Global Bicycle Component Aftermarket Market

Market Size in USD Billion

CAGR :

%

USD

16.39 Billion

USD

28.36 Billion

2024

2032

USD

16.39 Billion

USD

28.36 Billion

2024

2032

| 2025 –2032 | |

| USD 16.39 Billion | |

| USD 28.36 Billion | |

|

|

|

|

Bicycle Component Aftermarket Market Size

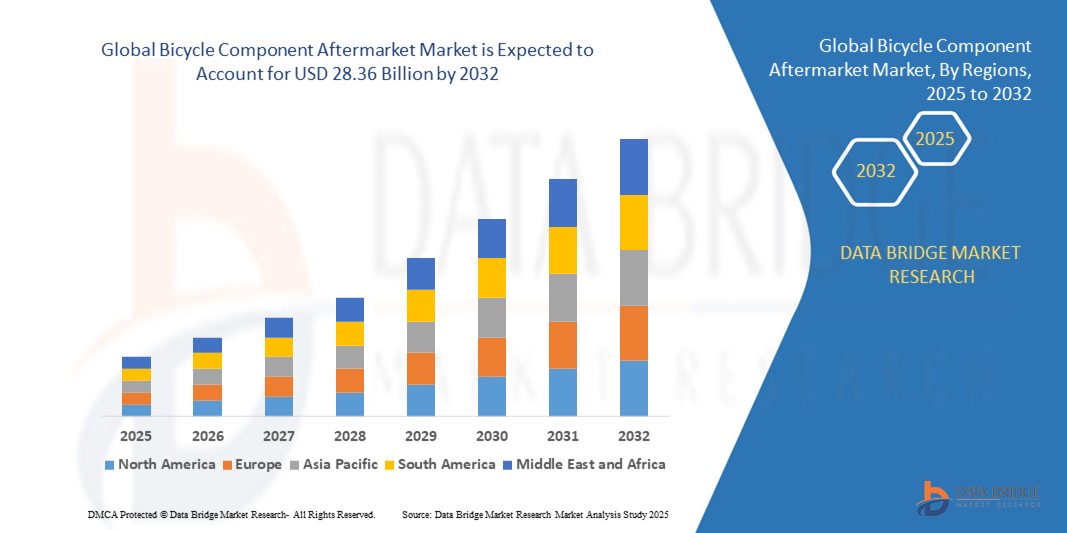

- The global bicycle component aftermarket market size was valued at USD 16.39 billion in 2024 and is expected to reach USD 28.36 billion by 2032, at a CAGR of 7.10% during the forecast period

- The market growth is primarily driven by increasing demand for bicycle customization, performance enhancement, and maintenance, along with rising popularity of cycling for fitness, recreation, and eco-friendly transportation

- Growing consumer awareness regarding the need for high-quality, durable components to improve bicycle performance and longevity is further boosting demand across both specialty and mass-market retail channels

Bicycle Component Aftermarket Market Analysis

- The bicycle component aftermarket market is experiencing robust growth as consumers increasingly focus on upgrading and maintaining bicycles for enhanced performance, comfort, and aesthetics

- Growing demand from both professional and recreational cyclists is encouraging manufacturers to innovate with lightweight, durable, and high-performance components such as advanced derailleurs, suspensions, and wheel sets

- Asia-Pacific dominated the bicycle component aftermarket market with the largest revenue share of 35.2% in 2024, driven by a strong cycling culture, high bicycle production, and increasing adoption of electric and performance bicycles in countries such as China, Japan, and India

- North America is expected to be the fastest-growing region during the forecast period, fueled by rising cycling enthusiasm, increasing adoption of electric bicycles, and growing awareness of sustainable transportation options, particularly in the U.S. and Canada

- The road groupsets segment dominated with the largest revenue share of over 53% in 2024, driven by their compatibility and comprehensive nature, offering cyclists pre-configured sets for seamless integration

Report Scope and Bicycle Component Aftermarket Market Segmentation

|

Attributes |

Bicycle Component Aftermarket Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Bicycle Component Aftermarket Market Trends

