Global Beverage Additives Market

Market Size in USD Billion

CAGR :

%

USD

4.91 Billion

USD

8.18 Billion

2024

2032

USD

4.91 Billion

USD

8.18 Billion

2024

2032

| 2025 –2032 | |

| USD 4.91 Billion | |

| USD 8.18 Billion | |

|

|

|

|

Beverages Additives Market Size

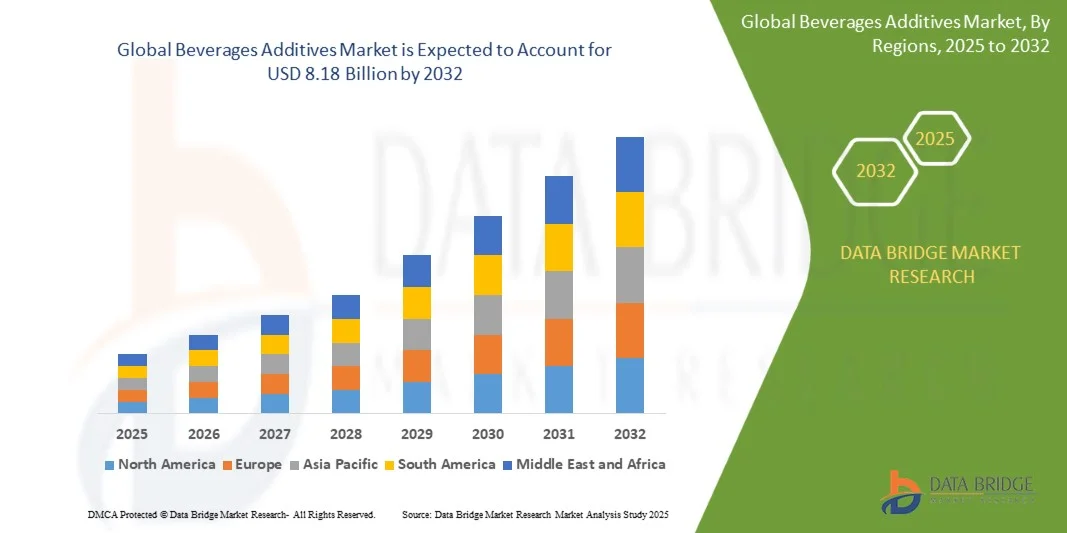

- The global beverages additives market size was valued at USD 4.91 billion in 2024 and is expected to reach USD 8.18 billion by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely fueled by increasing consumer demand for flavorful, visually appealing, and long-lasting beverages, which is driving the adoption of additives such as flavoring agents, colorants, and preservatives across both alcoholic and non-alcoholic segments

- Furthermore, rising health consciousness and the preference for clean-label, plant-based, and functional beverages are encouraging manufacturers to innovate with natural and safe additives, enhancing product quality, shelf life, and sensory appeal, thereby significantly boosting the industry’s growth

Beverages Additives Market Analysis

- Beverages additives are substances added to drinks to enhance flavor, color, stability, and shelf life. These include natural and artificial flavoring agents, colorants, and preservatives, which improve sensory properties and maintain product quality over time

- The escalating demand for beverages additives is primarily driven by the growing consumption of processed, ready-to-drink, and functional beverages, increasing consumer awareness of health and wellness, and the need for longer shelf life and improved product aesthetics in both domestic and international markets

- North America dominated the beverages additives market with a share of over 40% in 2024, due to high consumption of both alcoholic and non-alcoholic beverages and the strong demand for flavor, color, and preservation enhancements

- Asia-Pacific is expected to be the fastest growing region in the beverages additives market during the forecast period due to rapid urbanization, rising disposable incomes, and growing consumption of ready-to-drink and functional beverages in countries such as China, India, and Japan

- Flavoring agents segment dominated the market with a market share of 43% in 2024, due to the rising consumer preference for enhanced taste and aroma in beverages. Manufacturers are increasingly incorporating natural and artificial flavors to cater to evolving taste profiles, supporting both alcoholic and non-alcoholic products. The segment also benefits from the growing trend of premium and functional beverages, where distinctive flavor profiles are used as a key differentiator in competitive markets. In addition, flavoring agents offer versatility in beverage formulation, allowing producers to innovate and target niche consumer segments effectively

Report Scope and Beverages Additives Market Segmentation

|

Attributes |

Beverages Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Beverages Additives Market Trends

“Growing Preference for Clean-Label Beverages”

