Global Bio Vanillin Market

Market Size in USD Million

CAGR :

%

USD

269.48 Million

USD

352.12 Million

2025

2033

USD

269.48 Million

USD

352.12 Million

2025

2033

| 2026 –2033 | |

| USD 269.48 Million | |

| USD 352.12 Million | |

|

|

|

|

Bio Vanillin Market Size

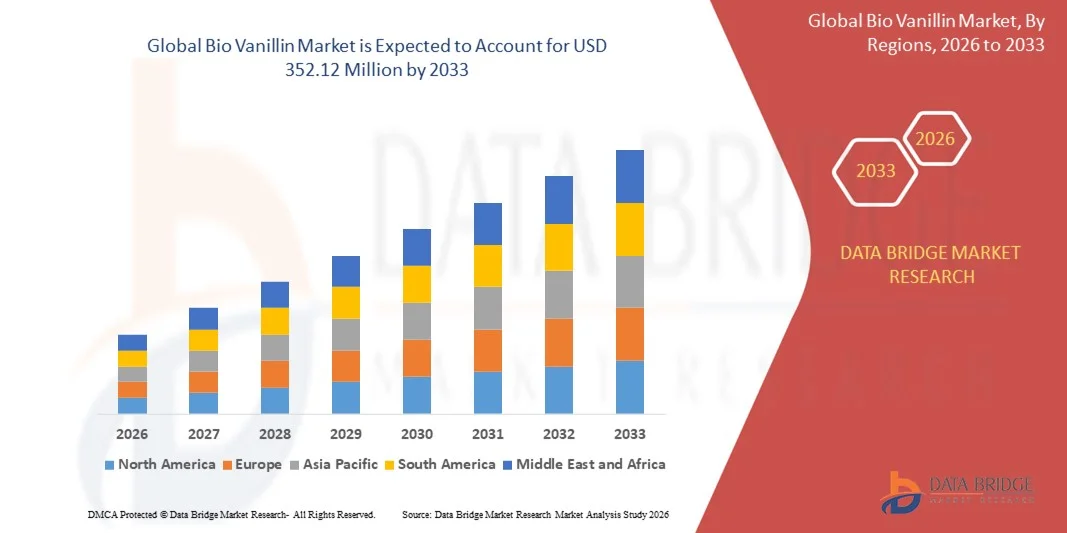

- The global bio vanillin market size was valued at USD 269.48 million in 2025 and is expected to reach USD 352.12 million by 2033, at a CAGR of 3.40% during the forecast period

- The market growth is largely fueled by the rising consumer preference for natural and clean-label ingredients, driving increased adoption of bio vanillin in food & beverages, cosmetics, and personal care products

- Furthermore, technological advancements in bioconversion, fermentation, and metabolic engineering are enhancing production efficiency and scalability, enabling manufacturers to meet growing global demand for sustainable and high-purity bio vanillin. These factors are accelerating the uptake of bio vanillin across industries, thereby significantly boosting market growth

Bio Vanillin Market Analysis

- Bio vanillin, derived from natural sources such as rice bran, wood, and other agricultural residues, is increasingly vital as a natural flavoring agent in food & beverages, fragrances, and personal care products due to its appealing aroma, clean-label positioning, and consumer perception as a healthier alternative to synthetic vanillin

- The escalating demand for bio vanillin is primarily fueled by the growing health-conscious consumer base, stringent regulations on synthetic flavoring agents, and a rising preference among manufacturers for sustainable, eco-friendly, and traceable ingredients in premium and functional products

- Asia-Pacific dominated the bio vanillin market with a share of 40.9% in 2025, due to expanding food & beverage manufacturing, increasing demand for natural flavoring agents, and a strong presence of flavor ingredient production hubs

- North America is expected to be the fastest growing region in the bio vanillin market during the forecast period due to robust demand for natural flavoring agents in food & beverages, confectionery, and personal care products

- Rice bran segment dominated the market with a market share of 48.6% in 2025, due to the abundance and cost-effectiveness of rice bran as a raw material. Manufacturers favor rice bran for its high vanillin yield and sustainable sourcing, making it an attractive option for both industrial and premium applications. The segment also benefits from strong consumer demand for naturally derived flavoring agents in food and beverages, as rice bran-based vanillin aligns with clean label trends and regulatory approvals. The ease of extraction and compatibility with existing processing technologies further enhances its adoption, positioning rice bran as the leading source for bio vanillin

