Global Bio Based Aromatics Market

Market Size in USD Billion

CAGR :

%

USD

2.77 Billion

USD

4.25 Billion

2024

2032

USD

2.77 Billion

USD

4.25 Billion

2024

2032

| 2025 –2032 | |

| USD 2.77 Billion | |

| USD 4.25 Billion | |

|

|

|

|

Bio-based Aromatics Market Size

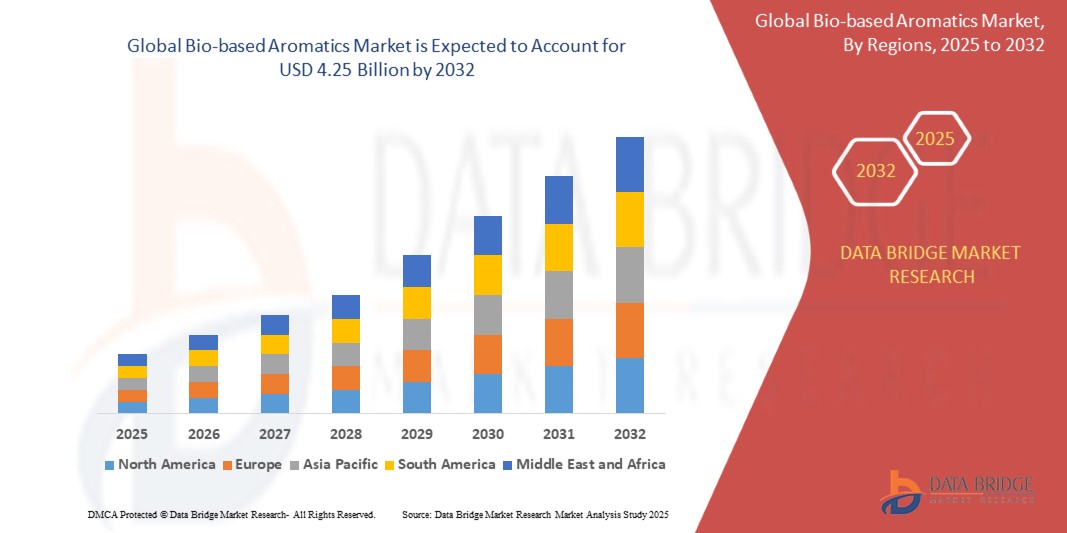

- The global bio-based aromatics market size was valued at USD 2.77 billion in 2024 and is expected to reach USD 4.25 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by increasing demand for sustainable and renewable chemical solutions, coupled with technological advancements in bio-based production processes, which are enabling manufacturers to produce aromatics from biomass instead of fossil resources

- Furthermore, growing environmental regulations and consumer preference for eco-friendly products are driving companies to adopt bio-based intermediates, accelerating the transition from petrochemical-based aromatics to renewable alternatives and significantly boosting the market’s expansion

Bio-based Aromatics Market Analysis

- Bio-based aromatics are renewable chemical compounds derived from biomass such as agricultural residues, corn stover, and plant-based sugars, used as feedstocks in polymers, resins, coatings, and specialty chemicals

- The escalating demand for bio-based aromatics is primarily fueled by the global push toward sustainability, increasing regulatory pressures to reduce carbon emissions, and rising adoption of green chemistry in industries such as plastics, personal care, pharmaceuticals, and food & beverages

- Asia-Pacific dominated the bio-based aromatics market with a share of 33.2% in 2024, due to rapid industrialization, increasing adoption of sustainable chemicals, and a strong presence of chemical manufacturing hubs

- North America is expected to be the fastest growing region in the bio-based aromatics market during the forecast period due to increasing demand for bio-based chemicals in pharmaceuticals, plastics, and personal care products

- Benzene segment dominated the market with a market share of 39% in 2024, due to its wide range of industrial applications and its established role as a primary feedstock in the production of polymers, resins, and solvents. Manufacturers favor bio-based benzene for its sustainability benefits and potential to reduce dependency on fossil-based feedstocks, making it a preferred choice for eco-conscious industries. The growing emphasis on green chemistry and renewable raw materials has further reinforced demand for benzene as a foundational aromatic compound

Report Scope and Bio-based Aromatics Market Segmentation

|

Attributes |

Bio-based Aromatics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio-based Aromatics Market Trends

