Global Bio Polypropylene Market

Market Size in USD Billion

CAGR :

%

USD

65.64 Billion

USD

100.13 Billion

2025

2033

USD

65.64 Billion

USD

100.13 Billion

2025

2033

| 2026 –2033 | |

| USD 65.64 Billion | |

| USD 100.13 Billion | |

|

|

|

|

Bio Polypropylene Market Size

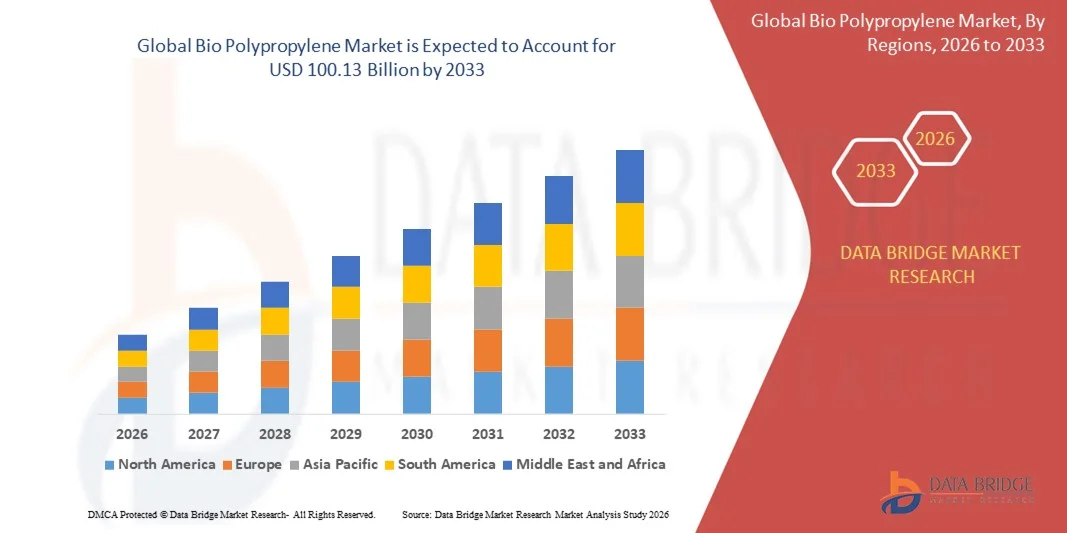

- The global bio polypropylene market size was valued at USD 65.64 billion in 2025 and is expected to reach USD 100.13 billion by 2033, at a CAGR of 5.42% during the forecast period

- The market growth is largely fueled by the increasing adoption of sustainable and renewable materials across automotive, packaging, and consumer goods industries, coupled with technological advancements in bio-based polymer production that enhance efficiency, performance, and scalability

- Furthermore, rising demand from manufacturers and brand owners for low-carbon, eco-friendly alternatives to conventional polypropylene is establishing bio polypropylene as a preferred solution for sustainable product design. These converging factors are accelerating adoption across multiple sectors, thereby significantly boosting the market’s growth

Bio Polypropylene Market Analysis

- Bio polypropylene, a renewable and low-carbon alternative to conventional polypropylene, is increasingly vital for applications requiring high mechanical performance, durability, and environmental compliance. Its versatility makes it suitable for automotive components, packaging materials, textiles, and industrial products, driving widespread industrial uptake

- The escalating demand for bio polypropylene is primarily fueled by global sustainability initiatives, regulatory pressures for reduced carbon emissions, and corporate commitments to environmental, social, and governance (ESG) targets. Growing awareness among consumers and industries of the environmental benefits of bio-based polymers further reinforces market expansion

- Europe dominated the bio polypropylene market with a share of 44.6% in 2025, due to rising demand for sustainable materials across automotive, packaging, and consumer goods industries

- Asia-Pacific is expected to be the fastest growing region in the bio polypropylene market during the forecast period due to rising urbanization, expanding industrial activity, and increasing demand for sustainable manufacturing materials

- Injection segment dominated the market with a market share of 53.9% in 2025, due to its widespread use in automotive parts, consumer products, and industrial components. Injection-grade bio polypropylene offers high rigidity, durability, and heat resistance, enabling its adoption in structural and load-bearing applications. Manufacturers prefer bio-based injection materials due to their ability to meet stringent mechanical performance requirements while supporting sustainability targets. The segment benefits from strong demand across automotive interiors, home appliances, and packaging caps, where precision molding is essential. Advancements in compounding technologies also enhance the performance characteristics of injection-molded bio polypropylene, strengthening its dominance across industries

