Global Bio Isobutene Market

Market Size in USD Billion

CAGR :

%

USD

31.90 Billion

USD

97.78 Billion

2025

2033

USD

31.90 Billion

USD

97.78 Billion

2025

2033

| 2026 –2033 | |

| USD 31.90 Billion | |

| USD 97.78 Billion | |

|

|

|

|

Bio-Isobutene Market Size

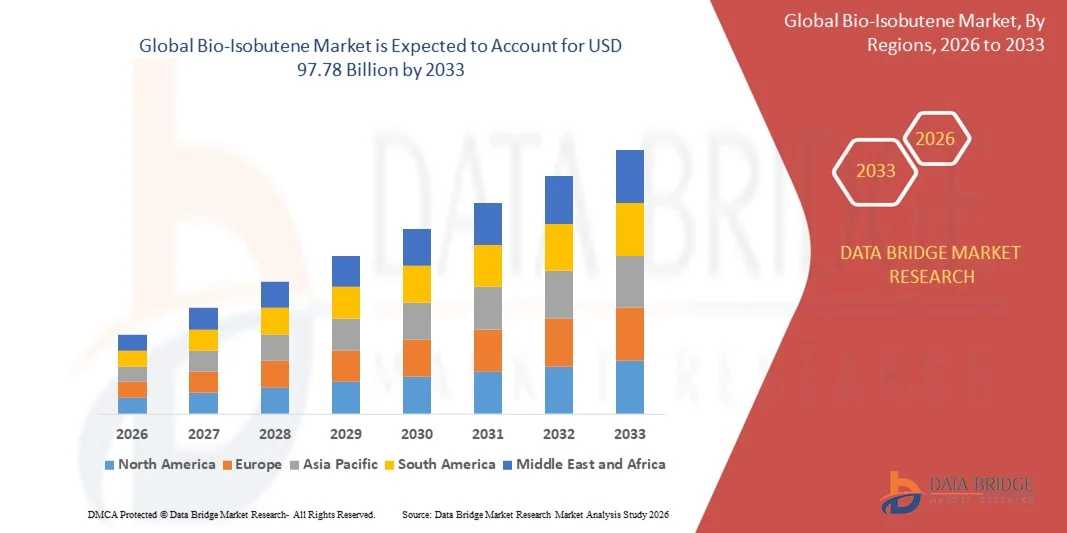

- The global bio-isobutene market size was valued at USD 31.9 billion in 2025 and is expected to reach USD 97.78 billion by 2033, at a CAGR of 15.03% during the forecast period

- The market growth is largely driven by increasing demand for sustainable and low-carbon chemical intermediates, as industries actively shift toward bio-based feedstocks to reduce reliance on fossil-derived materials and comply with tightening environmental regulations

- Furthermore, rising adoption of bio-isobutene in fuel additives, rubber, and specialty chemical applications is strengthening its commercial relevance, as manufacturers seek solutions that support emission reduction targets and long-term sustainability goals, thereby accelerating overall market expansion

Bio-Isobutene Market Analysis

- Bio-isobutene, produced from renewable feedstocks through advanced fermentation and conversion processes, is emerging as a critical building block in fuels, elastomers, and specialty chemicals due to its lower carbon footprint and compatibility with existing industrial value chains

- The growing demand for bio-isobutene is primarily supported by increasing biofuel mandates, rising corporate commitments to decarbonization, and continuous technological advancements that improve production efficiency and cost competitiveness across large-scale industrial applications

- Europe dominated the bio-isobutene market in 2025, due to strong regulatory support for bio-based chemicals, aggressive decarbonization targets, and high adoption of sustainable feedstocks in the chemical and fuel industries

- Asia-Pacific is expected to be the fastest growing region in the bio-isobutene market during the forecast period due to rapid industrialization, expanding biofuel programs, and rising demand for sustainable materials

- Cane-derived bio-isobutene segment dominated the market with a market share of 42.5% in 2025, due to the abundant availability of sugarcane feedstock and well-established fermentation infrastructure. High conversion efficiency and stable supply chains make cane-derived bio-isobutene commercially attractive for large-scale production. Major producers benefit from integrated sugar and bio-chemical operations, which help reduce production costs and improve process reliability. Strong adoption in regions with mature bio-ethanol and bio-chemical industries further reinforces its market leadership. Consistent product quality also supports its use across fuel and industrial applications

