Global Bioactive Ingredients In Animal Nutrition Market

Market Size in USD Billion

CAGR :

%

USD

203.89 Billion

USD

337.44 Billion

2024

2032

USD

203.89 Billion

USD

337.44 Billion

2024

2032

| 2025 –2032 | |

| USD 203.89 Billion | |

| USD 337.44 Billion | |

|

|

|

|

Global Bioactive Ingredients in Animal Nutrition Market Size

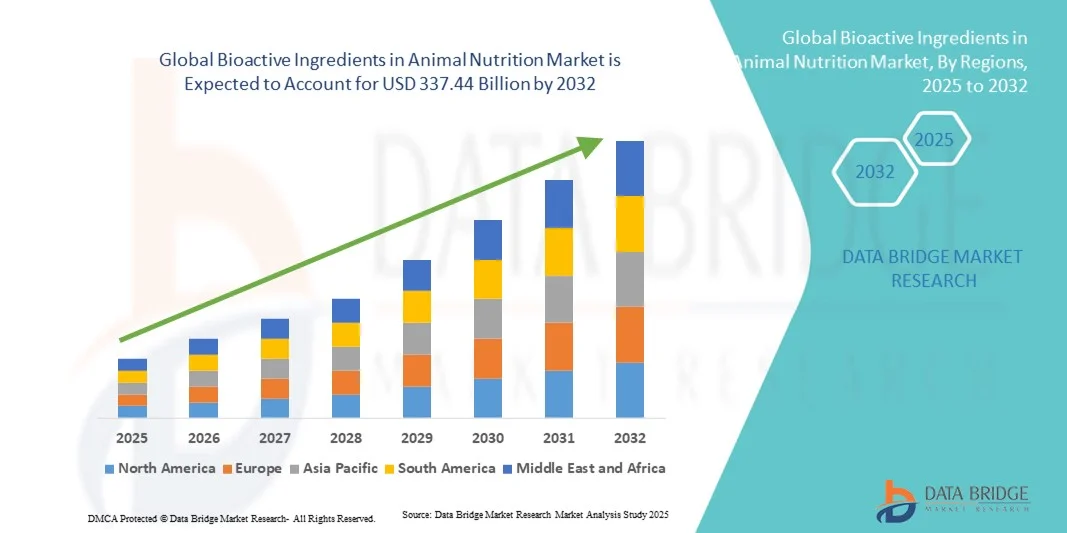

- The global Bioactive Ingredients in Animal Nutrition Market size was valued at USD 203.89 billion in 2024 and is projected to reach USD 337.44 billion by 2032, growing at a CAGR of 6.50% during the forecast period.

- The market expansion is primarily driven by the increasing focus on animal health, performance, and productivity, coupled with the growing use of functional feed additives such as probiotics, enzymes, and antioxidants to enhance feed efficiency and nutrient absorption.

- Additionally, rising awareness of sustainable livestock production and consumer preference for high-quality animal-based products are propelling the demand for bioactive ingredients, thereby accelerating the market’s overall growth trajectory.

Global Bioactive Ingredients in Animal Nutrition Market Analysis

- Bioactive ingredients, encompassing compounds such as probiotics, prebiotics, enzymes, amino acids, and phytogenics, are increasingly vital components of modern animal nutrition due to their role in enhancing gut health, immunity, and overall productivity across livestock and poultry sectors.

- The escalating demand for bioactive ingredients is primarily fueled by the rising focus on animal welfare, the ban on antibiotic growth promoters, and the growing preference for natural and sustainable feed additives that improve feed efficiency and product quality.

- Asia-Pacific dominated the Global Bioactive Ingredients in Animal Nutrition Market with the largest revenue share of 36.1% in 2024, supported by the presence of leading feed manufacturers, robust R&D capabilities, and increased adoption of advanced animal nutrition solutions, with the U.S. showing significant growth in the use of functional feed additives.

- North America is expected to be the fastest-growing region in the Global Bioactive Ingredients in Animal Nutrition Market during the forecast period, driven by rapid urbanization, rising meat consumption, and increased investments in livestock health and productivity.

- The plant-based segment dominated the market with the largest revenue share of 47.6% in 2024, driven by the rising demand for natural, sustainable, and antibiotic-free feed additives.

