Global Betting Online Gambling Market

Market Size in USD Billion

CAGR :

%

USD

207.35 Billion

USD

684.48 Billion

2025

2033

USD

207.35 Billion

USD

684.48 Billion

2025

2033

| 2026 –2033 | |

| USD 207.35 Billion | |

| USD 684.48 Billion | |

|

|

|

|

Global Betting Online Gambling Market Size

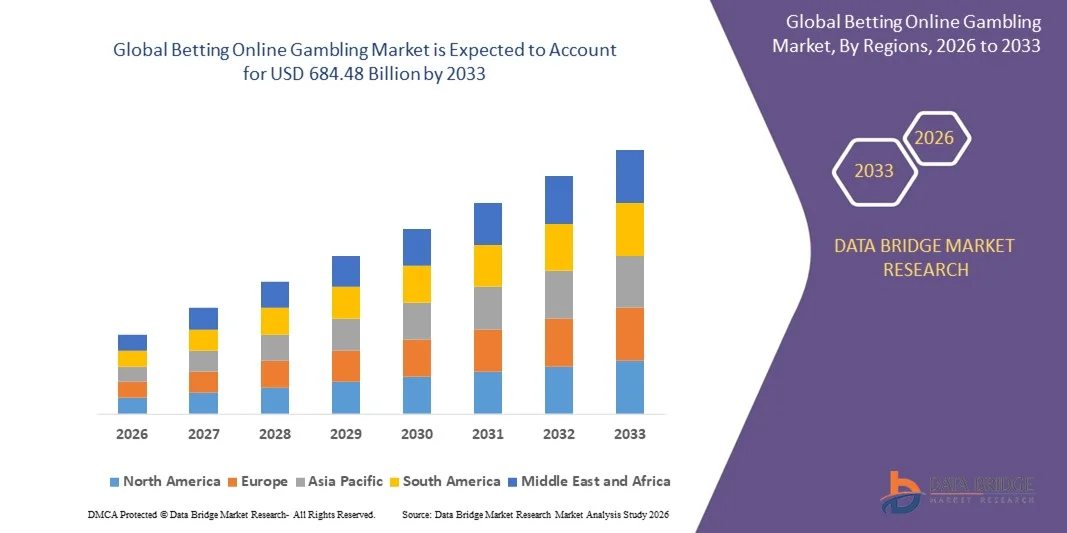

- The global Online Betting and Gambling Market size was valued at USD 207.35 billion in 2025 and is expected to reach USD 684.48 billion by 2033, at a CAGR of 16.10% during the forecast period.

- The market growth is largely fueled by the increasing penetration of internet and smartphone usage, coupled with the rising popularity of online sports betting, casino games, and virtual gambling platforms.

- Furthermore, advancements in secure payment systems, AI-driven personalized experiences, and live streaming technologies are enhancing user engagement and trust, making online gambling more accessible and attractive. These converging factors are driving rapid market adoption, thereby significantly boosting the industry’s growth.

Global Betting Online Gambling Market Analysis

- Online betting and gambling platforms, including sports betting, casino games, and virtual gaming, are increasingly vital components of the global entertainment and digital gaming ecosystem due to their convenience, accessibility via smartphones and computers, and seamless integration with secure payment and live streaming technologies.

- The escalating demand for online betting and gambling is primarily fueled by the widespread adoption of smartphones and high-speed internet, growing interest in virtual gaming experiences, and a rising preference for on-demand, interactive entertainment.

- North America dominated the Global Online Betting and Gambling Market with the largest revenue share of 34% in 2025, characterized by early adoption of online gaming platforms, high disposable incomes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in online betting and casino subscriptions, particularly among younger demographics, driven by innovations from both established gaming companies and startups focusing on AI-driven personalization and live streaming features.

- Asia-Pacific is expected to be the fastest growing region in the Global Online Betting and Gambling Market during the forecast period due to increasing smartphone penetration, rising disposable incomes, and expanding digital payment infrastructure.

- The betting segment dominated the market with the largest revenue share of 43.2% in 2025, driven by its widespread popularity, extensive sports coverage, and ease of participation via mobile and web platforms.

