Global Bio Based Hot Melt Adhesive Hma Market

Market Size in USD Million

CAGR :

%

USD

362.97 Million

USD

728.57 Million

2024

2032

USD

362.97 Million

USD

728.57 Million

2024

2032

| 2025 –2032 | |

| USD 362.97 Million | |

| USD 728.57 Million | |

|

|

|

|

What is the Global Bio-Based Hot Melt Adhesive (HMA) Market Size and Growth Rate?

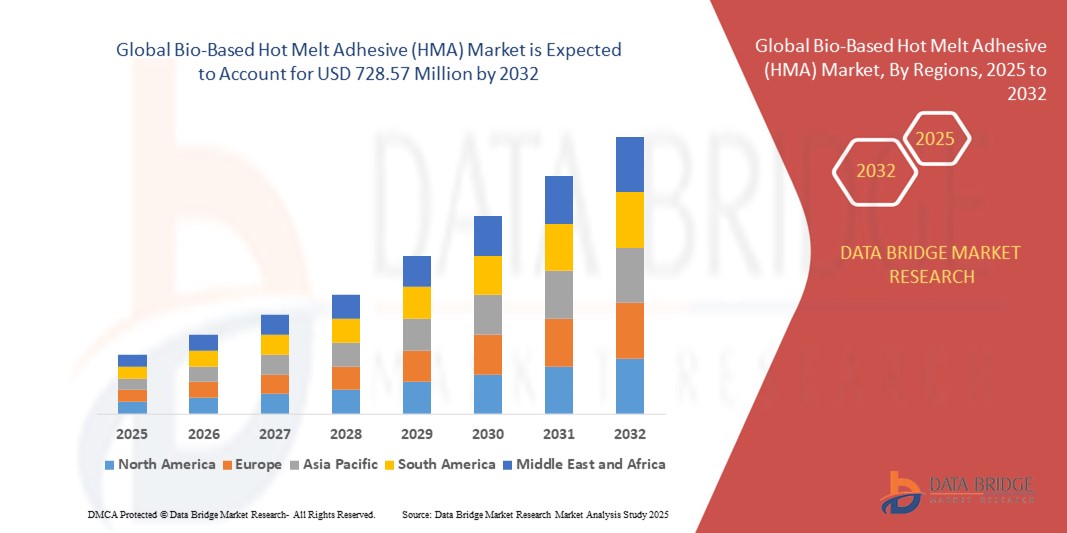

- The global bio-based hot melt adhesive (HMA) market size was valued at USD 362.97 million in 2024 and is expected to reach USD 728.57 million by 2032, at a CAGR of 9.10% during the forecast period

- The packaging industry is a major driver as hot melt adhesives are extensively used for sealing and bonding in the packaging sector due to their quick bonding capabilities. Hot melt adhesives offer fast bonding, making them ideal for industries that require high-speed production, such as automotive and textiles

- Continuous product innovation and the development of specialized formulations for various applications can drive market growth and maintain their dominance throughout the forecast period

What are the Major Takeaways of Bio-Based Hot Melt Adhesive (HMA) Market?

- The Increasing environmental awareness and stringent regulations related to VOC (volatile organic compounds) emissions, toxic chemicals, and sustainability have encouraged industries to seek eco-friendly adhesive alternatives

- Bio-based hot melt adhesives often have lower or zero VOC emissions, making them an attractive option to comply with environmental regulations. The production of bio-based adhesives typically results in a lower carbon footprint compared to petroleum-based adhesives

- The use of renewable feedstocks and reduced energy consumption in the manufacturing process contribute to this advantage. Companies and industries committed to reducing their environmental impact are opting for bio-based alternatives, which is driving market

- North America dominated the bio-based hot melt adhesive (HMA) market with the largest revenue share of 32.12% in 2024, driven by rising demand for eco-friendly adhesives in packaging, automotive, and hygiene applications, alongside strong regulatory support for sustainable materials

- Asia-Pacific market is poised to grow at the fastest CAGR of 12.04% from 2025 to 2032, driven by industrial expansion, rising disposable incomes, and government initiatives promoting sustainable materials

- The Ethylene Vinyl Acetate (EVA) segment dominated the bio-based HMA market with the largest market revenue share of 38.5% in 2024, driven by its excellent adhesion properties, versatility, and cost-effectiveness

Report Scope and Bio-Based Hot Melt Adhesive (HMA) Market Segmentation

|

Attributes |

Bio-Based Hot Melt Adhesive (HMA) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Bio-Based Hot Melt Adhesive (HMA) Market?

