Global Bio Based Thermoplastic Elastomer Market

Market Size in USD Million

CAGR :

%

USD

118.15 Million

USD

398.15 Million

2024

2032

USD

118.15 Million

USD

398.15 Million

2024

2032

| 2025 –2032 | |

| USD 118.15 Million | |

| USD 398.15 Million | |

|

|

|

|

Bio-Based Thermoplastic Elastomer Market Size

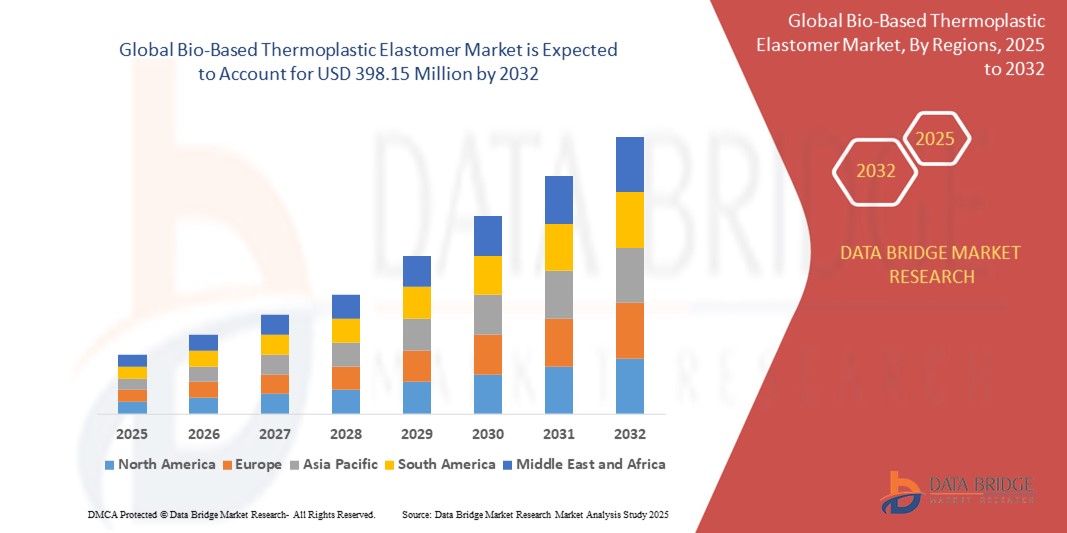

- The global bio-based thermoplastic elastomer market size was valued at USD 118.15 million in 2024 and is expected to reach USD 398.15 million by 2032, at a CAGR of 16.40% during the forecast period

- The market growth is primarily driven by increasing demand for sustainable and eco-friendly materials, advancements in bio-based polymer technologies, and growing environmental regulations promoting the use of renewable resources

- In addition, rising consumer awareness of environmental sustainability and the shift toward green manufacturing processes in various industries are positioning bio-based thermoplastic elastomers as a preferred alternative to conventional fossil-based materials, significantly fueling market expansion

Bio-Based Thermoplastic Elastomer Market Analysis

- Bio-based thermoplastic elastomers, derived from renewable biomass sources, offer a sustainable alternative to traditional elastomers, combining flexibility, durability, and eco-friendliness for applications across multiple industries

- The surge in demand is driven by the global push for sustainability, stricter environmental regulations, and the growing adoption of bio-based materials in industries such as automotive, medical, and electronics

- North America dominated the bio-based thermoplastic elastomer market with the largest revenue share of 38.5% in 2024, driven by strong regulatory support for sustainable materials, high investment in R&D, and the presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid industrialization, increasing adoption of sustainable materials, and rising disposable incomes in countries such as China, India, and Japan

- The Synthesized Biobased Polyester Elastomer segment held the largest market revenue share of 55% in 2024, driven by its versatility, cost-effectiveness, and ability to be tailored for specific applications through advanced manufacturing processes

Report Scope and Bio-Based Thermoplastic Elastomer Market Segmentation

|

Attributes |

Bio-Based Thermoplastic Elastomer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio-Based Thermoplastic Elastomer Market Trends

