Global Bicycle Alloy Chain Market

Market Size in USD Billion

CAGR :

%

USD

1.08 Billion

USD

1.54 Billion

2024

2032

USD

1.08 Billion

USD

1.54 Billion

2024

2032

| 2025 –2032 | |

| USD 1.08 Billion | |

| USD 1.54 Billion | |

|

|

|

|

Bicycle Alloy Chain Market Size

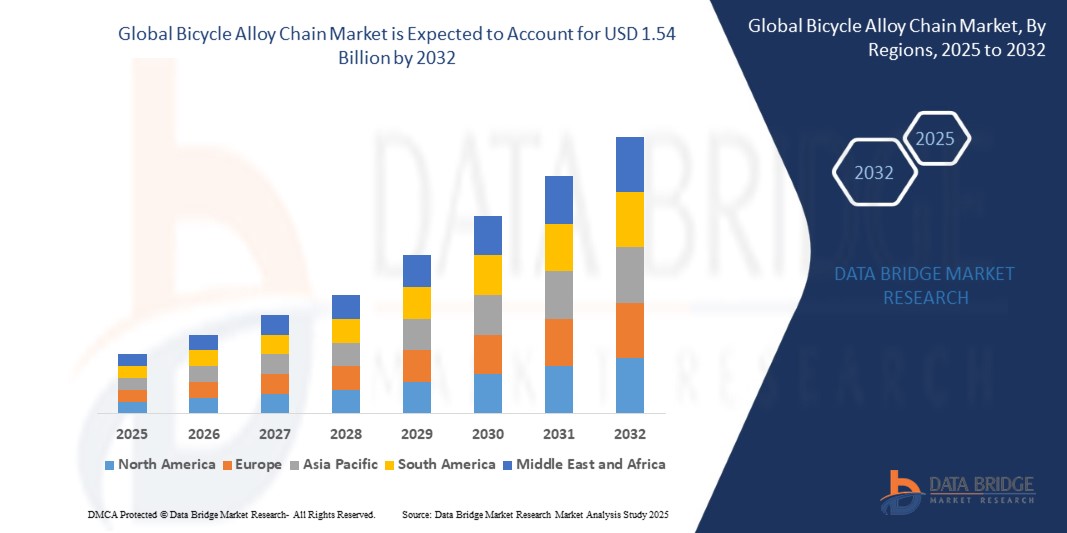

- The global bicycle alloy chain market size was valued at USD 1.08 billion in 2024 and is expected to reach USD 1.54 billion by 2032, at a CAGR of 39.30% during the forecast period

- The market growth is largely fuelled by the increasing demand for lightweight and durable bicycle components, rising popularity of cycling for fitness and eco-friendly transportation, and technological advancements in chain design

- Growing sales of high-performance and premium bicycles, along with expansion of urban cycling and bike-sharing programs, are further supporting market growth

Bicycle Alloy Chain Market Analysis

- Increasing demand for lightweight and durable bicycle components is driving the adoption of alloy chains, enhancing cycling efficiency and performance

- Growing popularity of cycling for fitness, recreation, and eco-friendly transportation is boosting the need for high-quality alloy chains

- North America dominated the bicycle alloy chain market with the largest revenue share of 38.5% in 2024, driven by growing cycling culture, increased recreational activities, and rising adoption of high-performance bicycles

- Asia-Pacific region is expected to witness the highest growth rate in the global bicycle alloy chain market, driven by expanding bicycle manufacturing capabilities, growing adoption of premium alloy chains, and supportive government initiatives promoting eco-friendly transportation

- The Medium Size Wheels segment held the largest market revenue share in 2024, driven by their widespread use across a variety of bicycles and balanced performance in terms of speed, durability, and comfort. Medium-sized wheels offer optimal handling and efficiency, making them a preferred choice among both recreational and professional cyclists

Report Scope and Bicycle Alloy Chain Market Segmentation

|

Attributes |

Bicycle Alloy Chain Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growth In Urban Cycling And Bike-Sharing Programs |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Bicycle Alloy Chain Market Trends

Rise of High-Performance and Lightweight Chains in Bicycles

The growing shift toward high-performance and lightweight bicycle alloy chains is transforming the cycling components market by enabling improved efficiency, smoother pedaling, and longer-lasting performance. These chains allow cyclists, especially professionals and enthusiasts, to optimize ride quality and reduce energy loss, resulting in enhanced cycling experience and durability

The rising demand for alloy chains in recreational, competitive, and e-bike segments is accelerating adoption across different bicycle types. These chains are particularly favored where frequent gear shifting, endurance riding, and low maintenance are critical. The trend is further supported by manufacturers emphasizing premium and mid-tier bicycles

The affordability and ease of installation of modern alloy chains are making them attractive for routine replacement and upgrades, leading to improved drivetrain performance. Cyclists benefit from more durable and low-maintenance chains without incurring excessive costs, ultimately improving overall bike reliability

