neutral flavor, and ability to dissolve easily, making it ideal for large-scale industrial applications. Its wide acceptance among both household and commercial consumers, coupled with the continuous supply from major European producers, further reinforces its market dominance. In addition, its cost-effectiveness and consistent quality standards make it the preferred choice over other variants.

The liquid sugar segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its growing adoption in ready-to-drink beverages, bakery glazes, and dairy formulations. Liquid beet sugar offers operational efficiency by eliminating the need for dissolving solid sugar, reducing processing time in industrial applications. Beverage manufacturers particularly prefer liquid sugar for its ease of blending, uniform sweetness, and compatibility with automated production systems. The increasing demand for convenience products and the expansion of beverage manufacturing facilities globally are expected to accelerate the growth of this segment.

• By Application

On the basis of application, the beet root sugar market is segmented into bakery, beverages, and cosmetics. The bakery segment held the largest revenue share in 2024, driven by the widespread use of beet sugar in cakes, pastries, and confectionery items. The fine crystal size and sweetness consistency of beet sugar make it suitable for achieving desired texture, color, and shelf stability in baked products. Rising global demand for premium and artisanal bakery goods, coupled with the use of non-GMO beet sugar as a clean-label ingredient, further supports segment growth. The thriving bakery industry in Europe and North America continues to anchor this segment’s dominance.

The cosmetics segment is projected to grow at the fastest rate from 2025 to 2032, attributed to the rising use of beet-derived sugar in natural exfoliants, moisturizers, and serums. The ingredient’s humectant properties help retain skin moisture and enhance product stability, making it a preferred alternative to synthetic additives. Growing consumer preference for natural, plant-based cosmetic ingredients, along with clean beauty trends, is boosting beet sugar adoption among personal care manufacturers. Expanding applications in skincare and body care formulations are expected to drive strong growth for this segment.

• By Distribution Channel

On the basis of distribution channel, the beet root sugar market is segmented into online and offline. The offline segment dominated the market in 2024, supported by the strong presence of supermarkets, retail outlets, and direct bulk supply networks for industrial buyers. Major food and beverage manufacturers prefer offline procurement due to the ability to negotiate large-scale supply contracts and ensure consistent product quality. The presence of established distributors and wholesalers, especially in Europe and North America, continues to strengthen offline dominance. Moreover, consumers purchasing for household use still rely on traditional retail stores for convenience and trusted product availability.

The online segment is expected to record the fastest growth from 2025 to 2032, driven by the rapid expansion of e-commerce platforms and rising consumer preference for doorstep delivery. Small and medium-scale bakeries, beverage startups, and end consumers are increasingly sourcing beet sugar through digital platforms due to easy price comparisons and wider product accessibility. The growing adoption of B2B e-commerce channels by sugar producers and distributors further enhances market reach. In addition, the shift toward digital supply chain management and subscription-based delivery models is anticipated to accelerate online segment growth over the coming years.

Beet Root Sugar Market Regional Analysis

- Europe dominated the beet root sugar market with the largest revenue share of 65.5% in 2024, driven by its long-standing history of beet cultivation, advanced processing infrastructure, and strong demand from food and beverage manufacturers

- The region benefits from favorable climatic conditions and a well-developed agricultural supply chain, particularly in countries such as France, Germany, and the U.K. Increasing focus on sustainable and non-GMO sugar production, coupled with government incentives supporting low-carbon farming practices, further strengthens Europe’s leadership in the global market

- Moreover, the presence of major sugar producers and refiners ensures consistent supply and high-quality output across both industrial and retail applications

U.K. Beet Root Sugar Market Insight

The U.K. beet root sugar market is expected to grow steadily over the forecast period, supported by the country’s shift toward sustainable farming practices and domestic beet sugar production. Following the ban on neonicotinoid pesticides, producers are adopting eco-friendly pest control methods to maintain yield and protect biodiversity. Growing demand from the bakery and confectionery sectors, coupled with increased use of natural sweeteners, is driving market expansion. Furthermore, the U.K.’s focus on reducing sugar imports and strengthening local processing facilities supports market resilience and self-sufficiency.

Germany Beet Root Sugar Market Insight

The Germany beet root sugar market held the largest share in 2024, driven by large-scale beet farming and advanced refining technologies. Germany’s strong food and beverage sector, along with its emphasis on quality and sustainability, fuels consistent demand for beet-derived sugar. The country’s producers are investing in precision agriculture and modern processing systems to improve sugar recovery rates and reduce environmental impact. In addition, rising consumer preference for locally sourced and environmentally responsible products continues to support steady market growth.

France Beet Root Sugar Market Insight

France remains one of Europe’s leading producers of beet root sugar, supported by favorable soil conditions and a robust agricultural base. The market benefits from strong domestic consumption and a well-integrated export network supplying nearby European markets. French sugar producers are increasingly focusing on organic and low-carbon production to align with EU sustainability directives. Moreover, the growing use of beet sugar in bakery, beverage, and dairy industries continues to drive demand, solidifying France’s position as a key contributor to the region’s dominance.

North America Beet Root Sugar Market Insight

The North America beet root sugar market accounted for a considerable share in 2024, with the U.S. leading due to its established beet farming regions in states such as Minnesota and North Dakota. Rising preference for natural sweeteners and clean-label ingredients supports stable market growth. However, changing consumption habits toward low-sugar diets and the rising influence of health-conscious trends are moderating demand. Despite this, technological advancements in crop management and processing efficiency continue to enhance production output and competitiveness in the region.