Rising Demand for Sustainable and High-Performance Adhesives

- A significant and accelerating trend in the global bio-based hot melt adhesive (HMA) market is the increasing shift towards sustainable, renewable, and eco-friendly materials as industries aim to reduce carbon footprints and comply with stringent environmental regulations

- Manufacturers are focusing on bio-based feedstocks derived from plant oils, resins, and other natural sources to replace petroleum-based adhesives without compromising performance

- For instance, companies such as Henkel and H.B. Fuller are developing bio-based HMAs that deliver comparable bonding strength and thermal resistance to conventional products while meeting global sustainability certifications. Similarly, Arkema’s Pebax® Rnew® series utilizes renewable raw materials to address both environmental and performance demands

- Technological advancements are enabling bio-based HMAs to achieve improved heat stability, enhanced durability, and superior adhesion across packaging, woodworking, and automotive applications. The trend is further supported by rising consumer preference for eco-labeled products, driving brands to adopt sustainable adhesives to enhance their environmental image

- The integration of bio-based HMAs into automated manufacturing processes ensures compatibility with modern machinery, making them increasingly viable for large-scale applications. Through these developments, bio-based HMAs are emerging as mainstream solutions for industries seeking both performance and sustainability

- This trend towards green chemistry and circular economy practices is fundamentally reshaping the adhesive industry. Consequently, companies are investing in R&D to launch next-generation bio-based HMAs that balance cost-effectiveness with environmental benefits, setting new standards for the global market

- The demand for bio-based HMAs offering performance parity with synthetic alternatives is growing rapidly across packaging, construction, and consumer goods sectors, as businesses increasingly prioritize sustainable and regulatory-compliant solutions

What are the Key Drivers of Bio-Based Hot Melt Adhesive (HMA) Market?

- The rising regulatory pressure to reduce VOC emissions and reliance on fossil-based materials, combined with increasing consumer demand for sustainable products, is a significant driver accelerating bio-based HMA adoption

- For instance, in 2024, Henkel launched a range of carbon-neutral HMAs aimed at packaging applications, targeting industries transitioning toward ESG-compliant solutions. Such initiatives are encouraging the replacement of synthetic adhesives with bio-based alternatives

- Growing packaging demand driven by e-commerce and food safety requirements is further boosting the market, as bio-based HMAs provide safe and efficient bonding while aligning with sustainability goals

- Furthermore, advancements in raw material processing technologies are improving the thermal resistance and adhesion performance of bio-based HMAs, making them competitive for automotive, woodworking, and construction applications

- The combination of brand differentiation through eco-friendly products, cost savings in the long term, and favorable government incentives for sustainable manufacturing is propelling the adoption of bio-based HMAs across multiple industries

Which Factor is Challenging the Growth of the Bio-Based Hot Melt Adhesive (HMA) Market?

- The high production costs and limited availability of bio-based raw materials pose significant challenges to widespread market penetration. Compared to petroleum-based adhesives, bio-based HMAs often have higher initial costs, which can deter adoption among price-sensitive industries

- For instance, fluctuations in agricultural feedstock prices affect the stability of bio-based adhesive costs, making long-term planning difficult for manufacturers

- Addressing these challenges requires technological innovations to reduce production costs, investment in feedstock supply chains, and the development of hybrid HMAs that balance performance with affordability. Companies such as H.B. Fuller and Arkema are actively working on expanding raw material sourcing and scaling production capacities to mitigate these constraints

- In addition, a lack of standardized certifications and performance benchmarks for bio-based adhesives creates uncertainty for end-users, particularly in industrial sectors requiring strict quality standards

- Overcoming these challenges through R&D investments, partnerships with raw material suppliers, and regulatory frameworks supporting bio-based solutions will be critical to achieving sustained growth in the bio-based HMA market

How is the Bio-Based Hot Melt Adhesive (HMA) Market Segmented?