Increasing Integration of Advanced Materials and Smart Technology

- The global bicycle component aftermarket is experiencing a notable trend toward the integration of advanced materials, such as carbon fiber and lightweight alloys, alongside smart technology

- These advancements enhance component durability, performance, and aesthetics, providing cyclists with improved efficiency and customization options

- Smart technology, including electronic shifting systems and integrated sensors, enables real-time data analysis of rider performance, bike condition, and environmental factors

- For instances, companies such as Shimano and SRAM are developing wireless electronic groupsets and smart suspension systems that adjust to terrain conditions, enhancing the riding experience for both recreational and professional cyclists

- This trend is increasing the appeal of aftermarket components for enthusiasts and fleet operators, as it allows for tailored upgrades that improve bike functionality and rider safety

- Smart components can monitor metrics such as cadence, power output, and tire pressure, offering insights for performance optimization and predictive maintenance

Bicycle Component Aftermarket Market Dynamics

Driver

Rising Demand for Bicycle Customization and E-Bike Components

- Growing consumer interest in personalized cycling experiences, driven by the popularity of cycling as a recreational and fitness activity, is a key driver for the global bicycle component aftermarket

- Aftermarket components, such as lightweight carbon fiber wheelsets, ergonomic saddles, and advanced drivetrains, allow cyclists to customize their bikes for specific purposes such as performance, comfort, or aesthetics

- The surge in electric bicycle (e-bike) adoption, particularly in urban areas, is fueling demand for specialized components such as batteries, motors, and torque sensors, especially in regions such as Asia-Pacific, which dominated the market with a 59% share in 2024

- Government initiatives promoting eco-friendly transportation, such as subsidies for e-bikes in Europe and Asia-Pacific, are further boosting the adoption of aftermarket components tailored for e-bikes

- Manufacturers are increasingly offering compatible aftermarket parts to meet the growing demand for upgrades in mountain, road, and folding bicycles, enhancing bike value and performance

Restraint/Challenge

High Costs of Premium Components and Compatibility Issues

- The high cost of premium aftermarket components, such as carbon fiber wheelsets and electronic groupsets, can be a significant barrier to adoption, particularly for casual cyclists and in cost-sensitive emerging markets

- Integrating advanced components into existing bicycles can be complex, requiring specialized tools and expertise, which increases overall costs

- Compatibility issues between aftermarket parts and original equipment manufacturer (OEM) components can lead to performance challenges, deterring some consumers from upgrading

- In addition, the lack of standardization across bicycle brands and models complicates the aftermarket landscape, making it difficult for consumers to find universally compatible parts

- These factors can limit market growth, especially in regions such as North America, despite its status as the fastest-growing market, where consumer awareness of customization benefits is still developing

Bicycle Component Aftermarket market Scope

The market is segmented on the basis of component type, sales channel, and bicycle type.

- By Component Type

On the basis of component type, the global bicycle component aftermarket market is segmented into derailleurs, road groupsets, suspensions, wheel sets, brakes, caliper type, gears, and others. The road groupsets segment dominated with the largest revenue share of over 53% in 2024, driven by their compatibility and comprehensive nature, offering cyclists pre-configured sets for seamless integration. These groupsets, including brands such as Shimano, SRAM, and Campagnolo, are highly sought after for their reliability and performance, particularly among road cyclists aiming for efficiency and precision.

The brakes segment is expected to register the fastest growth rate from 2025 to 2032, fueled by the increasing shift from rim brakes to hydraulic disc brakes, which offer superior modulation and shorter stopping distances. Approximately 80% of high-performance bikes in 2023 were equipped with disc brakes, especially in regions such as the USA and Europe, where safety regulations and all-weather performance needs drive demand for advanced brake systems, including rotors and lever kits.

