Global Beverage Containers Market

Market Size in USD Billion

CAGR :

%

USD

154.30 Billion

USD

243.50 Billion

2024

2032

USD

154.30 Billion

USD

243.50 Billion

2024

2032

| 2025 –2032 | |

| USD 154.30 Billion | |

| USD 243.50 Billion | |

|

|

|

|

Beverage Containers Market Size

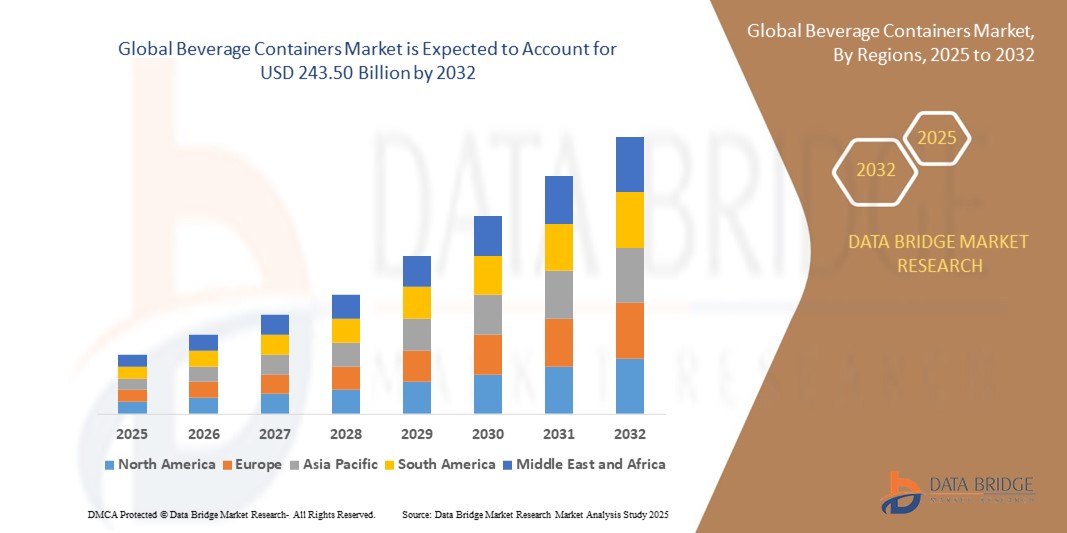

- The Global Beverage Containers Market size was valued at USD 154.30 Billion in 2024 and is expected to reach USD 243.50 Billion by 2032, at a CAGR of 5.2% during the forecast period

- The market growth is largely fueled by rising demand for both alcoholic and non-alcoholic beverages

- Furthermore, the adoption of lightweight and inexpensive packaging materials has transformed the way the packaging is done for beverages are further anticipated to propel the growth of the beverage containers market

Beverage Containers Market Analysis

- Beverage containers are the packaging materials that are used to contain and package alcoholic and non-alcoholic beverage products. The beverage containers make it easy and convenient in terms of handling and reduce the risk of contamination.

- Beverage containers play an important role in the transportation of beverage products and therefore, the containers are available in different sizes and shapes. The beverage containers also help to perform the functions of branding, labelling, identification and storage, and warehousing.

- The beverage containers also differ in the material as they are manufactured using varying materials such as glass, plastic, metal among others.

- North America dominates the Beverage Containers Market with the largest revenue share of 38.67% in 2024, characterized by high consumption of packaged beverages and strong demand for sustainable packaging solutions.

- Asia-Pacific is expected to be the fastest growing region in the Beverage Containers Market during the forecast period due to rapid urbanization, rising disposable income, and growing preference for hygienic, portable beverage solutions

- The plastics segment is expected to dominate the beverage containers market with a market share of 36.2% in 2024, driven by plastic's versatility, cost-effectiveness, and lightweight properties, making it ideal for various beverage container applications

Report Scope and Beverage Containers Market Segmentation

|

Attributes |

Beverage Containers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Beverage Containers Market Trends

“Smart Packaging and Sustainability Convergence in Beverage Containers”

- A prominent trend in the Global Beverage Containers Market is the integration of smart packaging technologies with sustainable materials. Beverage brands are increasingly adopting digital tools like QR codes, RFID tags, and thermochromic inks to engage consumers while meeting environmental mandates.

- For instance, Coca-Cola launched a smart beverage bottle in 2024 using NFC tags to deliver interactive content and recycling information.

- Similarly, Nestlé introduced water bottles with temperature-sensitive inks that change color, enhancing both user experience and sustainability awareness.

- Companies like SIG and Tetra Pak are deploying smart sensors and blockchain for supply chain transparency.

- This convergence allows beverage companies to track product freshness, monitor consumer interaction, and reduce plastic usage.

- As regulatory and consumer pressure for recyclable, reusable, and smart containers grows, the use of biodegradable materials paired with intelligent features is driving innovation across the bottled water, soft drinks, and functional beverages segments.