- The beverages additives market is witnessing a strong trend towards clean-label additives as health-conscious consumers increasingly demand transparency in ingredients. Consumers are rejecting artificial colors, flavors, and preservatives, pushing manufacturers to emphasize natural and plant-derived additive solutions

- For instance, companies such as Kerry Group have developed clean-label ingredient portfolios through their “Radicle” program, offering natural flavors and functional additives for beverages, while Tate & Lyle has introduced stevia-based sweeteners addressing both taste and transparency requirements. These initiatives highlight the industry’s growing response to natural alternatives in beverage formulations

- Natural colors and flavors sourced from botanicals, fruits, and vegetables are gaining significant traction. Beverage makers are increasingly investing in extracts such as turmeric, beetroot, and spirulina to create appealing colors and functional health benefits aligned with clean labeling

- In addition, rising consumer distrust of artificial preservatives is fostering innovation in natural preservation techniques. Additives such as rosemary extract, ascorbic acid, and fermentation-derived compounds are being utilized to enhance shelf life while meeting market demand for chemical-free products

- Functional beverages such as sports drinks, fortified waters, and plant-based alternatives are aligning closely with clean-label demands. The inclusion of naturally sourced vitamins, minerals, and plant extracts in beverages addresses both taste and health needs without reliance on artificial synthetics

- The clean-label trend is expanding from premium products into mainstream categories, signaling a long-term shift in beverage additives. As a result, suppliers are reformulating and also advancing sourcing, labeling, and sustainability practices to meet evolving consumer expectations for trust, safety, and authenticity in beverages

Beverages Additives Market Dynamics

Driver

“Rising Consumption of Ready-To-Drink and Functional Drinks”

- The increasing consumption of ready-to-drink and functional beverages is a major driver boosting the growth of beverage additives. Convenience-oriented lifestyles and demand for nutritional benefits in beverages are pushing expansion in additive use across multiple beverage segments

- For instance, Coca-Cola has expanded its functional drinks portfolio with additions such as vitamin-enhanced Smartwater and energy-infused beverages under Powerade, while PepsiCo has strengthened additive-driven RTD offerings through Gatorade and Tropicana functional lines. These developments reflect how leading brands leverage additives to innovate within ready-to-drink formats

- Additives such as natural flavors, sweeteners, stabilizers, and texturizers play a critical role in maintaining consistency, taste, and shelf life in ready-to-drink products. Consumers expect beverages that deliver refreshing quality, with additives ensuring product integrity during storage and distribution

- In addition, functional drinks enriched with probiotics, antioxidants, and plant-derived ingredients are creating new demand for specialized additives. These additives ensure bioavailability of nutrients while maintaining stability and appealing sensory profiles in products

- The proliferation of ready-to-drink and functional beverages shows no signs of slowing, directly fueling sustained demand for clean, natural, and functional additives. This growing segment ensures a strong base for additive manufacturers to innovate and align with evolving beverage consumption patterns worldwide

Restraint/Challenge

“Regulatory and Safety Compliance”

- Compliance with stringent food and beverage safety regulations presents a significant challenge to the beverage additives market. Regulatory complexities around allowable ingredients, labeling requirements, and health claims slow the market’s ability to commercialize innovations quickly and effectively

- For instance, companies such as Archer Daniels Midland (ADM) and DSM have faced instances where new additive launches required extended evaluation by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). This extended approval process delays product rollouts and raises development costs

- The complex landscape of safety testing for additives such as sweeteners, stabilizers, and preservatives demands significant investment in research, compliance documentation, and certification. New formulations face strict scrutiny before reaching the consumer market, intensifying challenges for smaller firms with limited resources

- In addition, regional disparities in acceptable additives and labeling norms create hurdles for global beverage brands. An additive approved in one geography may face restrictions in another, compelling companies to reformulate products based on market-specific regulatory frameworks

- While consumers push for natural and innovative additives, the need for scientific validation of safety, proven efficacy, and consistent global compliance slows innovation cycles. Overcoming these regulatory challenges through harmonization efforts, transparent ingredient communication, and proactive safety assurance will be crucial for sustaining long-term growth in the beverages additives market

Beverages Additives Market Scope

The market is segmented on the basis of product type, form, and application.

