Global Belt Sorters Market

Market Size in USD Billion

CAGR :

%

USD

3.61 Billion

USD

7.63 Billion

2024

2032

USD

3.61 Billion

USD

7.63 Billion

2024

2032

| 2025 –2032 | |

| USD 3.61 Billion | |

| USD 7.63 Billion | |

|

|

|

|

Belt Sorters Market Size

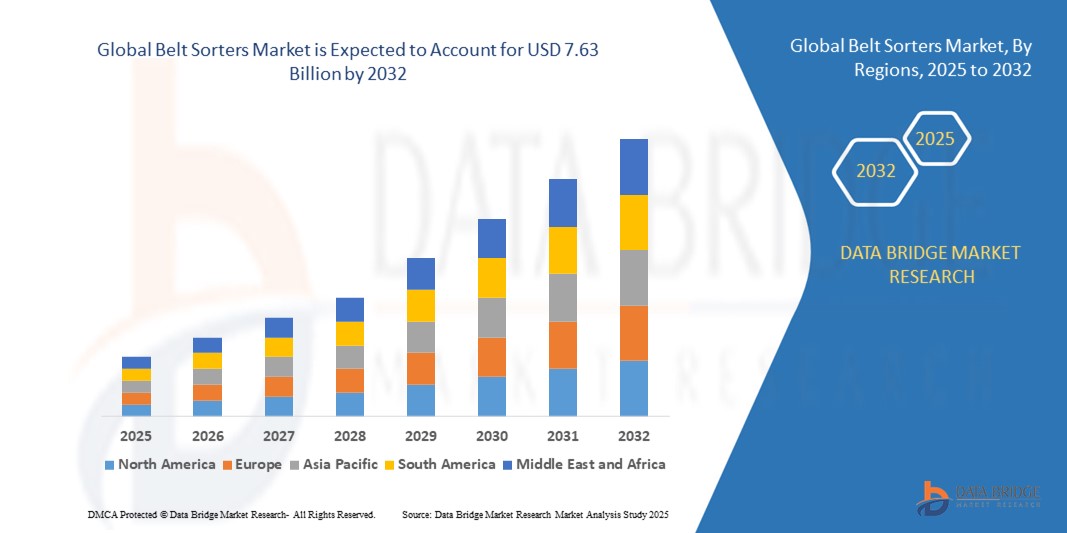

- The global belt sorters market size was valued at USD 3.61 billion in 2024 and is expected to reach USD 7.63 billion by 2032, at a CAGR of 9.80% during the forecast period

- The market growth is largely fueled by the increasing demand for automated material handling systems across industries such as logistics, e-commerce, and airport baggage handling. Belt sorters offer efficient, high-speed sorting capabilities, which are essential for managing the growing volume of parcels and goods in modern distribution environments

- Furthermore, the rising emphasis on operational efficiency, labor cost reduction, and faster delivery cycles is driving widespread adoption of belt sorters. These systems are becoming a preferred solution for companies aiming to streamline their supply chains, minimize errors, and enhance overall throughput, thereby significantly boosting the growth of the belt sorters market

Belt Sorters Market Analysis

- Belt sorters, widely used in automated material handling systems, are becoming increasingly essential in logistics, e-commerce, and airport baggage handling sectors due to their high-speed sorting capabilities, reduced manual labor dependency, and enhanced throughput efficiency

- The escalating demand for belt sorters is primarily fueled by the rapid growth of e-commerce, increasing parcel volumes, and the rising emphasis on warehouse automation and supply chain optimization

- North America dominated the belt sorters market with the largest revenue share of 34.8% in 2024, characterized by strong investments in logistics infrastructure, a growing number of fulfillment centers, and the adoption of advanced automation technologies by major players across the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the belt sorters market during the forecast period due to increasing urbanization, expansion of online retail, and heavy investments in smart warehousing solutions across countries like China, India, and Japan

- The Linear Cross Belt Sorting segment dominated the belt sorters market with a 62.8% revenue share in 2024, owing to its flexible and scalable layout, which is ideal for high-throughput operations across various industries. These systems are particularly favored for handling diverse item sizes and weights with high speed and accuracy in a straight-line configuration

Report Scope and Belt Sorters Market Segmentation

|

Attributes |

Belt Sorters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Belt Sorters Market Trends

Enhanced Efficiency and Automation in Material Handling

- A significant and accelerating trend in the global Belt Sorters market is the rising demand for high-speed, automated sorting solutions across logistics, e-commerce, and airport sectors. These systems offer unmatched efficiency, reduced operational costs, and improved parcel handling accuracy

- For instance, in early 2024, leading logistics providers in Europe and North America deployed next-generation belt sorter systems capable of handling over 15,000 parcels per hour, significantly improving warehouse throughput and minimizing bottlenecks

