Global Bike And Scooter Rental Market

Market Size in USD Billion

CAGR :

%

USD

3.29 Billion

USD

10.89 Billion

2024

2032

USD

3.29 Billion

USD

10.89 Billion

2024

2032

| 2025 –2032 | |

| USD 3.29 Billion | |

| USD 10.89 Billion | |

|

|

|

|

Global Bike and Scooter Rental Market Size

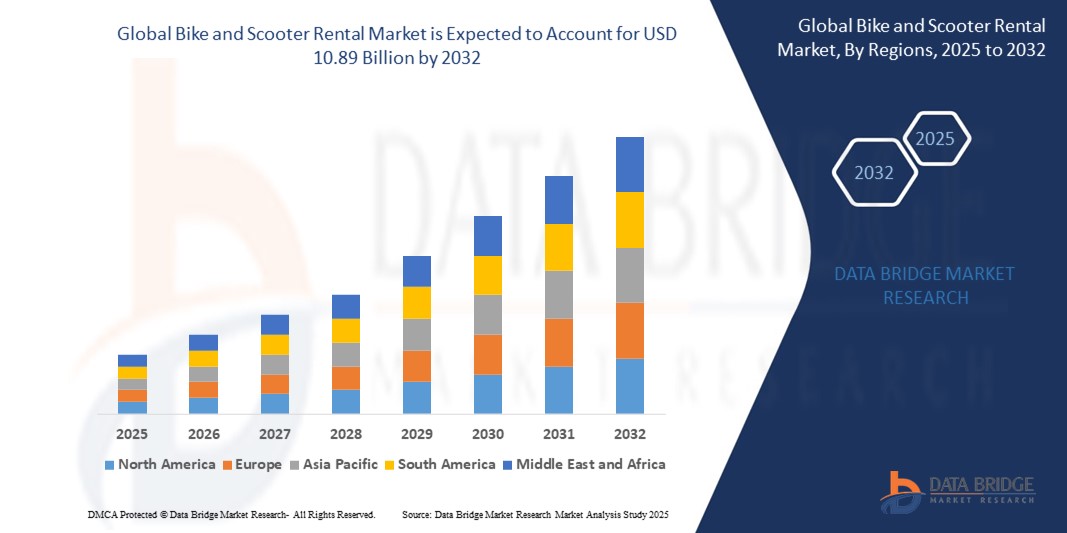

- The global bike and scooter rental market was valued at USD 3.29 Billion in 2024 and is expected to reach USD 10.89 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.16%, primarily driven by the urbanization and traffic congestion

- This growth is driven by factors such as environmental concerns, convenience and accessibility cost-effectiveness, and Technological Advancements

Global Bike and Scooter Rental Market Analysis

- The bike and scooter rental market refers to the industry involved in the short-term leasing or renting of bicycles and electric scooters to customers. This market allows individuals to rent bikes or scooters for a short duration, typically for urban transportation, tourism, or recreation, without the need to own them

- The global bike and scooter rental market is driven by urbanization, traffic congestion, environmental concerns, and the convenience of app-based rentals

- In addition, cost-effectiveness, government support, and technological advancements in GPS and booking systems further fuel market growth, making it an attractive transportation option in cities

- Cities such as San Francisco, New York, and Washington D.C. in North America have rapidly adopted bike and scooter rentals due to urbanization, traffic congestion, and the demand for eco-friendly transport

- For instance, the number of cars has significantly increased in the U.S resulting in traffic congestion. So, their people are keenly looking for rental options. In this manner they are protecting the environment as well as saving the time from traffic congestion

- The rental bike and scooter market is important as it provides sustainable, cost-effective, and convenient transportation solutions, reducing traffic congestion and promoting environmental and economic benefits

Report Scope Global Bike and Scooter Rental Market Segmentation

|

Attributes |

Global Bike and Scooter Rental Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Bike and Scooter Rental Market Trends

“Increasing Adoption of Bike and Scooter Rentals in Urban Areas”

• One prominent trend in the global bike and scooter rental market is the increasing adoption of these services in urban areas

• This shift is driven by factors such as urbanization, traffic congestion, and the growing demand for eco-friendly transportation solutions

- For instance, bike and scooter rentals offer a convenient, low-emission alternative for short-distance travel, helping to reduce the carbon footprint and alleviate city traffic