Report Scope and Bio Vanillin Market Segmentation

|

Attributes |

Bio Vanillin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio Vanillin Market Trends

Growing Demand for Clean-Label and Natural Flavoring Agents

- The global bio vanillin market is witnessing increasing demand for clean-label and naturally derived flavoring agents, driven by growing health-consciousness among consumers and stricter regulations on synthetic additives. Manufacturers are prioritizing natural vanillin to meet the rising need for sustainable and safe food and beverage formulations

- For instance, Solvay’s launch of Rhovanil Natural Delica, Alta, and Sublima allows easy labeling as natural flavors, enabling food and beverage producers to offer clean-label products and strengthen consumer trust. Such product launches are accelerating adoption of bio vanillin across multiple industries

- The preference for bio vanillin is also driven by its versatility across food, beverage, and personal care applications, offering manufacturers a natural solution without compromising taste or aroma. This trend is promoting investment in innovative production technologies that enhance quality and sustainability

- Rising consumer inclination towards premium, functional, and organic products is encouraging the use of bio vanillin in specialty and artisanal applications. This is further driving the market as consumers associate natural flavors with healthier and environmentally friendly choices

- Technological advancements in bioconversion and microbial fermentation are enabling cost-efficient production of high-purity bio vanillin. These improvements are facilitating larger-scale adoption and making bio vanillin more accessible to a broader market

- The ongoing global shift towards sustainability and natural ingredients is expected to continue shaping the bio vanillin market, establishing it as the preferred natural flavoring solution for future food and personal care products

Bio Vanillin Market Dynamics

Driver

Rising Consumer Preference for Sustainable and Healthier Ingredients

- Growing awareness of the health and environmental impact of synthetic additives is driving demand for bio vanillin, as consumers increasingly prefer naturally sourced and sustainable ingredients. Manufacturers are responding by incorporating bio vanillin into food, beverage, and cosmetic products to meet consumer expectations

- For instance, in January 2023, Solvay expanded its bio vanillin portfolio with products derived from rice bran-based Rhovanil Natural CW to cater to the clean-label trend. Such strategic moves by key companies are expected to strengthen market growth during the forecast period

- Increasing adoption of bio vanillin in high-value applications such as fragrances, confectionery, and functional foods is also contributing to market expansion. The versatility and premium perception of bio vanillin are encouraging wider integration into diverse product categories

- The scalability and efficiency improvements in biotechnological production methods are enabling manufacturers to meet rising demand. This is allowing bio vanillin to gain traction in regions with strong regulatory emphasis on natural ingredients

- Growing investments in research and development to improve extraction and fermentation processes are ensuring consistent quality and purity of bio vanillin. These efforts support manufacturers in meeting global standards and expanding their market reach

Restraint/Challenge

High Production Costs and Limited Raw Material Availability

- The high cost of producing bio vanillin due to complex bioconversion and fermentation processes remains a significant challenge, making it less price-competitive compared to synthetic alternatives. Limited availability of raw materials such as rice bran and ferulic acid further constrains production capacity

- For instance, fluctuations in the supply of agricultural residues can impact consistency and scalability for manufacturers. Such constraints require strategic sourcing and careful planning to maintain a stable supply chain

- Maintaining uniform quality and high purity across large-scale production is challenging, as variations in raw materials and microbial fermentation processes can affect final product performance. This necessitates additional investment in quality control systems

- Regulatory requirements for natural and bio-based labeling vary across regions, adding complexity for manufacturers seeking global distribution. Ensuring compliance can increase costs and create market entry barriers for new players

- While technological improvements are gradually reducing production costs, the initial capital investment for bio-vanillin production facilities remains high. Overcoming these cost and supply challenges is crucial for sustained market growth and broader adoption

Bio Vanillin Market Scope

The market is segmented on the basis of source and end-use.

- By Source

On the basis of source, the Bio Vanillin market is segmented into rice bran, wood, and others. The rice bran segment dominated the market with the largest market revenue share of 48.6% in 2025, driven by the abundance and cost-effectiveness of rice bran as a raw material. Manufacturers favor rice bran for its high vanillin yield and sustainable sourcing, making it an attractive option for both industrial and premium applications. The segment also benefits from strong consumer demand for naturally derived flavoring agents in food and beverages, as rice bran-based vanillin aligns with clean label trends and regulatory approvals. The ease of extraction and compatibility with existing processing technologies further enhances its adoption, positioning rice bran as the leading source for bio vanillin.