Beverage Containers Market Dynamics

Driver

“Consumer Demand for Convenience and On-the-Go Formats”

- The rising global consumption of RTD (ready-to-drink) beverages, fueled by urban lifestyles and health-conscious habits, is driving demand for innovative beverage containers.

- Lightweight, resealable, and portable packaging formats are essential for meeting the expectations of active consumers.

- For instance, PepsiCo launched redesigned aluminum slim cans in early 2024 for its energy drink line to cater to convenience-seeking millennials.

- Moreover, formats with improved ergonomics, spill-proof caps, and single-serve sizes are increasingly being adopted by functional beverage and protein drink producers.

Restraint/Challenge

“Volatile Raw Material Prices and Complex Recycling Infrastructure”

- The beverage containers market is vulnerable to fluctuations in raw material prices, especially aluminum, PET resin, and bio-based polymers.

- Moreover, fragmented recycling infrastructure in regions like Southeast Asia and parts of Africa limits the circularity of beverage containers.

- According to the Ellen MacArthur Foundation, only 14% of global plastic packaging is collected for recycling, with even less undergoing effective reuse.

- Beverage brands face logistical and financial challenges in establishing reverse logistics systems and ensuring compliance across different national EPR regulations.

- These constraints hamper the scalability of sustainable solutions and limit rapid deployment in developing markets.

Beverage Containers Market Scope

The market is segmented on the basis of material type, product type, and application.

- By Material Type

On the basis of material type, the Beverage Containers Market is segmented into plastics, paper and paperboard, and glass and metals. The plastics segment dominates the largest market revenue share of 36.2% in 2024, driven by plastic's versatility, cost-effectiveness, and lightweight properties, making it ideal for various beverage container applications. Plastic containers are widely used for water, soft drinks, juices, and alcoholic beverages due to their durability and recyclability.

The paper & paperboard segment is anticipated to witness the fastest growth rate of 6.8% from 2025 to 2032, fueled by increasing demand for sustainable and eco-friendly packaging solutions. Brands are shifting towards biodegradable and recyclable materials like paper and paperboard, especially for packaging juices, dairy products, and ready-to-drink beverages.

- By Product Type

On the basis of product type, the beverage containers market is segmented into bottles, cartons, cans, bag-in-boxes, jars, pouches and others. The bottles segment held the largest market revenue share in 2024, attributed to their widely used across various beverage categories, including water, soft drinks, juices, and alcoholic beverages, due to their convenience, portability, and branding opportunities. The increasing adoption of PET bottles, particularly in emerging markets, has strengthened this segment's position.

The cartons segment is expected to witness the fastest CAGR from 2025 to 2032, as cartons, primarily made from renewable resources like paperboard, are gaining popularity for packaging juices, dairy products, and plant-based beverages. Their sustainability credentials and innovative aseptic packaging solutions that extend product shelf life contribute to their growing adoption.

- By Application

On the basis of application, the beverage containers market is segmented into alcoholic beverages and non-alcoholic beverages. The alcoholic beverages segment captured the largest market revenue share in 2024, driven by the enduring popularity of alcoholic drinks such as beer, wine, and spirits, which require specialized containers like glass bottles and aluminum cans to maintain their taste and quality. Premium and craft alcohol brands emphasize unique packaging aesthetics, further contributing to this segment's market leadership.

The non-alcoholic beverages segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by rising health consciousness and consumer preference for functional beverages like energy drinks, sports drinks, and fortified waters. Manufacturers are compelled to innovate and introduce a diverse range of non-alcoholic beverages, consequently driving the demand for their containers.

Beverage Containers Market Regional Analysis

- North America dominates the Beverage Containers Market with the largest revenue share of 38.67% in 2024, driven by high consumption of packaged beverages and strong demand for sustainable packaging solutions.

- Consumers and companies in the region increasingly prefer recyclable and lightweight containers, encouraging the shift from traditional glass to PET bottles and aluminum cans in carbonated drinks, juices, and ready-to-drink teas.

- Growth is also fueled by regulatory support for recycling initiatives, rising popularity of health-focused beverages, and investments in advanced filling and packaging technology across the beverage industry.

U.S. Beverage Containers Market Insight

The U.S. Beverage Containers Market captured the largest revenue share of 83.15% in 2025 within North America, fueled by rising demand for single-serve packaging and growing health-conscious consumer preferences. Major beverage players are adopting aluminum and recycled PET for water, functional drinks, and low-calorie sodas. EPR regulations and federal sustainability goals are accelerating innovation in circular packaging formats across soft drinks, bottled water, and energy beverages.

Europe Beverage Containers Market Insight

The European Beverage Containers Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the EU’s directives on single-use plastics and strong momentum toward deposit return systems. Beverage producers are emphasizing lightweight, reusable, and mono-material solutions to meet carbon neutrality targets, particularly in Germany, France, and the Netherlands. Growth is also bolstered by the rising demand for organic juices and sparkling water packaged in recyclable cans and glass.

