Global Bidirectional Charging Market

Market Size in USD Million

CAGR :

%

USD

814.13 Million

USD

5,032.49 Million

2025

2033

USD

814.13 Million

USD

5,032.49 Million

2025

2033

| 2026 –2033 | |

| USD 814.13 Million | |

| USD 5,032.49 Million | |

|

|

|

|

Bidirectional Charging Market Size

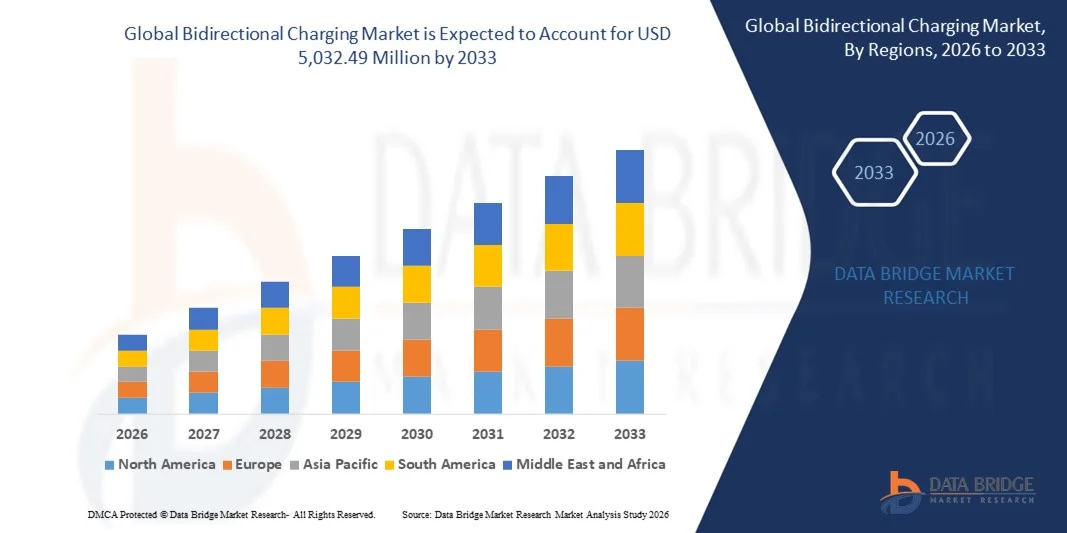

- The global bidirectional charging market size was valued at USD 814.13 million in 2025 and is expected to reach USD 5,032.49 million by 2033, at a CAGR of 25.57% during the forecast period

- The market growth is largely fuelled by the rising adoption of electric vehicles (EVs), growing demand for vehicle-to-grid (V2G) solutions, and increasing focus on renewable energy integration and energy storage optimization

- Expanding government initiatives supporting EV infrastructure, coupled with incentives for smart charging technologies, are further driving market growth

Bidirectional Charging Market Analysis

- Technological advancements in EV batteries and charging stations, along with the rising need for efficient energy utilization, are enhancing market adoption

- Collaboration between automotive OEMs, energy providers, and technology firms is accelerating the development of scalable V2G solutions

- North America dominated the bidirectional charging market with the largest revenue share of 38.75% in 2025, driven by growing adoption of electric vehicles (EVs), supportive government policies, and increasing deployment of smart grid infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global bidirectional charging market, driven by rapid urbanization, expanding EV markets in China, Japan, and South Korea, and government initiatives supporting grid stability and renewable energy integration

- The V2G segment held the largest market revenue share in 2025, driven by the increasing integration of electric vehicles with smart grids and growing utility investments in demand response programs. V2G-enabled systems allow real-time energy exchange, grid stabilization, and peak load management, making them highly attractive for commercial and utility operators

Report Scope and Bidirectional Charging Market Segmentation

|

Attributes |

Bidirectional Charging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Bidirectional Charging Market Trends

Rise of Vehicle-to-Grid (V2G) And Bidirectional Charging Solutions

• The growing adoption of bidirectional charging is transforming the EV ecosystem by enabling vehicles to not only draw energy from the grid but also feed excess power back. This two-way energy flow allows fleet operators, utilities, and homeowners to optimize energy usage, reduce electricity costs, and enhance grid stability. The technology also supports demand-side energy management, helping to mitigate peak load issues and prevent blackouts in high-demand regions