• The integration of digital platforms for easy rental access, real-time tracking, and seamless payment options is enhancing user convenience and fueling market growth

• This trend is transforming urban mobility, improving transportation efficiency, and driving the demand for rental services across cities globally

Global Bike and Scooter Rental Market Dynamics

Driver

"Rising Demand Due to Urbanization and Traffic Congestion"

• The increasing urbanization and rising traffic congestion in metropolitan areas are significantly contributing to the growing demand for bike and scooter rentals

• As more people move to urban centers, there is a higher need for convenient, eco-friendly, and cost-effective transportation solutions to navigate through crowded streets

- For instance, bike and scooter rentals are seen as ideal solutions for short-distance commuting, offering a faster alternative to cars and public transportation

• Furthermore, government initiatives promoting sustainable mobility, such as the creation of bike lanes and subsidies for rental companies, are driving further growth in the market.

• As more people opt for shared mobility services, the demand for rental bikes and scooters is expected to increase, improving access to cleaner and more efficient transportation options

- For instance, in 2022, according to a report by the International Transport Forum, urban areas with severe traffic congestion, such as New York and Paris, saw a significant rise in bike and scooter rentals due to growing commuter demand for alternative transportation methods. This trend highlights the importance of micro-mobility solutions in addressing urban mobility challenges

- In 2021, a study published by the European Commission found that cities with higher rates of bicycle-sharing adoption experienced reduced traffic congestion and improved air quality, further driving the adoption of rental services

• As a result, the increasing demand for alternative transportation methods, especially in densely populated cities, plays a major role in the expansion of the bike and scooter rental market

Opportunity

“Increasing Adoption of Electric Scooters and Digital Integration”

• One prominent trend in the global bike and scooter rental market is the growing adoption of electric scooters and digital integration

• These advanced features enhance the accessibility and convenience of urban mobility by providing users with eco-friendly and efficient transportation options

- For instance, electric scooters offer faster travel and longer range, making them an ideal solution for short-distance travel, especially in congested cities

• Digital integration through mobile apps allows for seamless rentals, GPS tracking, and contactless payments, improving the user experience and operational efficiency for rental providers

• This trend is revolutionizing urban transportation, driving demand for scooter rental services and enhancing their popularity among users who seek environmentally conscious and cost-effective mobility solutions

Restraint/Challenge

"Regulatory and Operational Challenges in the Bike and Scooter Rental Market"

• The regulatory landscape surrounding bike and scooter rentals poses a significant challenge to market growth, particularly in certain regions with stringent laws and safety regulations

• In many cities, rental companies must comply with local regulations regarding vehicle safety, helmet usage, and operational areas, which can limit expansion and operational flexibility

• These legal barriers can increase operational costs, as rental companies need to invest in compliance efforts, insurance, and infrastructure, which can make it difficult to penetrate new markets or expand in highly regulated cities

• In addition, concerns around safety, theft, and vandalism of rental bikes and scooters in certain areas may also impact market growth, deterring investment and limiting user adoption in some regions

• As a result, the combination of regulatory hurdles and operational challenges can slow down the growth of the bike and scooter rental market, especially in regions with evolving or unclear laws surrounding micro-mobility solutions

- For instance, In January 2024, according to an article published by the International Transport Forum, one of the main concerns surrounding regulatory and operational challenges in the bike and scooter rental market is its impact on service expansion and accessibility

- Strict safety regulations and city-specific restrictions often limit the ability of rental companies to operate in certain urban areas, thereby affecting their market reach and growth potential. Consequently, such limitations can result in disparities in the quality of care and access to advanced surgical procedures, ultimately hindering the overall growth of the market

Global Bike and Scooter Rental Market Scope

The market is segmented on the basis of service, propulsion, operational model, vehicle, application, end user and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Service |

|

|

By Propulsion |

|

|

By Operational Model |

|

|

By Vehicle

|

|

|

By Application |

|

|

By Distribution Channel

|

|

|

By End User: |

|

Global Bike and Scooter Rental Market Regional Analysis

“North America is the Dominant Region in the Global Bike and Scooter Rental Market”

- North America leads the global bike and scooter rental market, driven by a growing demand for eco-friendly transportation options, enhanced urban mobility, and the increasing adoption of electric bikes and scooters

- The U.S. holds a significant market share due to the rising trend of urban cycling, government initiatives promoting sustainability, and the widespread availability of bike and scooter-sharing programs in major cities such as New York, Los Angeles, and San Francisco

- Increased awareness of environmental issues and traffic congestion has led to a surge in demand for shared, sustainable mobility solutions, which is further bolstered by the adoption of technological innovations such as GPS tracking and mobile apps for seamless rentals.

