Global Beverage Dispenser Equipment Market

Market Size in USD Billion

CAGR :

%

USD

15.39 Billion

USD

21.89 Billion

2024

2032

USD

15.39 Billion

USD

21.89 Billion

2024

2032

| 2025 –2032 | |

| USD 15.39 Billion | |

| USD 21.89 Billion | |

|

|

|

|

Beverage Dispenser Equipment Market Size

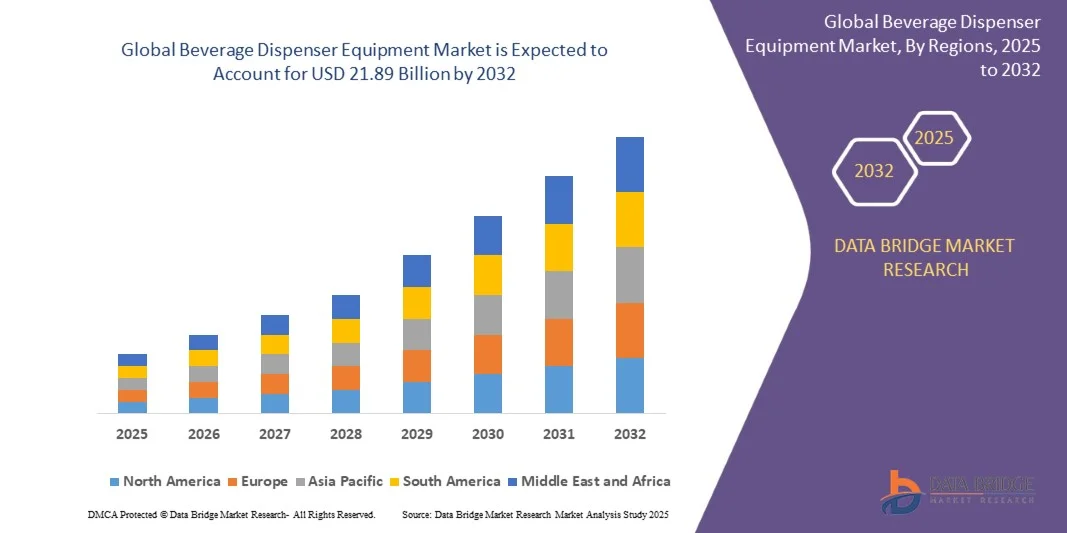

- The Beverage Dispenser Equipment Market size was valued at USD 15.39 billion in 2024 and is projected to reach USD 21.89 billion by 2032, growing at a CAGR of 4.50% during the forecast period

- The market expansion is primarily driven by increasing demand for automated and energy-efficient beverage dispensing systems across commercial sectors such as restaurants, hotels, and convenience stores

- Additionally, rising consumer preference for customizable, contactless, and hygienic beverage solutions is pushing innovation in dispenser technologies, further propelling market growth across both developed and emerging regions

Beverage Dispenser Equipment Market Analysis

- Beverage dispenser equipment, which enables the efficient and hygienic dispensing of various beverages, is becoming an essential component in modern foodservice operations and hospitality settings due to its ability to offer consistent quality, portion control, and enhanced user experience

- The rising demand for beverage dispenser equipment is primarily fueled by increasing consumer preference for on-the-go beverages, growing popularity of self-service formats, and the expanding footprint of quick-service restaurants and cafes globally

- Asia-Pacific dominated the Beverage Dispenser Equipment Market with the largest revenue share of 36.1% in 2024, supported by advanced foodservice infrastructure, strong consumer demand for convenience, and significant investments in automation by major restaurant and hospitality chains

- North America is expected to be the fastest growing region in the Beverage Dispenser Equipment Market during the forecast period due to rapid urbanization, rising middle-class population, and a surge in modern retail and foodservice establishments across countries like China and India

- The non-alcoholic segment dominated the market with the largest revenue share of 58.4% in 2024, owing to the widespread consumption of soft drinks, juices, water, and ready-to-drink teas and coffees.

