Global Bifenthrin Alcohol Market

Market Size in USD Million

CAGR :

%

USD

476.40 Million

USD

709.24 Million

2024

2032

USD

476.40 Million

USD

709.24 Million

2024

2032

| 2025 –2032 | |

| USD 476.40 Million | |

| USD 709.24 Million | |

|

|

|

|

Bifenthrin Alcohol Market Size

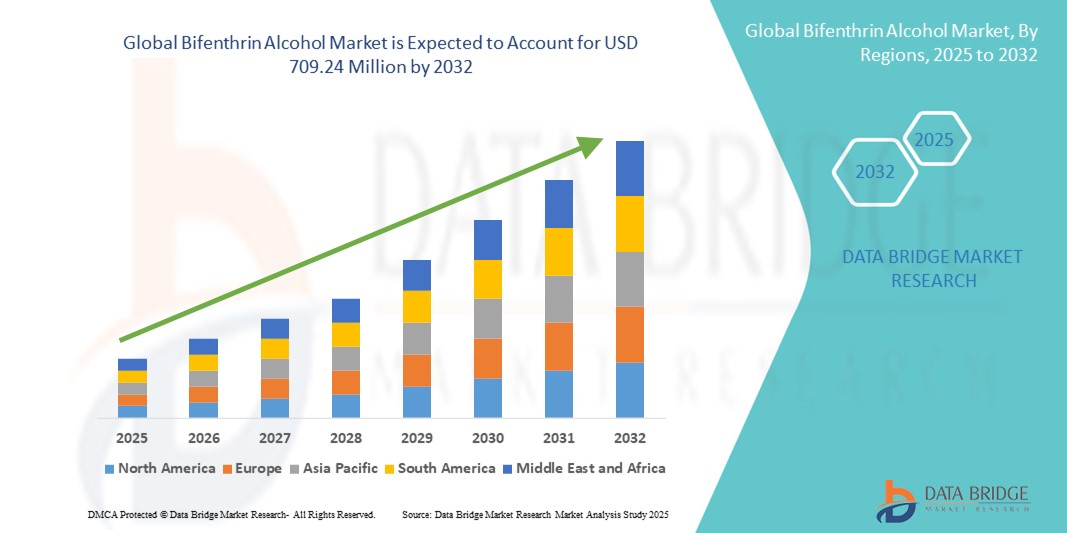

- The global bifenthrin alcohol market size was valued at USD 476.4 million in 2024 and is expected to reach USD 709.24 million by 2032, at a CAGR of 5.1% during the forecast period

- The bifenthrin alcohol market growth is largely driven by increasing demand for effective pest control solutions in agriculture, aimed at improving crop yields and ensuring food security amid rising global population and food consumption

- In addition, advancements in formulation technologies and growing awareness about integrated pest management practices are encouraging farmers to adopt safer and more efficient insecticides such as bifenthrin alcohol. These factors together are accelerating market expansion, especially in developing regions with expanding agricultural sectors

Bifenthrin Alcohol Market Analysis

- Bifenthrin alcohol is a synthetic pyrethroid insecticide widely used for controlling a broad spectrum of pests in crops such as cotton, cereals, vegetables, and fruits. Its high efficacy, low mammalian toxicity, and compatibility with various formulations make it a preferred choice among farmers and agrochemical companies.

- The market demand is further propelled by government initiatives supporting sustainable agriculture, increasing investments in research for eco-friendly pest control products, and the growing trend of adopting modern farming technologies to reduce crop losses due to pest infestations

- North America dominated the bifenthrin alcohol market with a share of 34.52% in 2024, due to the extensive adoption of advanced agricultural practices and the growing demand for efficient pest management solutions

- Asia-Pacific is expected to be the fastest growing region in the bifenthrin alcohol market during the forecast period due to increasing agricultural intensification, rising food demand from a growing population, and supportive government policies promoting modern farming techniques

- Farmers segment dominated the market with a market share of 70.5% in 2024, due to their extensive use of bifenthrin alcohol for effective pest control in various agricultural settings ranging from small-scale farms to large commercial operations. The direct relationship between farmers and product efficacy, combined with increasing awareness about crop protection solutions, contributes to this dominance. In addition, farmers’ preference for formulations that offer ease of application and cost-efficiency supports the strong market presence of this segment. Continuous education programs and government support further encourage farmers to adopt bifenthrin alcohol formulations