- In addition, North America's well-established infrastructure, high disposable incomes, and government policies encouraging shared mobility contribute to the growth of the bike and scooter rental market across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to experience the highest growth rate in the bike and scooter rental market, driven by rapid urbanization, improving public transportation systems, and an increasing preference for affordable and eco-friendly transportation alternatives

- Countries such as China, India, and Japan are becoming key markets for bike and scooter rentals due to their large urban populations, growing concerns over air pollution, and rising demand for last-mile transportation solutions

- In China, the booming middle class, increasing traffic congestion, and government-backed green initiatives are fueling the demand for bike and scooter-sharing services. China is home to some of the world's largest bike-sharing companies, and the market is further supported by the government’s push toward sustainable and smart cities

- India, with its densely populated urban areas and an expanding young population, is seeing significant growth in the demand for convenient, affordable transportation options. The market is growing due to the rising awareness of environmental issues, government support for sustainable mobility, and an expanding network of bike-sharing platforms

- Japan, with its advanced technological infrastructure and high urban density, remains a crucial market for bike and scooter rentals. The country has embraced shared mobility solutions, particularly in metropolitan areas such as Tokyo, which leads to a higher rate of adoption of rental bikes and electric scooters. The growing focus on reducing carbon emissions and improving mobility in cities contributes to market expansion in the region

Global Bike and Scooter Rental Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Lime (U.S.)

- Bird Rides, Inc (US)

- Ofo Inc. (China)

- TIER Mobility SE (Germany)

- CITYSCOOT Tous droits reserves (France)

- Uber Technologies Inc. (U.S.)

- Mobycy (India)

- Vogo Rental (India)

- Lyft, Inc. (U.S.)

- Zauba Technologies & Data Services Private Limited (India)

- Spin (U.S)

- Cooltra (Spain)

- Bolt Technology OU (Estonia)

- Yulu Bikes Pvt Ltd (India)

- YEGO Urban Mobility SL (Spain)

- Spinlister (U.S.)

- Zoomo (Sydney)

- Voi Technology AB (Sweden)

- emmy-sharing (Berlin)

Latest Developments in Global Bike and Scooter Rental Market

- In January 2025, Lime, a leading electric bike and scooter rental company, announced the expansion of its e-scooter fleet in major U.S. cities, including New York and San Francisco, as part of its commitment to providing sustainable urban transportation solutions. The new fleet features upgraded electric scooters with longer battery life, enhanced safety features, and improved GPS tracking systems, aimed at increasing the reliability and efficiency of the rental service

- In October 2024, Bird, a prominent player in the bike and scooter rental market, unveiled a new partnership with local municipalities in Europe to launch a fleet of electric bikes in key urban centers, including Berlin and Paris. This initiative is aimed at promoting green mobility and reducing carbon emissions in high-traffic areas, with an emphasis on providing accessible, eco-friendly transportation options to urban commuters

- In September 2024, Tier Mobility introduced an innovative multi-use scooter design, which allows riders to easily switch between different configurations, including standard e-scooters, cargo bikes, and bikes for group use. This move aims to diversify the rental service’s offerings, accommodating various customer needs and further enhancing the company's presence in European markets

- In September 2024, Bolt announced the launch of its first fully electric bike rental service in Tallinn, Estonia. The bikes feature improved ergonomics and battery systems designed for urban commuting, offering riders a smooth and efficient travel experience. Bolt’s expansion into electric bike rentals marks a strategic shift to further diversify its mobility offerings and cater to growing demand for sustainable travel alternatives in Europe

- In August 2024, Uber’s bike and scooter rental division, Uber Rides, expanded its service in Southeast Asia, with new operations in Singapore and Jakarta. The company introduced a fleet of electric scooters that can be rented via the Uber app, focusing on last-mile connectivity and offering an environmentally friendly solution to ease urban congestion in densely populated cities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.