Report Scope and Beverage Dispenser Equipment Market Segmentation

|

Attributes |

Beverage Dispenser Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Beverage Dispenser Equipment Market Trends

“Enhanced User Experience Through AI and Smart Dispensing Integration”

- A significant and rapidly emerging trend in the Beverage Dispenser Equipment Market is the integration of artificial intelligence (AI) and smart technologies into dispensing systems, enhancing operational efficiency, personalization, and user convenience across various end-use environments.

- For Instance, AI-enabled beverage dispensers are being developed to learn consumer preferences and adjust beverage formulations in real-time, offering personalized drink experiences. Brands such as Coca-Cola Freestyle machines already allow users to customize their drinks via touchscreens or connected apps, while new models are incorporating AI to predict popular choices based on time of day or location.

- AI integration also allows smart dispensers to monitor usage patterns, track ingredient levels, and provide predictive maintenance alerts to minimize downtime and ensure optimal performance. In commercial settings, this translates into reduced waste, lower operational costs, and more consistent product quality.

- Smart beverage dispensers are increasingly compatible with voice assistants such as Amazon Alexa or Google Assistant, allowing users in hospitality or self-service environments to initiate beverage dispensing or receive system status updates via voice commands, enabling touch-free operation.

- Integration with broader IoT platforms enables centralized control of beverage dispensers along with refrigeration, inventory management, and customer engagement tools—creating a connected foodservice ecosystem. This enhances business insights and improves service delivery in real-time.

- As demand grows for intelligent, hygienic, and interactive beverage experiences, companies like Welbilt and Hoshizaki are developing AI-integrated beverage systems that support remote monitoring, customizable menus, and integration with mobile and voice interfaces.

- This trend is reshaping consumer expectations in both commercial and institutional sectors, with beverage dispensers increasingly seen not just as equipment, but as smart service tools that align with broader digital transformation in food and hospitality.

Beverage Dispenser Equipment Market Dynamics

Driver

“Growing Demand Driven by Convenience, Hygiene, and Foodservice Expansion”

- The increasing demand for convenience, speed, and hygiene in beverage service—particularly in high-traffic venues like restaurants, convenience stores, and hotels—is a major factor driving the growth of the Beverage Dispenser Equipment Market.

- For instance, in March 2024, The Coca-Cola Company introduced AI-enabled beverage dispensers with contactless and voice-activated capabilities aimed at quick-service restaurants and event venues, enhancing the user experience while minimizing physical contact. Innovations like these by leading industry players are expected to drive adoption across both developed and emerging markets during the forecast period.

- With a growing global emphasis on food safety and operational efficiency, beverage dispensers offer features such as touchless operation, portion control, and real-time monitoring of beverage quality and inventory. These capabilities not only reduce waste and manual errors but also improve customer satisfaction.

- Additionally, the surge in fast food, coffee chains, and co-working spaces that rely on efficient and scalable beverage dispensing solutions is accelerating product penetration. Operators increasingly prefer automated dispensing systems for their ability to streamline workflows and ensure consistency across multiple locations.

- The integration of beverage dispensers into smart kitchens and connected foodservice systems further adds value, enabling remote monitoring, usage analytics, and system alerts through centralized platforms. This appeal to both operational and technological efficiency is driving adoption in commercial, institutional, and even residential applications.

- Moreover, the growing DIY beverage trend, particularly in co-living and micro-market environments, is contributing to the popularity of compact and smart dispensers. Brands like Danby and Igloo are introducing consumer-oriented models that blend design with intelligent functionality, meeting evolving expectations for smart and hygienic beverage solutions.

Restraint/Challenge

“High Initial Investment and Maintenance Complexity”

- Despite the numerous benefits, the high initial costs associated with purchasing and installing advanced beverage dispenser equipment—especially smart or AI-integrated models—pose a significant barrier to adoption, particularly for small businesses or operators in developing regions.

- For instance, state-of-the-art dispensers with customizable interfaces, automated cleaning systems, and cloud connectivity can represent a substantial upfront investment when compared to traditional manual solutions. This cost gap may deter budget-conscious operators from upgrading their existing systems.

