Global Bioactive Films Market

Market Size in USD Billion

CAGR :

%

USD

3.68 Billion

USD

6.87 Billion

2024

2032

USD

3.68 Billion

USD

6.87 Billion

2024

2032

| 2025 –2032 | |

| USD 3.68 Billion | |

| USD 6.87 Billion | |

|

|

|

|

Bioactive Films Market Size

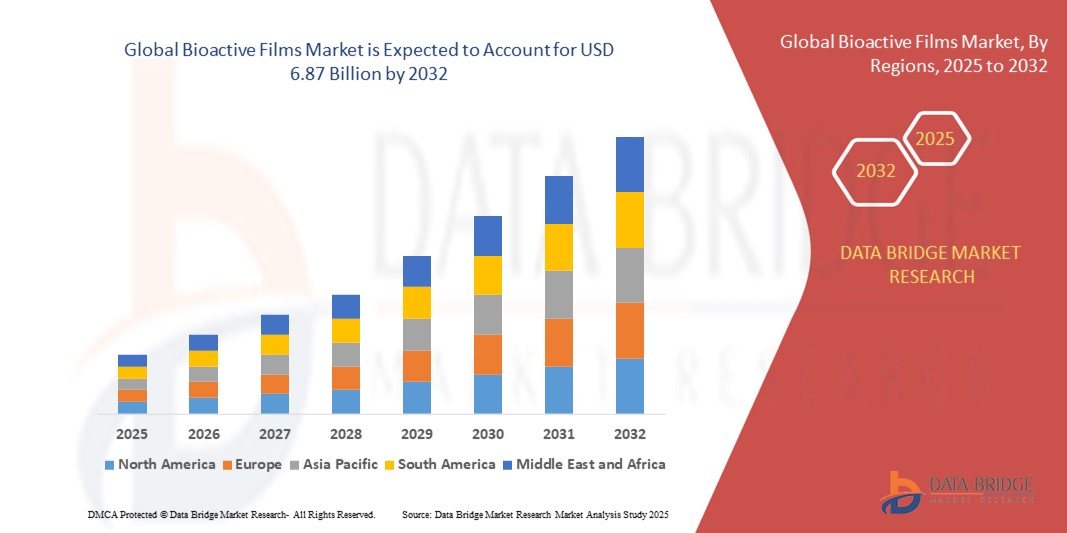

- The global bioactive films market size was valued at USD 3.68 billion in 2024 and is expected to reach USD 6.87 billion by 2032, at a CAGR of 8.10% during the forecast period

- The Bioactive Films Market growth is largely fueled by the increasing demand for sustainable and functional packaging solutions that extend the shelf life of food products while maintaining quality and safety

- Furthermore, rising consumer awareness about health, food safety, and eco-friendly packaging is driving the adoption of bioactive films across the food, pharmaceutical, and cosmetic industries, thereby significantly boosting the market's expansion

Bioactive Films Market Analysis

- Bioactive films are thin layers of biodegradable or edible materials incorporated with active compounds such as antimicrobials, antioxidants, or essential oils to preserve food quality and enhance safety

- The escalating demand for bioactive films is primarily fueled by the rising need to reduce food spoilage, extend product shelf life, comply with stringent food safety regulations, and support sustainability initiatives across global markets

- North America dominated the bioactive films market with a share of 37.5% in 2024, due to increasing demand for sustainable and functional packaging in the food, healthcare, and pharmaceutical sectors

- Asia-Pacific is expected to be the fastest growing region in the bioactive films market during the forecast period due to rising urbanization, disposable incomes, and awareness of food safety in countries such as China, Japan, and India

- Food & beverage segment dominated the market with a market share of 44.7% in 2024, due to the increasing demand for packaged foods with extended shelf life and enhanced safety. Bioactive films are highly valued in this sector for their ability to prevent microbial contamination, reduce spoilage, and maintain sensory qualities. The segment’s prominence is further reinforced by the expansion of organized retail, rising consumer awareness about food safety, and the adoption of functional packaging solutions that integrate antimicrobial and antioxidant properties

Report Scope and Bioactive Films Market Segmentation

|

Attributes |

Bioactive Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bioactive Films Market Trends