Report Scope and Bio-Isobutene Market Segmentation

|

Attributes |

Bio-Isobutene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio-Isobutene Market Trends

Rising Integration of Bio-Isobutene in Sustainable Aviation Fuel Production

- A major trend in the bio-isobutene market is the increasing integration of bio-isobutene into sustainable aviation fuel production pathways, driven by the aviation sector’s focus on reducing lifecycle carbon emissions and meeting regulatory decarbonization targets. Bio-isobutene serves as a critical intermediate for producing bio-based iso-octane and other high-performance fuel components, supporting the transition toward cleaner aviation fuels

- For instance, Global Bioenergies has developed bio-isobutene production technology that supplies renewable intermediates for sustainable aviation fuel programs in collaboration with aviation and energy stakeholders. This integration enhances fuel performance characteristics while aligning with emission reduction objectives across the aviation value chain

- The growing adoption of sustainable aviation fuels is increasing demand for bio-isobutene due to its compatibility with existing refining and blending infrastructure. This is enabling smoother integration into current fuel systems without requiring extensive modifications

- Airlines and fuel producers are prioritizing drop-in bio-based components that maintain energy density and combustion efficiency, which is reinforcing interest in bio-isobutene-based solutions. This trend is supporting broader acceptance of renewable fuel intermediates within commercial aviation

- Regulatory initiatives promoting low-carbon fuels are encouraging investment in bio-isobutene production technologies. These policies are accelerating commercialization efforts and strengthening the role of bio-isobutene in future aviation fuel supply chains

- Overall, the rising use of bio-isobutene in sustainable aviation fuel production is reinforcing its strategic importance as a renewable chemical building block. This trend is positioning the market for steady growth as aviation decarbonization efforts continue to expand globally

Bio-Isobutene Market Dynamics

Driver

Growing Demand for Low-Carbon and Bio-Based Chemical Intermediates

- The increasing demand for low-carbon and bio-based chemical intermediates is a key driver for the bio-isobutene market, as industries seek alternatives to fossil-derived feedstocks to reduce environmental impact. Bio-isobutene supports sustainability goals across fuels, polymers, and specialty chemicals by enabling lower greenhouse gas emissions

- For instance, Arkema has explored bio-based isobutene derivatives to support its strategy of expanding sustainable specialty chemical offerings. Such initiatives demonstrate industrial interest in integrating renewable intermediates into established chemical value chains

- The shift toward circular and bio-based economies is encouraging chemical producers to adopt renewable intermediates that align with long-term sustainability commitments. Bio-isobutene fits well within these strategies due to its versatility and performance characteristics

- End-use industries are under increasing pressure from regulators and consumers to demonstrate reduced carbon footprints, which is driving demand for bio-based inputs. This is strengthening the commercial appeal of bio-isobutene across multiple applications

- Overall, the growing preference for low-carbon chemical intermediates is reinforcing market momentum. This driver is positioning bio-isobutene as an important contributor to sustainable industrial transformation

Restraint/Challenge

High Production Costs and Limited Commercial-Scale Capacity

- The bio-isobutene market faces challenges due to high production costs associated with advanced fermentation processes, specialized catalysts, and downstream purification requirements. These cost factors limit price competitiveness compared to conventional petrochemical isobutene

- For instance, early commercial-scale deployments by Global Bioenergies highlighted the capital-intensive nature of scaling bio-isobutene production facilities. Such investments require long development timelines and substantial financial resources

- Limited availability of large-scale production plants restricts supply and slows broader market penetration. This constraint affects the ability of producers to meet rising industrial demand consistently

- Process optimization and yield improvement remain critical challenges for manufacturers seeking to lower unit production costs. Achieving economic viability at scale requires continued technological refinement

- Collectively, high costs and limited commercial-scale capacity continue to restrain market expansion. Overcoming these challenges will be essential for enabling wider adoption and sustained growth of bio-isobutene across global markets

Bio-Isobutene Market Scope

The market is segmented on the basis of products and application.