- Additionally, the complexity of maintenance for technologically advanced dispensers, including software updates, IoT connectivity issues, and mechanical servicing, adds operational challenges. Businesses lacking dedicated technical staff may face increased downtime or require third-party support, increasing long-term ownership costs.

- Concerns around system reliability, replacement parts, and training requirements further contribute to hesitancy in market segments with limited access to skilled technicians or distributor networks.

- To overcome these obstacles, manufacturers are focusing on offering modular designs, flexible leasing models, and simplified user interfaces that reduce maintenance demands. Increased availability of local service networks and improved customer support will be crucial in broadening the market reach of smart beverage dispensers.

Beverage Dispenser Equipment Market Scope

The beverage dispenser equipment market is segmented on the basis of beverage type, technology, product type and end use.

• By Beverage Type

On the basis of beverage type, the Beverage Dispenser Equipment Market is segmented into alcoholic and non-alcoholic. The non-alcoholic segment dominated the market with the largest revenue share of 58.4% in 2024, owing to the widespread consumption of soft drinks, juices, water, and ready-to-drink teas and coffees. Non-alcoholic dispensers are commonly used across quick-service restaurants, cinemas, offices, and institutional settings where high-volume, hygienic, and consistent beverage service is required.

The alcoholic segment is expected to witness the fastest CAGR of 22.6% from 2025 to 2032, driven by rising demand for automated wine and beer dispensers in bars, pubs, and premium hotels. Increasing preference for draft beverages and portion-controlled alcohol serving systems in developed markets is fueling innovation in this segment. Smart dispensers capable of tracking consumption, automating inventory, and offering personalized pours are gaining popularity in both commercial and self-serve environments.

• By Technology

On the basis of technology, the market is segmented into automatic, semi-automatic, and manual dispensers. The automatic segment held the largest market share of 47.3% in 2024, primarily due to its growing adoption in commercial environments where efficiency, hygiene, and speed are critical. Automatic dispensers equipped with touchless sensors and programmable settings offer a premium experience, reduce waste, and comply with health regulations—making them ideal for modern restaurants, hotels, and institutional facilities.

The semi-automatic segment is anticipated to grow at the fastest CAGR of 21.3% during the forecast period, as it strikes a balance between functionality and affordability. These systems are especially favored by small- to mid-sized establishments and co-working spaces where customization and moderate automation are desired. Increasing availability of compact, semi-automatic models that integrate IoT and mobile controls is further boosting this segment’s adoption in emerging economies and casual hospitality settings.

• By Product Type

On the basis of product type, the Beverage Dispenser Equipment Market is segmented into soft drink or cold drink dispensers, water dispensers, juice dispensers, coffee or tea dispensers, and beer and wine dispensers. The soft drink or cold drink dispenser segment dominated with a market share of 36.9% in 2024, driven by strong demand in fast food outlets, convenience stores, and movie theaters. These dispensers are designed for high-volume, rapid service, and often integrate with branded syrup systems and automated portion control.

The beer and wine dispenser segment is projected to register the fastest CAGR of 23.1% from 2025 to 2032, due to increasing consumer interest in tap-based alcohol service and premium self-pour experiences. These dispensers help minimize wastage, maintain product freshness, and are increasingly equipped with digital payment and age verification features—making them attractive to bars, pubs, and even event venues.

• By End Use

On the basis of end use, the Beverage Dispenser Equipment Market is categorized into hotels, bars and pubs, restaurants and coffee shops, cinemas, and others. The restaurants and coffee shops segment led the market with the largest revenue share of 41.5% in 2024, reflecting the strong influence of the foodservice sector on beverage dispensing needs. Operators in this segment demand reliable, aesthetically pleasing, and hygienic equipment to ensure fast and consistent service. The integration of smart, user-friendly dispensers also enhances customer satisfaction and operational efficiency.

The bars and pubs segment is expected to witness the fastest CAGR of 22.9% from 2025 to 2032, fueled by the rising adoption of beer, wine, and cocktail dispensing machines. These venues increasingly invest in smart beverage systems for portion control, freshness preservation, and inventory tracking—enhancing profitability and user experience. Innovations in self-serve taproom systems are also boosting this segment’s growth globally.

