Global Benchtop Laboratory Water Purifier Market

Market Size in USD Billion

CAGR :

%

USD

15.17 Billion

USD

24.36 Billion

2024

2032

USD

15.17 Billion

USD

24.36 Billion

2024

2032

| 2025 –2032 | |

| USD 15.17 Billion | |

| USD 24.36 Billion | |

|

|

|

|

Benchtop Laboratory Water Purifier Market Size

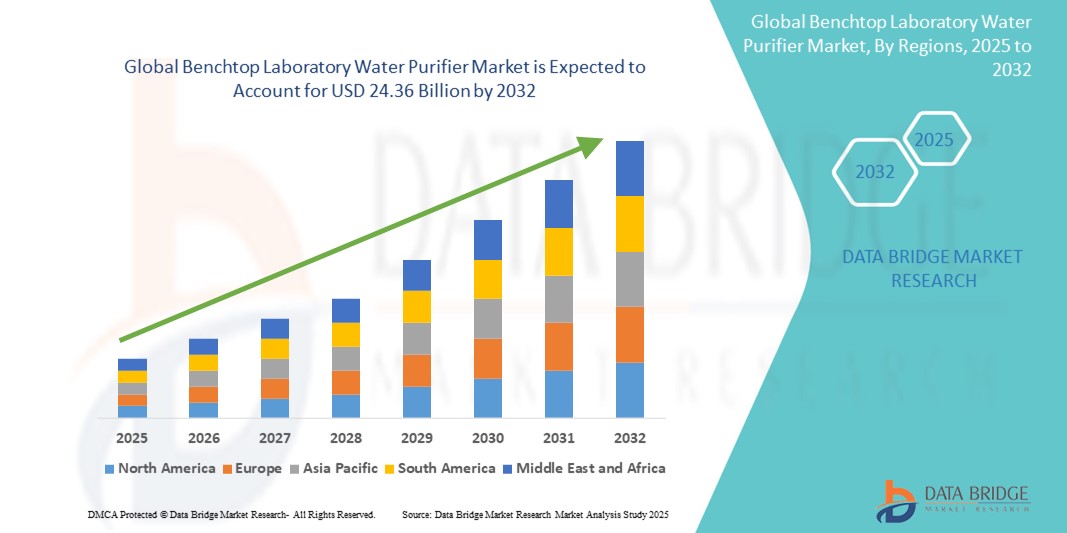

- The global benchtop laboratory water purifier market size was valued at USD 15.17 billion in 2024 and is expected to reach USD 24.36 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by the increasing need for high-purity water in research laboratories, diagnostics, and pharmaceutical applications, coupled with ongoing technological advancements in purification systems. The miniaturization of purification technology and growing emphasis on water quality standardization across labs are also driving adoption of benchtop systems

- Furthermore, rising consumer demand for compact, energy-efficient, and user-friendly purification solutions is establishing benchtop laboratory water purifiers as the preferred choice for academic, clinical, and industrial laboratories. These converging factors are accelerating the uptake of Benchtop Laboratory Water Purifier solutions, thereby significantly boosting the industry's growth across both developed and emerging markets

Benchtop Laboratory Water Purifier Market Analysis

- Benchtop laboratory water purifiers, which ensure high-quality water for experiments and diagnostics, are increasingly vital in modern research and clinical settings due to their compact size, reliability, and ability to meet stringent water purity standards

- The escalating demand for benchtop laboratory water purification systems is primarily fueled by the growing number of diagnostic laboratories, research centers, and academic institutions, coupled with the rising focus on accurate and reproducible results in life sciences and healthcare

- North America dominated the benchtop laboratory water purifier market with the largest revenue share of 37.8% in 2024, driven by a mature research infrastructure, substantial investments in life sciences, and strong regulatory emphasis on water purity. The U.S. continues to lead due to its well-established pharmaceutical, biotechnology, and clinical research sectors

- Asia-Pacific is expected to be the fastest growing region in the benchtop laboratory water purifier market with a CAGR of 10.6% from 2025 to 2032, owing to increasing R&D activities, expanding academic research, and a growing number of clinical laboratories, especially in China, India, and South Korea. Rising government funding and improving healthcare infrastructure also support this growth