• By Product Type

On the basis of product type, the beverages additives market is segmented into flavoring agents, colorants, food preservatives, and others. The flavoring agents segment dominated the largest market revenue share of 43% in 2024, driven by the rising consumer preference for enhanced taste and aroma in beverages. Manufacturers are increasingly incorporating natural and artificial flavors to cater to evolving taste profiles, supporting both alcoholic and non-alcoholic products. The segment also benefits from the growing trend of premium and functional beverages, where distinctive flavor profiles are used as a key differentiator in competitive markets. In addition, flavoring agents offer versatility in beverage formulation, allowing producers to innovate and target niche consumer segments effectively.

The colorants segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for visually appealing beverages. Colorants play a critical role in product differentiation and brand recognition, especially in functional and ready-to-drink beverages. The rising consumer preference for vibrant and natural colors is prompting manufacturers to adopt natural colorants that align with clean-label trends. Moreover, regulatory support for safe food-grade colorants further drives their adoption across both alcoholic and non-alcoholic segments.

• By Form

On the basis of form, the beverages additives market is segmented into dry and wet. The dry form segment dominated the largest market revenue share in 2024, supported by its longer shelf life, ease of storage, and convenience in handling during beverage formulation. Dry additives are particularly preferred by large-scale beverage manufacturers for precise dosing and consistent quality, reducing production complexity. Their stability under varied processing conditions also makes them suitable for powdered mixes and instant beverage products, contributing to their widespread adoption.

The wet form segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its ease of blending and uniform dispersion in liquid formulations. Wet additives offer superior solubility and faster integration during beverage production, making them ideal for functional drinks, syrups, and ready-to-drink beverages. The growing preference for liquid concentrates in both alcoholic and non-alcoholic segments, due to process efficiency and consistent flavor delivery, is further accelerating the growth of this segment.

• By Application

On the basis of application, the beverages additives market is segmented into alcoholic beverages and non-alcoholic beverages. The non-alcoholic beverages segment dominated the largest market revenue share in 2024, propelled by the rising consumption of soft drinks, energy drinks, juices, and functional beverages globally. Increasing health consciousness and demand for fortified beverages with added flavors, colors, or preservatives have reinforced the adoption of additives in non-alcoholic drinks. Market players are actively innovating to enhance taste, appearance, and shelf life, making additives a critical component in the non-alcoholic segment.

The alcoholic beverages segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the surge in craft and premium alcoholic products where flavor and appearance are key differentiators. Additives in alcoholic beverages enhance taste complexity, color stability, and shelf life, appealing to both traditional and experimental consumers. The expansion of ready-to-drink alcoholic beverages, coupled with growing cocktail culture in emerging markets, further contributes to the segment’s rapid growth.

Beverages Additives Market Regional Analysis

- North America dominated the beverages additives market with the largest revenue share of over 40% in 2024, driven by high consumption of both alcoholic and non-alcoholic beverages and the strong demand for flavor, color, and preservation enhancements

- Consumers in the region prioritize product quality, natural ingredients, and innovative flavors, prompting manufacturers to introduce premium and functional additives

- The market growth is further supported by high disposable incomes, stringent food safety standards, and a mature supply chain, making North America a key region for beverages additives

U.S. Beverages Additives Market Insight

The U.S. beverages additives market captured the largest revenue share in 2024 within North America, fueled by the widespread adoption of functional drinks, flavored beverages, and processed drinks. Consumer preference for natural flavoring agents and colorants, alongside fortified beverages, is driving growth. The trend toward healthier, low-sugar, and clean-label beverages is encouraging manufacturers to innovate with safe preservatives and natural additives. Strong distribution networks and growing demand in foodservice and retail channels further support the market’s expansion.

Europe Beverages Additives Market Insight

The Europe beverages additives market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising demand for high-quality flavored beverages and regulatory support for safe additive use. Consumers are increasingly focusing on natural and clean-label products, boosting the adoption of natural colorants and flavoring agents. The region is witnessing growth across non-alcoholic and alcoholic segments, with additives playing a crucial role in enhancing taste, appearance, and shelf life.

U.K. Beverages Additives Market Insight

The U.K. beverages additives market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising demand for flavored soft drinks, juices, and alcoholic beverages. The market is also driven by consumer interest in premium, functional, and fortified beverages. Increasing awareness regarding food safety and labeling regulations, along with a strong retail and e-commerce infrastructure, continues to stimulate market adoption.

Germany Beverages Additives Market Insight

The Germany beverages additives market is expected to expand at a considerable CAGR during the forecast period, supported by the growing preference for high-quality, natural, and innovative beverage products. Strong regulatory frameworks ensure additive safety, driving consumer confidence. The market also benefits from a well-developed manufacturing sector and rising consumption of flavored and functional drinks across residential and commercial channels.