Beverage Dispenser Equipment Market Regional Analysis

- Asia-Pacific dominated the Beverage Dispenser Equipment Market with the largest revenue share of 36.1% in 2024, driven by the strong presence of quick-service restaurants, cafes, and hospitality chains, along with a high rate of technological adoption in foodservice operations.

- Businesses and consumers in the region highly value the efficiency, hygiene, and customization offered by modern beverage dispenser systems, especially those integrated with touchless, smart, and IoT-enabled features.

- This widespread adoption is further supported by high disposable incomes, a well-developed foodservice infrastructure, and strong demand for automated, sustainable solutions, making beverage dispenser equipment a preferred investment across both commercial and institutional settings.

U.S. Beverage Dispenser Equipment Market Insight

The U.S. beverage dispenser equipment market captured the largest revenue share of 79% in 2024 within North America, driven by the rapid expansion of the foodservice industry and the widespread adoption of automated and hygienic beverage dispensing solutions. The rise of quick-service restaurants, convenience stores, and workplace cafeterias is fueling strong demand for both hot and cold beverage dispensers. Additionally, the growing trend of self-service stations and touchless dispensing—especially in the post-pandemic landscape—continues to support market growth. The U.S. also benefits from a robust presence of key players such as The Coca-Cola Company, Welbilt, and Middleby Corporation, who are continually innovating in AI integration, smart portion control, and connectivity.

Europe Beverage Dispenser Equipment Market Insight

The Europe beverage dispenser equipment market is projected to expand at a solid CAGR throughout the forecast period, bolstered by stringent hygiene regulations, increasing sustainability efforts, and the adoption of energy-efficient dispensing solutions. Countries across Europe are witnessing rising demand for compact and aesthetically appealing dispensers in cafés, hotels, and office spaces. Additionally, the region’s strong preference for reusable packaging and waste reduction is encouraging the use of smart beverage dispensers that support precise portion control and tracking. Growth is prominent in both commercial and institutional applications, with innovations catering to the eco-conscious European consumer base.

U.K. Beverage Dispenser Equipment Market Insight

The U.K. beverage dispenser equipment market is expected to grow at a notable CAGR, supported by increasing demand from hospitality venues, coffee chains, and corporate spaces. As consumers seek faster, cleaner, and more customizable beverage options, the adoption of automated dispensers continues to rise. The growth of specialty coffee shops, along with evolving customer preferences for self-service and contactless solutions, is propelling investments in advanced dispensing technologies. Furthermore, the push toward energy efficiency and reduced water usage is aligning with government sustainability initiatives, making the U.K. a high-potential market for innovative beverage equipment solutions.

Germany Beverage Dispenser Equipment Market Insight

Germany’s beverage dispenser equipment market is expected to grow steadily, driven by the country’s established hospitality infrastructure and its strong commitment to technology and environmental sustainability. The increasing implementation of intelligent dispensers in restaurants, hotels, and coworking spaces is enhancing operational efficiency and customer experience. German consumers and businesses are placing growing importance on hygienic, customizable, and eco-friendly dispensing systems. Additionally, the integration of beverage dispensers into smart kitchen systems, especially in urban settings, is contributing to rising adoption in both new establishments and retrofitted commercial kitchens.

Asia-Pacific Beverage Dispenser Equipment Market Insight

The Asia-Pacific beverage dispenser equipment market is projected to grow at the fastest CAGR of 23.7% from 2025 to 2032, fueled by rising urbanization, growing disposable incomes, and increasing demand for modern food and beverage service solutions. Rapid expansion of retail chains, cafes, and hotel infrastructure in countries such as China, India, and Japan is driving adoption. Additionally, government efforts promoting smart cities and digital transformation across the region are encouraging automation in foodservice operations. With APAC also emerging as a global manufacturing hub for beverage dispensing components, affordability and accessibility of advanced dispensers are increasing across diverse market segments.