Increasing Use in Sustainable Packaging

- Growth in sustainable packaging is accelerating the application of bio-based aromatics, as manufacturers pursue eco-friendly alternatives to petrochemical-based components. These solutions help reduce reliance on fossil fuels and address consumer environmental concerns

- For instance, BASF launched bio-based polymers incorporating aromatics for packaging and consumer goods, supporting brands that want to demonstrate environmental leadership while meeting regulatory mandates for renewable materials

- Innovation in bio-refineries is increasing production efficiency and expanding the diversity of feedstocks used for bio-aromatic synthesis. The integration of lignocellulosic biomass and waste streams supports the circular economy and resource efficiency

- Environmental incentives and policy reforms are driving research into advanced catalytic processes for improved yields and lower carbon footprints. Adoption of new biotechnologies enables companies to compete in premium sustainable product categories

- Collaborations with technology leaders and raw material suppliers are helping scale new bio-aromatics manufacturing processes. This trend is driving geographical expansion and accelerating market penetration in Europe, North America, and APAC

- Consumer brands are highlighting bio-based aromatic content on packaging to strengthen their sustainability credentials. Such marketing efforts are increasing consumer awareness and willingness to pay premiums for eco-friendly and renewable ingredients

Bio-based Aromatics Market Dynamics

Driver

Increase in Consumer Preference for Sustainable Products

- Growing consumer awareness and preference for products with sustainable content is increasing demand for bio-based aromatics. This dynamic is influencing manufacturers in sectors such as packaging, automotive, and cosmetics to invest in new, renewable chemistry solutions

- For instance, Dow is investing significantly in bio-based aromatic production technologies to supply major personal care and packaging firms. Their partnerships help meet end-user requirements for safer materials and low-carbon footprints

- Eco-labeling and clear product disclosure of bio-based aromatic content are becoming fundamental in gaining consumer trust and market differentiation. Brands that align with this consumer shift are achieving stronger growth in high-value markets

- Retailers are prioritizing suppliers who utilize bio-based ingredients, amplifying the reach of these chemicals beyond traditional manufacturing to consumer-facing segments. This further strengthens the supply chain for bio-aromatics

- Rising global emphasis on climate goals and reduced emissions is prompting more industries to seek bio-based aromatic solutions as part of their strategic sustainability commitments

Restraint/Challenge

Limited Raw Material Availability

- Feedstock availability remains a major challenge, as the supply of suitable biomass and organic waste streams fluctuates by season and geography. This constraint affects production scalability until broader agricultural and collection infrastructure is established

- For instance, Anellotech highlighted in its recent technology roadmap that scaling up their innovative bio-aromatics production required overcoming bottlenecks in feedstock logistics and processing consistency

- Competition for biomass between bio-aromatics, bioenergy, and food production increases volatility and price pressures across the value chain. Securing high-quality, cost-effective raw materials is a top concern for market players

- Regulatory conflicts and policy gaps sometimes hinder large-scale feedstock sourcing and land use. These issues delay investment and slow adoption, especially in developing markets with less robust environmental legislation

- Investment in alternative feedstocks and process optimization is ongoing, but maturity remains limited in comparison to established petrochemical supply chains. The industry requires further breakthroughs to close the gap and achieve scalability

Bio-based Aromatics Market Scope

The market is segmented on the basis of type, end-use, and application.

• By Type

On the basis of type, the bio-based aromatics market is segmented into benzene, toluene, xylene, styrene, phenol, and others. The benzene segment dominated the largest market revenue share of 39% in 2024, driven by its wide range of industrial applications and its established role as a primary feedstock in the production of polymers, resins, and solvents. Manufacturers favor bio-based benzene for its sustainability benefits and potential to reduce dependency on fossil-based feedstocks, making it a preferred choice for eco-conscious industries. The growing emphasis on green chemistry and renewable raw materials has further reinforced demand for benzene as a foundational aromatic compound.

The styrene segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its increasing use in the production of bio-based plastics and resins for packaging and construction materials. Rising consumer awareness of sustainable products and regulatory support for renewable chemical production are accelerating the adoption of bio-based styrene. Its compatibility with existing manufacturing processes and the ability to deliver comparable performance to petrochemical-derived styrene are also driving rapid uptake across multiple industrial applications.