Asia-Pacific Beverages Additives Market Insight

The Asia-Pacific beverages additives market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing consumption of ready-to-drink and functional beverages in countries such as China, India, and Japan. The region’s increasing demand for flavored and fortified beverages, supported by government initiatives for food safety and digital retail adoption, is propelling market growth.

Japan Beverages Additives Market Insight

The Japan beverages additives market is gaining momentum due to a high preference for innovative and functional beverages, combined with rising health-consciousness among consumers. The demand for natural flavors and preservatives is increasing in both non-alcoholic and alcoholic beverages. Manufacturers are introducing convenient, ready-to-drink products that integrate additives for enhanced taste, appearance, and shelf life.

China Beverages Additives Market Insight

The China beverages additives market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, rapid urbanization, and increasing demand for flavored and fortified beverages. Growth is further supported by the rise of domestic beverage manufacturers, strong distribution networks, and the popularity of functional and ready-to-drink products. The increasing focus on product innovation and affordable additive solutions is fueling the market’s expansion.

Beverages Additives Market Share

The beverages additives industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- DSM (Netherlands)

- Ashland (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- ADM (U.S.)

- California Custom Fruits & Flavors (U.S.)

- Sensient Colors, LLC (U.S.)

- Ingredion Incorporated (U.S.)

- Roquette Frères (France)

- DuPont (U.S.)

- Tate & Lyle (U.K.)

- Amyris (U.S.)

- Gulshan Polyols Ltd. (India)

- International Flavors & Fragrances Inc. (U.S.)

- Dallant, S.A. (Spain)

- Celanese Corporation (U.S.)

- Bell Flavors & Fragrances (U.S.)

- Kerry (Ireland)

- Prinova Group LLC (U.S.)

- Keva Flavours Pvt. Ltd. (India)

Latest Developments in Beverages Additives Market

- In August 2025, California-based T. Hasegawa introduced HASECITRUS, a groundbreaking technology designed to enhance the shelf life and stability of citrus flavors in beverages. The innovation protects delicate flavors from oxidation, ensuring that the taste remains fresh throughout the product’s lifecycle. By maintaining flavor stability without the need for refrigeration or specialized packaging, this technology enables beverage manufacturers to produce clean-label citrus drinks more efficiently. It also supports the rising consumer demand for natural, transparent ingredients, helping brands cater to health-conscious and convenience-driven customers while reducing waste and storage costs

- In July 2025, ADM unveiled a range of lifestyle beverage innovations that integrate functional ingredients aimed at supporting hydration, energy, and mental wellness. These developments reflect the growing trend of health-oriented beverages, where consumers seek added nutritional benefits alongside taste. By incorporating functional additives, manufacturers can differentiate their products in a crowded market and appeal to wellness-focused consumers. This approach allows brands to align with current lifestyle trends, meeting consumer expectations for drinks that contribute to overall health without compromising flavor or quality

- In June 2025, the U.S. Food and Drug Administration approved several new natural color additives sourced from minerals, algae, and flower petals. This approval allows beverage manufacturers to replace synthetic dyes with natural alternatives, enhancing the appeal of clean-label products. Natural colorants meet regulatory and safety requirements and also resonate with consumers increasingly seeking healthier, visually appealing drinks. The availability of these additives encourages product innovation, supports brand transparency, and enables manufacturers to respond effectively to the rising demand for beverages free from artificial ingredients

- In February 2025, the FDA recalled over 16,000 units of Oak Cliff Beverage Works’ Lemonade Base due to the undeclared presence of a synthetic dye associated with potential health risks. This event underscores the importance of regulatory compliance and highlights the increasing consumer awareness regarding artificial additives. The recall serves as a cautionary instance for beverage manufacturers to prioritize ingredient transparency, clean-label formulations, and rigorous quality control, reinforcing the market trend toward safer and more natural beverage solutions

- In September 2024, Bangalore-based Mossant Fermentary launched the first clean-label tonics globally, offering healthier alternatives to conventional beverages. These tonics are plant-based and transparent, aligning with growing health and wellness trends that emphasize natural ingredients. The launch addresses the rising consumer preference for beverages that are free from artificial additives while still delivering unique flavors. By catering to the demand for functional and clean-label drinks, Mossant has positioned itself at the forefront of innovation in the beverage additives market, setting new benchmarks for transparency, quality, and consumer trust

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Beverage Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Beverage Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Beverage Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.