Report Scope and Global Betting Online Gambling Market Segmentation

|

Attributes |

Betting Online Gambling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Flutter Entertainment (Ireland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Betting Online Gambling Market Trends

Enhanced Convenience Through AI and Personalization

- A significant and accelerating trend in the global Online Betting and Gambling Market is the deepening integration of artificial intelligence (AI) and advanced personalization features. This fusion of technologies is significantly enhancing user convenience, engagement, and decision-making within online betting and gaming platforms.

- For instance, platforms like DraftKings and Bet365 utilize AI-driven recommendation engines to suggest games, bets, and promotions tailored to individual user preferences. Similarly, some casino platforms employ AI to adapt game difficulty or provide personalized bonuses, creating a more engaging and customized experience.

- AI integration in online gambling enables features such as predicting user behavior, optimizing betting strategies, and offering intelligent alerts for responsible gambling. For example, some platforms use AI to identify unusual betting patterns and notify users to promote safer gaming practices. Additionally, chatbots powered by AI provide real-time assistance, account management, and customer support, enhancing overall user convenience.

- The seamless integration of AI and personalization tools with multi-platform access—web, mobile apps, and live streaming interfaces—facilitates centralized control over a user’s gaming experience. Through a single interface, users can manage their betting history, track winnings, and access interactive live casino games, creating a unified and highly engaging entertainment ecosystem.

- This trend towards more intelligent, intuitive, and personalized gaming experiences is fundamentally reshaping user expectations for online betting and gambling. Consequently, companies such as FanDuel and Flutter Entertainment are developing AI-powered platforms with predictive betting suggestions, personalized promotions, and interactive live gaming features.

- The demand for AI-enabled and highly personalized online gambling platforms is growing rapidly across global markets, as consumers increasingly prioritize convenience, tailored experiences, and safer, smarter ways to engage with digital betting and casino games.

Global Betting Online Gambling Market Dynamics

Driver

Growing Need Due to Rising Popularity and Digital Adoption

- The increasing popularity of online gaming and sports betting, coupled with the accelerating adoption of digital payment systems and mobile platforms, is a significant driver for the heightened demand in the global online betting and gambling market.

- For instance, in early 2025, DraftKings launched enhanced AI-powered betting features integrated with real-time sports analytics, aimed at providing more engaging and personalized experiences for users. Such innovations by key companies are expected to drive market growth during the forecast period.

- As consumers seek more convenient, immersive, and interactive entertainment options, online gambling platforms offer features such as live streaming, instant deposits, and personalized game recommendations, providing a compelling upgrade over traditional offline betting and casino experiences.

- Furthermore, the growing popularity of mobile gaming and integrated digital ecosystems is making online betting platforms an essential component of modern entertainment, offering seamless integration with payment wallets, loyalty programs, and interactive live games.

- The convenience of placing bets anytime, accessing multiple games or sports events from a single app, and managing accounts digitally are key factors propelling the adoption of online gambling in both developed and emerging markets. The trend towards app-based platforms and user-friendly interfaces further contributes to rapid market growth.

Restraint/Challenge

Concerns Regarding Responsible Gambling and Regulatory Constraints

- Concerns surrounding problem gambling, addiction risks, and regulatory compliance pose significant challenges to broader market growth. As online gambling platforms rely on digital connectivity and financial transactions, they are subject to strict legal and ethical scrutiny, raising anxieties among potential users and regulators.

- For instance, reports of gambling addiction and underage access have made some consumers hesitant to engage fully with online betting platforms.

- Addressing these concerns through responsible gambling measures, secure payment systems, and strict age verification protocols is crucial for building consumer trust. Companies such as Bet365 and FanDuel emphasize responsible gambling tools and self-exclusion features in their platforms to reassure users. Additionally, regulatory requirements and licensing fees in some regions can act as barriers to market entry and expansion, particularly for smaller or emerging operators.

- While platforms are continuously implementing safer gaming features, the perception of risk and the potential for financial loss can still hinder widespread adoption, especially among cautious or first-time users.

- Overcoming these challenges through robust responsible gambling initiatives, regulatory compliance, user education, and innovative, safe gaming experiences will be vital for sustained market growth.