- The fully automatic segment dominated the benchtop laboratory water purifier market with a share of 46.4% in 2024, driven by increased adoption in laboratories seeking reduced operational effort, real-time error detection, and consistent output quality

Report Scope and Benchtop Laboratory Water Purifier Market Segmentation

|

Attributes |

Benchtop Laboratory Water Purifier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Benchtop Laboratory Water Purifier Market Trends

“Smart Functionality and Seamless Connectivity Driving Benchtop Laboratory Water Purifier Adoption”

- A growing trend in the global benchtop laboratory water purifier market is the seamless incorporation of intelligent technologies that improve usability, efficiency, and automation for end-users in both research and clinical environments

- For instance, modern benchtop purifiers are now being equipped with smart interface panels, remote monitoring capabilities, and programmable dispensing settings that enhance user experience and system reliability. These features allow users to control water purification cycles, monitor filter status, and receive maintenance alerts—all from centralized dashboards or connected mobile applications

- Some advanced systems can even learn user usage patterns, suggesting optimization schedules or proactively warning about potential issues before they arise. For instance, Merck Millipore’s Milli-Q systems and Thermo Fisher’s Barnstead series now feature digital connectivity and real-time diagnostics, helping laboratories maintain high uptime and water quality assurance

- The integration of these purifiers into larger laboratory ecosystems—where they can sync with LIMS (Laboratory Information Management Systems) or environmental monitoring platforms—is becoming increasingly common, especially in facilities focused on automation and regulatory compliance

- Moreover, many systems now offer voice or touchless interaction capabilities, catering to sterile lab environments where manual contact must be minimized. This supports hands-free operation and reduces contamination risk, a growing priority in pharmaceutical and biotechnology settings

- As laboratories continue adopting more digitally connected and intelligent infrastructure, demand is rising for benchtop water purifiers that not only meet stringent purity standards but also offer a user-friendly, integrated experience. This shift is expected to significantly shape product development and market competition over the coming years

Benchtop Laboratory Water Purifier Market Dynamics

Driver

“Growing Need Due to Rising Water Purity Awareness and Lab Safety Standards”

- The increasing concerns over water contamination in laboratories and the rising demand for ultra-pure water for experimental accuracy are major drivers fueling the adoption of benchtop laboratory water purifiers

- For instance, in April 2024, ELGA LabWater (Veolia Water Technologies) introduced a new range of benchtop water purification systems that incorporate advanced filtration and UV sterilization technologies, addressing the growing need for compact, high-performance lab equipment. Such innovations are expected to drive the Benchtop Laboratory Water Purifier industry growth during the forecast period

- Laboratories are becoming increasingly aware of the importance of water purity in ensuring the reliability of scientific experiments, especially in pharmaceutical, chemical, and biomedical sectors. This awareness has led to a surge in the replacement of conventional purification systems with more advanced benchtop models that offer consistent water quality

- Furthermore, the shift towards automation and smart lab solutions has made benchtop water purifiers a preferred choice due to their easy integration with lab management systems, touchless operation, and compact design ideal for space-constrained settings

- Convenience features such as auto-flushing, remote monitoring, and mobile alerts are propelling adoption in academic and research labs. The rising demand for decentralized purification solutions in diagnostic labs, driven by the need for contamination-free media preparation and sample processing, also contributes to market growth

Restraint/Challenge

“High Maintenance Costs and Technical Complexity”

- The high cost of ownership, including frequent replacement of filters, UV lamps, and other consumables, remains a significant restraint in the benchtop laboratory water purifier market. Budget constraints in small- to medium-sized labs especially hinder widespread adoption

- In addition, concerns over the technical complexity and maintenance requirements of advanced purification systems make some laboratories hesitant to invest in such equipment. The need for skilled personnel to manage calibrations and servicing further adds to the operational burden

- Moreover, some users report variability in water quality over time due to inconsistent maintenance or improper installation, leading to disruptions in lab operations and data reliability

- To address these concerns, manufacturers like Merck Millipore and Sartorius are investing in user-friendly, low-maintenance designs with smart diagnostics and auto-notification systems for service needs. However, balancing performance with affordability remains a key challenge

- Promoting educational initiatives on system maintenance, extending warranty and service plans, and offering modular, scalable purifiers may help overcome these barriers and support sustained market growth

Benchtop Laboratory Water Purifier Market Scope

The market is segmented on the basis of technology, operation, water production, automation grade, end-use, and distribution channel.