Report Scope and Bio Polypropylene Market Segmentation

|

Attributes |

Bio Polypropylene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio Polypropylene Market Trends

Rising Adoption of Bio-Based Polymers Across Automotive and Packaging Industries

- The increasing adoption of bio polypropylene in automotive and packaging applications is significantly reshaping material selection in manufacturing, as industries seek sustainable alternatives that reduce environmental impact and comply with emerging regulatory standards

- For instance, LyondellBasell has expanded its bio polypropylene portfolio for automotive interiors and rigid packaging, demonstrating high mechanical performance while lowering lifecycle carbon emissions and encouraging broader adoption among OEMs and packaging companies

- Advancements in polymer processing technologies have enabled manufacturers to produce bio polypropylene with improved heat resistance, clarity, and tensile strength, making it suitable for high-performance applications that were traditionally dominated by conventional polypropylene

- The growing focus on corporate sustainability and consumer awareness regarding environmental impacts is motivating brands to integrate bio-based materials into their products, thereby driving demand for bio polypropylene in consumer goods and packaging solutions

- Collaboration between material producers and industry stakeholders is fostering innovation in bio polypropylene composites, enabling novel applications such as lightweight automotive components and durable industrial products that meet both functional and sustainability requirements

- The overall trend towards renewable and low-carbon materials, supported by government incentives and environmental regulations, is accelerating the global adoption of bio polypropylene and solidifying its position as a critical material for sustainable manufacturing

Bio Polypropylene Market Dynamics

Driver

Increasing Demand for Sustainable and Low-Carbon Materials

- The global shift towards sustainability and carbon footprint reduction is driving demand for bio polypropylene, as manufacturers and brand owners seek renewable polymer alternatives that can replace conventional fossil-based materials

- For instance, Braskem’s investment in carbon-negative bio polypropylene projects in the U.S. is setting a benchmark for low-carbon polymer production and encouraging adoption among automotive, packaging, and industrial sectors

- Bio polypropylene provides performance characteristics comparable to traditional polypropylene while offering environmental benefits, which strengthens its appeal among companies striving to meet ESG targets and reduce their supply chain emissions

- Growing regulatory pressure in regions such as Europe and North America, requiring sustainable materials and promoting recycling initiatives, is increasing industrial reliance on bio polypropylene for automotive components, consumer goods, and packaging

- Corporate focus on circular economy practices, including the use of renewable feedstocks and end-of-life recyclability, is further enhancing market growth by positioning bio polypropylene as a strategic material for environmentally responsible product design

Restraint/Challenge

High Production Costs and Feedstock Variability

- The production of bio polypropylene is often associated with higher costs compared to conventional polypropylene, which can limit adoption, particularly among cost-sensitive manufacturers in developing regions

- For instance, variability in biomass feedstock quality and availability, such as corn or sugarcane-derived ethanol, can create supply inconsistencies that challenge large-scale production planning for companies such as LyondellBasell and Borealis

- Technological complexities in processing bio-based feedstocks into high-performance polypropylene require significant capital investment and specialized expertise, which can act as a barrier for new entrants and smaller producers

- Fluctuations in raw material prices due to seasonal or geopolitical factors can further increase production costs and affect pricing stability for end users, impacting market expansion in certain regions

- Overcoming these challenges through process optimization, strategic feedstock sourcing, and investment in scalable production technologies will be critical for sustaining long-term growth of the bio polypropylene market

Bio Polypropylene Market Scope

The market is segmented on the basis of source and application.

- By Source

On the basis of source, the bio polypropylene market is segmented into corn, sugar cane, vegetable oil, and other biomass. The corn segment dominated the market with the largest revenue share in 2025, supported by its abundant availability, cost-efficient cultivation, and established processing technologies. Corn-based feedstock ensures consistent polymer quality, enabling manufacturers to scale production without major technological shifts. Industries prefer corn-derived polypropylene for its reliable supply chain, which strengthens long-term procurement planning for packaging, automotive, and consumer goods. Its compatibility with current polymerization methods also enhances production efficiency and reduces operational challenges for large processors. Growing investments in agricultural biotechnology further support the expansion of the corn segment by improving yield output and raw material stability across regions.