Report Scope and Global Bioactive Ingredients in Animal Nutrition Market Segmentation

|

Attributes |

Bioactive Ingredients in Animal Nutrition Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Bioactive Ingredients in Animal Nutrition Market Trends

Enhanced Animal Health Through Biotech and Functional Innovation

- A significant and accelerating trend in the Global Bioactive Ingredients in Animal Nutrition Market is the deepening integration of biotechnology, microbiome research, and precision nutrition to enhance feed efficiency, animal performance, and overall health outcomes. This technological fusion is transforming traditional animal nutrition into a more targeted and sustainable science-driven practice.

- For instance, companies such as DSM-Firmenich and BASF SE are leveraging advanced biotech tools to develop next-generation enzymes and probiotics that optimize nutrient utilization and reduce environmental impact. Similarly, Cargill has introduced precision nutrition platforms that analyze real-time animal data to tailor feed formulations for specific growth and health needs.

- Biotech integration enables features such as genome-based ingredient development, improved gut microbiome modulation, and predictive analytics for feed efficiency. For example, certain probiotic strains are now being engineered to enhance immune response and reduce pathogen load, while enzyme innovations are improving fiber and protein digestibility in livestock diets.

- The seamless incorporation of functional bioactives into feed formulations allows producers to achieve multiple objectives—enhanced productivity, reduced antibiotic dependency, and improved sustainability—through a single, integrated nutritional strategy. These innovations are also driving the adoption of data-driven feed solutions, where performance feedback continuously refines ingredient efficacy.

- This trend toward intelligent, science-based, and performance-oriented nutrition is fundamentally reshaping industry standards and expectations in animal health management. Consequently, leading companies such as Evonik Industries and Alltech are investing heavily in R&D to create biologically active compounds that deliver measurable benefits to animal well-being and farm efficiency.

- The demand for biotech-enhanced and functionally advanced bioactive ingredients is rapidly increasing across poultry, swine, and ruminant sectors, as producers and consumers alike prioritize sustainable production, animal welfare, and superior product quality.

Global Bioactive Ingredients in Animal Nutrition Market Dynamics

Driver

Growing Need Due to Rising Focus on Animal Health and Sustainable Nutrition

- The increasing emphasis on animal health, welfare, and sustainable livestock production, coupled with the shift toward antibiotic-free feed formulations, is a significant driver for the heightened demand for bioactive ingredients in animal nutrition.

- For instance, in April 2024, BASF SE announced the expansion of its feed enzyme production facility to meet the rising global demand for natural performance enhancers in livestock diets. Such strategic investments by key companies are expected to fuel market growth over the forecast period.

- As producers and feed manufacturers seek to improve animal performance while ensuring food safety, bioactive ingredients such as probiotics, prebiotics, amino acids, and phytogenics are being increasingly adopted for their ability to enhance gut health, nutrient absorption, and immunity—offering a superior alternative to traditional synthetic additives.

- Furthermore, the growing consumer preference for sustainably sourced and residue-free animal products is driving the inclusion of functional bioactives that support clean-label meat, milk, and egg production, aligning with global sustainability and regulatory goals.

- The benefits of improved feed efficiency, reduced disease incidence, and higher productivity are key factors propelling the adoption of bioactive ingredients across poultry, swine, aquaculture, and ruminant sectors. Additionally, the growing availability of customized nutritional solutions and data-driven feed formulations is further contributing to market expansion.

Restraint/Challenge

High Production Costs and Variability in Efficacy

- Challenges related to the high cost of production, raw material sourcing, and inconsistent performance outcomes in different animal species or environmental conditions pose significant restraints on the broader adoption of bioactive ingredients.

- For instance, fluctuations in the prices of plant-derived compounds and fermentation substrates have made it difficult for some manufacturers to maintain competitive pricing, particularly in cost-sensitive markets across Asia and Africa.

- Addressing these challenges through advanced formulation technologies, standardized testing protocols, and collaborative R&D efforts is crucial for enhancing consistency and cost-effectiveness. Companies such as DSM-Firmenich and Evonik Industries are investing heavily in biotechnology and precision fermentation to optimize ingredient yield and efficacy.

- Additionally, the limited awareness among small and medium-scale farmers regarding the benefits of bioactive ingredients and the lack of clear regulatory frameworks in emerging economies can hinder market penetration.

- Overcoming these barriers through education initiatives, cost-reduction strategies, and technological innovations aimed at improving scalability and stability will be vital for ensuring sustained market growth and wider acceptance of bioactive ingredients in global animal nutrition.

Global Bioactive Ingredients in Animal Nutrition Market Scope

Bioactive ingredients in animal nutrition market is segmented on the basis of source and type.