“Increasing Adoption of Sustainable and Eco-Friendly Materials”

- The global bio-based thermoplastic elastomer (TPE) market is experiencing a significant trend toward the adoption of sustainable and eco-friendly materials driven by growing environmental awareness and regulatory support

- Bio-based TPEs, derived from renewable sources such as plant-based polymers, corn starch, or agricultural by-products, offer reduced carbon footprints and lower volatile organic compound (VOC) emissions compared to petroleum-based counterparts

- These materials are being increasingly utilized in industries seeking high-performance, sustainable alternatives, with applications in automotive, medical, and consumer goods sectors

- For instance, companies such as BASF and Lubrizol are developing bio-based thermoplastic polyurethanes (TPUs) for use in footwear, automotive interiors, and electronics, providing comparable performance to traditional thermoplastic elastomer while enhancing biodegradability

- This trend is boosting the appeal of bio-based thermoplastic elastomer for manufacturers aiming to meet consumer demand for green products and comply with stringent environmental regulations

- Advanced bio-based thermoplastic elastomer formulations are being engineered to improve mechanical properties, such as tensile strength and elasticity, making them suitable for demanding applications such as automotive trims and medical devices

Bio-Based Thermoplastic Elastomer Market Dynamics

Driver

“Rising Demand for Lightweight and Sustainable Automotive Components”

- The growing consumer and regulatory push for sustainable, lightweight materials in the automotive industry is a major driver for the bio-based thermoplastic elastomer market

- Bio-based thermoplastic elastomer are increasingly used in automotive applications, such as interior trims, dashboards, seals, and mats, to reduce vehicle weight, improve fuel efficiency, and lower CO2 emissions

- Government regulations, particularly in North America and Europe, promoting eco-friendly materials and reduced emissions, are accelerating the adoption of bio-based thermoplastic elastomer

- The rise of electric vehicles (EVs) further fuels demand, as bio-based thermoplastic elastomer are used in battery sealing systems, cable insulation, and noise reduction components, aligning with sustainability goals

- Major automakers are incorporating factory-fitted bio-based thermoplastic elastomer components to meet consumer expectations for environmentally responsible vehicles and enhance product value

Restraint/Challenge

“High Production Costs and Limited Raw Material Availability”

- The high cost of producing bio-based thermoplastic elastomer , due to expensive renewable feedstock’s and complex manufacturing processes, poses a significant barrier to widespread adoption, particularly in cost-sensitive emerging markets

- Integrating bio-based thermoplastic elastomer into existing manufacturing systems can require costly modifications to production lines and supply chains

- In addition, the limited availability of bio-based raw materials, such as plant-derived polymers or agricultural by-products, can constrain scalability and lead to supply chain disruptions

- Concerns about the consistency and quality of bio-based feedstock’s compared to petroleum-based alternatives further complicate market growth

- These challenges can deter manufacturers and limit market expansion, especially in regions with less developed infrastructure for bio-based material production

Bio-Based Thermoplastic Elastomer market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the global bio-based thermoplastic elastomer market is segmented into Synthesized Biobased Polyester Elastomer and Natural Biobased Polyester Elastomer. The Synthesized Biobased Polyester Elastomer segment held the largest market revenue share of 55% in 2024, driven by its versatility, cost-effectiveness, and ability to be tailored for specific applications through advanced manufacturing processes. This segment benefits from technological advancements that allow performance characteristics comparable to petroleum-based elastomers, making it a preferred choice across multiple industries.

The Natural Biobased Polyester Elastomer segment is expected to witness the fastest growth rate of 9% from 2025 to 2032, driven by increasing consumer and regulatory demand for sustainable, renewable materials derived from natural sources such as plant-based polymers. Its biodegradability and lower environmental impact are key factors accelerating adoption in eco-conscious markets.