Global Betting Online Gambling Market Scope

Betting online gambling market is segmented on the basis of type and device.

- By Type

On the basis of type, the Global Online Betting and Gambling Market is segmented into lottery, bingo, betting, and casino. The betting segment dominated the market with the largest revenue share of 43.2% in 2025, driven by its widespread popularity, extensive sports coverage, and ease of participation via mobile and web platforms. Consumers increasingly prefer online sports betting due to its convenience, real-time odds updates, and personalized experiences facilitated by AI-powered recommendation engines. The market also benefits from partnerships between betting platforms and major sports leagues, further fueling engagement.

The casino segment is expected to witness the fastest CAGR of 21.7% from 2026 to 2033, propelled by the growing adoption of virtual and live casino games, immersive graphics, and interactive features that replicate the experience of physical casinos. Rising interest in digital entertainment and increasing smartphone penetration are further contributing to the rapid growth of online casino gaming.

- By Device

On the basis of device, the Global Online Betting and Gambling Market is segmented into desktop and mobile platforms. The mobile segment held the largest market revenue share of 52.5% in 2025, reflecting the increasing preference of users to access betting and casino platforms anytime, anywhere. Mobile applications offer seamless integration with digital wallets, push notifications for personalized promotions, and live streaming of games and sports events, making them highly convenient for users.

The desktop segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by the need for higher-resolution interfaces, multiple simultaneous tabs for live bets, and advanced analytics for professional bettors. Desktop platforms remain popular among users who prefer a larger screen experience, detailed statistics, and more complex gameplay, particularly in regions with stable broadband access. Increasing investments in cross-platform compatibility are enhancing the overall user experience across both desktop and mobile devices.

Global Betting Online Gambling Market Regional Analysis

- North America dominated the Global Online Betting and Gambling Market with the largest revenue share of 34% in 2025, driven by the growing popularity of online sports betting, casino games, and lottery platforms, as well as widespread access to high-speed internet and mobile devices.

- Consumers in the region highly value the convenience, instant accessibility, and personalized experiences offered by online gambling platforms, including features such as live streaming, real-time odds, and AI-driven recommendations tailored to individual preferences.

- This widespread adoption is further supported by high disposable incomes, a digitally savvy population, and the strong presence of major market players such as DraftKings, FanDuel, and Bet365, establishing online betting and gambling as a favored entertainment and recreational activity across both casual users and professional bettors in residential and commercial settings.

U.S. Online Betting and Gambling Market Insight

The U.S. online betting and gambling market captured the largest revenue share of 81% in 2025 within North America, fueled by widespread internet penetration, smartphone adoption, and the growing legalization of sports betting across several states. Consumers are increasingly prioritizing convenience, immersive experiences, and real-time access to betting and casino platforms. The growing preference for mobile and app-based platforms, combined with robust demand for live-streaming features, personalized promotions, and AI-driven recommendations, further propels the market. Moreover, partnerships between major sportsbooks and professional sports leagues, alongside the integration of secure digital payment systems, are significantly contributing to the market's expansion.

Europe Online Betting and Gambling Market Insight

The Europe online betting and gambling market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by favorable regulations in countries like the U.K., Spain, and Italy, and increasing adoption of digital payment solutions. Rising consumer interest in interactive betting, live casinos, and online lotteries is fostering market growth. The region is experiencing significant expansion across mobile, desktop, and cross-platform gaming, with platforms being integrated into both established casino brands and emerging online operators.

U.K. Online Betting and Gambling Market Insight

The U.K. online betting and gambling market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s advanced digital infrastructure, the popularity of sports betting, and increasing consumer demand for convenient, real-time online casino experiences. Additionally, regulatory support for responsible gambling and a robust e-commerce ecosystem are encouraging both casual and professional users to engage with online platforms, stimulating market growth.

Germany Online Betting and Gambling Market Insight

The Germany online betting and gambling market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of online gaming, expanding broadband connectivity, and demand for secure, regulated platforms. Germany’s well-developed financial and digital infrastructure, coupled with a preference for safe and transparent betting environments, promotes the adoption of online gambling across residential and commercial users. Live casinos and mobile betting apps are becoming increasingly popular in the country.