- Increased investments in warehouse automation and the growing focus on enhancing last-mile delivery efficiency are driving the adoption of belt sorters globally. These systems support both horizontal and vertical configurations, making them suitable for facilities of varying scale and complexity

- The shift toward omni-channel retail and the boom in online shopping have placed unprecedented pressure on distribution centers to accelerate order fulfillment, further reinforcing the demand for fast and reliable sorting technologies

- Furthermore, government initiatives aimed at improving industrial automation and productivity, especially in emerging economies across Asia-Pacific, are creating favorable growth opportunities for belt sorter manufacturers and integrators

- As industries continue to focus on reducing labor costs and maximizing operational accuracy, belt sorters are becoming a vital component of smart warehousing strategies, ensuring high-speed performance and reliable product tracking

Belt Sorters Market Dynamics

Driver

Growing Demand Due to E-commerce Expansion and Industrial Automation

- The rapid expansion of the e-commerce sector and the increasing pressure on supply chain operations have significantly fueled the demand for automated belt sorter systems globally. These systems enhance order fulfillment speed and accuracy, crucial for meeting growing consumer expectations

- For instance, in April 2024, major logistics operators in Europe announced upgrades to their distribution centers with high-capacity belt sorters, capable of handling diverse parcel sizes and reducing manual sorting requirements by over 40%. This shift reflects the industry's commitment to automation and throughput optimization

- As businesses aim to streamline operations, the need for reliable, low-maintenance, and energy-efficient sorting solutions is growing. Belt sorters offer a continuous flow mechanism ideal for sorting high volumes of items across warehouses, airports, postal facilities, and manufacturing plants

- Furthermore, with the rise of just-in-time delivery models and tighter inventory cycles, industries are turning to belt sorters to ensure minimal delays, enhanced package tracking, and smooth coordination between upstream and downstream operations

Restraint/Challenge

High Capital Investment and System Integration Complexities

- A key challenge restraining the growth of the belt sorters market is the high initial cost associated with system procurement, installation, and integration with existing warehouse management systems (WMS). Smaller logistics operators and SMEs may find it difficult to justify the upfront investment

- In addition, implementing belt sorter systems in older facilities often requires significant retrofitting, including layout redesign and floor reinforcement, which adds to project complexity and cost

- The shortage of skilled technicians for operating and maintaining advanced belt sorter systems is another concern, particularly in developing markets. Training costs and operational downtime during system upgrades may further hinder market adoption

- Despite these challenges, technological advancements are making modern belt sorters more modular, scalable, and easier to integrate, which is expected to gradually reduce these barriers and support wider market penetration in the coming years

- Many belt sorters are designed for high-volume, continuous operations, which may not suit facilities with highly variable or low-volume workflows, leading to inefficiencies or underutilization

- System downtime due to maintenance or unexpected mechanical failures can cause major bottlenecks in time-sensitive supply chain operations, highlighting the need for robust backup systems or redundancies that further add to investment burdens

Belt Sorters Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the belt sorters market is segmented into linear cross belt sorting and ring cross belt sorting. The linear cross belt sorting segment dominated the market with a 62.8% revenue share in 2024, owing to its flexible and scalable layout, which is ideal for high-throughput operations across various industries. These systems are particularly favored for handling diverse item sizes and weights with high speed and accuracy in a straight-line configuration.

The Ring Cross Belt Sorting segment is projected to witness the fastest CAGR of 10.4% from 2025 to 2032, due to its compact, space-saving circular design that supports continuous sorting, making it ideal for automated warehouses and urban logistics hubs.

- By Application

On the basis of application, the belt sorters market is segmented into mail and post industry, E-commerce industry, food and beverage industry, apparel industry, healthcare and medical industry, and others. The E-commerce Industry held the largest market revenue share of 39.7% in 2024, driven by the rapid expansion of online retail and the growing need for accurate, high-speed parcel sorting in fulfillment centers.

The Healthcare and Medical Industry is expected to grow at the fastest CAGR of 11.2% from 2025 to 2032, supported by the increasing automation of pharmaceutical distribution and the demand for hygienic, reliable sorting solutions for sensitive medical products.

Belt Sorters Market Regional Analysis

- North America dominated the belt sorters market with the largest revenue share of 34.8% in 2024, driven by a growing demand for automation in logistics, retail, and postal services. The region’s established e-commerce infrastructure and rising labor costs are accelerating the shift toward automated sorting systems such as belt sorters

- Businesses in the region increasingly value the efficiency, speed, and accuracy that belt sorters bring to parcel and product sorting processes. Major investments in distribution center automation by logistics and retail giants are further fueling the regional market expansion

- This widespread adoption is further supported by high technological readiness, strong infrastructure, and the growing need for timely and accurate deliveries—making belt sorters a preferred solution across commercial and industrial applications

U.S. Belt Sorters Market Insight

The U.S. belt sorters market captured the largest revenue share of 78% within North America in 2024, fueled by the rapid growth of e-commerce and rising expectations for next-day and same-day delivery. Major logistics companies are integrating high-speed belt sorters to streamline operations and handle increasing parcel volumes efficiently. In addition, automation in warehouse and fulfillment centers continues to drive adoption across both public and private sectors.