- By Source

On the basis of source, the Global Bioactive Ingredients in Animal Nutrition Market is segmented into plant-based, animal-based, and microbial-based ingredients. The plant-based segment dominated the market with the largest revenue share of 47.6% in 2024, driven by the rising demand for natural, sustainable, and antibiotic-free feed additives. Plant-derived ingredients such as phytochemicals, essential oils, and polyphenols are increasingly used to enhance gut health, improve feed efficiency, and reduce oxidative stress in livestock. Their wide availability and clean-label appeal also support their dominance in the global market.

The microbial-based segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the expanding use of probiotics, enzymes, and microbial metabolites in precision nutrition. Continuous advancements in microbial biotechnology, along with growing awareness of the benefits of live cultures in improving immunity and digestion, are propelling this segment’s rapid growth across poultry, swine, and ruminant sectors.

- By Type

On the basis of type, the Global Bioactive Ingredients in Animal Nutrition Market is segmented into prebiotics, probiotics, amino acids, peptides and proteins, omega-3 and structured lipids, phytochemicals and plant extracts, minerals, vitamins, fibers and specialty carbohydrates, carotenoids and antioxidants, and others. The probiotics segment dominated the market with the largest market revenue share of 43.2% in 2024, driven by their proven role in improving gut microflora balance, nutrient absorption, and overall animal health. Probiotics are widely adopted as antibiotic alternatives, especially in poultry and swine feed, where they enhance immunity and performance.

The phytochemicals and plant extracts segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the growing preference for natural growth promoters and disease-resistance enhancers. Increasing research on bioactive plant compounds such as flavonoids, alkaloids, and terpenes, along with their integration into feed formulations for improved productivity and sustainability, is expected to significantly drive segment growth.

Global Bioactive Ingredients in Animal Nutrition Market Regional Analysis

- Asia-Pacific dominated the Global Bioactive Ingredients in Animal Nutrition Market with the largest revenue share of 36.1% in 2024, driven by a growing focus on sustainable livestock production, animal welfare, and advanced feed formulations.

- Producers in the region increasingly prioritize high-quality, natural, and functional feed additives such as probiotics, prebiotics, amino acids, and phytochemicals to enhance animal performance, immunity, and overall productivity.

- This widespread adoption is further supported by strong R&D capabilities, high awareness of regulatory standards, and the presence of leading feed additive manufacturers, establishing bioactive ingredients as the preferred solution for poultry, swine, ruminant, and aquaculture nutrition. High disposable incomes among livestock producers and government initiatives promoting antibiotic-free and residue-free animal products also contribute to the region’s market leadership, driving continued growth and innovation in advanced animal nutrition solutions.

U.S. Bioactive Ingredients in Animal Nutrition Market Insight

The U.S. market captured the largest revenue share of 81% in North America in 2024, driven by the growing focus on sustainable livestock production, animal health, and high-performance feed solutions. Producers are increasingly adopting bioactive ingredients such as probiotics, prebiotics, amino acids, and phytochemicals to improve gut health, immunity, and feed efficiency. The presence of leading feed additive manufacturers, strong R&D capabilities, and supportive regulatory frameworks further bolster the market. Additionally, the rising demand for antibiotic-free and residue-free animal products is encouraging widespread adoption across poultry, swine, ruminant, and aquaculture sectors.

Europe Bioactive Ingredients in Animal Nutrition Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, driven by stringent regulations regarding feed safety, animal welfare, and sustainable production practices. Increasing urbanization, rising consumer awareness of clean-label animal products, and the demand for advanced feed additives are fostering market growth. Bioactive ingredients are increasingly incorporated into poultry, swine, and aquaculture feed formulations, supporting productivity, immunity, and product quality.

U.K. Bioactive Ingredients in Animal Nutrition Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, fueled by the increasing demand for high-quality animal nutrition solutions and enhanced livestock health. Concerns regarding food safety and the push for antibiotic-free meat and dairy production are driving adoption of bioactive ingredients. Government initiatives supporting sustainable agriculture and growing awareness among small and medium-scale farmers also contribute to market expansion.

Germany Bioactive Ingredients in Animal Nutrition Market Insight

The Germany market is expected to expand at a considerable CAGR, supported by the country’s advanced livestock sector, focus on innovation, and strict regulatory standards. Producers are increasingly integrating bioactive ingredients, including enzymes, probiotics, and phytogenics, to improve animal performance, health, and product quality. Rising emphasis on sustainability and eco-friendly feed solutions is accelerating market penetration in both poultry and swine industries.