- By Products

On the basis of products, the Bio-Isobutene market is segmented into straw-derived bio-isobutene, sugar beet bio-isobutene, cane-derived bio-isobutene, and others. The cane-derived bio-isobutene segment dominated the market with the largest revenue share of 42.5% in 2025, supported by the abundant availability of sugarcane feedstock and well-established fermentation infrastructure. High conversion efficiency and stable supply chains make cane-derived bio-isobutene commercially attractive for large-scale production. Major producers benefit from integrated sugar and bio-chemical operations, which help reduce production costs and improve process reliability. Strong adoption in regions with mature bio-ethanol and bio-chemical industries further reinforces its market leadership. Consistent product quality also supports its use across fuel and industrial applications.

The straw-derived bio-isobutene segment is anticipated to witness the fastest growth during the forecast period, driven by rising focus on second-generation bio-based chemicals. Agricultural residue utilization supports circular economy goals and reduces dependence on food-based feedstocks. Technological progress in biomass pretreatment and fermentation is improving yields from straw-based sources. Regulatory support for waste valorization is encouraging investments in this segment. Growing interest from chemical producers seeking lower carbon intensity pathways is further accelerating demand.

- By Application

On the basis of application, the Bio-Isobutene market is segmented into fuel, butyl rubber, bio-based cosmetic ingredients, lubricant additives, and others. The fuel segment accounted for the largest market share in 2025, driven by increasing demand for renewable blending components in gasoline. Bio-isobutene serves as a key intermediate for bio-based isooctane and other clean fuel additives. Its ability to enhance octane ratings while lowering lifecycle emissions supports widespread adoption. Government mandates promoting biofuels continue to strengthen demand from refiners. Established downstream processing routes further support large-scale consumption in fuel applications.

The bio-based cosmetic ingredients segment is expected to register the fastest growth rate from 2026 to 2033, supported by rising consumer preference for sustainable and plant-derived ingredients. Bio-isobutene is increasingly used in emollients and texture enhancers for personal care formulations. Cosmetic manufacturers are shifting toward bio-based inputs to meet sustainability commitments and regulatory expectations. Its favorable sensory properties and compatibility with clean-label formulations enhance its adoption. Expanding premium and natural cosmetics markets are further driving rapid growth in this segment.

Bio-Isobutene Market Regional Analysis

- Europe dominated the bio-isobutene market with the largest revenue share in 2025, driven by strong regulatory support for bio-based chemicals, aggressive decarbonization targets, and high adoption of sustainable feedstocks in the chemical and fuel industries

- Manufacturers across the region increasingly utilize bio-isobutene as a renewable intermediate to comply with EU emission norms and circular economy policies, particularly in fuel additives and specialty chemicals

- This dominance is further supported by advanced biorefinery infrastructure, strong R&D investment, and the presence of established chemical producers, positioning Europe as a mature and sustainability-driven market

Germany Bio-Isobutene Market Insight

The Germany bio-isobutene market accounted for the largest share within Europe in 2025, supported by the country’s strong chemical manufacturing base and leadership in industrial biotechnology. German producers emphasize low-carbon raw materials and process efficiency, driving adoption of bio-isobutene in fuels, elastomers, and specialty chemicals. Government incentives for bio-based innovation and the presence of major integrated chemical clusters further support market growth.

U.K. Bio-Isobutene Market Insight

The U.K. bio-isobutene market is projected to grow at a steady CAGR during the forecast period, driven by increasing focus on renewable chemicals and sustainable fuels. Rising demand for bio-based ingredients in cosmetics and specialty applications encourages market adoption. Policy initiatives supporting green chemistry and reduced fossil fuel dependency further strengthen growth prospects.

North America Bio-Isobutene Market Insight

The North America bio-isobutene market holds a significant market share, supported by strong demand for renewable fuel components and growing investment in bio-based chemical production. The region benefits from advanced fermentation technologies and availability of agricultural feedstocks. Increasing corporate commitments toward carbon reduction and sustainable sourcing continue to drive market expansion.

U.S. Bio-Isobutene Market Insight

The U.S. bio-isobutene market represents a key share within North America, driven by strong demand for renewable fuel components and bio-based chemical intermediates. The presence of advanced fermentation technology providers and large-scale bio-refining facilities supports commercial-scale production. U.S.-based chemical and energy companies increasingly adopt bio-isobutene to meet corporate sustainability targets and low-carbon fuel standards. Continued investment in bio-based innovation and supportive regulatory frameworks further strengthen market development.