Japan Beverage Dispenser Equipment Market Insight

Japan’s beverage dispenser equipment market is gaining traction due to the country’s strong culture of automation, compact design innovation, and emphasis on hygiene. With the popularity of vending machines and compact cafes, the demand for small-footprint, high-efficiency beverage dispensers is rising. Japanese businesses prioritize reliability and technological integration, leading to widespread use of smart dispensers in both commercial and institutional environments. Moreover, the rise of eco-conscious consumers is pushing for dispensers that support reusable containers and reduce plastic usage, aligning with Japan's sustainability goals.

China Beverage Dispenser Equipment Market Insight

China accounted for the largest revenue share in the Asia-Pacific beverage dispenser equipment market in 2024, attributed to its massive foodservice sector, growing middle class, and fast-paced adoption of smart and self-service technologies. Beverage dispensers are increasingly used in fast-food chains, tech parks, universities, and smart cafeterias, driven by consumer demand for convenience and hygiene. The proliferation of tech-savvy consumers and strong domestic manufacturing capabilities make China a key hub for innovation in the segment. Integration with mobile payment systems, AI-based customization, and connected maintenance platforms are shaping the next wave of dispenser solutions in the country.

Beverage Dispenser Equipment Market Share

The Beverage Dispenser Equipment industry is primarily led by well-established companies, including:

- Avantco Equipment (U.S.)

- Marmon Foodservice Technologies, Inc. (U.S.)

- Professional Beverage Systems (U.S.)

- TableCraft Products Company (U.S.)

- The Vollrath Company, LLC (U.S.)

- Wells Fargo (U.S.)

- Bloomfield, LLC (U.S.)

- Igloo Products Corp. (U.S.)

- FBD Partnership, LP (U.S.)

- Follett Products, LLC (U.S.)

- Hoshizaki Corporation (Japan)

- Bras Internazionale Spa (Italy)

- Danby Appliances Inc. (Canada)

- Cambro Manufacturing Company (U.S.)

- Standex International Corporation (U.S.)

- The Middleby Corporation (U.S.)

- Welbilt Inc. (U.S.)

- The Coca Cola Company (U.S.)

- Nestlé S.A. (Switzerland)

- Rosseto Country Kitchen Creations (U.S.)

- Godrej & Boyce Mfg. Co. Ltd. (India)

- Berg Company, LLC (U.S.)

What are the Recent Developments in Beverage Dispenser Equipment Market?

- In April 2023, Cornelius Inc., a global leader in beverage dispensing solutions, launched a strategic initiative in South Africa aimed at enhancing beverage service efficiency in both commercial and hospitality sectors. This initiative emphasizes the company’s commitment to delivering innovative, reliable dispenser technologies tailored to regional market needs. By leveraging its global expertise and advanced product offerings, Cornelius is strengthening its position in the rapidly expanding Beverage Dispenser Equipment Market.

- In March 2023, Beverage-Air, a leading U.S.-based manufacturer of commercial refrigeration and dispensing equipment, introduced a new line of energy-efficient soda dispensers designed specifically for high-traffic restaurants and convenience stores. The innovative systems feature improved temperature control and automated cleaning cycles, highlighting Beverage-Air’s dedication to sustainability and operational efficiency in the foodservice industry.

- In March 2023, Follett Products, LLC successfully completed the rollout of a large-scale beverage dispensing solution for a major airport in India, aimed at improving passenger convenience and reducing waste. This project showcases Follett’s advanced dispensing technologies and its commitment to supporting smart, eco-friendly infrastructure in growing urban environments, reinforcing its presence in the Asia-Pacific market.

- In February 2023, Hoshizaki Corporation, a global leader in commercial refrigeration and ice machines, announced a partnership with a major European hotel chain to deploy integrated beverage dispensing and refrigeration systems across multiple properties. This collaboration aims to enhance operational efficiency and guest experience, emphasizing Hoshizaki’s focus on innovation and customer-centric solutions in the hospitality industry.

- In January 2023, The Coca-Cola Company unveiled its latest smart beverage dispenser at the National Restaurant Association Show, featuring IoT-enabled functionality for real-time inventory monitoring and remote diagnostics. This new system highlights Coca-Cola’s commitment to leveraging advanced technology to improve service quality and reduce operational costs, strengthening its leadership in the Beverage Dispenser Equipment Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.