Global Bio Lubricant Market

Market Size in USD Billion

CAGR :

%

USD

3.45 Billion

USD

5.55 Billion

2024

2032

USD

3.45 Billion

USD

5.55 Billion

2024

2032

| 2025 –2032 | |

| USD 3.45 Billion | |

| USD 5.55 Billion | |

|

|

|

|

Bio-Lubricant Market Size

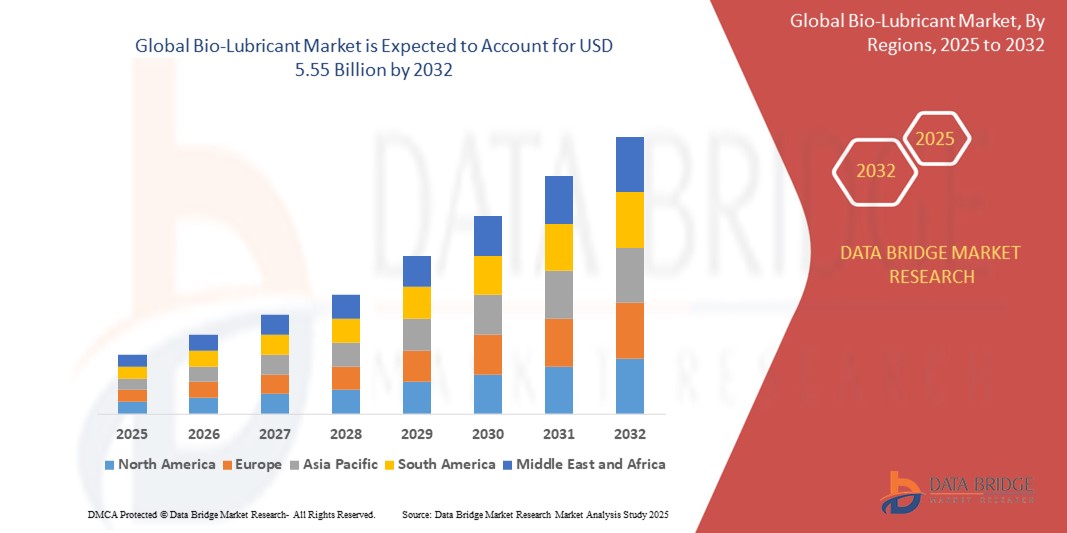

- The global Bio-Lubricant market size was valued at USD 3.45 billion in 2024 and is expected to reach USD 5.55 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled rising environmental concerns and stringent regulations promoting the use of sustainable, biodegradable lubricants

- Growing demand from industries such as automotive, marine, and industrial machinery is driving adoption, as bio-lubricants offer lower toxicity and reduced environmental impact compared to conventional oils

- Government incentives and regulatory frameworks in regions such as Europe and North America are encouraging manufacturers to shift toward renewable, plant-based lubricant alternatives

Bio-Lubricant Market Analysis

- The global bio-lubricant market is steadily transitioning as industries increasingly prioritize sustainable and environmentally safe alternatives in their operations

- A noticeable shift is being observed in industrial practices where manufacturers are now integrating bio-lubricants into their production lines to align with cleaner manufacturing goals and reduce ecological footprints

- North America dominated the bio-lubricant market with the market share of 45.05% in 2024, driven by strong environmental regulations and increasing demand for sustainable industrial solutions

- Asia-Pacific is expected to be the fastest growing region in the bio-lubricant market due to rapid industrialization, increasing environmental awareness, and strong government initiatives promoting sustainable and eco-friendly technologies.

- The automotive segment leads with the largest market share of 64.09% in 2024, as industries seek environmentally responsible alternatives in hydraulic systems used in construction, manufacturing, and agriculture

Report Scope and Bio-Lubricant Market Segmentation

|

Attributes |

Bio-Lubricant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio-Lubricant Market Trends

“Increasing Demand from the Automotive and Transportation Sectors”

- A prominent trend in the current bio-lubricant market is the increasing demand from the automotive and transportation sectors

- This rise is driven by the need for lubricants that offer enhanced performance, longevity, energy efficiency, and environmental friendliness in vehicles

- For instance, bio-greases are finding greater application in various transportation modes including construction vehicles and railway systems

- Furthermore, the industrial sector is also showing a growing preference for bio-based metal cutting fluids and coolants for machining operations

- In conclusion, consequently, the overall market is witnessing a significant shift towards bio-lubricants as a more sustainable alternative to traditional petroleum-based products

Bio-Lubricant Market Dynamics

Driver

“Growing Environmental Awareness and Stringent Regulations Fueling Bio-Lubricant Adoption”

- Growing global environmental awareness is a key driver for bio-lubricant market expansion as people understand the harm of traditional lubricants

