Global Beverage Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

8.77 Billion

USD

13.72 Billion

2024

2032

USD

8.77 Billion

USD

13.72 Billion

2024

2032

| 2025 –2032 | |

| USD 8.77 Billion | |

| USD 13.72 Billion | |

|

|

|

|

Beverages Processing Equipment Market Analysis

Expansion of beverage industry are expected to drive the market growth. High initial investment and maintenance costs is expected to hinder the market. Adaptation of innovative technologies in the beverage processing industry is expected to provide opportunity for the market growth. Changing consumer preference toward fresh and non-processed food and beverages is expected to challenge the market.

Beverages Processing Equipment Market Size

The global Beverages Processing Equipment market size was valued at USD 8.77 billion in 2024 and is projected to reach USD 13.72 billion by 2032, with a CAGR of 5.74% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Report Scope and Beverages Processing Equipment Market Segmentation

|

Attributes |

Beverages Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Tetra Pak Group, GEA Group Aktiengesellschaft, Krones AG, SPX Flow, Pentair, KHS Group, ALFA LAVAL, JBT., Bühler AG, Paul Mueller Company, Bucher Unipektin AG, Praj Industries, HRS Process Systems Ltd., TechniBlend, Inc., Fristam, Omnia Della Toffola SpA, PROXES GMBH, Caloris Engineering, LLC., FME Food Machinery Europe Sp. z o.o, and Bigtem Makine A.S. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Beverages Processing Equipment Market Definition

Beverage processing involves the transformation of raw ingredients into drinks through various techniques. It encompasses steps like mixing, heating, cooling, and filtration to achieve desired flavors and textures. Processing ensures beverages meet quality standards and safety regulations before packaging. It plays a crucial role in maintaining consistency and shelf life, optimizing production efficiency throughout the manufacturing process.

Beverages Processing Equipment Market Dynamics

Drivers

- Growing Beverage Sector

The growing beverage sector is a significant driver for the global beverage processing equipment market. This growth is fueled by rising consumer demand for a variety of beverages, including carbonated soft drinks, juices, alcoholic beverages, and functional drinks like sports and energy beverages. The increasing global population, urbanization, and changing consumer lifestyles have led to higher consumption of ready-to-drink products, thus necessitating advanced beverage processing equipment to meet production demands efficiently and maintain product quality.

As the beverage sector expands, manufacturers are increasingly investing in advanced processing technologies to enhance production efficiency and product consistency. This includes equipment for filtration, homogenization, pasteurization, and packaging. The need to adhere to stringent food safety regulations and quality standards drives the adoption of sophisticated processing machinery. This trend is further propelled by the requirement to produce beverages with extended shelf lives and improved safety profiles, ensuring consumer trust and satisfaction.

The globalization of the beverage industry has opened new markets and increased competition among producers. To remain competitive and meet international standards, beverage manufacturers are investing in state-of-the-art processing equipment that ensures product uniformity and compliance with global quality norms. This need to meet diverse regulatory requirements and consumer preferences worldwide is a key driver for the continuous growth and evolution of the beverage processing equipment market.

Rising consumer demand, the push for advanced technology, the trend towards healthier options, globalization, and supportive government policies collectively contribute to the increasing need for sophisticated beverage processing equipment. This continuous investment and innovation in processing technologies foster the market's growth and development, ensuring that manufacturers can meet evolving consumer preferences and regulatory standards. Thus, the growing beverage sector significantly is driving the global beverage processing equipment market.

- Increasing Beverage Consumption Across the Globe

The surge in the beverage consumption stems from various factors, including changing consumer lifestyles, urbanization, and rising disposable incomes. As more people seek convenience and ready-to-drink options, the demand for processed beverages like juices, soft drinks, and alcoholic beverages has skyrocketed. This trend necessitates the expansion and modernization of beverage processing facilities to keep up with consumer preferences.

One major factor contributing to the rise in beverage consumption is the shift in dietary habits, with consumers opting for healthier and functional drinks. Beverages enriched with vitamins, minerals, and other nutrients are gaining popularity, prompting beverage manufacturers to invest in advanced processing equipment to maintain the nutritional value and quality of these products. This shift towards health-conscious consumption directly boosts the demand for sophisticated beverage processing technologies. Moreover, the increasing popularity of premium and craft beverages, such as artisanal sodas, specialty coffees, and craft beers, is fueling the growth of the beverage processing equipment market. These high-quality, often small-batch products require precise and reliable processing equipment to ensure consistency and meet the high standards expected by discerning consumers. As a result, beverage producers are compelled to adopt advanced equipment that can handle the complexities of producing such specialized drinks.

The rapid expansion of the global beverage industry also highlights the need for efficient and scalable processing solutions. With emerging markets in Asia, Latin America, and Africa showing robust growth in beverage consumption, manufacturers are under pressure to enhance their production capabilities. Investments in modern beverage processing equipment enable these companies to scale operations, improve production efficiency, and meet the rising demand in these burgeoning markets.