- By Application

On the basis of application, the global bio-based thermoplastic elastomer market is segmented into Automotive, Electrical and Electronics, Medical, Sealants and Coatings, Footwear, and Others. The Automotive segment dominated the market with a revenue share of 40% in 2024, fueled by the rising demand for lightweight, sustainable materials in vehicle manufacturing to improve fuel efficiency and reduce CO2 emissions. Bio-based thermoplastic elastomers are widely used in automotive interiors, such as dashboards, mats, and seals, due to their flexibility, durability, and compliance with Vehicle Interior Air Quality (VIAQ) standards.

The Medical segment is anticipated to experience the fastest growth rate of 8% from 2025 to 2032. The increasing demand for biocompatible materials in medical device manufacturing, such as tubing, catheters, and implants, drives this growth. Bio-based thermoplastic elastomers offer safety, flexibility, and reduced environmental impact, aligning with the healthcare industry’s focus on sustainability and patient safety.

Bio-Based Thermoplastic Elastomer Market Regional Analysis

- North America dominated the bio-based thermoplastic elastomer market with the largest revenue share of 38.5% in 2024, driven by strong regulatory support for sustainable materials, high investment in R&D, and the presence of key industry players

- Consumers prioritize bio-based thermoplastic elastomers for their sustainability, reduced carbon footprint, and versatility in applications, particularly in regions with stringent environmental regulations

- Growth is supported by advancements in bio-based material technologies, such as starch-based and plant oil-based elastomers, alongside rising adoption in both OEM and aftermarket segments

U.S. Bio-Based Thermoplastic Elastomer Market Insight

The U.S. bio-based thermoplastic elastomer market captured the largest revenue share of 79.4% in 2024 within North America, fueled by strong aftermarket demand and growing consumer awareness of sustainability and performance benefits. The trend toward eco-friendly vehicle components and medical devices boosts the adoption of synthesized and natural bio-based polyester elastomers. Stringent regulations promoting sustainable materials and increasing focus on vehicle customization further drive market growth. Automakers’ integration of bio-based TPEs in factory-installed components complements aftermarket sales, creating a robust product ecosystem.

Europe Bio-Based Thermoplastic Elastomer Market Insight

The Europe bio-based TPE market is expected to witness significant growth, supported by regulatory emphasis on environmental sustainability and material safety. Consumers demand films that offer high performance, thermal stability, and reduced environmental impact. Growth is prominent in both OEM installations and aftermarket applications, with countries such as Germany and France showing significant uptake due to rising environmental concerns and advanced manufacturing capabilities.

U.K. Bio-Based Thermoplastic Elastomer Market Insight

The U.K. market for bio-based TPEs is expected to witness rapid growth, driven by demand for sustainable materials that enhance product performance and comply with environmental regulations. Increased interest in eco-friendly vehicle components and consumer goods, along with rising awareness of bio-based TPE benefits such as biodegradability and recyclability, encourages adoption. Evolving regulations balancing material performance with sustainability standards further influence consumer choices.

Germany Bio-Based Thermoplastic Elastomer Market Insight

Germany is expected to witness rapid growth in the bio-based TPE market, attributed to its advanced automotive manufacturing sector and high consumer focus on sustainability and energy efficiency. German consumers prefer technologically advanced bio-based TPEs, such as synthesized bio-based polyester elastomers, that reduce environmental impact and contribute to lower fuel consumption. The integration of these materials in premium vehicles and aftermarket options supports sustained market growth.

Asia-Pacific Bio-Based Thermoplastic Elastomer Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of sustainability, performance, and environmental benefits boosts demand for bio-based TPEs in applications such as automotive, electrical and electronics, and footwear. Government initiatives promoting energy efficiency and eco-friendly materials further encourage the adoption of advanced bio-based TPEs.

Japan Bio-Based Thermoplastic Elastomer Market Insight

Japan’s bio-based TPE market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced materials that enhance product performance and sustainability. The presence of major automotive manufacturers and the integration of bio-based TPEs in OEM vehicles accelerate market penetration. Rising interest in aftermarket customization, particularly in footwear and electronics, also contributes to growth.