• The increasing deployment of smart charging infrastructure is accelerating the integration of V2G-enabled chargers across residential, commercial, and public sectors. These systems are particularly effective in balancing peak demand, providing backup power, and supporting renewable energy integration. Moreover, they enable dynamic pricing strategies, allowing users to sell energy back to the grid during peak hours, creating additional revenue streams

• Advancements in battery technology and inverter efficiency are making bidirectional chargers more reliable, safe, and compatible with a variety of EV models. The affordability and ease of installation of modern chargers are further encouraging adoption among individual consumers and fleet operators. These advancements also extend battery life through optimized charging cycles and reduce overall maintenance costs

• For instance, in 2024, several commercial fleets in Europe and North America reported reduced operational costs and improved energy utilization after deploying V2G-enabled electric buses and trucks across their networks. The integration of real-time monitoring and smart energy management software further improved fleet efficiency and reduced grid dependency during peak hours

• While bidirectional charging solutions offer significant operational and energy benefits, market growth depends on continued technological innovation, regulatory support, and consumer awareness. Companies must focus on interoperable solutions and scalable deployment strategies to fully capitalize on this growing demand. The development of regional partnerships and government-backed pilot projects will also play a critical role in market expansion

Bidirectional Charging Market Dynamics

Driver

Rising Adoption of Electric Vehicles and Demand for Grid Flexibility

• The surge in electric vehicle adoption is pushing automakers, fleet operators, and utilities to invest in bidirectional charging solutions as a key enabler for energy management and cost optimization. EVs equipped with bidirectional chargers provide additional revenue streams by participating in grid services. Growing urbanization and increasing EV fleet sizes in metropolitan areas further amplify the demand for flexible and responsive energy solutions

• Governments and energy regulators are promoting policies that encourage the use of V2G technology to support renewable energy integration, reduce carbon emissions, and enhance grid resilience. Incentives for smart charging infrastructure adoption are further boosting demand. Subsidies for residential V2G installations and tax credits for commercial fleet upgrades are helping accelerate large-scale adoption globally

• The growing awareness among fleet operators and commercial businesses of the operational and cost-saving benefits of V2G-enabled charging is driving widespread deployment. These systems allow real-time energy management, peak load reduction, and emergency backup solutions. In addition, integration with smart grids enables predictive energy analytics, helping operators plan usage and reduce energy wastage

• For instance, in 2023, multiple utility companies in North America integrated bidirectional charging into their smart grid pilot programs, enabling EVs to provide demand response and energy storage services during peak periods. This led to measurable reductions in energy costs and grid stress, providing proof of concept for wider commercial adoption

• While EV adoption and supportive policies are driving the market, challenges such as interoperability, standardization, and investment costs need to be addressed to ensure sustained growth. Collaboration between automakers, technology providers, and utility companies is essential for building a unified ecosystem for bidirectional energy solutions

Restraint/Challenge

High Equipment Costs and Limited Charging Infrastructure

• The premium price of bidirectional chargers, including V2G-capable inverters and smart energy management systems, limits accessibility for individual consumers and small commercial operators. High upfront investment remains a major barrier to widespread adoption. In addition, high installation costs and complex permitting requirements in certain regions further hinder market penetration

• In many regions, insufficient charging infrastructure and lack of standardized protocols restrict the deployment of bidirectional charging solutions. Compatibility issues with existing EV models and grid systems further hamper market penetration. The lack of uniform communication standards between EVs, chargers, and utility networks increases technical complexity and slows down large-scale deployment

• Supply chain constraints for advanced power electronics, inverters, and control software add to installation delays and operational inefficiencies, particularly in emerging markets. These limitations are exacerbated by geopolitical factors and material shortages, which affect the timely delivery of key components. In addition, localized expertise gaps in emerging regions further challenge market scalability