Asia-Pacific Bioactive Ingredients in Animal Nutrition Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and demand for higher-quality animal protein. Countries such as China, India, and Japan are witnessing rapid adoption of bioactive ingredients in livestock and aquaculture feed due to technological advancements and growing awareness of animal health and productivity. Expansion of feed additive manufacturing facilities in the region is also improving accessibility and affordability, further fueling market growth.

Japan Bioactive Ingredients in Animal Nutrition Market Insight

The Japan market is gaining momentum due to its highly developed livestock sector, advanced technological adoption, and strong focus on animal health and feed efficiency. Producers are increasingly incorporating bioactive ingredients into poultry, swine, and aquaculture feed to enhance immunity, gut health, and productivity. The market growth is also supported by regulatory encouragement for residue-free and sustainable feed solutions.

China Bioactive Ingredients in Animal Nutrition Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, a growing middle class, and the expansion of commercial livestock and aquaculture operations. Bioactive ingredients are increasingly adopted to improve feed efficiency, product quality, and disease resistance. Government initiatives promoting sustainable livestock production and strong domestic feed additive manufacturers are key factors propelling market growth across poultry, swine, and aquaculture sectors.

Global Bioactive Ingredients in Animal Nutrition Market Share

The Bioactive Ingredients in Animal Nutrition industry is primarily led by well-established companies, including:

• Cargill Incorporated (U.S.)

• Koninklijke DSM N.V. (Netherlands)

• BASF SE (Germany)

• ADM Animal Nutrition (U.S.)

• DuPont de Nemours, Inc. (U.S.)

• Alltech, Inc. (U.S.)

• Evonik Industries AG (Germany)

• Nutreco N.V. (Netherlands)

• Nuproxa Switzerland Ltd. (Switzerland)

• Novus International, Inc. (U.S.)

• Kemin Industries, Inc. (U.S.)

• Lesaffre Group (France)

• BioMar Group (Denmark)

• Calpis Co., Ltd. (Japan)

• Adisseo (France)

• Orffa International Holding B.V. (Netherlands)

• Beneo GmbH (Germany)

• Olmix Group (France)

• Hansen A/S (Denmark)

• Zinpro Corporation (U.S.)

What are the Recent Developments in Global Bioactive Ingredients in Animal Nutrition Market?

- In April 2023, Cargill, Inc., a global leader in animal nutrition, launched a strategic initiative in South Africa focused on promoting advanced bioactive feed solutions for poultry, swine, and aquaculture. This initiative emphasizes Cargill’s commitment to improving animal health, feed efficiency, and productivity in emerging markets. By leveraging its global expertise in bioactive ingredients and innovative feed formulations, Cargill is addressing regional challenges while reinforcing its position in the rapidly growing Global Bioactive Ingredients in Animal Nutrition Market.

- In March 2023, ADM Animal Nutrition introduced a new line of microbial-based probiotics and prebiotics specifically designed for commercial poultry farms. The innovative formulations are aimed at enhancing gut health, immune response, and overall performance of livestock. This launch highlights ADM’s dedication to developing cutting-edge feed solutions that support sustainable and high-performance animal production.

- In March 2023, DSM Nutritional Products successfully deployed a comprehensive animal health improvement program in India, focusing on the integration of enzymes, amino acids, and omega-3 fatty acids into feed formulations. The initiative underscores DSM’s commitment to leveraging advanced bioactive ingredients to enhance livestock productivity, product quality, and disease resistance, contributing to more sustainable and profitable animal farming.

- In February 2023, Novus International, Inc. announced a strategic partnership with leading poultry and swine cooperatives in the U.S. to create a platform for bioactive ingredient-based feed solutions. This collaboration aims to improve feed efficiency, animal immunity, and overall farm profitability, while facilitating knowledge sharing and innovation in feed technology. The initiative underscores Novus’ commitment to advancing sustainable and effective animal nutrition practices.

- In January 2023, Evonik Industries AG unveiled its new line of specialty amino acids and peptides for livestock nutrition at the International Production & Processing Expo (IPPE) 2023. These innovative products are designed to optimize growth performance, gut health, and protein utilization in poultry, swine, and aquaculture. The launch highlights Evonik’s focus on integrating advanced bioactive ingredients into modern feed formulations, offering producers enhanced productivity, sustainability, and animal welfare benefits.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.