- By Sales Channel

On the basis of sales channel, the global bicycle component aftermarket market is segmented into specialty bicycle retailers, discount stores, department stores, full-line sporting goods stores, outdoor specialty stores, and other sales channels. Specialty bicycle retailers accounted for the largest revenue share in 2024, driven by their expertise, wide range of high-quality components, and personalized customer service. These retailers cater to enthusiasts and professional cyclists seeking premium, performance-oriented parts such as carbon fiber wheel sets and electronic shifting systems, particularly in established cycling markets such as Europe and North America.

The online sales channel is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the convenience of e-commerce, competitive pricing, and extensive product availability. Platforms such as Amazon, eBay, and specialized cycling websites offer vast catalogs and home delivery, appealing to a growing number of urban cyclists and DIY enthusiasts. The rise of online retail is particularly significant in Asia-Pacific, where digital marketplaces are expanding rapidly, enabling broader access to components for both recreational and professional use.

- By Bicycle Type

On the basis of bicycle type, the global bicycle component aftermarket market is segmented into mountain bike, hybrid/cross, road, comfort, youth, cruiser, recumbent/tandem, electric, and folding bicycles. The electric bicycle segment held the largest revenue share of 15.9% in 2024, driven by the surging popularity of e-bikes for urban commuting and recreational use. The demand for specialized components such as batteries, motors, and torque sensors is growing, especially in Europe, where e-bikes accounted for 43% of total bike sales in Germany in 2023. Government incentives and eco-friendly transportation trends further bolster this segment.

The mountain bike segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by the global rise in mountain biking as a sport and leisure activity. The demand for rugged drivetrains, suspension forks, dropper posts, and reinforced wheel sets is particularly strong in regions such as North America, New Zealand, and Switzerland, where outdoor recreation is a cultural staple. The increasing popularity of gravel biking also contributes to the need for durable, high-performance components tailored to rugged terrains.

Bicycle Component Aftermarket Market Regional Analysis

- Asia-Pacific dominated the bicycle component aftermarket market with the largest revenue share of 35.2% in 2024, driven by a strong cycling culture, high bicycle production, and increasing adoption of electric and performance bicycles in countries such as China, Japan, and India

- Consumers prioritize bicycle components for improved ride quality, durability, and customization, particularly in regions with increasing cycling enthusiasm and diverse terrains

- Growth is supported by advancements in component technology, such as lightweight materials, advanced gear systems, and suspension innovations, alongside rising adoption in both OEM and aftermarket segments

Japan Bicycle Component Market Insight

Japan’s bicycle component market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced components that enhance cycling comfort and safety. The presence of major bicycle manufacturers and integration of advanced components in OEM bicycles accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Bicycle Component Market Insight

China holds the largest share of the Asia-Pacific bicycle component market, propelled by rapid urbanization, rising bicycle ownership, and increasing demand for performance and durability solutions. The country’s growing middle class and focus on sustainable mobility support the adoption of advanced components. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

North America Bicycle Component Market Insight

North America is the fastest-growing region in the global bicycle component market, driven by increasing cycling enthusiasm, particularly in urban areas, and growing demand for high-performance components. The rise in e-bike adoption and consumer focus on fitness and eco-friendly transportation further fuel market expansion. Both OEM and aftermarket segments benefit from innovations in lightweight materials and advanced braking systems.

U.S. Bicycle Component Aftermarket Market Insight

The U.S. bicycle component aftermarket market is expected to witness significant growth, fueled by strong aftermarket demand and growing consumer awareness of performance and safety benefits. The trend toward bicycle customization and increasing regulations promoting safer cycling standards boost market expansion. Manufacturers’ integration of high-performance components in factory-built bicycles complements aftermarket sales, fostering a diverse product ecosystem.

Europe Bicycle Component Aftermarket Market Insight

The European bicycle component market is expected to witness rapid growth, supported by regulatory emphasis on cycling safety and sustainability. Consumers seek components that enhance ride efficiency while offering durability and comfort. Growth is prominent in both new bicycle installations and aftermarket upgrades, with countries such as Germany and the Netherlands showing significant uptake due to rising environmental awareness and urban cycling trends.