• For instance, in 2023, several EV fleet operators in Sub-Saharan Africa reported low adoption rates due to high equipment costs and the absence of adequate V2G-enabled charging stations. The lack of trained personnel and technical support also contributed to delays in implementing energy management systems and integrating renewable sources

• While technology and grid capabilities continue to advance, addressing affordability, infrastructure availability, and interoperability is essential for expanding market reach and unlocking long-term growth potential. Strategic investments in regional infrastructure, government incentives, and industry collaborations will be key to overcoming these challenges and promoting widespread adoption

Bidirectional Charging Market Scope

The market is segmented on the basis of application, propulsion type, vehicle type, charging type, and end use

- By Application

On the basis of application, the global bidirectional charging market is segmented into V2G (Vehicle-to-Grid), V2H (Vehicle-to-Home), and V2L (Vehicle-to-Load). The V2G segment held the largest market revenue share in 2025, driven by the increasing integration of electric vehicles with smart grids and growing utility investments in demand response programs. V2G-enabled systems allow real-time energy exchange, grid stabilization, and peak load management, making them highly attractive for commercial and utility operators.

The V2H segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer interest in home energy management, backup power solutions, and reduced electricity costs. V2H systems enable homeowners to utilize EV batteries for domestic power needs, enhancing energy efficiency and resilience.

- By Propulsion Type

On the basis of propulsion type, the market is segmented into Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV). The BEV segment dominated the market in 2025, attributed to higher adoption rates, longer driving ranges, and compatibility with advanced bidirectional chargers. BEVs are widely preferred for both residential and commercial energy storage integration.

The PHEV segment is expected to witness the fastest growth from 2026 to 2033, supported by increasing hybrid vehicle adoption and incentives for flexible energy storage solutions. PHEVs offer partial renewable energy utilization and grid support capabilities, making them appealing for both private and fleet operators seeking cost-efficient energy management.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars and light commercial vehicles. The passenger cars segment held the largest market share in 2025, driven by growing private EV ownership and the installation of home and public bidirectional chargers.

The light commercial vehicle segment is expected to register the fastest growth from 2026 to 2033, fueled by fleet electrification, delivery services, and logistics operations requiring flexible energy management and peak load reduction capabilities.

- By Charging Type

On the basis of charging type, the market is segmented into AC charging and DC charging. The AC charging segment dominated the market in 2025, due to cost-effectiveness, ease of installation, and compatibility with residential and commercial setups.

The DC charging segment is expected to witness the fastest growth from 2026 to 2033, driven by demand for rapid bidirectional energy exchange in V2G, commercial, and utility-scale applications. DC chargers enable higher power transfer and faster deployment for large EV fleets.

- By End Use

On the basis of end use, the market is segmented into residential, commercial fleets, semi-public, and utility applications. The residential segment held the largest revenue share in 2025, attributed to increasing consumer awareness of home energy management and incentives for V2H adoption.

The commercial fleets segment is projected to witness the fastest growth from 2026 to 2033, fueled by electrification of delivery and municipal vehicles, operational cost savings, and participation in grid services. Fleets benefit from reduced energy costs, improved sustainability, and flexible energy management through bidirectional charging.

Bidirectional Charging Market Regional Analysis

- North America dominated the bidirectional charging market with the largest revenue share of 38.75% in 2025, driven by growing adoption of electric vehicles (EVs), supportive government policies, and increasing deployment of smart grid infrastructure

- Consumers and commercial fleet operators in the region are increasingly leveraging V2G and V2H solutions to optimize energy usage, reduce electricity costs, and participate in demand response programs

- The widespread adoption is further supported by high EV penetration, incentives for renewable energy integration, and growing awareness of energy management benefits

U.S. Bidirectional Charging Market Insight

The U.S. bidirectional charging market captured the largest revenue share in North America in 2025, fueled by robust EV adoption, expansion of smart charging networks, and government incentives for V2G integration. Fleet operators, utilities, and residential users are deploying bidirectional chargers to balance peak load, provide emergency backup, and participate in energy markets. Increasing investments in renewable energy and smart grids are significantly contributing to market expansion, driving the deployment of interoperable and scalable charging solutions.