• By End-Use

On the basis of end-use, the bio-based aromatics market is segmented into chemicals, food & beverages, pharmaceuticals, personal care & consumer, and others. The chemicals segment held the largest market revenue share in 2024, as bio-based aromatics serve as essential intermediates in the production of polymers, solvents, and specialty chemicals. The shift toward renewable feedstocks, coupled with stricter environmental regulations, has prompted chemical manufacturers to increasingly adopt bio-based alternatives. This segment benefits from broad industrial demand and long-term contracts that ensure steady market growth.

The personal care & consumer segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing consumer preference for eco-friendly and sustainable ingredients in cosmetics, fragrances, and household products. Bio-based aromatics are valued for their natural origin, lower environmental footprint, and compatibility with clean-label formulations. Rising consumer demand for transparency in sourcing and the expansion of premium personal care products incorporating bio-based aromatics are accelerating market adoption.

• By Application

On the basis of application, the bio-based aromatics market is segmented into paints & coatings, textile industry, plastic industry, chemical processing, and others. The plastic industry segment dominated the largest market revenue share in 2024, owing to its high consumption of bio-based aromatics as precursors for sustainable polymers and packaging materials. Manufacturers are increasingly turning to bio-based aromatics to reduce carbon emissions and enhance product sustainability without compromising performance. The segment also benefits from growing demand in packaging, construction, and automotive sectors, where renewable materials are becoming a regulatory and consumer requirement.

The paints & coatings segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand for environmentally friendly coatings in residential, commercial, and industrial applications. Bio-based aromatic compounds improve VOC compliance while maintaining performance standards, making them attractive for green building initiatives. Increasing awareness of sustainability and government incentives for low-emission materials are further accelerating the adoption of bio-based aromatics in this segment.

Bio-based Aromatics Market Regional Analysis

- Asia-Pacific dominated the bio-based aromatics market with the largest revenue share of 33.2% in 2024, driven by rapid industrialization, increasing adoption of sustainable chemicals, and a strong presence of chemical manufacturing hubs

- The region’s cost-effective production landscape, rising investments in bio-based chemical facilities, and growing exports of renewable aromatics are accelerating market expansion

- The availability of skilled labor, supportive government policies, and increasing focus on eco-friendly manufacturing across developing economies are contributing to higher consumption of bio-based aromatics in both industrial and consumer sectors

China Bio-based Aromatics Market Insight

China held the largest share in the Asia-Pacific bio-based aromatics market in 2024, owing to its position as a global leader in chemical manufacturing and polymer production. The country’s well-established industrial base, government initiatives supporting renewable chemical production, and strong export capabilities for bio-based intermediates are key growth drivers. Demand is further bolstered by ongoing investments in specialty and sustainable chemicals for both domestic and international markets.

India Bio-based Aromatics Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding pharmaceutical, polymer, and specialty chemical industries. Government initiatives promoting sustainable manufacturing, such as “Make in India” and renewable chemical adoption programs, are driving demand. Rising exports of bio-based intermediates and increasing R&D investments in green chemistry are further contributing to robust market expansion.

Europe Bio-based Aromatics Market Insight

The Europe bio-based aromatics market is expanding steadily, supported by strict environmental regulations, high demand for sustainable chemical intermediates, and growing investments in green and specialty chemical production. The region emphasizes eco-friendly processes, product quality, and regulatory compliance, particularly in pharmaceuticals, personal care, and polymer applications. Increasing adoption of bio-based aromatics in advanced chemical formulations is enhancing market growth.

Germany Bio-based Aromatics Market Insight

Germany’s bio-based aromatics market is driven by its advanced chemical industry, strong R&D networks, and focus on sustainable manufacturing. The country is a leader in high-performance polymer and specialty chemical production, with collaborations between industry and academic institutions fostering innovation in renewable aromatics. Demand is particularly strong for use in chemicals, plastics, and fine chemical applications.

U.K. Bio-based Aromatics Market Insight

The U.K. market is supported by a mature chemical and life sciences sector, rising emphasis on sustainable sourcing, and increased adoption of bio-based intermediates. Growing R&D investments, academic-industry collaborations, and production of niche renewable chemicals are driving the market. The focus on sustainable supply chains and eco-friendly formulations strengthens the U.K.’s role in the bio-based aromatics industry.

