Global Bioactive Milk Compound Market

Market Size in USD Billion

CAGR :

%

USD

4.38 Billion

USD

6.52 Billion

2025

2033

USD

4.38 Billion

USD

6.52 Billion

2025

2033

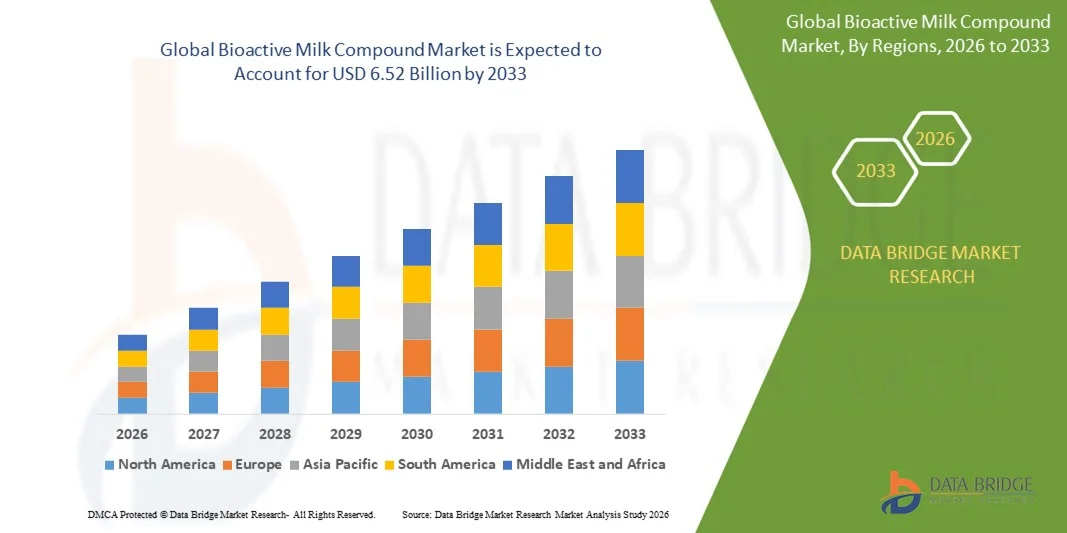

| 2026 –2033 | |

| USD 4.38 Billion | |

| USD 6.52 Billion | |

|

|

|

|

Bioactive Milk Compound Market Size

- The global bioactive milk compound market size was valued at USD 4.38 billion in 2025 and is expected to reach USD 6.52 billion by 2033, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the increasing consumer focus on health, wellness, and preventive nutrition, driving higher demand for functional foods, nutraceuticals, and fortified dairy products containing bioactive milk compounds

- Furthermore, rising awareness of the immune‑boosting, gut-health, and cardiovascular benefits of bioactive proteins, peptides, and lactoferrin is establishing these compounds as essential ingredients in functional and clinical nutrition. These converging factors are accelerating the adoption of bioactive milk compounds, thereby significantly boosting the industry’s growth

Bioactive Milk Compound Market Analysis

- Bioactive milk compounds, including casein and whey proteins, lactoferrin, immunoglobulins, and other peptides, are increasingly incorporated into functional foods, dietary supplements, infant nutrition, and clinical formulations due to their scientifically proven health benefits and versatile applications

- The escalating demand for bioactive milk compounds is primarily fueled by growing health awareness, rising prevalence of lifestyle and immunity-related disorders, and increasing consumer preference for natural, protein-rich, and clinically validated nutritional ingredients

- Asia-Pacific dominated the bioactive milk compound market with a share of around 39% in 2025, due to increasing demand for functional foods, rising health awareness, and a strong presence of dairy production hubs

- North America is expected to be the fastest growing region in the bioactive milk compound market during the forecast period due to robust demand for functional foods, nutraceuticals, and clinical nutrition products

- Casein & whey protein segment dominated the market with a market share of 43.7% in 2025, due to its high nutritional value and widespread use in functional foods and infant formulas. Manufacturers and consumers often prioritize casein & whey proteins for their complete amino acid profile and proven health benefits, including muscle growth and gut health support. The segment also benefits from extensive research validating its bioactive properties and strong integration into dietary supplements and clinical nutrition products. Moreover, its compatibility with diverse processing techniques enhances its adoption across various formulations, including powders, beverages, and protein-enriched snacks

Report Scope and Bioactive Milk Compound Market Segmentation

|

Attributes |

Bioactive Milk Compound Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bioactive Milk Compound Market Trends