U.S. Beet Root Sugar Market Insight

The U.S. market captured the largest share within North America in 2024, driven by industrial demand from the food and beverage sector. The market is witnessing gradual adoption of sustainable agricultural practices to improve crop yield and reduce carbon footprint. However, reduced sugar consumption due to dietary changes and the popularity of low-calorie sweeteners have slightly constrained growth. Ongoing R&D efforts focused on yield optimization and cost reduction are expected to sustain market presence over the forecast period.

Asia-Pacific Beet Root Sugar Market Insight

The Asia-Pacific beet root sugar market is projected to grow at the fastest CAGR from 2025 to 2032, fueled by increasing urbanization, rising disposable incomes, and the expanding food processing industry. Countries such as China and India are investing in beet cultivation as an alternative to sugarcane, aiming to enhance domestic production and reduce import dependence. The growing demand for bakery products, beverages, and packaged foods further stimulates sugar consumption. In addition, government initiatives promoting agricultural modernization and sustainability are contributing to the region’s rapid growth.

China Beet Root Sugar Market Insight

China accounted for the largest share within Asia-Pacific in 2024, supported by expanding beet cultivation in northern provinces and growing use in food manufacturing. The government’s focus on diversifying sugar sources to enhance self-reliance and control import costs is driving beet sugar production. Rising consumption of processed and ready-to-drink beverages continues to boost demand, while advancements in refining technologies are improving product quality and competitiveness.

India Beet Root Sugar Market Insight

The India beet root sugar market is expected to grow significantly during the forecast period, driven by the government’s emphasis on crop diversification and efficient water use. Increasing demand for packaged foods, confectionery items, and beverages is fueling the adoption of beet sugar as an alternative to cane sugar. Moreover, ongoing research to improve beet crop yield under local climatic conditions and expanding processing capabilities are expected to strengthen the country’s position in the regional market.

Beet Root Sugar Market Share

The beet root sugar industry is primarily led by well-established companies, including:

- Südzucker AG (Germany)

- Nordzucker AG (Germany)

- British Sugar – Associated British Foods plc (U.K.)

- Tereos Group (France)

- Cosun Beet Company (Netherlands)

- American Crystal Sugar Company (U.S.)

- Michigan Sugar Company (U.S.)

- Amalgamated Sugar Company (U.S.)

- Western Sugar Cooperative (U.S.)

- Southern Minnesota Beet Sugar Cooperative (U.S.)

- COFCO International (China)

- Mitr Phol Group (Thailand)

- Dalmia Bharat Sugar and Industries Limited (India)

- E.I.D. – Parry (India)

- Rusagro Group (Russia)

- Thai Roong Ruang Sugar Group (Thailand)

- Louis Dreyfus Company (Netherlands)

- Wilmar International Ltd. (Singapore)

- The Savola Group (Saudi Arabia)

- Agrana Beteiligungs-AG (Austria)

Latest Developments in Beet Root Sugar Market

- In March 2024, Nordzucker AG announced a major investment to expand its sugar beet processing facilities in Germany, aimed at enhancing production efficiency and sustainability. The company’s initiative focuses on adopting advanced refining technologies to reduce energy consumption and improve yield recovery. This development significantly strengthens Europe’s leadership in the beet root sugar market by increasing the availability of high-quality, eco-friendly beet sugar and supporting the EU’s long-term carbon reduction goals

- In August 2023, Tereos Group revealed its plans to introduce a new range of low-carbon beet sugar products designed for food and beverage manufacturers across Europe. The launch aligns with the growing consumer demand for sustainably sourced sweeteners and reinforces Tereos’s commitment to climate-friendly production. This initiative is expected to boost the adoption of beet-derived sugar in clean-label and health-focused food applications, further expanding its market footprint in the region

- In February 2023, Südzucker AG entered into a strategic partnership with technology providers to implement precision agriculture and digital monitoring systems across its beet farming operations. The integration of data-driven cultivation techniques aims to optimize crop yield, improve soil health, and reduce resource waste. This technological advancement enhances the company’s production efficiency and also drives innovation across the beet root sugar market by setting new standards for sustainable and high-yield beet farming

- In December 2022, Cosun Beet Company announced the launch of its new ingredient “Fidesse” during the Europe trade fair in Paris. This innovative, plant-based ingredient, derived from beet root, offers a neutral taste and ideal texture, making it suitable for use in meat substitutes and various other applications. The launch underscores the diversification of beet-derived products and their growing role in alternative protein markets, contributing to the expanding application scope of beet root sugar derivatives

- In July 2022, the Vasantdada Sugar Institute entered into a collaborative project with Swiss agro major Syngenta to promote sugar production from sugar beet in India. Under this project, Syngenta supplied imported beet seeds to about 40 factories for pilot cultivation, marking a significant step toward diversifying India’s sugar production base. This initiative is expected to accelerate domestic beet sugar development, reduce dependence on cane sugar, and open new avenues for sustainable sugar sourcing in the Asia-Pacific region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Beet Root Sugar Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Beet Root Sugar Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Beet Root Sugar Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.