North America Bio-based Aromatics Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing demand for bio-based chemicals in pharmaceuticals, plastics, and personal care products. Growing regulatory support for renewable chemicals, reshoring of chemical manufacturing, and technological advancements in green chemical production are boosting market expansion.

U.S. Bio-based Aromatics Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by a strong chemical industry, advanced R&D infrastructure, and significant investment in bio-based chemical production. The country’s focus on sustainable innovation, regulatory compliance, and high-purity renewable intermediates is encouraging adoption across pharmaceuticals, plastics, and specialty chemical applications. Presence of key manufacturers and a well-established distribution network further solidify the U.S.'s leading position.

Bio-based Aromatics Market Share

The bio-based aromatics industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Chevron Phillips Chemical Company LLC (U.S.)

- Dow (U.S.)

- DSM (Netherlands)

- Exxon Mobil Corporation (U.S.)

- LG Chem (South Korea)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Neste (Finland)

- Reliance Industries Limited (India)

- SABIC (Saudi Arabia)

Latest Developments in Global Bio-based Aromatics Market

- In February 2025, DSM-Firmenich announced the sale of its stake in the Feed Enzymes Alliance to its partner Novonesis for €1.5 billion. This strategic divestment enables DSM-Firmenich to concentrate resources on its core nutrition, health, and beauty businesses while allowing Novonesis to expand its focus on innovative biosolutions in the feed enzymes sector. The transaction highlights DSM’s approach to portfolio optimization and reinforces its ability to invest in high-growth areas within bio-based and sustainable chemicals. It also demonstrates the increasing market shift toward specialized, renewable chemical intermediates and solutions that cater to evolving industrial and consumer demands

- In April 2024, BASF expanded its biomass-balanced EcoBalanced product range, doubling its portfolio of environmentally conscious solutions for detergent and cleaning product manufacturers. This expansion allows BASF to replace more fossil-based raw materials with renewable alternatives, supporting the company’s sustainability goals. By providing versatile bio-based ingredients that integrate seamlessly into existing production processes, BASF is addressing the growing consumer and regulatory demand for sustainable chemicals. The move reinforces BASF’s leadership in the bio-based aromatics market and its commitment to enabling greener supply chains across multiple industries

- In January 2024, LyondellBasell unveiled plans to scale up production of bio-based styrene in North America, targeting applications in sustainable plastics and resins. The company’s strategy focuses on leveraging renewable feedstocks to meet the increasing demand for environmentally friendly polymers. This expansion strengthens LyondellBasell’s position in the bio-based aromatics market and also provides downstream manufacturers with reliable, high-quality bio-based intermediates for eco-conscious product lines, supporting the broader transition to sustainable chemical production

- In May 2023, Dow Chemical Company and New Energy Blue entered into a long-term supply agreement in North America to produce bio-based ethylene from renewable agricultural residues. Dow plans to purchase this ethylene to lower emissions from plastic production and incorporate it into recyclable products such as transportation materials, footwear, and packaging. This initiative marks Dow's first North American project using corn stover and agricultural residues for plastic production, reflecting a strategic push toward sustainable feedstocks and circular economy solutions in the chemical and plastics sectors. The agreement is expected to accelerate adoption of bio-based intermediates in large-scale industrial applications and strengthen Dow’s position in the green materials market

- In August 2023, Solvay announced the launch of a bio-based paraxylene pilot plant in Europe aimed at producing renewable aromatics for high-performance polymers. The facility is designed to use biomass-derived feedstocks, reducing reliance on fossil resources and lowering carbon emissions in polymer production. This initiative is expected to accelerate the adoption of bio-based aromatics in packaging, electronics, and automotive applications, demonstrating Solvay’s commitment to sustainability and innovation in high-value chemical markets

- In July 2022, BASF strengthened its position as a key ingredients partner in the nutrition, flavor, and fragrance industries by consolidating strategic and operational responsibilities into one global business unit, Nutrition Ingredients. The division focused on enhancing core platforms in vitamins and carotenoids while expanding the feed enzyme business. This initiative allows BASF to leverage synergies across product lines, improve operational efficiency, and respond more effectively to the rising demand for bio-based ingredients in health, food, and personal care applications. The restructuring supports sustainable growth in high-value segments and positions BASF as a leading provider of renewable chemical solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bio Based Aromatics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Based Aromatics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Based Aromatics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.