Rising Demand for Functional and Immunity-Boosting Dairy Products

- A significant trend in the bioactive milk compound market is the increasing consumer preference for functional foods, nutraceuticals, and fortified dairy products that support immunity, gut health, and overall wellness. This trend is driven by growing health awareness, rising prevalence of lifestyle-related and immunity-related disorders, and a shift toward preventive nutrition strategies across key regions

- For instance, companies such as Arla Foods Ingredients and FrieslandCampina Ingredients are actively developing whey protein fractions and lactoferrin-enriched formulations for functional beverages and fortified foods, providing clinically validated bioactive benefits. Such products are enhancing nutritional profiles and creating differentiation in competitive functional food markets

- The adoption of bioactive milk compounds in infant nutrition is increasing as ingredients such as lactoferrin, immunoglobulins, and bioactive peptides are incorporated into formulas to promote immunity and gut microbiome development. This is positioning bioactive milk compounds as critical components for supporting early-life nutrition and long-term health outcomes

- Functional beverages, sports nutrition products, and dietary supplements are increasingly integrating bioactive milk proteins to meet consumer demands for high-protein, immune-supporting, and recovery-enhancing products. These applications are driving R&D efforts and enabling manufacturers to target multiple consumer segments simultaneously

- The market is witnessing expansion in clinical and therapeutic applications where casein and whey-derived bioactive peptides are used for managing hypertension, cardiovascular health, and metabolic disorders. This rising incorporation is reinforcing the relevance of bioactive milk compounds in health-centric formulations beyond traditional dairy products

- Companies such as Kerry Group and DuPont are leveraging advanced processing techniques to enhance the bioavailability and stability of bioactive proteins, which is further encouraging adoption in functional foods and nutraceuticals. These innovations are strengthening product portfolios and improving consumer accessibility to bioactive ingredients

Bioactive Milk Compound Market Dynamics

Driver

Increasing Consumer Focus on Health, Wellness, and Preventive Nutrition

- The growing emphasis on preventive healthcare and wellness is driving the adoption of bioactive milk compounds across functional foods, dietary supplements, and clinical nutrition products. Consumers are increasingly seeking natural, protein-rich, and clinically validated ingredients that offer immunity enhancement, cardiovascular support, and digestive health benefits

- For instance, Nestlé Health Science has expanded its portfolio with lactoferrin and whey protein-based formulations targeting immunity and gut health, reflecting rising consumer preference for bioactive ingredients in everyday nutrition. Such initiatives are accelerating the market uptake of bioactive milk compounds and fostering partnerships between ingredient suppliers and food manufacturers

- Rising research and clinical validation of bioactive milk proteins by companies such as Fonterra Co-operative Group and Arla Foods are strengthening consumer confidence and promoting product adoption in premium functional food categories

- The demand for protein-fortified and bioactive-enriched products in both developed and emerging markets is pushing manufacturers to innovate and diversify offerings, contributing to the overall growth of the bioactive milk compound industry

- Increasing awareness campaigns and nutritional education initiatives by industry associations and leading manufacturers are supporting consumer understanding of bioactive milk compounds’ health benefits, driving broader market adoption

Restraint/Challenge

High Production Costs

- The bioactive milk compound market faces challenges due to the high production costs associated with sourcing, extraction, and purification of specialized proteins, peptides, and bioactive ingredients. These costs limit large-scale commercial availability and can increase retail prices for functional foods and nutraceutical products

- For instance, companies such as Helaina and Vivici rely on precision fermentation to produce human-identical lactoferrin, which involves advanced biotechnological processes and specialized facilities, elevating overall production costs. Such high-cost production methods restrict accessibility and slow market penetration in price-sensitive regions

- Maintaining consistency, stability, and bioactivity of milk-derived compounds through processing and storage adds additional operational complexity and cost pressures

- The need for stringent quality control, regulatory compliance, and clinical validation further contributes to cost intensity, creating barriers for smaller manufacturers to compete effectively in the bioactive milk compound market

- Balancing performance, efficacy, and economic feasibility remains a critical challenge for manufacturers aiming to scale production while meeting growing consumer demand and maintaining competitive pricing

Bioactive Milk Compound Market Scope

The market is segmented on the basis of type, end-use, and function.