Europe Bidirectional Charging Market Insight

The Europe bidirectional charging market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent energy efficiency regulations, ambitious EV adoption targets, and widespread renewable energy integration. Growing urbanization, smart city initiatives, and high consumer awareness about energy management are fostering adoption of V2G and V2H solutions. The region is experiencing notable growth across residential, commercial, and utility applications, with governments and private operators investing in interoperable bidirectional charging infrastructure.

Germany Bidirectional Charging Market Insight

The Germany bidirectional charging market is expected to witness significant growth from 2026 to 2033, fueled by strong EV adoption, progressive energy policies, and increasing emphasis on sustainable mobility solutions. The country’s advanced grid infrastructure, combined with government incentives for renewable energy integration, promotes V2G deployment across commercial and residential sectors. Integration with smart home and energy management systems is driving the adoption of bidirectional chargers, with a focus on efficiency, cost savings, and grid stabilization.

Asia-Pacific Bidirectional Charging Market Insight

The Asia-Pacific bidirectional charging market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid EV adoption, government initiatives for smart grids, and rising urbanization in countries such as China, Japan, and India. The region’s growing inclination towards energy-efficient solutions and renewable energy utilization is supporting the adoption of V2G and V2H technologies. Furthermore, APAC’s emergence as a manufacturing hub for EV components and charging infrastructure is enhancing affordability and accessibility, expanding the market to a wider consumer base.

China Bidirectional Charging Market Insight

The China bidirectional charging market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s high EV adoption, government support for renewable energy, and rapidly developing charging infrastructure. Chinese consumers, fleet operators, and utilities are increasingly deploying V2G and V2H solutions to optimize energy management and participate in grid services. Strong domestic manufacturers, coupled with smart city initiatives and renewable energy targets, are key factors propelling the market in China.

Japan Bidirectional Charging Market Insight

The Japan bidirectional charging market is expected to witness strong growth from 2026 to 2033 due to the country’s advanced EV ecosystem, high-tech culture, and focus on energy efficiency. Japanese consumers and commercial operators are adopting V2H and V2G solutions to reduce electricity costs, ensure reliable backup power, and integrate renewable energy sources. Aging population trends, combined with smart home initiatives and industrial applications, are further driving the deployment of bidirectional charging systems across residential and commercial sectors.

Bidirectional Charging Market Share

The Bidirectional Charging industry is primarily led by well-established companies, including:

• Walibox Chargers (Spain)

• Fermata Energy (U.S.)

• NUVVE Holding Corp (U.S.)

• BYD Company Limited (China)

• Siemens (Germany)

• Tesla (U.S.)

• ABB (Switzerland)

• Ford Motor Company (U.S.)

• Zaptec AS (Norway)

• General Motors (U.S.)

• loTecha (U.S.)

• Hyundai Motor Company (South Korea)

Latest Developments in Global Bidirectional Charging Market

- In June 2025, Wallbox Chargers launched the Quasar 2, a bidirectional EV charger enabling vehicle-to-home (V2H) and vehicle-to-grid (V2G) functionality. The Quasar 2 allows EVs to act as energy storage devices, helping homeowners save on electricity costs and optimize energy usage. This innovation enhances grid stability and accelerates the adoption of smart energy solutions in residential markets

- In March 2025, Emphase Energy introduced a smart bidirectional EV charger with integrated support for AC V2H and V2G. The charger seamlessly connects with Enphase solar and battery systems, while also functioning independently, enabling efficient energy management and future-proofing residential charging infrastructure

- In November 2025, ABB signed a licensing agreement with Black Box Innovations to produce EV energy management systems in Canada. These systems facilitate the installation of bidirectional chargers on existing electrical panels, reducing infrastructure upgrades and supporting the broader adoption of V2G solutions

- In September 2025, Siemens, in collaboration with Ford, developed an 80-amp Level 2 bidirectional-ready charger, the first to receive UL 9741 certification. This charger enables the Ford F-150 Lightning to supply backup power to homes via Ford's Intelligent Backup Power system, promoting energy resilience and expanding the residential market for V2H solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.