Increasing Demand for Packaged and Processed Foods

- Rising global consumption of packaged and processed foods fuels demand for bioactive films that preserve freshness and extend shelf life. These films offer moisture barrier and antimicrobial properties tailored to sensitive food applications

- For instance, Mitsubishi Chemical has developed bioactive packaging films embedded with natural antimicrobial agents to inhibit microbial growth and oxidation, helping brands maintain product quality and compliance with food safety standards

- Advancements in biodegradable and compostable film technologies support sustainability goals by reducing plastic waste. Consumers increasingly prefer foods packaged in eco-friendly formats that align with circular economy principles and legislative mandates

- Innovations allow bioactive films to deliver active release of preservatives, antioxidants, or oxygen scavengers, enhancing packaged food quality dynamically. Smart films that respond to environmental changes provide superior protection compared to traditional packaging materials

- The emergence of multi-layer and blended bio-based films enhances mechanical strength and functional performance. Packaging manufacturers are able to match conventional plastics in durability while adding bioactivity, improving end-user acceptance

- Growing interest in ready-to-eat and convenience foods accelerates adoption dynamically. Bioactive films contribute to longer shelf life, reduced spoilage, and assured food safety, enabling manufacturers to optimize distribution and reduce product losses

Bioactive Films Market Dynamics

Driver

Increasing Demand for Food Safety and Quality

- Sustained growth in food safety concerns is driving bioactive film adoption as manufacturers seek intelligent packaging that extends shelf life and counters microbial contamination. Regulatory pressure further encourages active packaging investments

- For instance, Amcor has introduced advanced bioactive films with embedded antimicrobial compounds for meat and dairy packaging to reduce contamination risk and comply with international hygiene regulations, enhancing consumer trust and safety

- The rise in global food recalls motivates brands to implement protective packaging solutions that maintain product integrity. Bioactive films reduce spoilage and pathogen growth, minimizing economic losses and brand damage

- Consumers increasingly expect transparency and freshness in packaged foods. Packaging that prolongs product legibility and inhibits quality degradation is a key differentiator that contributes to positive buying decisions

- Growing exports of perishable goods increase logistics complexity, requiring enhanced packaging solutions. Bioactive films allow safe long-distance transportation and global distribution without compromising product quality and regulatory compliance

Restraint/Challenge

Limited Availability of Raw Materials

- The bioactive films market is challenged by supply constraints of natural and bio-based polymers. Limited scale of production across sustainable feedstocks leads to cost volatility and delivery uncertainties for film manufacturers

- For instance, NatureWorks has experienced supply fluctuations in bio-polymers derived from corn, impacting bioactive film production schedules and pricing strategies, which in turn slows the transition from conventional plastics to bioplastics

- Raw materials such as chitosan, cellulose, and starch require consistent quality to ensure functional performance, but harvesting variability and regional production gaps lead to inconsistent film properties and batch reliability

- Competition with food and fuel markets for bio-feedstock limits scalability. This competition drives raw material price volatility and limits long-term supply agreements necessary for confident manufacturing investments

- Technology innovation is ongoing to develop alternative bio-feedstocks, but current availability gaps remain. Without sufficient supply chain infrastructure and agricultural support, raw material scarcity continues to restrain bioactive film market growth

Bioactive Films Market Scope

The market is segmented on the basis of product type, material, and application.

- By Product Type

On the basis of product type, the bioactive films market is segmented into antimicrobial films, antioxidant films, nanocomposite films, and others. The antimicrobial films segment dominated the largest market revenue share in 2024, driven by the growing demand for enhanced food safety and shelf-life extension across packaged goods. These films are widely preferred due to their proven ability to inhibit microbial growth, reduce contamination risks, and maintain product quality during storage and transportation. The segment’s dominance is further strengthened by increasing adoption in healthcare and pharmaceutical packaging, where microbial control is critical. Moreover, advancements in bioactive agents and compatibility with biodegradable substrates have made antimicrobial films a reliable and sustainable packaging solution.

The nanocomposite films segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by technological innovations in film reinforcement and barrier properties. Nanocomposite films offer superior mechanical strength, thermal stability, and controlled release of bioactive compounds, making them increasingly suitable for high-value food and pharmaceutical applications. Their enhanced performance in preserving freshness, reducing spoilage, and supporting functional packaging solutions is driving rapid adoption in both industrial and consumer markets.