Europe Belt Sorters Market Insight

The Europe belt sorters market is projected to grow at a robust CAGR throughout the forecast period, driven by strict operational standards in logistics, increased parcel volumes, and growing demand for automation in warehousing. The European Union’s push for green logistics is also encouraging the adoption of energy-efficient sorting technologies, including belt sorters, particularly in high-volume fulfillment centers and postal services.

U.K. Belt Sorters Market Insight

The U.K. belt sorters market is expected to register noteworthy CAGR growth, supported by rapid advancements in warehouse automation, especially in the e-commerce and apparel industries. High labor costs and a booming online retail sector are compelling logistics providers and third-party warehouses to adopt belt sorting solutions for increased efficiency and accuracy in order fulfillment.

Germany Belt Sorters Market Insight

The Germany belt sorters market is anticipated to witness steady growth owing to the country’s strong industrial base and focus on logistics innovation. With increasing investments in Industry 4.0 and smart warehousing, German firms are adopting belt sorters to improve throughput, reduce manual errors, and enhance overall process reliability. Sustainability concerns also drive the shift toward low-noise, energy-efficient sorting systems.

Asia-Pacific Belt Sorters Market Insight

The Asia-Pacific belt sorters market is projected to grow at the fastest CAGR during the forecast period from 2025 to 2032, led by surging e-commerce activity, rapid infrastructure development, and high demand for automated material handling in countries like China, India, and Japan. Government support for industrial automation and expanding warehouse construction across the region are significant factors bolstering the market.

Japan Belt Sorters Market Insight

The Japan belt sorters market is experiencing rising demand, driven by the country’s focus on compact and efficient automation solutions. Japan’s logistics sector is increasingly adopting belt sorters to handle high parcel volumes while minimizing space usage. Technological integration, such as real-time data monitoring and IoT-enabled sorting, is also a key growth contributor in the region.

China Belt Sorters Market Insight

The China belt sorters market held the largest revenue share in the Asia-Pacific region in 2024, propelled by the country’s dominance in e-commerce, manufacturing, and logistics. Belt sorters are increasingly adopted in large-scale warehouses and distribution centers to enhance sorting speed and accuracy. Domestic manufacturers offering cost-effective and scalable sorting solutions further accelerate market penetration across the country.

Belt Sorters Market Share

The Belt Sorters industry is primarily led by well-established companies, including:

- BEUMER Group (Germany)

- Siemens (Germany)

- Toyota Advanced Logistics (Bastian Solutions, Vanderlande) (U.S.)

- Fives Intralogistics (U.S.)

- Honeywell Intelligrated (U.S.)

- KENGIC Intelligent Equipment (China)

- OMH Science Group (China)

- Mjc Co., Ltd (Japan)

- ILS (Innovative Logistics Solutions)

- Kunming Shipbuilding Equipment (China)

- Suzhou Jinfeng Logistics Equipment (China)

- China Post Science and Technology (China)

- Dematic Corporation (KION) (U.S.)

- Okura Yusoki Co., Ltd (Japan)

- Interroll Holding (Switzerland)

- Muratec Machinery (Japan)

- Zhejiang Damon Technology (China)

- Jiangsu Leadoin Intelligent Technology (China)

- Wayz Intelligent Manufacturing Technology (China)

- MHS Global (U.S.)

- SDI Systems (U.S.)

- Shanghai Simba Automation Technology (China)

- Daifuku Co., Ltd. (Japan)

Latest Developments in Global Belt Sorters Market

- In August 2025, Alstef Group introduced its Xsort cross-belt sorter, the first of its kind specifically engineered for baggage handling applications. The system was unveiled as a breakthrough solution to address the challenges of high-speed baggage sortation in modern airports, offering compact design, precise control, and modularity. Xsort combines enhanced energy efficiency with improved tracking and traceability, making it ideal for space-constrained airport environments. With this launch, Alstef Group aims to elevate operational efficiency and streamline baggage logistics across global airport hubs

- In June 2025, Dematic introduced its Silky Cross‑belt sorter in Southeast Asia, offering high throughput and energy-efficient performance tailored to rapidly growing warehousing and parcel sorting needs in the region

- In April 2025, Key Technology launched its COMPASS belt-fed optical sorter, designed for gentle handling of delicate items like produce and snack foods. Installed horizontally to minimize facility modifications, the system offers high throughput while simplifying changeovers

- In March 2021, Interroll Group announced launch of a new split tray sorter called the 'MT015S'. It is an automatic cross-belt sorting system suitable for numerous industries such as logistics, e-commerce, and pharmaceuticals. It weighs 12 kilograms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.