For instance, in 2023, several European bicycle manufacturers reported increased adoption of corrosion-resistant and lightweight alloy chains in their mid- to high-range models, enhancing rider satisfaction and reducing maintenance requirements

While alloy chains are enhancing performance and user experience, their impact depends on material quality, precision engineering, and innovation in design. Manufacturers must focus on localized product development, compatibility with modern drivetrains, and deployment strategies to fully capitalize on this growing demand

Bicycle Alloy Chain Market Dynamics

Driver

Growing Adoption of High-Performance Bicycles and Cycling as a Fitness Trend

- The rise in global cycling activities, including professional racing, recreational riding, and e-bike usage, is pushing both manufacturers and cyclists to prioritize advanced alloy chains for performance and durability. This has accelerated investment in high-quality bicycle components, encouraging innovation in materials and design for enhanced strength and corrosion resistance, while also enabling longer chain life and smoother rides

- Cyclists are increasingly aware of the benefits of lightweight, durable chains in terms of energy efficiency, smoother gear transitions, and extended component life. This awareness has led to the regular replacement and upgrade of chains, even among casual riders. Growing online communities, social media influence, and cycling events are further promoting the adoption of premium chains

- Government initiatives promoting cycling infrastructure, urban mobility programs, and eco-friendly transportation are strengthening the demand for durable and reliable bicycle components, including alloy chains. These policies also support e-bike adoption, creating a sustained market for high-performance drivetrain components

- For instance, in 2022, cycling associations in the Netherlands and Germany encouraged the adoption of premium alloy chains for competitive and recreational riders, boosting market demand across the region. Partnerships between local manufacturers and bike retailers further enhanced availability and awareness of advanced chains

- While adoption and awareness are driving the market, there is still a need to enhance availability, affordability, and product compatibility to ensure sustained adoption. Manufacturers are focusing on expanding distribution networks and offering versatile chains compatible with a wide range of bike models and gear systems

Restraint/Challenge

High Cost of Premium Alloy Chains and Compatibility Issues

- The high price point of advanced alloy chains makes them less accessible for budget-conscious consumers and small-scale bicycle retailers. Premium chains are often reserved for high-end or performance bicycles. The additional costs of shipping, import duties, and retail markups further limit adoption in emerging and price-sensitive markets

- In many regions, there is a lack of technical knowledge and service infrastructure to install, maintain, or replace advanced chains correctly. This can lead to reduced performance, faster wear, or suboptimal drivetrain function. Training programs and service workshops are often limited, especially in rural or less-developed areas

- Market penetration is also restricted by supply chain challenges, including inconsistent availability of specific chain models, materials, or sizes in certain regions, limiting adoption among smaller or emerging cycling markets. Delays in production or shipping can disrupt retailer inventories and impact consumer confidence

- For instance, in 2023, several bike shops in Southeast Asia reported delays in stocking high-performance alloy chains due to import constraints and higher costs, highlighting adoption challenges. Such logistical issues also affect seasonal demand spikes, especially during cycling events or festivals

- While manufacturing innovations continue to improve chain durability and efficiency, addressing cost, compatibility, and distribution limitations remains crucial for broader market growth and sustained consumer satisfaction. Companies are now investing in local production facilities and modular designs to reduce costs, improve availability, and ensure global compatibility

Bicycle Alloy Chain Market Scope

The market is segmented on the basis of type, application, component material, bicycle type, and distribution channel.

• By Type

On the basis of type, the bicycle alloy chain market is segmented into Small Size Wheels, Medium Size Wheels, and Large Size Wheels. The Medium Size Wheels segment held the largest market revenue share in 2024, driven by their widespread use across a variety of bicycles and balanced performance in terms of speed, durability, and comfort. Medium-sized wheels offer optimal handling and efficiency, making them a preferred choice among both recreational and professional cyclists.

The Small Size Wheels segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their compact design and suitability for folding bikes and urban commuting. Small-sized wheels are particularly favored for their portability and maneuverability in tight spaces, often serving as a key feature for city cyclists.

• By Application

On the basis of application, the market is segmented into Original Wheels, Mountain Biking, Road Cycling, Commuting, Recreational Cycling, and Replacement Wheels. The Mountain Biking segment held the largest market share in 2024 due to growing interest in off-road cycling and adventure sports. Mountain biking wheels are designed for durability and rugged terrain, offering enhanced traction and performance.

The Commuting segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urban cycling trends and eco-friendly transportation initiatives. Commuter wheels are preferred for their lightweight construction and ease of maintenance, making them ideal for daily riders.

• By Component Material

On the basis of component material, the market is segmented into Aluminum Alloy, Titanium Alloy, Steel Alloy, and Carbon Composite. The Aluminum Alloy segment dominated the market in 2024, owing to its excellent strength-to-weight ratio, corrosion resistance, and affordability. Aluminum alloy wheels provide a balance of performance and cost, making them popular across various bicycle types.