- By Technology

On the basis of technology, the benchtop laboratory water purifier market is segmented into Reverse Osmosis (RO) Systems, Ultrafiltration (UF) Systems, Deionization (DI) Systems, UV Purification Systems, and Other. The Reverse Osmosis (RO) Systems segment accounted for the largest market revenue share of 34.8% in 2024, owing to their high efficiency in removing contaminants and providing consistently pure water for sensitive laboratory applications. RO systems are favored across pharmaceutical and biotechnology labs due to their ability to eliminate even dissolved solids.

The Ultrafiltration (UF) Systems segment is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, driven by growing use in laboratories that require removal of high-molecular-weight particles without affecting water minerals, making them ideal for microbiological and biochemical research.

- By Operation

On the basis of operation, the benchtop laboratory water purifier market is segmented into multi-stage purification and smart and connected systems. The multi-stage purification segment held the dominant market share of 52.6% in 2024, as laboratories increasingly prefer systems that combine multiple purification technologies for achieving ultra-pure water standards.

The smart and connected systems segment is projected to grow at the highest CAGR of 10.3% from 2025 to 2032, due to rising demand for real-time monitoring, automated maintenance alerts, and integration with laboratory information management systems (LIMS).

- By Water Production

On the basis of water production, the benchtop laboratory water purifier market is segmented into Low (less than 100L/h), Mid (100-200 L/h), and High (more than 200 L/h). The Mid (100-200 L/h) segment captured the highest revenue share of 38.1% in 2024, favored by medium-scale laboratories in research institutes and diagnostics centers.

The High (more than 200 L/h) segment is expected to register the fastest growth during the forecast period due to rising installations in large pharmaceutical and industrial labs requiring continuous high-volume output.

- By Automation Grade

On the basis of automation grade, the benchtop laboratory water purifier market is segmented into fully automatic, semi-automatic, and manual. The fully automatic segment held the leading market share of 46.4% in 2024, driven by increased adoption in laboratories seeking reduced operational effort, real-time error detection, and consistent output quality.

The Semi-Automatic segment is projected to grow significantly from 2025 to 2032, due to its balance between cost-efficiency and operational ease.

- By End-use

On the basis of end-use, the benchtop laboratory water purifier market is segmented into food and beverages, pulp and paper, pharmaceuticals, chemicals, and others. The pharmaceuticals segment accounted for the largest share of 41.7% in 2024, fueled by the critical requirement of ultra-pure water for drug formulation, testing, and laboratory diagnostics.

The food and beverages segment is poised to grow at the fastest CAGR from 2025 to 2032, due to increasing testing for quality assurance and safety in food processing labs.

- By Distribution Channel

On the basis of distribution channel, the benchtop laboratory water purifier market is segmented into direct and indirect. The direct segment dominated with a revenue share of 61.5% in 2024, driven by long-term supplier-lab partnerships and tailored installation and maintenance contracts.

The Indirect segment is expected to grow at the fastest CAGR from 2025 to 2032, due to the rising popularity of third-party lab equipment vendors and e-commerce platforms in developing regions.

Benchtop Laboratory Water Purifier Market Regional Analysis

- North America dominated the benchtop laboratory water purifier market with the largest revenue share of 37.8% in 2024, driven by stringent regulatory frameworks for laboratory water quality, robust R&D infrastructure, and the presence of top-tier biotechnology and pharmaceutical firms

- The region's emphasis on precision in diagnostics and experimentation fosters sustained demand for reliable, compact water purification systems

- Laboratories across North America prioritize operational efficiency, and benchtop systems provide an ideal solution due to their space-saving design, ease of installation, and consistent water quality output. The increasing preference for decentralized lab setups in clinical research and diagnostics has further supported the adoption of benchtop purifiers

U.S. Benchtop Laboratory Water Purifier Market Insight

The U.S. benchtop laboratory water purifier market accounted for 77% of North America's revenue share in 2024, driven by large-scale investments in life sciences, biotechnology, and academic research institutions. The rising demand for Type I and ultrapure water in genomics, cell culture, and analytical chemistry has significantly contributed to the market's expansion. Moreover, regulatory compliance with EPA and USP standards encourages the installation of high-performance water purifiers in labs across universities, hospitals, and CROs.