The market is segmented on the basis of resin type and end-user.

- By Resin Type

On the basis of resin type, the bio-based hot melt adhesive (HMA) market is segmented into Ethylene Vinyl Acetate (EVA), Styrenic Block Copolymers (SBC), Metallocene Polyolefin (MPO), Amorphous Polyalphaolefins (APAO), Polyolefins, Polyamides, and Polyurethane (PU). The Ethylene Vinyl Acetate (EVA) segment dominated the bio-based HMA market with the largest market revenue share of 38.5% in 2024, driven by its excellent adhesion properties, versatility, and cost-effectiveness. EVA-based HMAs are widely used in packaging and bookbinding applications due to their low application temperature and compatibility with bio-based raw materials, making them a preferred choice for sustainable solutions.

The Metallocene Polyolefin (MPO) segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by its superior thermal stability, enhanced bond strength, and reduced material consumption in high-speed manufacturing processes. MPO-based HMAs are increasingly being adopted in packaging and hygiene products, owing to their consistent performance and environmental advantages.

- By End-User

On the basis of end-user, the bio-based hot melt adhesive (HMA) market is segmented into Packaging Solutions, Disposable Hygiene Products, Furniture & Woodwork, Automotive & Transportation, Footwear, Textiles, Electronics, and Bookbinding. The Packaging Solutions segment accounted for the largest market revenue share of 41.2% in 2024, driven by the rising demand for eco-friendly packaging in food & beverages and e-commerce industries. The shift toward sustainable and recyclable materials further accelerates the adoption of bio-based HMAs in this segment.

The Disposable Hygiene Products segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by increasing global demand for sustainable hygiene solutions such as diapers, sanitary products, and medical disposables. Bio-based HMAs in this segment offer skin-friendly, odor-free, and environmentally safe bonding solutions, aligning with consumer preferences and regulatory mandates.

Which Region Holds the Largest Share of the Bio-Based Hot Melt Adhesive (HMA) Market?

- North America dominated the bio-based hot melt adhesive (HMA) market with the largest revenue share of 32.12% in 2024, driven by rising demand for eco-friendly adhesives in packaging, automotive, and hygiene applications, alongside strong regulatory support for sustainable materials

- Manufacturers in the region are increasingly investing in R&D for bio-based innovations to replace petroleum-derived adhesives, meeting consumer and industrial preferences for low-VOC and recyclable solutions

- The region’s robust packaging and automotive sectors, combined with high disposable incomes and sustainability awareness, firmly establish Bio-Based HMAs as a preferred choice across multiple industries

U.S. Bio-Based Hot Melt Adhesive (HMA) Market Insight

The U.S. market dominated North America’s revenue share in 2024, driven by stringent environmental regulations and the growing shift toward sustainable packaging in e-commerce and food sectors. Increasing adoption in automotive lightweighting and hygiene products further supports growth. Technological innovations, coupled with government incentives for bio-based products, continue to strengthen the U.S. as a key hub for bio-based adhesive development and commercialization.

Europe Bio-Based Hot Melt Adhesive (HMA) Market Insight

The Europe market is projected to grow at a substantial CAGR, fueled by EU directives promoting bio-economy initiatives and rising industrial demand for low-carbon adhesives. Countries are witnessing strong uptake of Bio-Based HMAs in furniture, woodworking, and automotive applications. Rapid urbanization and consumer preference for environmentally certified products also contribute to increasing demand across residential and industrial sectors.

U.K. Bio-Based Hot Melt Adhesive (HMA) Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, driven by packaging sector innovation and demand for compostable and recyclable adhesive solutions. In addition, the country’s retail and e-commerce boom, combined with commitments to net-zero targets, is accelerating the adoption of Bio-Based HMAs across multiple industries, including textiles and electronics.