- By Type

On the basis of type, the Bioactive Milk Compound market is segmented into lipids, vitamins & minerals, lactoferrin, enzymes, casein & whey protein, immunoglobulin, and lactose & oligosaccharides. The casein & whey protein segment dominated the market with the largest revenue share of 43.7% in 2025, driven by its high nutritional value and widespread use in functional foods and infant formulas. Manufacturers and consumers often prioritize casein & whey proteins for their complete amino acid profile and proven health benefits, including muscle growth and gut health support. The segment also benefits from extensive research validating its bioactive properties and strong integration into dietary supplements and clinical nutrition products. Moreover, its compatibility with diverse processing techniques enhances its adoption across various formulations, including powders, beverages, and protein-enriched snacks.

The lactoferrin segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising awareness of its immunomodulatory and antimicrobial properties. For instance, companies such as Fonterra and Arla Foods are actively incorporating lactoferrin into infant nutrition and clinical products to enhance immunity. Its multifunctional benefits, including antioxidant, anti-inflammatory, and gut microbiome regulation, drive adoption across nutraceutical and pharmaceutical applications. The segment’s growth is further supported by increasing research investments, product innovation, and growing consumer preference for naturally derived bioactive ingredients.

- By End-Use

On the basis of end-use, the Bioactive Milk Compound market is segmented into pharmaceutical, food and beverage, and nutraceutical applications. The nutraceutical segment dominated the market with the largest revenue share in 2025, driven by increasing consumer demand for preventive healthcare and functional foods enriched with bioactive milk compounds. Nutraceutical manufacturers prioritize these compounds for their proven health benefits, including immunity enhancement, cardiovascular support, and digestive health. The segment also benefits from rising health awareness and changing dietary patterns, which encourage the use of bioactive compounds in fortified foods, dietary supplements, and wellness beverages. Strong collaborations between ingredient suppliers and nutraceutical brands further enhance the availability and adoption of these compounds.

The pharmaceutical segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by expanding clinical research on bioactive milk compounds for therapeutic applications. For instance, Nestlé Health Science and Danone Nutricia are investing in bioactive peptide formulations targeting hypertension, inflammation, and metabolic disorders. Increased regulatory support and growing incorporation into prescription and over-the-counter products drive its adoption. Rising prevalence of lifestyle diseases and focus on functional therapeutics accelerate demand for bioactive compounds in pharma-grade formulations.

- By Function

On the basis of function, the Bioactive Milk Compound market is segmented into anti-hypertensive, antithrombotic, immunomodulating, antistress, antimicrobial, antiviral, anti-tumour, and transport facilitator. The immunomodulating segment dominated the market with the largest revenue share in 2025, driven by its crucial role in enhancing the immune response and overall health. Consumers and healthcare providers prioritize immunomodulating compounds due to their protective effects against infections and support for infant and elderly immunity. The segment benefits from strong scientific evidence supporting efficacy, increasing inclusion in functional foods, nutraceuticals, and infant formulas. Its versatility across oral and clinical applications further supports market dominance and sustained adoption.

The anti-hypertensive segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising incidence of cardiovascular diseases and growing consumer focus on blood pressure management. For instance, companies such as FrieslandCampina and Arla Foods are developing bioactive peptide-based products targeting hypertension management. The segment’s growth is supported by clinical studies validating efficacy, regulatory approvals for health claims, and rising consumer preference for natural alternatives to pharmaceuticals. Increased integration into functional beverages, dairy products, and dietary supplements accelerates its adoption globally.

Bioactive Milk Compound Market Regional Analysis

- Asia-Pacific dominated the bioactive milk compound market with the largest revenue share of around 39% in 2025, driven by increasing demand for functional foods, rising health awareness, and a strong presence of dairy production hubs

- The region’s cost-effective manufacturing landscape, expanding R&D in bioactive ingredients, and growing exports of dairy-based nutraceuticals are accelerating market expansion

- The availability of skilled labor, supportive government policies, and rapid urbanization across developing economies are contributing to increased consumption of bioactive milk compounds in pharmaceutical, nutraceutical, and food applications

China Bioactive Milk Compound Market Insight

China held the largest share in the Asia-Pacific Bioactive Milk Compound market in 2025, owing to its strong dairy industry, increasing functional food production, and active investment in bioactive ingredient research. The country’s industrial base, favorable policies supporting nutritional innovations, and extensive export capabilities for dairy-derived compounds are major growth drivers. Demand is also bolstered by rising consumer preference for immunity-enhancing and protein-enriched products.

India Bioactive Milk Compound Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly growing dairy sector, increasing nutraceutical adoption, and rising investments in functional food infrastructure. Government initiatives promoting nutritional security, such as the National Dairy Plan, are strengthening demand for bioactive milk compounds. In addition, expanding R&D capabilities, growing consumer health awareness, and rising exports of dairy-based nutraceuticals are contributing to robust market expansion.