Asia-Pacific Bio-Isobutene Market Insight

The Asia-Pacific bio-isobutene market is expected to witness the fastest CAGR from 2026 to 2033, driven by rapid industrialization, expanding biofuel programs, and rising demand for sustainable materials. Chemical manufacturers increasingly adopt bio-isobutene to meet environmental regulations and cost-efficiency goals. Growing investments in biorefinery capacity further accelerate regional growth.

China Bio-Isobutene Market Insight

China dominated the Asia-Pacific bio-isobutene market in 2025, supported by its large chemical manufacturing ecosystem and strong focus on renewable industrial inputs. Government-led initiatives promoting bio-based chemicals and alternative fuels drive widespread adoption. Expanding domestic production capacity and increasing use of bio-isobutene in fuels and industrial applications further contribute to market expansion.

India Bio-Isobutene Market Insight

The India bio-isobutene market is emerging as a high-growth segment, supported by abundant agricultural feedstock availability and expanding biofuel initiatives. Government programs promoting ethanol blending and bio-based chemicals encourage domestic production and adoption. Growing demand from fuel, lubricant additives, and specialty chemical applications supports market expansion. Increasing investments in biorefinery infrastructure and focus on reducing fossil fuel dependence further position India as a promising growth market.

Bio-Isobutene Market Share

The bio-isobutene industry is primarily led by well-established companies, including:

- LyondellBasell Industries Holdings B.V. (Netherlands)

- LanzaTech (U.S.)

- Exxon Mobil Corporation (U.S.)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Global Bioenergies (France)

- Chandra Asri Petrochemical (Indonesia)

- Dow (U.S.)

- Clariant (Switzerland)

- Eastman Chemical Company (U.S.)

- LANXESS (Germany)

- Butagaz SAS (France)

- INEOS (U.K.)

Latest Developments in Global Bio-Isobutene Market

- In February 2025, Global Bioenergies signed a term sheet with a major international industrial partner to jointly develop an integrated process for Sustainable Aviation Fuel production, strengthening the commercial outlook of bio-isobutene–based SAF pathways. This collaboration combines Global Bioenergies’ bio-isobutene technology with a proprietary downstream conversion process, significantly lowering capital and operating costs compared to conventional SAF technologies. The development supports large-scale deployment of non-oil-based aviation fuels and positions bio-isobutene as a critical intermediate for meeting future aviation decarbonization mandates

- In October 2024, Global Bioenergies announced a strategic realignment to focus exclusively on Sustainable Aviation Fuel production from bio-isobutene, reshaping its market positioning toward higher-volume, long-term demand segments. By discontinuing its standalone cosmetics-focused facility and adopting a partnership-driven deployment model, the company aims to accelerate technology commercialization while reducing financial risk. This shift highlights growing market prioritization of aviation fuel decarbonization over niche specialty applications

- In September 2024, Gevo, Inc. received a U.S. patent for its ethanol-to-olefin technology enabling the production of bio-based isobutylene, reinforcing innovation-driven competition in the bio-isobutene market. The patented process supports cost-effective conversion of renewable ethanol into drop-in chemicals and fuels, expanding potential supply routes for sustainable isobutylene. This advancement enhances feedstock flexibility and strengthens the role of bio-isobutene in fuels, rubber, and chemical applications

- In July 2023, Exxon Mobil Corporation completed its acquisition of Denbury Inc., significantly strengthening its carbon capture and storage capabilities and indirectly supporting low-carbon fuel and chemical value chains. By operating the largest CO2 pipeline network in the U.S., ExxonMobil enhances infrastructure critical for reducing lifecycle emissions of fuels and petrochemical products. This development supports broader market adoption of lower-carbon intermediates and aligns with long-term sustainability strategies across the energy and chemicals sectors

- In June 2023, Axens entered into a licensing alliance with ExxonMobil Catalysts and Licensing LLC to access MTBE Decomposition technology for high-purity isobutylene production, improving global availability of key isobutylene feedstock. The agreement enables Axens to market and license advanced process technology worldwide, supporting capacity expansion and technology standardization. This move strengthens downstream markets that rely on isobutylene, including fuels, elastomers, and emerging bio-based derivatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bio Isobutene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Isobutene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Isobutene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.