- By Material

On the basis of material, the bioactive films market is segmented into polysaccharides, proteins, lipids, synthetic polymers, and biodegradable polymers. The polysaccharides segment dominated the largest market revenue share in 2024, owing to their natural origin, biodegradability, and film-forming capabilities. Polysaccharide-based films are widely used in food and pharmaceutical packaging due to their ability to carry bioactive agents and maintain product integrity. The segment’s leadership is further supported by increasing consumer preference for sustainable and environmentally friendly packaging solutions, along with regulatory encouragement for natural polymer use.

The biodegradable polymers segment is projected to witness the fastest CAGR from 2025 to 2032, driven by growing sustainability concerns and stringent regulations on single-use plastics. Biodegradable polymer-based bioactive films offer eco-friendly packaging alternatives without compromising on functional performance. Their ability to degrade naturally while providing adequate barrier and antimicrobial properties is attracting adoption across food, cosmetic, and pharmaceutical industries seeking to reduce environmental footprint.

- By Application

On the basis of application, the bioactive films market is segmented into food & beverage, healthcare & pharmaceuticals, agriculture, and cosmetics & personal care. The food & beverage segment dominated the largest market revenue share of 44.7% in 2024, driven by the increasing demand for packaged foods with extended shelf life and enhanced safety. Bioactive films are highly valued in this sector for their ability to prevent microbial contamination, reduce spoilage, and maintain sensory qualities. The segment’s prominence is further reinforced by the expansion of organized retail, rising consumer awareness about food safety, and the adoption of functional packaging solutions that integrate antimicrobial and antioxidant properties.

The healthcare & pharmaceuticals segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising need for advanced drug delivery systems, sterile packaging, and controlled-release applications. Bioactive films in this sector enhance product stability, prevent microbial contamination, and support patient safety, thereby driving rapid adoption in hospitals, pharmacies, and pharmaceutical manufacturing. Continuous innovations in film formulations and regulatory support for bioactive packaging are further accelerating growth in this segment.

Bioactive Films Market Regional Analysis

- North America dominated the bioactive films market with the largest revenue share of 37.5% in 2024, driven by increasing demand for sustainable and functional packaging in the food, healthcare, and pharmaceutical sectors

- Consumers in the region are increasingly prioritizing food safety, extended shelf life, and eco-friendly solutions, boosting the adoption of antimicrobial, antioxidant, and nanocomposite films

- This widespread adoption is further supported by strong regulatory frameworks promoting biodegradable and bioactive packaging, high awareness of health and hygiene standards, and the presence of advanced manufacturing infrastructure

U.S. Bioactive Films Market Insight

The U.S. bioactive films market captured the largest revenue share in 2024 within North America, fueled by rising demand for active packaging in the food & beverage and pharmaceutical industries. The market growth is driven by technological innovations in film formulations, such as nanocomposite and polysaccharide-based films, enhancing barrier and antimicrobial properties. Consumers’ increasing preference for eco-friendly packaging and the expansion of organized retail channels are further accelerating market adoption. In addition, government initiatives supporting sustainable packaging solutions are positively impacting the market.

Europe Bioactive Films Market Insight

The Europe bioactive films market is projected to grow at a substantial CAGR during the forecast period, primarily driven by stringent food safety regulations and growing consumer preference for sustainable and functional packaging. The increasing adoption of bioactive films in food, healthcare, and personal care sectors is fostering market expansion. European manufacturers are investing in research and development to enhance the performance of biodegradable and nanocomposite films. The market is also witnessing significant growth in multi-functional packaging applications, including antimicrobial and antioxidant films.

U.K. Bioactive Films Market Insight

The U.K. bioactive films market is expected to grow at a noteworthy CAGR during the forecast period, driven by rising consumer awareness regarding food safety, hygiene, and environmental sustainability. The adoption of antimicrobial and antioxidant films in packaged foods and pharmaceuticals is gaining momentum. In addition, government regulations promoting biodegradable packaging, along with increasing demand for convenience and functional properties in consumer goods, are fueling market growth. Robust research initiatives and collaboration with food manufacturers further stimulate market adoption.