Opportunities

- Adoption of Innovative Technologies in the Beverage Processing Industry

Technological advancements have revolutionized various aspects of beverage processing, enhancing efficiency, productivity, and product quality. Automation and robotics, for instance, have enabled streamlined manufacturing processes, decreasing labor costs and improving overall operational efficiency. This integration of advanced technologies allows beverage processing equipment manufacturers to develop and offer sophisticated machinery that meets the evolving needs of beverage processors.

The adoption of digitalization and Internet of Things (IoT) in beverage processing equipment has facilitated real-time monitoring and data analytics. Sensors embedded in equipment can track parameters such as temperature, humidity, and processing times, ensuring precise control over production processes. This data-driven approach not only enhances product consistency and quality but also enables predictive maintenance, minimizing equipment downtime and optimizing operational uptime.

Innovative technologies also contribute to enhancing beverage safety and hygiene standards. Advancements in sanitation techniques, such as automated cleaning systems and antimicrobial coatings, help mitigate contamination risks during processing. These technologies are crucial for compliance with stringent beverage safety regulations, thereby bolstering consumer confidence and market competitiveness for beverage processors. In addition, the advent of smart manufacturing concepts, including artificial intelligence (AI) and machine learning, enables equipment to self-optimize and adapt to changing production demands in real-time.

Predictive analytics algorithms can forecast demand patterns and production requirements, allowing manufacturers to adjust production schedules and optimize resource utilization proactively. This agility is particularly valued in a dynamic market environment where consumer preferences and regulatory requirements evolve rapidly.

Restraints/Challenges

- Operational Complexity Associated with Beverage Processing Equipment

Operational complexity is a significant factor acting as a restraint for the global beverage processing equipment market. The intricate nature of modern beverage production, which involves multiple stages and specialized processes, presents numerous challenges for manufacturers. These complexities can deter companies from investing in advanced processing equipment, thus limiting market growth. Understanding the specific factors contributing to operational complexity helps in identifying why this is a substantial barrier.

One key aspect of operational complexity is the integration of advanced technologies into existing production lines. Modern beverage processing equipment often includes sophisticated automation and control systems that require specialized knowledge and training to operate efficiently. The need for skilled personnel to manage and maintain these systems can be a significant hurdle, especially for smaller manufacturers with limited resources. This necessity for specialized skills can lead to increased operational costs and potential disruptions during the transition period, making companies hesitant to adopt new technologies.

Another contributing factor is the maintenance and downtime associated with advanced processing equipment. High-tech machinery often comes with stringent maintenance requirements to ensure optimal performance and longevity. Frequent maintenance and the need for regular updates or replacements of parts can lead to increased operational expenses. Additionally, unplanned downtimes due to equipment failure can disrupt production schedules, leading to financial losses and delayed product deliveries. The potential for such disruptions makes some manufacturers wary of investing heavily in new processing technologies.

Regulatory compliance adds another layer of complexity to beverage processing operations. Manufacturers must adhere to strict food safety and quality standards, which can vary significantly across different regions. Ensuring that advanced processing equipment meets these diverse regulatory requirements can be challenging and costly. The process of obtaining necessary certifications and approvals can be time-consuming, further delaying the implementation of new equipment. This regulatory burden can discourage companies from upgrading their processing capabilities, thus restraining market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Beverages Processing Equipment Market Scope

The market is segmented on the basis of equipment type, automation type, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Equipment Type