Asia-Pacific Online Betting and Gambling Market Insight

The Asia-Pacific online betting and gambling market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by increasing smartphone penetration, rising disposable incomes, and digital payment adoption in countries such as China, Japan, and India. The region's growing interest in online casinos, sports betting, and lottery platforms, supported by emerging mobile-first strategies and government initiatives promoting digital entertainment, is driving adoption. Furthermore, as APAC becomes a hub for platform development and technology innovation, affordability and accessibility are expanding the user base.

Japan Online Betting and Gambling Market Insight

The Japan online betting and gambling market is gaining momentum due to the country’s tech-savvy population, increasing smartphone and broadband penetration, and growing interest in online casino and sports betting platforms. The market is driven by demand for convenience, personalized gaming experiences, and secure, regulated platforms. Moreover, Japan’s aging population is likely to spur adoption of simplified, accessible online gaming interfaces in both residential and commercial segments.

China Online Betting and Gambling Market Insight

The China online betting and gambling market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid digital adoption, urbanization, and high engagement with mobile platforms. China represents one of the largest markets for digital entertainment, with online betting, lotteries, and casino games gaining popularity across residential and commercial users. The government push towards digital entertainment infrastructure, combined with the availability of affordable platforms and strong domestic operators, are key factors driving market growth in China.

Global Betting Online Gambling Market Share

The Betting Online Gambling industry is primarily led by well-established companies, including:

• Flutter Entertainment (Ireland)

• DraftKings (U.S.)

• BetMGM (U.S.)

• 888 Holdings (U.K.)

• Entain Plc (U.K.)

• Kindred Group (Sweden)

• Betfair (U.K.)

• William Hill (U.K.)

• FanDuel (U.S.)

• Pinnacle (Curacao)

• Playtech (U.K.)

• Scientific Games (U.S.)

• PointsBet (Australia)

• Bet365 (U.K.)

• Caesars Entertainment (U.S.)

• LeoVegas (Sweden)

• MGM Resorts Online (U.S.)

• PartyCasino (Malta)

• Unikrn (U.S.)

• Konami Gaming (Japan)

What are the Recent Developments in Global Betting Online Gambling Market?

- In April 2024, DraftKings, a global leader in sports betting and online gambling, launched a strategic initiative in South Africa aimed at expanding its digital betting and casino platform offerings. This initiative underscores the company’s dedication to delivering innovative, secure, and user-friendly online gaming solutions tailored to regional preferences. By leveraging its global expertise and advanced platform features, DraftKings is not only addressing local market demand but also reinforcing its position in the rapidly growing global Online Betting and Gambling Market.

- In March 2024, FanDuel, a veteran-led company based in the U.S., introduced a new AI-powered live betting module specifically engineered for professional and casual sports bettors. The innovative platform enhances user engagement by providing real-time odds, predictive analytics, and personalized recommendations. This advancement highlights FanDuel’s commitment to developing cutting-edge technology that improves the user experience while ensuring safe and responsible gambling practices.

- In March 2024, Bet365 successfully launched its Smart Live Casino Project in Bengaluru, India, aimed at enhancing interactive online gaming experiences through high-quality streaming and AI-based personalization. This initiative leverages state-of-the-art technology to create a more engaging and secure environment for players, underscoring Bet365’s dedication to expanding its presence in emerging markets while providing safer, more immersive digital gambling experiences.

- In February 2024, 888 Holdings, a leading online gaming company, announced a strategic partnership with European Sports Federations to create a secure and integrated betting platform for league events. This collaboration is designed to enhance the user experience by providing seamless access to multiple sports and casino games while ensuring robust security and compliance with regional regulations. The initiative underscores 888 Holdings’ commitment to innovation and operational excellence in online gambling.

- In January 2024, MGM Resorts International, a leading provider of online and offline casino experiences, unveiled its MGM Online Casino Mobile App Upgrade at the ICE London 2024 exhibition. The platform features advanced mobile connectivity, live casino streaming, and personalized game recommendations, enabling users to place bets and access games anytime, anywhere. This upgrade highlights the company’s commitment to integrating advanced technology into online gambling platforms, offering enhanced convenience, engagement, and security for players worldwide.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.