- Stricter environmental regulations worldwide are pushing industries to adopt bio-lubricants, for instance, limitations on lubricant toxicity in marine applications are increasing bio-lubricant use in ships right now

- Governments are incentivizing bio-based product adoption, including bio-lubricants, for instance, some regions offer tax breaks for using biodegradable lubricants in agriculture currently

- End-users are increasingly prioritizing eco-friendly products, with companies using bio-lubricants for sustainability goals, for instance, many automotive manufacturers now use bio-based assembly fluids in their current operations

- The combination of environmental concerns, regulations, and user preference is significantly boosting the real-time growth and adoption of bio-lubricants across various sectors currently

Restraint/Challenge

“Higher Initial Costs and Price Volatility of Bio-Lubricant Feedstocks”

- The higher initial cost of bio-lubricants compared to traditional options is a key restraint in the current market due to complex manufacturing and specialized sourcing

- Price volatility of bio-based feedstocks such as vegetable oils and animal fats, influenced by agriculture and commodity markets, directly impacts bio-lubricant pricing right now

- This cost difference presents a barrier for price-sensitive consumers and industries despite the recognized long-term environmental benefits of bio-lubricants in the present scenario

- The less mature supply chain for bio-lubricant feedstocks, susceptible to disruptions, contrasts with the established petroleum supply chain currently

- Overcoming these cost and supply chain issues through production advancements and potential policy support is crucial for wider bio-lubricant adoption in the existing market

Bio-Lubricant Market Scope

The market is segmented on the basis of raw material, application, and end user industry.

- By Raw Material

On the basis of raw material, the bio-lubricant market is segmented into Plant Oil, Animal Oil and Others. The plant oil segment dominated with the largest market revenue share in 2024, driven by its natural abundance, biodegradability, and compatibility with a wide range of industrial applications. Industries prefer plant-based bio-lubricants due to their high lubricity, oxidative stability, and lower environmental impact compared to synthetic alternatives. The scalability of plant oil production also contributes to its widespread adoption across manufacturing and processing sectors.

The Animal Oil segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by advancements in refining technologies and increasing use in niche applications requiring superior thermal stability. These oils are increasingly utilized in specialty lubricants due to their performance in extreme conditions and cost-effectiveness in specific industrial use cases.

- By Application

On the basis of application, the bio-lubricant market is segmented into Hydraulic Oil, Metal Working Fluids, Penetrating Oils, Grease, Transformer Oil, Crankcase Oils Engine Oils, Elevator Hydraulic Fluid, Bar and Chain Oil, Firearm Lubricant, Automotive and Others. The automotive Oil segment leads with the largest market share of 64.09% in 2024, as industries seek environmentally responsible alternatives in hydraulic systems used in construction, manufacturing, and agriculture. The performance efficiency of bio-based hydraulic oils in terms of viscosity, temperature tolerance, and biodegradability makes them a preferred choice.

The Metal Working Fluids segment is expected to grow at the highest rate during the forecast period due to increasing demand from automotive and heavy machinery sectors for non-toxic and sustainable cooling and lubrication solutions. These fluids enhance tool life, reduce wear, and ensure operator safety while maintaining regulatory compliance.

- By End User Industry

On the basis of end user industry, the bio-lubricant market is segmented into Power Generation, Automotive and Other Transportation, Heavy Equipment, Food and Beverage, Metallurgy and Metalworking, Chemical Manufacturing, and Other End-user Industries. The Automotive and Other Transportation segment dominated the market revenue share in 2024, propelled by the automotive sector’s growing shift toward eco-friendly materials and sustainable maintenance products. For instance, electric vehicle manufacturers are increasingly integrating bio-lubricants to reduce carbon emissions and extend component lifespan.

The food and beverage is projected to grow at the fastest rate from 2025 to 2032, driven by stringent hygiene regulations and the rising need for food-grade lubricants that are non-toxic, odorless, and biodegradable. These lubricants are essential for equipment maintenance without risking contamination, supporting safe and efficient operations in processing and packaging environments.

Bio-Lubricant Market Regional Analysis

- North America dominates the Bio-Lubricant market with the largest revenue share of 45.05% in 2024, driven by strong environmental regulations and increasing demand for sustainable industrial solutions

- The presence of major automotive and manufacturing industries in the region promotes the adoption of bio-lubricants to reduce carbon emissions and comply with stricter environmental standards

- Technological advancements and ongoing government incentives encourage companies to integrate bio-based lubricants into their operations, supporting growth across sectors such as power generation and heavy equipment maintenance

U.S. Bio-Lubricant Market Insight

The U.S. Bio-Lubricant market captured the largest revenue share of 76.10% within North America in 2024, fueled by strong industrial demand for sustainable lubrication solutions. Growing awareness of environmental impact and strict regulations on chemical usage in manufacturing drive adoption. The automotive and heavy equipment sectors are increasingly integrating bio-lubricants to enhance operational efficiency and reduce emissions. For instance, government incentives for green technologies boost industry-wide acceptance. Continuous innovation in bio-based formulations further supports market growth across multiple industries.