The wood segment is anticipated to witness the fastest growth rate of 19.8% from 2026 to 2033, fueled by increasing demand from premium and artisanal product lines. For instance, companies such as Borregaard are investing in sustainable lignin-derived vanillin from wood, offering high-quality natural flavor profiles. Wood-based vanillin is preferred for applications where robust flavor intensity and aromatic complexity are desired, particularly in specialty foods, beverages, and fragrance products. Its growth is further supported by sustainable forestry initiatives and rising consumer awareness of eco-friendly sourcing practices.

- By End-Use

On the basis of end-use, the Bio Vanillin market is segmented into food & beverages, cosmetics & personal care, and pharmaceuticals. The food & beverages segment dominated the market with the largest market revenue share in 2025, driven by the widespread use of bio vanillin as a natural flavoring agent in bakery products, confectionery, dairy, and beverages. Manufacturers increasingly prefer bio-based vanillin over synthetic alternatives to meet the growing consumer demand for natural ingredients, clean labels, and healthier product formulations. The segment benefits from the versatility of bio vanillin in enhancing flavor profiles without adding artificial chemicals, making it highly attractive for both large-scale and artisanal producers.

The cosmetics & personal care segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising incorporation of bio vanillin in fragrances, lotions, and other personal care formulations. For instance, Firmenich and Givaudan are expanding their portfolio of bio-based vanillin for perfumery and skincare applications, catering to premium and eco-conscious consumers. Bio vanillin provides appealing aromatic properties while aligning with sustainability and natural product trends in the cosmetics industry. Its adoption is further fueled by stringent regulations on synthetic fragrances and increasing consumer preference for products with naturally derived ingredients.

Bio Vanillin Market Regional Analysis

- Asia-Pacific dominated the bio vanillin market with the largest revenue share of 40.9% in 2025, driven by expanding food & beverage manufacturing, increasing demand for natural flavoring agents, and a strong presence of flavor ingredient production hubs

- The region’s cost-effective production landscape, rising investments in bio-based ingredient manufacturing, and growing exports of natural flavors are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased consumption of bio vanillin in both food & beverage and personal care sectors

China Bio Vanillin Market Insight

China held the largest share in the Asia-Pacific Bio Vanillin market in 2025, owing to its status as a global leader in natural flavor and fragrance production. The country's strong industrial base, favorable government policies supporting bio-based ingredient manufacturing, and extensive export capabilities for natural flavors are major growth drivers. Demand is also bolstered by ongoing investments in sustainable and clean-label products for both domestic and international markets.

India Bio Vanillin Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding food & beverage sector, increasing use of natural and functional ingredients, and rising investments in bio-vanillin production infrastructure. Government initiatives promoting sustainable manufacturing, along with a shift toward clean-label products, are strengthening the demand for bio vanillin. In addition, growth in cosmetics & personal care and expanding R&D capabilities in natural flavor extraction are contributing to robust market expansion.

Europe Bio Vanillin Market Insight

The Europe Bio Vanillin market is expanding steadily, supported by stringent regulatory frameworks, high demand for natural and high-purity flavoring agents, and growing investments in sustainable ingredient production. The region places strong emphasis on product quality, environmental compliance, and organic sourcing, particularly in food & beverages and cosmetics. Increasing use of bio vanillin in premium and functional formulations is further enhancing market growth.

Germany Bio Vanillin Market Insight

Germany’s Bio Vanillin market is driven by its leadership in high-quality food and beverage production, strong natural ingredient manufacturing heritage, and export-oriented production model. The country has well-established R&D networks and partnerships between academic institutions and flavor manufacturers, fostering continuous innovation in bio-based vanillin. Demand is particularly strong for use in confectionery, dairy, and fragrance applications.

U.K. Bio Vanillin Market Insight

The U.K. market is supported by a mature food & beverage and cosmetics industry, growing efforts to source natural ingredients locally, and increased demand for sustainable and clean-label flavoring solutions. With rising focus on R&D, academic-industry collaboration, and investments in small- and medium-scale production of bio vanillin, the U.K. continues to play a significant role in high-value natural flavor markets.