Report Scope and Bifenthrin Alcohol Market Segmentation

|

Attributes |

Bifenthrin Alcohol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bifenthrin Alcohol Market Trends

Rising Demand for Effective Insecticides

- The bifenthrin alcohol market is growing robustly due to the heightened need for effective insecticides capable of controlling a broad spectrum of pests in agriculture, public health, and residential settings, supporting improved crop yields and disease vector management

- For instance, leading agrochemical companies such as Meghmani Group, Aether Industries, and Jiangsu Huifeng Agrochemical are innovating bifenthrin formulations to enhance efficacy, reduce toxicity, and support integrated pest management strategies, which are increasingly adopted worldwide amid rising pest resistance challenges

- Advances in chemical synthesis and formulation technologies are improving the stability, bioavailability, and targeted delivery of bifenthrin alcohol-based products, meeting the demand for safer, more efficient pest control solutions

- Expanding agricultural activities, especially in emerging markets such as Asia-Pacific, are driving regional demand due to greater crop protection needs in high-value commodities such as cotton, fruits, and vegetables

- Urbanization and increasing awareness of safe pest control in residential environments bolster market growth by stimulating interest in bifenthrin’s versatile applications beyond traditional agriculture

- Product diversification, including new uses in public health for vector control and in commercial pest management, is broadening market adoption and resilience against regulatory constraints

Bifenthrin Alcohol Market Dynamics

Driver

Growth of Eco-Friendly Pest Control

- Increasing focus on eco-friendly and sustainable pest control methods is pushing market players to develop bifenthrin alcohol formulations with reduced environmental impact, aligning with global regulations and consumer demand for greener agricultural inputs

- For instance, the adoption of integrated pest management (IPM) practices and environmentally conscious farming is encouraging the use of bifenthrin products that balance efficacy with lower toxicity and biodegradability, supported by innovations in controlled-release and nano-formulation technologies

- Regulatory incentives and mandates in regions such as North America and Europe favor safer pesticide profiles, driving R&D toward formulations that minimize residue, non-target effects, and environmental persistence

- Growing partnerships between agrochemical companies and ecological research institutions foster development of bio-rational products that incorporate bifenthrin alcohol as a key but responsibly managed active intermediate

- Market expansion includes improving supply chain transparency and sustainability credentials to meet corporate social responsibility goals of agricultural producers and distributors

Restraint/Challenge

Strict Regulations on Pesticide Use

- The bifenthrin alcohol market faces ongoing challenges from stringent regulatory frameworks governing pesticide registration, residue limits, environmental safety, and usage restrictions, which increase compliance costs and complicate market entry

- For instance, authorities such as the U.S. EPA, European Commission, and regulatory bodies in Asia impose rigorous safety assessments and usage guidelines designed to protect pollinators, reduce aquatic toxicity, and prevent bioaccumulation, limiting unrestricted use of bifenthrin-containing products

- Evolving pesticide regulations and frequent updates require manufacturers to invest heavily in toxicological studies, registration dossiers, and reformulated products to maintain market access and avoid sanctions

- Challenges related to pesticide resistance development also prompt regulators to enforce integrated pest management principles, mandating rotational use, dosage restrictions, and education, which can constrain volume growth of bifenthrin alcohol-based pesticides

- Supply chain and export complexities emerge from varied international regulatory standards, resulting in operational hurdles and increased costs for global producers and distributors

Bifenthrin Alcohol Market Scope

The market is segmented on the basis of formulation type, distribution channel, end user type, and concentration level.

- By Formulation Type

On the basis of formulation type, the bifenthrin alcohol market is segmented into emulsifiable concentrate (EC), granules (GR), aqueous suspensions (AS), and wettable powders (WP). The emulsifiable concentrate segment dominated the market in 2024, accounting for the largest revenue share. This dominance stems from its excellent solubility and ease of mixing with water, which allows uniform application and improved pest control efficacy across a wide variety of crops. EC formulations also offer greater flexibility for farmers, as they can be easily used with common spraying equipment, enhancing operational efficiency. In addition, the cost-effectiveness of EC makes it a preferred choice among both smallholder and commercial farmers. The formulation’s stability and long shelf life contribute further to its widespread adoption in various agricultural regions.