Europe Benchtop Laboratory Water Purifier Market Insight

The Europe benchtop laboratory water purifier market is projected to grow at a robust CAGR during the forecast period, fueled by strict regulatory norms across pharmaceutical and clinical laboratories, coupled with rising government funding for academic and biomedical research. Demand is especially growing in countries like Germany, France, and the U.K., where environmental sustainability and technological innovation are central to procurement strategies. Advanced features like energy-efficient purification and low water wastage are increasingly prioritized.

U.K. Benchtop Laboratory Water Purifier Market Insight

The U.K. benchtop laboratory water purifier market is expected to expand significantly during the forecast period, supported by the rapid growth of diagnostic laboratories and increased research grants from institutions such as the National Institute for Health and Care Research (NIHR). The emphasis on water quality for diagnostic reproducibility and pharmaceutical compliance is increasing investments in compact, high-purity water systems, particularly in hospital and academic labs.

Germany Benchtop Laboratory Water Purifier Market Insight

The Germany benchtop laboratory water purifier market is poised for steady growth during the forecast period, benefiting from the country's leadership in laboratory automation and sustainable lab practices. Labs in Germany are adopting advanced purification systems with modular functionalities, real-time monitoring, and minimal environmental footprint. Regulatory alignment with EU water purity guidelines further propels demand, especially in biotech startups and chemical labs.

Asia-Pacific Benchtop Laboratory Water Purifier Market Insight

The Asia-Pacific benchtop laboratory water purifier market is projected to grow at the fastest CAGR of 10.6% from 2025 to 2032, driven by rapid industrialization, increasing investments in research infrastructure, and a growing focus on laboratory quality standards across China, India, and Japan. Government initiatives supporting healthcare R&D and academic excellence are stimulating the adoption of lab water purification solutions.

Japan Benchtop Laboratory Water Purifier Market Insight

The Japan benchtop laboratory water purifier market is gaining traction, supported by the country's technological prowess and regulatory focus on laboratory water standards in pharma and life sciences. High demand from analytical testing labs, combined with automation in water quality management and compact space requirements, is boosting the adoption of benchtop systems in both private and academic sectors.

China Benchtop Laboratory Water Purifier Market Insight

The China benchtop laboratory water purifier market held the largest revenue share in the Asia-Pacific region in 2024, attributed to the rapid expansion of biopharma manufacturing and a growing emphasis on research quality. The country's "Made in China 2025" initiative, combined with increased focus on ISO and GMP compliance in labs, is driving the adoption of high-grade benchtop water purifiers, supported by strong domestic production capabilities and affordable pricing.

Benchtop Laboratory Water Purifier Market Share

The benchtop laboratory water purifier industry is primarily led by well-established companies, including:

- Merck Group (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Sartorius AG (Germany)

- Pall Corporation (U.S.)

- ELGA LabWater (U.K.)

- Aqua Solutions, Inc. (U.S.)

- AQUA Lab Equipment (U.S.)

- Evoqua Water Technologies LLC (U.S.)

- Labconco Corporation (U.S.)

- Siemens Water Technologies Corp. (U.S.)

- Purite Ltd. (U.K.)

- LabStrong Corporation (U.S.)

- Toray Industries, Inc. (Japan)

- Milli-D Inc. (U.S.)

- AQUA SOLUTIONS, INC. (U.S.)

Latest Developments in Global Benchtop Laboratory Water Purifier Market

- In March 2023, Evoqua Water Technologies LLC acquired the industrial water service business of Kemco Systems to expand its presence in Texas, U.S.

- In October 2022, Labconco Corporation announced a new exclusive agreement with Erlab Inc., a global leader in air filtration technology, to support more sustainable lab designs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.