Germany Bioactive Films Market Insight

The Germany bioactive films market is anticipated to expand at a considerable CAGR during the forecast period, fueled by increasing demand for innovative and eco-friendly packaging solutions. Germany’s strong industrial base, regulatory focus on sustainability, and high consumer awareness regarding food safety and pharmaceutical quality are key factors promoting adoption. The integration of bioactive films in advanced food packaging and healthcare applications is driving market growth. Local manufacturers are increasingly investing in high-performance, polysaccharide- and biodegradable polymer-based films to meet consumer and regulatory demands.

Asia-Pacific Bioactive Films Market Insight

The Asia-Pacific bioactive films market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising urbanization, disposable incomes, and awareness of food safety in countries such as China, Japan, and India. The adoption of bioactive films is increasing in the food & beverage, healthcare, and personal care sectors, supported by government initiatives promoting sustainable packaging. In addition, APAC is emerging as a manufacturing hub for bioactive film technologies, making advanced antimicrobial, antioxidant, and nanocomposite films more accessible and affordable to consumers.

Japan Bioactive Films Market Insight

The Japan bioactive films market is growing steadily due to strong consumer demand for food safety, hygiene, and functional packaging in healthcare and personal care products. Technological advancements in polysaccharide-based and nanocomposite films, combined with the country’s focus on eco-friendly solutions, are driving adoption. Aging demographics and preference for convenient, safe, and high-quality packaged goods are further supporting market expansion. Collaboration between manufacturers and research institutions is accelerating innovation in the bioactive films segment.

China Bioactive Films Market Insight

The China bioactive films market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, growing disposable income, and rising demand for safe, functional, and eco-friendly packaging. The food & beverage and pharmaceutical sectors are the primary adopters of antimicrobial and antioxidant films. Government initiatives promoting sustainable packaging, along with strong domestic manufacturing capabilities and research in film technologies, are key factors propelling market growth in China.

Bioactive Films Market Share

The bioactive films industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Sealed Air (U.S.)

- Mondi (U.K.)

- Constantia Flexibles (Austria)

- DuPont De Nemours,Inc (U.S.)

- Toray Industries,Inc (Japan)

- AVERY DENNISON CORPORATION (U.S.)

- Berry Global,Inc. (U.S.)

- LINPAC Packaging Limited (U.K.)

Latest Developments in Global Bioactive Films Market

- In July 2024, Tate & Lyle PLC announced IMCD Mexico as a new partner for the distribution of its ingredients in Mexico. This strategic collaboration is expected to strengthen Tate & Lyle’s market presence in the region by enhancing accessibility to its products for the food and beverage industry. By leveraging IMCD Mexico’s established distribution network, Tate & Lyle can better meet growing regional demand for high-quality, innovative ingredients, which may drive increased adoption of their bioactive and functional components in food applications, thus positively impacting market expansion

- In February 2024, DuPont Teijin Films unveiled its global rebranding to Mylar Specialty Films. This repositioning is aimed at signaling the company’s focus on future growth in differentiated polyester films, enhancing its visibility and brand recognition in the global market. By emphasizing innovation and specialized applications, the rebranding is likely to stimulate demand for high-performance films in sectors such as food packaging, healthcare, and industrial uses, supporting both market penetration and premium product positioning

- In July 2023, a novel biodegradable film was introduced that extends food freshness by incorporating natural components derived from citrus rinds and crustacean exoskeletons. This development has significant implications for the bioactive films market, as it offers a sustainable alternative to traditional packaging while simultaneously enhancing food preservation. The eco-friendly nature of the film aligns with rising consumer and regulatory demand for greener packaging solutions, potentially accelerating adoption in the food and beverage sector and driving innovation-led market growth

- In October 2022, joint research conducted by teams in Portugal and Brazil developed chitosan-based bioactive films infused with lemongrass essential oil (LEO). These films exhibit strong antioxidant and antimicrobial properties, making them suitable for cosmetic applications such as skin masks. This innovation reflects the increasing trend of functional and natural bioactive films in the personal care and cosmetics market. By leveraging the combined benefits of chitosan and LEO, these films offer eco-conscious and effective skincare solutions, potentially boosting demand and influencing market dynamics toward natural, high-value bioactive products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bioactive Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bioactive Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bioactive Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.