The sugar cane segment is anticipated to witness the fastest growth rate from 2026 to 2033, propelled by rising demand for low-carbon and highly sustainable feedstocks across industrial applications. Sugar cane delivers superior carbon sequestration benefits, making it a preferred choice for companies pursuing stringent sustainability goals and lifecycle emission reductions. Its high sucrose content enhances conversion efficiency, resulting in improved polymer yield for manufacturers seeking scalable production. Demand for sugar cane-based polypropylene is expanding rapidly in regions with strong bioethanol capacity, which supports integrated biorefinery models for added cost efficiency. Increasing corporate commitments to bio-based materials further accelerate the adoption of sugar cane feedstock in packaging and automotive components. Supportive government policies for sugar cane cultivation strengthen the segment’s long-term growth outlook.

- By Application

On the basis of application, the bio polypropylene market is segmented into injection, textile, films, and others. The injection segment dominated the market with the largest revenue share of 53.9% in 2025, driven by its widespread use in automotive parts, consumer products, and industrial components. Injection-grade bio polypropylene offers high rigidity, durability, and heat resistance, enabling its adoption in structural and load-bearing applications. Manufacturers prefer bio-based injection materials due to their ability to meet stringent mechanical performance requirements while supporting sustainability targets. The segment benefits from strong demand across automotive interiors, home appliances, and packaging caps, where precision molding is essential. Advancements in compounding technologies also enhance the performance characteristics of injection-molded bio polypropylene, strengthening its dominance across industries.

The films segment is expected to witness the fastest CAGR from 2026 to 2033, supported by rising demand for sustainable flexible packaging solutions across food, pharmaceutical, and consumer goods industries. Film-grade bio polypropylene offers excellent clarity, moisture resistance, and sealing performance, making it suitable for high-volume packaging applications. The segment’s growth is accelerated by shifting regulatory pressure toward eco-friendly and recyclable packaging formats across major markets. Increasing adoption of bio-based films by FMCG brands strengthens commercial demand and drives large-scale production capacity expansion. Technological improvements in bio-based film extrusion enhance material processing efficiency and widen application in specialty packaging. Growing consumer preference for sustainable packaged products reinforces the long-term growth trajectory of this segment.

Bio Polypropylene Market Regional Analysis

- Europe dominated the bio polypropylene market with the largest revenue share of 44.6% in 2025, driven by rising demand for sustainable materials across automotive, packaging, and consumer goods industries

- European industries are rapidly transitioning toward bio-based polymers due to stringent environmental regulations and strong emphasis on reducing carbon emissions. The region demonstrates high adoption of renewable polypropylene in lightweight automotive parts, flexible packaging, and durable consumer applications

- Companies across Europe prioritize material circularity, which strengthens the integration of bio polypropylene into large-scale manufacturing processes. Strong R&D capabilities combined with advanced biopolymer processing infrastructure further enhance market growth in the region

Germany Bio Polypropylene Market Insight

The Germany bio polypropylene market captured the largest market share in 2025, fueled by strong manufacturing capabilities and extensive focus on circular economy principles. Germany’s automotive and engineering industries are key consumers, integrating bio polypropylene into interior components and lightweight structures. The country’s commitment to sustainability encourages the adoption of renewable polymers that meet performance requirements while lowering environmental impact. Advanced research collaborations and material innovation centers further support the expansion of the bio polypropylene sector within Germany.

U.K. Bio Polypropylene Market Insight

The U.K. bio polypropylene market is anticipated to register notable growth during the forecast period, supported by rising demand for sustainable packaging and eco-conscious consumer products. Manufacturers in the region are increasingly shifting toward bio-based alternatives in order to align with regulatory pressures that promote reduced plastic waste and improved recyclability. Growing investment in green materials and strong development in food packaging, healthcare products, and consumer goods sectors reinforce the adoption of bio polypropylene. The region’s expanding focus on material innovation further enhances long-term growth prospects.

North America Bio Polypropylene Market Insight

The North America bio polypropylene market captured a significant market share in 2025, driven by increasing industrial adoption of renewable polymers in automotive, electronics, and packaging sectors. Consumers and manufacturers in the region place high importance on sustainability, encouraging companies to use bio-based materials that lower carbon emissions. Strong presence of biopolymer producers and advancements in commercial-scale production support the region’s expanding demand. Growth in lightweight automotive components and recyclable packaging formats continues to strengthen market development in North America.

U.S. Bio Polypropylene Market Insight

The U.S. bio polypropylene market accounted for the largest revenue share within North America in 2025, supported by expanding initiatives in green manufacturing and high interest in sustainable product alternatives. The adoption of bio polypropylene is reinforced by strong demand from automotive, aerospace, and consumer goods companies that prioritize materials with improved environmental performance. Growing domestic production capacity and increasing investment in biopolymer R&D further accelerate market penetration across the U.S. industrial ecosystem.

