Global Biodefense Market

Market Size in USD Billion

CAGR :

%

USD

19.27 Billion

USD

30.48 Billion

2025

2033

USD

19.27 Billion

USD

30.48 Billion

2025

2033

| 2026 –2033 | |

| USD 19.27 Billion | |

| USD 30.48 Billion | |

|

|

|

|

Biodefense Market Size

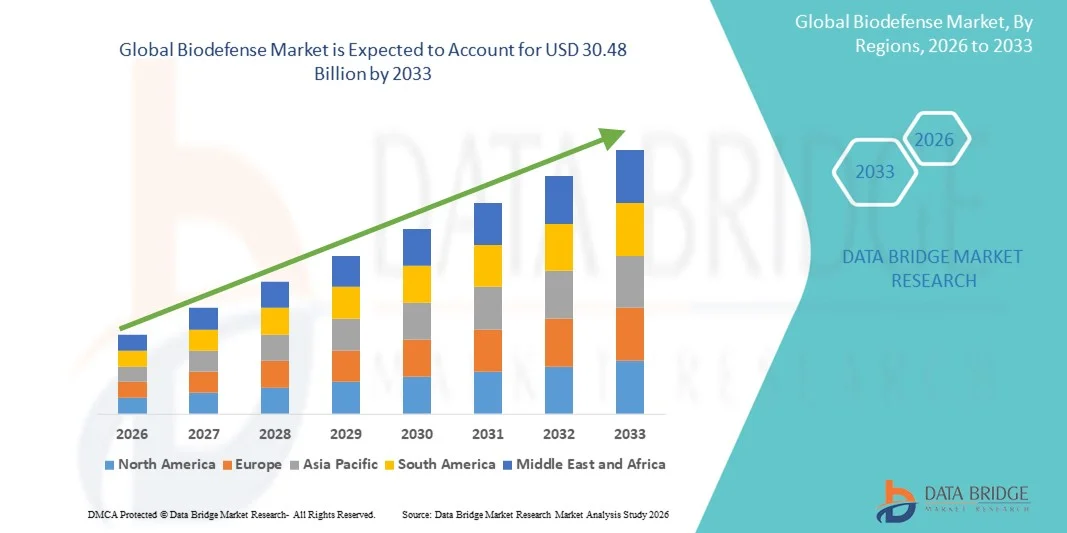

- The global biodefense market size was valued at USD 19.27 billion in 2025 and is expected to reach USD 30.48 billion by 2033, at a CAGR of 5.90% during the forecast period

- The market growth is largely fueled by increasing global concerns about biological threats both natural and man‑made prompting governments and organizations worldwide to invest in countermeasures: vaccines, rapid diagnostics, detection devices, decontamination systems, and surveillance infrastructure

- Furthermore, rising demand for preparedness, public health security, and robust bio‑surveillance along with technological advances in biotechnology, diagnostics, and detection systems is establishing biodefense as a critical component of national security and global health infrastructure

Biodefense Market Analysis

- Biodefense, encompassing vaccines, biothreat detection devices, and decontamination solutions, is increasingly vital for national security and public health in both civilian and military settings due to its enhanced preparedness capabilities, rapid response potential, and integration with global bio-surveillance and healthcare systems

- The escalating demand for biodefense solutions is primarily fueled by increasing concerns about pandemics, emerging infectious diseases, and bioterrorism, alongside growing government and institutional investments in surveillance, rapid countermeasure deployment, and public health infrastructure

- North America dominated the biodefense market with the largest revenue share of 43.4% in 2025, characterized by substantial government funding, advanced R&D infrastructure, and a strong presence of key biotech and defense companies, with the U.S. experiencing substantial growth in vaccine production, deployment of detection devices, and hospital preparedness programs

- Asia-Pacific is expected to be the fastest-growing region in the biodefense market during the forecast period due to rising public health investments, increasing awareness of biological threats, expanding biosurveillance networks, and government initiatives to strengthen national biodefense infrastructure

- The Anthrax segment dominated the biodefense market with a market share of 29.1% in 2025, driven by its critical role in national security preparedness and widespread adoption across hospitals, military facilities, and research organizations

Report Scope and Biodefense Market Segmentation

|

Attributes |

Biodefense Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Biodefense Market Trends

Advanced Threat Detection and Rapid Response Technologies

- A significant and accelerating trend in the global biodefense market is the integration of advanced biosensors, AI-powered threat detection, and real-time monitoring systems, enhancing preparedness and rapid response against biological threats