The Carbon Composite segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for lightweight and high-performance wheels among professional cyclists. Carbon composite wheels are known for superior stiffness, reduced weight, and enhanced speed capabilities.

• By Bicycle Type

On the basis of bicycle type, the market is segmented into Hybrid Bikes, Electric Bikes, Racing Bikes, and Cruiser Bikes. The Racing Bikes segment held the largest revenue share in 2024, attributed to the increasing popularity of competitive cycling and sports events. Racing bike wheels are optimized for speed, aerodynamics, and precision handling.

The Electric Bikes segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the surge in e-bike adoption for urban commuting and leisure. E-bike wheels are designed for durability and stability to support battery weight and motor assistance.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Online Retail, Specialty Stores, Supermarkets, and Wholesale Distributors. The Online Retail segment held the largest market share in 2024, driven by convenience, broader product availability, and attractive pricing. Online platforms allow customers to compare specifications, reviews, and brands easily.

The Specialty Stores segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing consumer preference for personalized services, expert guidance, and premium bicycle accessories. Specialty stores offer customized solutions and hands-on product demonstrations, enhancing the customer experience.

Bicycle Alloy Chain Market Regional Analysis

- North America dominated the bicycle alloy chain market with the largest revenue share of 38.5% in 2024, driven by growing cycling culture, increased recreational activities, and rising adoption of high-performance bicycles

- Consumers in the region highly value durable, lightweight, and high-quality alloy chains that enhance bicycle performance and safety

- This widespread adoption is further supported by well-developed cycling infrastructure, high disposable incomes, and increasing awareness of fitness and eco-friendly transportation, establishing alloy chains as a preferred choice across hybrid, electric, and racing bikes

U.S. Bicycle Alloy Chain Market Insight

The U.S. bicycle alloy chain market captured the largest revenue share in 2024 within North America, fueled by rising interest in professional and recreational cycling. Consumers are increasingly seeking lightweight and corrosion-resistant alloy chains for improved efficiency and longevity. The growing trend of e-bikes and urban commuting bikes, combined with robust demand for premium materials such as aluminum and carbon composite, further propels the market.

Europe Bicycle Alloy Chain Market Insight

The Europe bicycle alloy chain market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by increasing bicycle adoption for urban mobility and recreational purposes. Stricter environmental regulations and rising demand for lightweight, durable chains are fostering growth. European consumers are also drawn to chains that enhance performance while reducing maintenance, with strong uptake across road, mountain, and hybrid bike applications.

U.K. Bicycle Alloy Chain Market Insight

The U.K. bicycle alloy chain market is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing cycling community, urban commuting trends, and government initiatives promoting eco-friendly transportation. Concerns regarding sustainability and performance are encouraging both recreational and professional cyclists to choose high-quality alloy chains.

Germany Bicycle Alloy Chain Market Insight

The Germany bicycle alloy chain market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing awareness of sustainable mobility and demand for technologically advanced bicycles. Germany’s well-established cycling infrastructure, combined with consumer preference for premium and durable components, is promoting the adoption of high-performance alloy chains across multiple bicycle types.

Asia-Pacific Bicycle Alloy Chain Market Insight

The Asia-Pacific bicycle alloy chain market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising urbanization, increasing disposable incomes, and growing popularity of cycling for fitness and commuting in countries such as China, Japan, and India. The region’s expanding manufacturing capabilities for bicycle components are enhancing affordability and accessibility of alloy chains, supporting wider adoption.

Japan Bicycle Alloy Chain Market Insight

The Japan bicycle alloy chain market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s strong cycling culture, urban density, and preference for technologically advanced bicycles. Lightweight and corrosion-resistant chains are in high demand for both recreational and e-bike applications. The integration of premium components and focus on performance and durability is fueling market growth.

China Bicycle Alloy Chain Market Insight

The China bicycle alloy chain market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s large cycling population, rapid urbanization, and expanding middle class. Growth is driven by high demand for mountain, road, and commuter bikes equipped with durable and lightweight alloy chains. Strong domestic manufacturing and availability of cost-effective components are further propelling the market in China.

Bicycle Alloy Chain Market Share

The Bicycle Alloy Chain industry is primarily led by well-established companies, including:

- Campagnolo S.r.l. (Italy)

- FSA S.r.l. (U.S.)

- DT Swiss Inc. (U.S.)

- Shimano Inc. (Japan)

- SRAM LLC (U.S.)

- absoluteBLACK Ltd. (U.K.)

- Acros Components GmbH (Germany)

- Avid Technology, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Brooks England Ltd. (U.K.)

- BMC Switzerland AG (Switzerland)

- Cane Creek Cycling Components, Inc. (U.S.)

- Cervélo Cycles Inc. (Canada)

- Cinelli S.r.l. (Italy)

- Continental AG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.