Germany Bio-Based Hot Melt Adhesive (HMA) Market Insight

The Germany market is expected to expand considerably, underpinned by advanced manufacturing capabilities and a strong focus on circular economy principles. Bio-Based HMAs are witnessing rising adoption in automotive, furniture, and industrial applications, supported by consumer emphasis on eco-conscious solutions and the country’s leadership in adhesive technology innovation.

Which Region is the Fastest Growing Region in the Bio-Based Hot Melt Adhesive (HMA) Market?

Asia-Pacific market is poised to grow at the fastest CAGR of 12.04% from 2025 to 2032, driven by industrial expansion, rising disposable incomes, and government initiatives promoting sustainable materials. Increasing demand for eco-friendly packaging and hygiene products, coupled with the region’s role as a manufacturing hub for adhesive materials, is boosting affordability and adoption of Bio-Based HMAs.

Japan Bio-Based Hot Melt Adhesive (HMA) Market Insight

The Japan market is gaining momentum due to technological advancements and strong sustainability goals. Rising demand in electronics and packaging industries, coupled with emphasis on low-emission manufacturing, is propelling growth. Government incentives and consumer inclination toward green products further enhance market expansion.

China Bio-Based Hot Melt Adhesive (HMA) Market Insight

The China market accounted for the largest share in Asia-Pacific in 2024, driven by rapid industrialization, large-scale packaging demand, and government policies favoring bio-based solutions. With strong domestic manufacturing and growing exports, China is becoming a key driver of global bio-based HMA production and consumption.

Which are the Top Companies in Bio-Based Hot Melt Adhesive (HMA) Market?

The bio-based hot melt adhesive (HMA) industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Arkema (U.S.)

- Avery Dennison Corporation (U.S.)

- Beardow & Adams (Adhesives) Ltd. (U.S.)

- DOW Inc. (U.S.)

- HB Fuller Company (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Jowat SE (Germany)

- Sika AG (Switzerland)

- Tex Year Industries Inc. (Taiwan)

- Adtek Malaysia SDN BHD (Malaysia)

- Buhnen GmbH & Co. KG (Germany)

- Cherng Tay Technology Co., Ltd. (China)

- Evonik Industries AG (Germany)

What are the Recent Developments in Global Bio-Based Hot Melt Adhesive (HMA) Market?

- In June 2024, Henkel launched its Technomelt Supra ECO range of bio-based hot melt adhesives designed to capture CO₂ emissions, setting a new benchmark for sustainable adhesive solutions. This innovation significantly strengthens Henkel’s adhesive technology portfolio and reinforces its commitment to environmental stewardship

- In September 2023, Bostik, the adhesives division of Arkema, introduced a new lineup of bio-based specialty hot melt adhesives, including Copolyesters and Copolyamides, tailored to meet the rising demand for eco-friendly materials in industries such as technical textiles, automotive interiors, filters, electronics, and footwear. This product launch positions Bostik as a key player in driving sustainable material adoption

- In April 2023, Avery Dennison collaborated with Dow to develop a new hot melt label adhesive that supports the mechanical reuse of polyolefin filmic labels with polypropylene (PP) or polyethylene (PE) packaging. This collaboration enhances circular economy initiatives and promotes greater recyclability in packaging solutions

- In June 2022, Henkel inaugurated a state-of-the-art hot melt adhesives plant in Guadalupe, Mexico, to produce both non-pressure-sensitive and pressure-sensitive adhesives under its Technomelt brand. This facility expands Henkel’s manufacturing footprint and strengthens its supply capabilities in the Americas

- In October 2020, Applied Adhesives acquired Premier Packaging Solutions, a Chattanooga-based distributor specializing in hot-melt and water-based adhesives, to expand its presence in North America. This acquisition enhances Applied Adhesives’ ability to deliver localized technical support, problem-solving expertise, and tailored adhesive solutions to its customers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bio Based Hot Melt Adhesive Hma Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Based Hot Melt Adhesive Hma Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Based Hot Melt Adhesive Hma Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.