North America Bio Vanillin Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust demand for natural flavoring agents in food & beverages, confectionery, and personal care products. A strong focus on clean-label trends, functional foods, and sustainable sourcing is boosting demand. In addition, rising reshoring of bio-based ingredient production and increasing collaboration between flavor manufacturers and food companies are supporting market expansion.

U.S. Bio Vanillin Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive food & beverage and personal care industries, strong R&D infrastructure, and significant investment in bio-vanillin production. The country’s focus on innovation, regulatory compliance, and sustainability is encouraging the use of high-purity bio vanillin in natural flavoring applications. Presence of key players and a mature distribution network further solidify the U.S.'s leading position in the region.

Bio Vanillin Market Share

The bio vanillin industry is primarily led by well-established companies, including:

- Evolva Holding (Switzerland)

- Solvay (Belgium)

- De Monchy Aromatics (Netherlands)

- Advanced Biotech (U.S.)

- Omega Ingredients Limited (U.K.)

- ENNOLYS (France)

- Comax MFG Corp (U.S.)

- Beijing LYS Chemicals Co., Ltd (China)

- ADM (U.S.)

- AUROCHEMICALS (India)

- Axxence Aromatic GmbH (Germany)

- BERJÉ INC (U.S.)

- Champon Vanilla Inc (U.S.)

- MOELLHAUSEN S.P.A. (Italy)

- Borregaard (Norway)

- Jiaxing Zhonghua Chemical Co., Ltd (China)

- Shanghai Xinjia Perfume Co., Ltd (China)

- Zibo Svolei Fragrance Co., Ltd. (China)

- Liaoning Shixing Pharmaceutical & Chemical Co., Ltd (China)

- Takasago International Corporation (Japan)

- Suzhou Function Group Co Ltd (China)

- OAMIC BIOTECH CO., LTD. (China)

- Apple Flavor & Fragrance Group Co., Ltd (China)

- Kunshan AsiaAroma Spice Co., Ltd (China)

Latest Developments in Global Bio Vanillin Market

- In June 2025, the United States Department of Commerce issued final affirmative determinations on antidumping and countervailing duty investigations for vanillin imports from China, establishing dumping margins of 190.20% for most Chinese producers and 379.87% for the China-wide entity. This move significantly reshaped global vanillin trade dynamics, creating opportunities for domestic U.S. producers and alternative international suppliers to expand market share, while encouraging diversification of sourcing strategies among food & beverage manufacturers

- In November 2024, research published in MDPI highlighted biotechnological advances in vanillin production using metabolic engineering platforms, demonstrating that microalgae can serve as sustainable production systems capable of utilizing CO2 to generate high-value compounds. This breakthrough is expected to accelerate the adoption of environmentally friendly bio vanillin production methods, reduce reliance on conventional agricultural feedstocks, and support the growing consumer preference for sustainable and natural flavor ingredients

- In May 2024, Tokyo University of Science researchers announced the development of a genetically engineered enzyme that converts ferulic acid from agricultural waste into natural vanillin in a single-step process. Operating under mild conditions without cofactor requirements and utilizing abundant raw materials such as rice and wheat bran, this innovation enhances cost-efficiency, scalability, and sustainability of industrial-scale bio vanillin production, making it highly attractive to food, beverage, and personal care manufacturers

- In January 2023, Solvay launched Rhovanil Natural Delica, Alta, and Sublima, expanding its portfolio of bio vanillin products derived from Rhovanil Natural CW through bioconversion of ferulic acid in rice bran. These products facilitate labeling as natural flavors, responding to the rising consumer demand for healthier and clean-label food options. The launch strengthens the company’s market position, enhances the availability of high-quality bio vanillin, and supports broader adoption of natural ingredients across the food and beverage industry

- In February 2022, Firmenich announced the commercialization of a novel fermentation-based bio vanillin production process using non-GMO microorganisms, enabling consistent quality and scalable supply while minimizing environmental impact. This development supports the increasing demand for sustainably produced natural flavors, encourages adoption among global food and beverage brands, and positions Firmenich as a leader in bio-based flavor innovations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bio Vanillin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Vanillin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Vanillin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.