Europe Bioactive Milk Compound Market Insight

The Europe Bioactive Milk Compound market is expanding steadily, supported by stringent regulatory frameworks, high demand for high-quality functional ingredients, and growing investments in nutraceutical production. The region emphasizes product safety, environmental compliance, and clinical validation of bioactive compounds, particularly in pharmaceuticals and fortified foods. Increasing incorporation of bioactive milk compounds in health-focused dietary products is further enhancing market growth.

Germany Bioactive Milk Compound Market Insight

Germany’s market is driven by its advanced dairy and pharmaceutical manufacturing, strong R&D networks, and export-oriented production model. The country has well-established collaborations between academic institutions and industry, fostering continuous innovation in bioactive milk compounds. Demand is particularly strong for immunomodulating and protein-based formulations for clinical nutrition and functional foods.

U.K. Bioactive Milk Compound Market Insight

The U.K. market is supported by a mature life sciences and nutraceutical industry, growing focus on preventive healthcare, and increased demand for fortified and functional dairy products. With rising emphasis on R&D, clinical trials, and partnerships between academia and industry, the U.K. continues to play a significant role in high-value bioactive milk compound development and commercialization.

North America Bioactive Milk Compound Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust demand for functional foods, nutraceuticals, and clinical nutrition products. A strong focus on wellness trends, advancements in dairy processing technology, and increasing consumer preference for immunity and heart-health products are boosting demand. Rising collaborations between food, pharmaceutical, and nutraceutical companies are supporting market expansion.

U.S. Bioactive Milk Compound Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive dairy and nutraceutical industry, strong R&D infrastructure, and significant investment in bioactive ingredient production. The country’s focus on innovation, regulatory compliance, and clinical validation is encouraging the use of bioactive milk compounds in functional foods, dietary supplements, and pharmaceutical formulations. Presence of key players and a mature distribution network further solidify the U.S.'s leading position in the region.

Bioactive Milk Compound Market Share

The bioactive milk compound industry is primarily led by well-established companies, including:

- ADM (U.S.)

- DuPont (U.S.)

- Kerry Group (Ireland)

- Corbion (Netherlands)

- BASF SE (Germany)

- Arla Foods Ingredients (Denmark)

- Glanbia plc (Ireland)

- Fonterra Co‑operative Group (New Zealand)

- FrieslandCampina Ingredients (Netherlands)

- Ingredion Incorporated (U.S.)

- Milk Specialties Global (U.S.)

- AMCO Proteins (U.S.)

- Saputo Inc. (Canada)

- Synlait (New Zealand)

- Perfect Day (U.S.)

Latest Developments in Global Bioactive Milk Compound Market

- In September 2025, Desert Harvest launched the first menopause supplement containing human‑identical lactoferrin developed by Helaina, establishing a new category of bioactive milk protein applications by targeting hormonal health, immune support, and gut compatibility in women transitioning through menopause. This development broadens the market’s reach beyond traditional nutrition and functional foods and signals growing clinical adoption of precision‑fermented ingredients

- In September 2024, Helaina secured $45 million in Series B funding to accelerate production and commercialization of its human‑equivalent lactoferrin ingredient. The investment enables broader distribution through partnerships with consumer brands, expands ingredient availability for functional foods, beverages, and supplements, and reinforces investor confidence in precision‑fermented bioactive proteins as high‑growth nutrition solutions

- In March 2024, Triplebar Bio and FrieslandCampina Ingredients advanced their multi‑year precision fermentation partnership to co‑produce lactoferrin. This strategic collaboration aims to scale sustainable, high-value bioactive proteins, reduce reliance on traditional dairy extraction, and increase global supply for applications in infant nutrition, immune health, and functional products, supporting overall market growth

- In 2025, Vivici B.V., backed by €32.5 million in Series A funding, prepared to launch its fermentation‑derived lactoferrin ingredient globally. This positions the company to introduce scalable, animal‑free bioactive proteins into infant formula, supplements, and active nutrition markets, aligning with sustainability trends and expanding product formulation options for manufacturers

- In 2025, Australian biotech All G formed a strategic joint venture with Armor Protéines to commercialize precision‑fermented milk proteins, including recombinant lactoferrin. This initiative represents a major step toward scalable bio‑identical milk protein production, potentially lowering costs, increasing availability, and enabling novel high-nutrition products across infant formula and adult health segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bioactive Milk Compound Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bioactive Milk Compound Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bioactive Milk Compound Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.