China Bio-Based Thermoplastic Elastomer Market Insight

China holds the largest share of the Asia-Pacific bio-based TPE market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for sustainable and high-performance materials. The country’s growing middle class and focus on green manufacturing support the adoption of synthesized and natural bio-based polyester elastomers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, particularly in automotive and electrical applications.

Bio-Based Thermoplastic Elastomer Market Share

The bio-based thermoplastic elastomer industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer (Germany)

- China Petroleum Corporation (China)

- Evonik Industries AG (Germany)

- Dow Chemical (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Huntsman International LLC. (U.S.)

- Lubrizol Corporation (U.S.)

- PolyOne (U.S.)

- L.Y.C. Group (China)

- L.G. Chemicals (South Korea)

- Arkema (France)

- Covestro AG (Germany)

- Tosoh Corporation (Japan)

- Kraton Corporation (U.S.)

- Exxon Mobil Corporation (U.S.)

- Celanese Corporation (U.S.)

- Asahi Kasei Corporation (Japan)

What are the Recent Developments in Global Bio-Based Thermoplastic Elastomer Market?

- In April 2024, Lubrizol Corporation and Eastman announced a collaboration to improve the adhesion strength of thermoplastic elastomers (TPEs) overmolded onto Eastman’s Tritan™ copolyester TX1501HF. The initiative focused on optimizing processing variables—such as mold temperature and barrel conditions—during 2K injection molding, resulting in a 124% increase in adhesion strength. By using Lubrizol’s ESTANE ECO TPU grades, which are renewably sourced, the partnership emphasized sustainable innovation in the bio-based TPE sector, expanding design flexibility and performance for consumer goods without compromising environmental goals

- In March 2024, KRAIBURG TPE Americas partnered with APTA Resinas to strengthen the distribution of thermoplastic elastomers (TPEs) across Brazil and South America. This strategic alliance builds on their earlier collaboration and aims to boost market penetration in key sectors such as automotive and consumer goods. By leveraging APTA’s regional expertise and KRAIBURG TPE’s high-performance compounds, the partnership supports the wider adoption of sustainable elastomer solutions tailored to local manufacturing needs. The move reflects a shared commitment to delivering durable, eco-conscious materials with enhanced flexibility, adhesion, and processing efficiency

- In January 2024, Teknor Apex introduced a new Monprene® thermoplastic elastomer (TPE) compound containing 35% recycled content, marking a significant step toward sustainable materials innovation. This eco-conscious formulation includes post-consumer recycled material and UBQ™, a bio-based thermoplastic derived from unsorted household waste. Designed for injection molding and overmolding onto polypropylene, the new Monprene® grade offers high flow performance and is ideal for consumer products requiring flexibility, comfort, and durability. The launch reflects the industry's growing commitment to circular economy principles, reducing reliance on virgin plastics and lowering the carbon footprint of end products

- In November 2023, HEXPOL AB acquired 100% of the shares in Star Thermoplastic Alloys and Rubbers, Inc., a U.S.-based thermoplastic elastomer (TPE) compounder founded in 1993. This strategic move marked HEXPOL’s formal entry into the American TPE market, expanding its global footprint and reinforcing its product portfolio across sectors such as automotive, medical, electronics, and consumer goods. With sustainability gaining traction in the elastomer industry, the acquisition positions HEXPOL to potentially integrate bio-based TPE offerings in response to evolving market demands

- In September 2023, the Mitsubishi Chemical Group Corporation unveiled a plant-derived polycarbonate thermoplastic elastomer featuring an impressive biomass content of up to 70%. Developed using proprietary material design technology, this innovation offers high heat resistance (melting point above 180°C), excellent transparency, and alkaline resistance, while maintaining flexibility across a wide temperature range—from -10°C to 150°C. The material’s non-yellowing properties and durability make it suitable for diverse applications, including consumer goods and industrial components. This breakthrough underscores Mitsubishi Chemical’s commitment to advancing sustainable, high-performance elastomers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bio Based Thermoplastic Elastomer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Based Thermoplastic Elastomer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Based Thermoplastic Elastomer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.