Asia-Pacific Bio Polypropylene Market Insight

The Asia-Pacific bio polypropylene market is projected to exhibit the fastest CAGR during the forecast period, supported by rising urbanization, expanding industrial activity, and increasing demand for sustainable manufacturing materials. Countries across the region are adopting bio-based polymers to support national environmental commitments and growing awareness of eco-friendly packaging. Significant investment in biopolymer production facilities and availability of biomass feedstock contribute to expanding market accessibility. The region’s rapid industrialization strengthens demand across automotive, packaging, textiles, and consumer goods.

China Bio Polypropylene Market Insight

The China bio polypropylene market captured the largest revenue share in Asia Pacific in 2025, driven by the country’s expanding manufacturing base and reinforced focus on environmental sustainability. China’s strong presence in packaging, consumer electronics, and automotive production increases commercial demand for renewable polymers. The growth of smart manufacturing hubs and increasing adoption of eco-friendly materials support widespread integration of bio polypropylene. Domestic producers continue to scale operations, improving affordability and supply stability across industries.

Japan Bio Polypropylene Market Insight

The Japan bio polypropylene market is gaining momentum due to the nation’s high-tech manufacturing landscape and implementation of advanced sustainability measures. Demand is driven by applications in automotive components, consumer goods, and packaging where quality, durability, and reduced environmental impact are essential. Integration of renewable polymers with precision manufacturing systems strengthens the adoption of bio polypropylene across sectors. Japan’s focus on innovation and resource-efficient materials supports enduring market growth.

Bio Polypropylene Market Share

The bio polypropylene industry is primarily led by well-established companies, including:

- Biobent Polymers (Germany)

- FKuR Kunststoff GmbH (Germany)

- LyondellBasell Industries Holdings (Netherlands)

- China Petrochemical Corporation (China)

- Exxon Mobil Corporation (U.S.)

- INEOS (Switzerland)

- Dow (U.S.)

- Washington Penn Plastic Co., Inc. (U.S.)

- Braskem (Brazil)

- Solvay S.A. (Belgium)

- Global Bioenergies (France)

- SABIC (Saudi Arabia)

- Mitsui Chemicals (Japan)

Latest Developments in Global Bio Polypropylene Market

- In August 2023, Neste, LyondellBasell, Biofibre, and Naftex collaborated to develop a value chain that integrates bio-based polypropylene with natural fibers for construction-grade materials. This initiative positively impacted the market by demonstrating practical carbon-storing solutions in the construction sector and expanding the application potential of bio polypropylene beyond traditional packaging and automotive uses. By combining renewable PP with natural fibers, the project highlights the material’s durability, lightweight properties, and contribution to climate-resilient infrastructure. The collaboration also encourages innovation in composite materials and sets a precedent for similar sustainability-driven projects across the industry

- In May 2023, Borealis and LyondellBasell, alongside several packaging and consumer goods manufacturers, conducted large-scale trials of bio polypropylene for high-volume film and rigid packaging applications. The trials demonstrated that bio PP could meet critical performance requirements, such as clarity, tensile strength, and heat resistance, while remaining compatible with existing production lines. This development significantly boosted market confidence and accelerated adoption, particularly among FMCG, food, and pharmaceutical brands aiming to meet sustainability targets. The successful trials also signal that bio PP can be seamlessly integrated into conventional manufacturing processes, reducing barriers to widespread use

- In March 2023, Borealis expanded its commercial production capacity for bio polypropylene at its European facilities, responding to increasing demand from automotive, packaging, and industrial sectors. This capacity expansion strengthened the global supply landscape, improving material availability and enabling manufacturers to scale production without facing supply constraints. The move also reduced cost pressures associated with renewable polymer adoption and reinforced the material’s credibility as a reliable, low-carbon alternative to conventional polypropylene. The increased production capability supports broader integration of bio PP across diverse applications, including lightweight automotive components, durable consumer goods, and industrial products

- In January 2023, Braskem initiated a project in the U.S. to evaluate the production of carbon-negative bio-based polypropylene using proprietary technology that converts bioethanol into physically segregated bio polypropylene. This initiative reinforced the market’s growth prospects by proving the commercial viability of low-carbon PP production at scale. The project also fostered collaboration with brand owners, suppliers, and other stakeholders, encouraging early adoption of carbon-negative materials in commercial and industrial applications. By offering a sustainable, high-performance alternative to conventional polypropylene, Braskem’s project highlights the potential for bio PP to play a key role in achieving corporate and global decarbonization goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bio Polypropylene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Polypropylene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Polypropylene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.