The granules segment is anticipated to witness the fastest growth rate from 2025 to 2032. Granules provide advantages such as safer handling, reduced inhalation risks, and easier storage compared to liquid formulations. Their solid form makes them suitable for precise application, especially in soil treatments and targeted pest control measures. Environmental regulations favor granular formulations due to their minimized risk of chemical runoff and lower environmental contamination. Furthermore, increasing awareness about eco-friendly pest management practices among farmers and cooperatives is driving the demand for granules, especially in regions with stringent environmental policies.

- By Distribution Channel

On the basis of distribution channel, the bifenthrin alcohol market is segmented into company websites and third-party e-commerce platforms. The third-party e-commerce platforms segment accounted for the largest market share in 2024, supported by the rapid expansion of internet connectivity and smartphone penetration in rural areas. These platforms provide farmers and agricultural cooperatives easy access to a broad product portfolio at competitive prices. Moreover, the availability of customer reviews, product ratings, and detailed descriptions on these platforms enables informed purchasing decisions, enhancing consumer confidence. The convenience of doorstep delivery also plays a crucial role in boosting sales through e-commerce, especially in remote regions where physical retail options are limited.

The company websites segment is projected to witness the fastest growth rate during the forecast period. Manufacturers are increasingly adopting direct-to-consumer models via their official websites to better control product quality and provide personalized customer support. This approach helps build brand loyalty and trust among end users by offering exclusive deals, technical guidance, and after-sales services. Direct sales channels also allow companies to gather valuable consumer data, which can be used to tailor marketing strategies and develop new formulations, further driving growth in this segment.

- By End User Type

On the basis of end user type, the bifenthrin alcohol market is segmented into farmers and agricultural cooperatives. Farmers held the dominant revenue share of 70.5% in 2024, given their extensive use of bifenthrin alcohol for effective pest control in various agricultural settings ranging from small-scale farms to large commercial operations. The direct relationship between farmers and product efficacy, combined with increasing awareness about crop protection solutions, contributes to this dominance. In addition, farmers’ preference for formulations that offer ease of application and cost-efficiency supports the strong market presence of this segment. Continuous education programs and government support further encourage farmers to adopt bifenthrin alcohol formulations.

Agricultural cooperatives are expected to register the fastest growth rate from 2025 to 2032. Cooperatives facilitate bulk purchasing, reducing costs and improving accessibility for their members. They also play a vital role in disseminating knowledge about integrated pest management and safe chemical usage. The growing influence of cooperatives in promoting sustainable farming practices and their ability to negotiate better prices with manufacturers make them an increasingly important segment. As cooperatives expand their reach into emerging markets, their contribution to overall market growth is projected to rise substantially.

- By Concentration Level

On the basis of concentration level, the bifenthrin alcohol market is segmented into low concentration (< 10%), medium concentration (10%-20%), and high concentration (> 20%). The medium concentration segment dominated the market in 2024 due to its balanced combination of pest control efficacy and safety. These formulations effectively target a wide range of pests while minimizing the risk of phytotoxicity or environmental harm, making them ideal for diverse agricultural applications. The versatility of medium concentration products meets the needs of both individual farmers and cooperatives, ensuring broad adoption. Their moderate potency also allows for flexibility in application rates, optimizing cost-efficiency.

The high concentration segment is anticipated to witness the fastest growth rate from 2025 to 2032. This growth is driven by the increasing demand for potent formulations in areas with severe pest infestations where frequent applications are less practical. High concentration products reduce the frequency of spraying, lowering labor and operational costs for large-scale commercial farms. They also appeal to agribusinesses seeking longer-lasting pest control solutions to improve yield quality and quantity. The development of safer, high concentration formulations with reduced environmental impact further fuels growth in this segment.

Bifenthrin Alcohol Market Regional Analysis

- North America dominated the bifenthrin alcohol market with the largest revenue share of 34.52% in 2024, driven by the extensive adoption of advanced agricultural practices and the growing demand for efficient pest management solutions

- Farmers and agribusinesses in the region are increasingly adopting bifenthrin formulations to protect high-value crops and enhance yield quality

- This widespread adoption is further supported by the presence of well-established agrochemical companies, favorable government regulations promoting crop protection, and rising awareness about sustainable farming practices

U.S. Bifenthrin Alcohol Market

The U.S. bifenthrin alcohol market accounted for largest share of North America’s revenue share in 2024. This is largely due to the country’s extensive farming activities, where bifenthrin serves as a key component of integrated pest management strategies. Farmers prioritize bifenthrin for its broad-spectrum efficacy against numerous pests, compatibility with various crops, and ease of application. Rising consumer demand for safe and sustainable agricultural products encourages the adoption of improved and eco-friendly formulations. Moreover, the growing export market for U.S. agricultural produce underlines the need for high-quality pest control, propelling the bifenthrin segment forward.