U.K. Beverage Containers Market Insight

The U.K. Beverage Containers Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by national commitments to reduce plastic waste and expand recycling infrastructure. Retailers and beverage brands are shifting to refillable and closed-loop container programs. Increased demand for premium juices, kombucha, and craft sodas is also boosting the use of high-clarity glass and aluminum bottles.

Germany Beverage Containers Market Insight

The German Beverage Containers Market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s robust recycling systems and mandatory deposit-return legislation. Germany’s beverage sector is advancing toward a fully circular economy by increasing the share of reusable glass bottles and refillable PET systems. Demand for dairy-based drinks and carbonated beverages packaged in sustainable containers is expanding across retail and foodservice channels.

Asia-Pacific Beverage Containers Market Insight

The Asia-Pacific Beverage Containers Market is poised to grow at the fastest CAGR of over 6.5% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable income, and growing preference for hygienic, portable beverage solutions. Local producers are investing in lightweight PET and biodegradable packaging for tea, juice, and energy drinks. China, India, and Southeast Asia are witnessing strong growth in bottled water and functional beverages, intensifying demand for low-cost, recyclable containers.

Japan Beverage Containers Market Insight

The Japan Beverage Containers Market is gaining momentum due to cultural emphasis on convenience and recycling efficiency. With high beverage vending machine penetration, demand for lightweight, resealable, and recyclable containers remains strong. Innovations in smart packaging and sustainable plastics are also emerging in response to national environmental goals. Green tea, functional waters, and isotonic beverages are key segments driving container evolution.

China Beverage Containers Market Insight

The China Beverage Containers Market accounted for the largest market revenue share in Asia Pacific in 2025, driven by its vast population and the rapid expansion of RTD tea, bottled water, and dairy drinks. Government mandates for plastic reduction and investments in local recycling infrastructure are reshaping packaging strategies. Aluminum cans, multilayer PET bottles, and plant-based plastics are gaining traction as major beverage manufacturers scale up production to meet evolving consumer preferences and sustainability demands.

Beverage Containers Market Share

The Beverage Containers Industry is primarily led by well-established companies, including:

- Liquibox (U.S.)

- Amcor plc (Switzerland)

- ProAmpac (U.S.)

- Crown (U.S.)

- Ardagh Group S.A. (Luxembourg)

- BALL CORPORATION (U.S.)

- Berry Global Inc. (U.S.)

- CCL Industries (Canada)

- Sonoco Products Company (U.S.)

- The Coca-Cola Company (U.S.)

- Pactiv Evergreen Inc. (U.S.)

- Tetra Pak Group (Switzerland)

- Toyo Seikan Group Holdings, Ltd. (Japan)

- O-I Glass, Inc. (U.S.)

- Silgan Holdings Inc. (U.S.)

- Mondi (United Kingdom)

- Alcoa Corporation (U.S.)

- Stora Enso (Finland)

- CKS Packaging, Inc. (U.S.)

- Graham Packaging Company (U.S.)

Latest Developments in Global Beverage Containers Market

- In October 2023, CPMC Holdings Limited revealed plans to construct a new beverage can facility in Hungary, as part of a joint venture with ORG. This project would become Europe’s second beverage can plant under Chinese ownership and will produce two-piece aluminum cans, representing a major move in the beverage packaging sector.

- In August 2023, TricorBraun acquired CanSource, a producer of brite, shrink-sleeved, and printed cans serving the craft beer, wine, spirits, and non-alcoholic beverage segments. Although the deal's value was not disclosed, it significantly bolstered TricorBraun’s market presence across North America.

- In July 2022, Canpack S.A., part of the Canpack Group, announced the expansion of its aluminum can production with a new facility in Poços de Caldas, Minas Gerais, Brazil. The plant, with an initial annual capacity of around 1.3 billion cans, involved a USD 140 million investment.

- In January 2021, Crown Holdings Inc. announced the construction of a new beverage can facility in Kentucky to meet the rising demand in North America for cans used in sparkling water, energy drinks, craft beers, and cocktails.

- In February 2020, Amcor unveiled its latest custom packaging designs at the Wine and Grape Symposium in North America and announced a partnership with British start-up Garçon Wines. As part of this collaboration, Amcor would manufacture flat wine bottles in the U.S. using post-consumer recycled (PCR) PET plastic.

- In January 2020, Ardagh Group, Glass – North America, a division of Ardagh Group SA and the leading domestic glass bottle producer for the U.S. wine industry, introduced six elegant new glass wine bottle designs.

- In October 2020, Ball Corporation partnered with Kroenke Sports & Entertainment to promote sustainability in sports and entertainment using aluminum beverage packaging.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Beverage Containers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Beverage Containers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Beverage Containers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.