- Filtration Equipment

- Heat Exchangers

- Brewery Equipment

- Blenders & Mixers

- Carbonation Equipment

- Sugar Dissolvers

- Others

Automation Type

- Automatic

- Semi-Automatic

- Manual

Application

- Non-Alcoholic Beverages

- Alcoholic Beverages

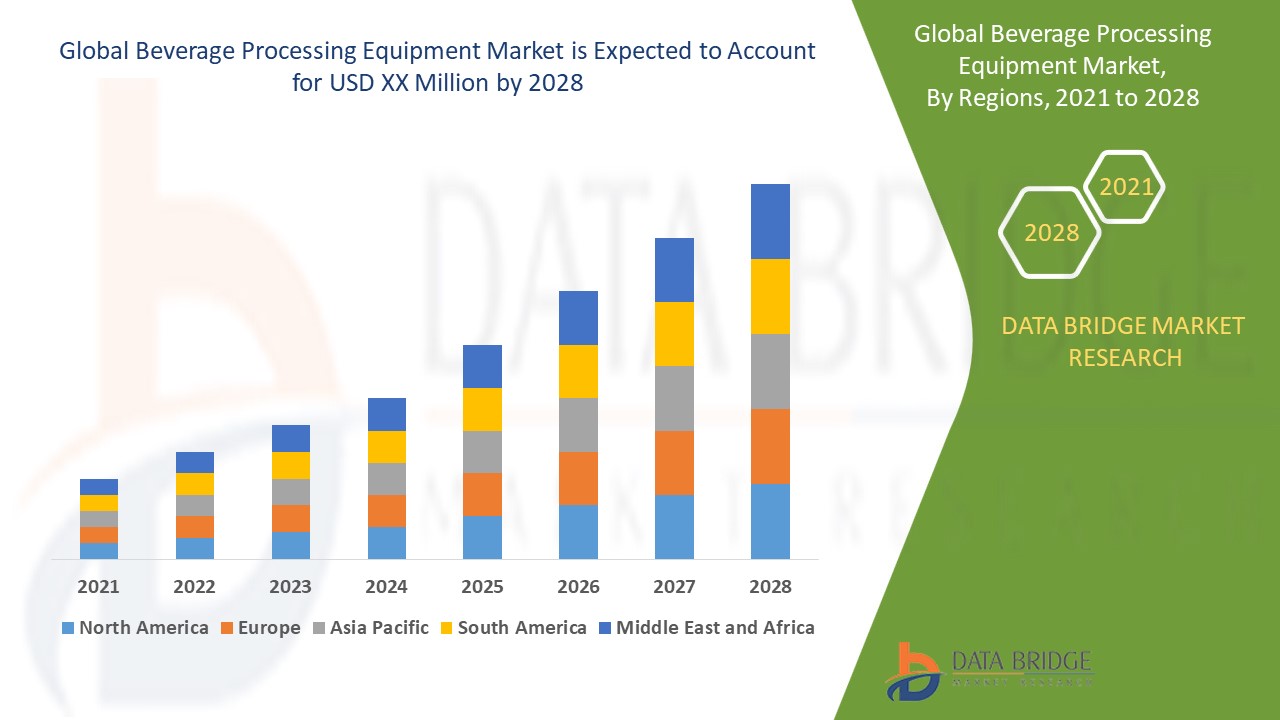

Beverages Processing Equipment Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, equipment type, automation type, and application as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

Asia-Pacific region is expected to dominate the global beverages processing equipment market due to rising government investments and supportive policies in the beverages processing sector. China is expected to dominate the Asia-Pacific region due to increasing beverage consumption across the country. Germany is expected to dominate the Europe region due to its vast manufacturing capabilities, low production costs, and extensive export network. The U.S. is expected to dominate the North America region due to adaptation of innovative technologies in the beverage processing industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Beverages Processing Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Beverages Processing Equipment Market Leaders Operating in the Market Are:

- Tetra Pak Group

- GEA Group Aktiengesellschaft

- Krones AG

- SPX Flow

- Pentair

- KHS Group

- ALFA LAVAL

- JBT

- Bühler AG

- Paul Mueller Company

- Bucher Unipektin AG

- Praj Industries

- HRS Process Systems Ltd.

- TechniBlend, Inc.

- Fristam

- Omnia Della Toffola SpA

- PROXES GMBH

- Caloris Engineering, LLC.

- FME Food Machinery Europe Sp. z o.o

- Bigtem Makine A.S.

Latest Developments in Beverages Processing Equipment Market

- In 2024, Tetra Pak Group unveiled its ‘Factory Sustainable Solutions’ offering, a new comprehensive approach to optimizing energy, water, and Cleaning-in-Place (CIP) processes across factories. This initiative, part of Tetra Pak’s broader sustainability portfolio, will provide Food and Beverage (F&B) producers with a customized blend of advanced technologies and superior plant integration capabilities. The goal is to help F&B producers enhance their energy and resource efficiency, aiding them in achieving their sustainability targets while reducing operational costs

- In 2024, GEA Group Aktiengesellschaft at Anuga FoodTec launched Insight Partner, a new cloud-based application for food processing and packaging. The solution provided real-time monitoring and analytics, optimizing machine performance and extending equipment lifespan. It aimed to enhance efficiency, reduce downtime, and lower Total Cost of Ownership for food plants. Insight Partner featured user-friendly interfaces, live data access, and proactive maintenance alerts, supporting operational productivity and maintenance planning

- In May, SPX FLOW's APV Aseptic Rapid Recovery System (ARRS) won the Sustainable Product Award at the 2024 SEAL Business Sustainability Awards for cutting product waste by 87%. The technology reduced dairy product loss from 4% to 0.5% by recapturing leftovers in process piping. It also minimized water usage and cleaning time, enhancing sustainability in dairy and beverage production. The innovation aims to set a new standard in aseptic processing for improved environmental impact and consumer safety

- In May 2024, Alfa Laval introduced a new heat exchanger, the Hygienic WideGap, aiming to revolutionize sustainable practices in food processing. It cuts emissions by half in the production of liquid foods like juices and plant-based beverages. The new technology enhances energy efficiency by 50 percent and reduces steam and power consumption significantly. This innovation supports the food industry's shift away from fossil fuels, addressing both energy use and greenhouse gas emissions. It offers a sustainable solution for food production at a time when global food demand is rising sharply

- In April 2024, Alfa Laval introduced the Alfa Laval Foodec Hygiene Plus, a highly hygienic decanter designed specifically for the food industry. It features advanced cleaning features and smooth surfaces to prevent residue build-up and enhance cleanliness. Optional extras like TrueStainlessTM and SaniRibs further improve hygiene by using stainless steel for key parts and reducing pathogen hotspots. This innovation aims to meet evolving hygiene standards in food production, ensuring improved productivity and product quality

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Beverage Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Beverage Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Beverage Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.