Europe Bifenthrin Alcohol Market

The bifenthrin alcohol market in Europe is projected to witness steady growth, driven by increasing regulatory emphasis on sustainable farming and efficient crop protection. Stringent European Union policies promote the responsible use of pesticides, encouraging farmers to adopt proven and safer formulations such as bifenthrin. Urbanization and modernization of agriculture boost the demand for innovative pest management solutions across countries including Germany, France, and Italy. European farmers increasingly focus on maximizing yield quality while minimizing environmental footprint, fostering steady demand for bifenthrin products that align with these priorities.

U.K. Bifenthrin Alcohol Market

In the U.K., the bifenthrin alcohol market is expected to grow consistently, supported by expanding agricultural mechanization and a rising focus on sustainable crop protection. Agricultural cooperatives and extension services actively promote the use of effective insecticides such as bifenthrin to combat pest pressures. The increasing awareness of environmentally responsible pest control measures among both commercial and small-scale farmers further propels market growth. Moreover, the U.K.’s well-developed supply chains and e-commerce platforms facilitate easy access to bifenthrin products, helping the market expand steadily.

Germany Bifenthrin Alcohol Market

Germany represents one of the key markets in Europe for bifenthrin alcohol, expected to register robust growth due to strong agricultural infrastructure and a proactive approach towards integrated pest management (IPM). German farmers’ preference for advanced, eco-friendly pest control products aligns with government initiatives aimed at reducing chemical overuse. The demand for bifenthrin is bolstered by ongoing research and development efforts focused on formulation improvements and environmental safety. Germany’s focus on sustainability and innovation creates a favorable environment for bifenthrin’s continued adoption in both conventional and organic farming systems.

Asia-Pacific Bifenthrin Alcohol Market

The Asia-Pacific bifenthrin alcohol market is poised for the fastest growth at a CAGR from 2025 to 2032. This surge is driven by increasing agricultural intensification, rising food demand from a growing population, and supportive government policies promoting modern farming techniques. Countries such as China, India, Australia, and Southeast Asian nations are rapidly adopting bifenthrin products to tackle persistent pest challenges while enhancing crop yields. Expansion of distribution channels, increased farmer awareness through training programs, and growing investment in agricultural infrastructure contribute significantly to the market’s rapid growth.

Japan Bifenthrin Alcohol Market

Japan’s bifenthrin alcohol market is gaining traction due to the country’s technological advancements in agriculture and strong emphasis on food safety and sustainability. Farmers increasingly adopt integrated pest management practices that incorporate effective insecticides such as bifenthrin to maintain crop health and reduce environmental impact. Government incentives and research in precision agriculture promote the development and use of safer and more efficient pesticide formulations. The aging farming population also drives demand for user-friendly, reliable pest control solutions, positioning bifenthrin products well for continued market growth.

China Bifenthrin Alcohol Market

China holds the largest market revenue share in Asia-Pacific for bifenthrin alcohol in 2024, propelled by its vast agricultural landscape and high demand for crop protection chemicals. Rapid urbanization and modernization in farming techniques have increased the adoption of bifenthrin formulations among Chinese farmers. Strong domestic production capabilities and government initiatives aimed at improving agricultural productivity and food security further accelerate market growth. In addition, the push toward smart agriculture and sustainable pest control measures encourages ongoing investment in advanced bifenthrin-based products, maintaining China’s leadership in the regional market.

Bifenthrin Alcohol Market Share

The bifenthrin alcohol industry is primarily led by well-established companies, including:

- Meghmani Group (India)

- Hangzhou Hulk Bio-Tech (China)

- Aether Industries (India)

- Jiangsu Huifeng Agrochemical (China)

- Liaoning Futuo New Energy Materials (China)

- Xinxiang City Sanxin Science and Technology (China)

- Bayer Crop Science (Germany)

- Syngenta AG (Switzerland)

- BASF SE (Germany)

- FMC Corporation (U.S.)

- Nufarm Limited (Australia)

- UPL Limited (India)

- ADAMA Agricultural Solutions (Israel)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.