U.K. Bicycle Component Market Insight

The U.K. market for bicycle components is expected to experience strong growth, driven by demand for enhanced ride comfort and performance in urban and rural settings. Increased interest in bicycle aesthetics and rising awareness of durability benefits encourage adoption. Evolving cycling safety regulations influence consumer choices, balancing performance enhancements with compliance.

Germany Bicycle Component Market Insight

Germany is expected to witness rapid growth in the bicycle component market, attributed to its advanced bicycle manufacturing sector and high consumer focus on ride quality and energy efficiency. German consumers prefer technologically advanced components, such as lightweight derailleurs and suspensions that improve performance and contribute to smoother rides. The integration of these components in premium bicycles and aftermarket options supports sustained market growth.

Bicycle Component Aftermarket Market Share

The bicycle component aftermarket industry is primarily led by well-established companies, including:

- Dorel Industries Inc (Canada)

- Accell Group N.V. (Netherlands)

- Shimano Inc (Japan)

- SRAM LLC (U.S.)

- Hero Cycles Limited (India)

- Campagnolo S.R.L. (Italy)

- Merida Industry Co. Ltd. (Taiwan)

- Specialized Bicycle Components (U.S.)

- Rohloff AG (Germany)

- Giant Manufacturing Co. Ltd. (Taiwan)

- Avon Cycles Ltd. (India)

What are the Recent Developments in Global Bicycle Component Aftermarket Market?

- In March 2024, Cannondale issued a recall for certain model year 2021–2023 Dave bicycles and framesets due to a critical safety concern. The headtube/downtube weld on affected units may become compromised, potentially leading to separation of the headtube from the frame. This defect poses a serious fall and injury hazard to riders. Approximately 660 units were sold in the U.S., with an additional 113 in Canada. Cannondale urges consumers to immediately stop using the recalled bicycles and contact an authorized dealer for a free frame replacement

- In September 2024, Taiwanese bicycle component manufacturer Glory Wheel Enterprise Co. Ltd. acquired Spank Industries and Fratelli Industries for an undisclosed amount. The acquisition, announced just before Taichung Bike Week, significantly expands Glory Wheel’s product portfolio to include high-performance components such as rims, hubs, handlebars, and pedals. This strategic move strengthens Glory Wheel’s position in the premium bicycle accessories market and reflects its ambition to grow globally. By integrating Spank and Fratelli’s innovative technologies and loyal customer bases, Glory Wheel aims to deliver more diverse and advanced cycling solutions worldwide

- In January 2023, KMC Chain USA officially launched operations across the United States and Canada, introducing a specialized line of e-bike chainrings and sprockets. These components were engineered specifically for second-generation Bosch and Shimano drive systems, offering direct replacement options for OEM parts. Designed to withstand the increased torque and wear typical of e-bike drivetrains, the new products aim to enhance durability, restore drivetrain efficiency, and extend battery life. With competitive pricing and Bosch certification, KMC’s expansion into the North American market marks a strategic move to support the growing demand for high-performance e-bike components

- In May 2022, German electronics manufacturer Sigma Sport launched its innovative AURA 100 and BLAZE LINK bicycle lighting sets, marking a leap forward in smart cycling accessories. The AURA 100 LINK front light and BLAZE LINK rear brake light feature a Bluetooth-enabled link function that allows both lights to be controlled from the front unit. With up to 100 lux brightness and automatic light adjustment via ambient sensors, the system enhances safety and convenience. The rear light includes a brake light function, and both units are water-resistant and USB rechargeable—ideal for urban and trail riders asuch as

- In August 2022, UK-based e-bike brand Mycle unveiled a comprehensive range of accessories tailored for its Mycle Cargo bike lineup. These accessories were thoughtfully designed to enhance versatility, allowing riders to configure their bikes for transporting goods, passengers, or both. The lineup includes front and rear cargo baskets, weather-resistant bags, comfort-enhancing deck pads, and safety-focused features such as the Passenger Handle and Caboose for older children. Notably, many of these accessories are compatible with other Mycle models, reflecting the brand’s commitment to modular design and rider convenience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.