Europe Bio-Lubricant Market Insight

The European Bio-Lubricant market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent environmental policies and the push for carbon-neutral industrial processes. Increasing urbanization and industrial modernization foster demand for biodegradable and non-toxic lubricants. The automotive and metalworking industries are key consumers, seeking efficient and eco-friendly products. For instance, sustainability mandates across countries encourage manufacturers to adopt bio-lubricants in both production and maintenance activities. This creates a strong foundation for ongoing market growth.

U.K. Bio-Lubricant Market Insight

The U.K. Bio-Lubricant market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising industrial focus on sustainability and reducing carbon footprints. Businesses across manufacturing, transportation, and food processing sectors are adopting bio-lubricants to comply with environmental standards. The country’s well-established green policies and incentives for clean technologies foster adoption. For instance, bio-lubricants are increasingly used in heavy machinery and automotive applications, combining performance with environmental responsibility.

Germany Bio-Lubricant Market Insight

The German Bio-Lubricant market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s commitment to environmental innovation and industrial sustainability. German industries emphasize eco-friendly manufacturing processes, creating strong demand for bio-lubricants. The automotive, chemical manufacturing, and power generation sectors are notable consumers. For instance, bio-lubricants are integrated into advanced machinery and production lines to meet strict emission standards, supporting the country’s sustainability goals.

Asia-Pacific Bio-Lubricant Market Insight

The Asia-Pacific Bio-Lubricant market is poised to grow at the fastest CAGR in 2024, driven by rapid industrialization, rising disposable incomes, and increasing environmental awareness in countries such as China, India, and Japan. Expanding automotive and manufacturing sectors are adopting bio-lubricants to enhance sustainability. For instance, government initiatives promoting green technology and renewable resources accelerate market penetration. The region’s growing production capabilities also improve affordability and accessibility, further fueling demand.

Japan Bio-Lubricant Market Insight

The Japan Bio-Lubricant market is gaining momentum due to the country’s technological advancement and focus on sustainable industrial practices. Demand is rising in automotive and electronics manufacturing, driven by the need for high-performance yet eco-friendly lubrication solutions. For instance, Japan’s aging population encourages adoption of safer, non-toxic products to maintain workplace safety. Integration with smart manufacturing and automation technologies further supports market growth.

China Bio-Lubricant Market Insight

The China Bio-Lubricant market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding industrial base, and increasing environmental regulations. China’s strong push towards renewable resources and green manufacturing fuels bio-lubricant adoption. For instance, large-scale infrastructure and smart city projects incorporate sustainable materials including bio-lubricants. The presence of competitive domestic manufacturers also drives affordability, enhancing market expansion.

Bio-Lubricant Market Share

The Bio-Lubricant industry is primarily led by well-established companies, including:

- Shell plc (Netherlands)

- BP p.l.c. (U.K.)

- Chevron Corporation (U.S.)

- Exxon Mobil Corporation (U.S.)

- FUCHS (Germany)

- TotalEnergies (France)

- Magna International Pte Ltd. (Canada)

- Polnox Corp. (U.S.)

- KLÜBER LUBRICATION INDIA Pvt. Ltd. (India)

- Biosynthetic Technologies (U.S.)

- Carl Bechem Lubricants India Private Limited (India)

- CITGO Petroleum Corporation (U.S.)

- ROCOL (U.K.)

- RSC Bio Solutions (U.S.)

- Albemarle Corporation (U.S.)

- Emery Oleochemicals (Malaysia)

- PANOLIN Distribution AG (Switzerland)

Latest Developments in Global Bio-Lubricant Market

- In April 2023, Exxon Mobil announced a $110 million investment to build a lubricants production facility in India, slated to start operations by late 2025. With a capacity of up to 159 million liters annually, the facility aims to meet growing domestic demand across manufacturing, steel, power, mining, construction, and automotive sectors

- In November 2022, Shell plc's subsidiaries in Switzerland, the UK, the US, and Sweden acquired Panolin Group's environmentally considerate lubricants (ECLs) business. This acquisition enhances Shell's portfolio with biodegradable lubricant offerings

- In July 2022, Chevron Corporation launched a new synthetic grease made from biodegradable synthetic esters. Complying with EPA's 2013 Vessel General Permit (VGP), the grease meets stringent environmental regulations for marine and land applications in forestry, agriculture, and construction

- In February 2022, BP acquired a 30% stake in Green Biofuels Ltd, focusing on renewable hydrogenated vegetable oil (HVO) fuels. This collaboration aims to decarbonize industries including construction, freight, off-road vehicles, and maritime operations, offering a sustainable alternative to diesel

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bio Lubricant Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Lubricant Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Lubricant Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.