- For instance, Biocatch Technologies has developed AI-enabled pathogen detection platforms capable of identifying biohazards in real time, allowing for faster containment and mitigation of potential outbreaks

- AI integration in biodefense enables predictive threat analysis, pattern recognition of pathogen spread, and intelligent alert systems to flag unusual biological activities. For instance, some Thermo Fisher detection systems utilize AI to improve pathogen identification accuracy and notify public health agencies automatically

- The seamless integration of detection devices with digital reporting and public health infrastructure facilitates centralized monitoring of biohazards and coordinated response strategies across hospitals, research organizations, and military units

- This trend towards more intelligent, automated, and interconnected biodefense solutions is fundamentally reshaping expectations for national security and public health preparedness. Consequently, companies such as Emergent BioSolutions are developing AI-enabled detection and vaccine platforms with rapid deployment capabilities

- The demand for biodefense systems offering predictive analytics, rapid detection, and automated reporting is growing rapidly across both public and private sectors, as governments increasingly prioritize biosecurity and pandemic preparedness

- The rising use of portable and field-deployable detection devices allows rapid on-site testing during outbreaks, reducing response time and enhancing containment efforts. For instance, handheld PCR devices are now deployed in military and remote healthcare settings

- The trend of integration with global data-sharing networks is enabling real-time pathogen mapping and threat intelligence exchange, improving global situational awareness. For instance, several vaccine and diagnostic platforms now report anonymized outbreak data to WHO-supported networks

Biodefense Market Dynamics

Driver

Rising Global Biological Threat Awareness and Government Investments

- The increasing awareness of bioterrorism risks, pandemics, and emerging infectious diseases, coupled with rising government and institutional funding, is a significant driver for the heightened demand for biodefense solutions

- For instance, in March 2025, the U.S. Department of Health and Human Services allocated additional funding to strengthen vaccine stockpiles and deploy AI-based pathogen detection systems nationwide

- As governments and healthcare institutions become more aware of potential biological threats, biodefense systems offer advanced solutions such as rapid diagnostics, early warning alerts, and vaccine countermeasure deployment

- Furthermore, the growing emphasis on public health security and preparedness is making biodefense systems an integral component of national safety strategies, providing coordinated protection against biohazards

- The availability of modular, scalable detection and vaccine systems, along with increased adoption of integrated biosurveillance platforms, is a key factor propelling the uptake of biodefense solutions in both civilian and military sectors

- Increasing collaborations between private biotech firms and public health agencies to accelerate R&D and deployment of vaccines and detection systems are driving market growth. For instance, joint ventures for rapid Anthrax vaccine development are being prioritized in North America and Europe

- Rising global concern over zoonotic diseases and spillover events is encouraging investment in early-warning detection technologies and stockpiling of preventive countermeasures. For instance, several Asian nations are expanding surveillance of high-risk wildlife and livestock pathogens

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The high development and deployment costs of advanced biodefense systems, combined with stringent regulatory and compliance requirements, pose a significant challenge to broader market penetration

- For instance, regulatory approvals for novel vaccines or detection devices can take several years, delaying market entry and increasing operational expenses for companies

- Addressing these challenges through streamlined regulatory pathways, government incentives, and cost-effective production methods is crucial for encouraging adoption. Companies such as Emergent BioSolutions emphasize their compliance capabilities and scalable manufacturing processes in marketing strategies to reassure stakeholders

- In addition, budget constraints in developing nations and limited healthcare infrastructure can hinder widespread adoption of biodefense technologies, despite increasing awareness of biological threats

- Overcoming these barriers through enhanced public-private partnerships, cost-sharing initiatives, and localized manufacturing will be vital for sustained growth and global preparedness against biological hazards

- The complexity of coordinating biodefense programs across multiple agencies and international borders can slow deployment and limit market efficiency. For instance, discrepancies in safety standards and reporting requirements between countries create operational challenges

- Limited skilled workforce and technical expertise for operating advanced biodefense systems poses an adoption hurdle, particularly in emerging markets. For instance, handling high-containment labs and AI-powered detection platforms requires specialized training that is often in short supply

Biodefense Market Scope

The market is segmented on the basis of vaccine type, biothreat detection device, end-users, and distribution channel.

- By Vaccine Type

On the basis of vaccine type, the biodefense market is segmented into botulism, anthrax, radiation/nuclear, smallpox, and others. The Anthrax vaccine segment dominated the market with the largest market revenue share of 29.1% in 2025, driven by its critical role in national security and military preparedness. Governments and defense agencies prioritize Anthrax vaccination programs due to its potential use in bioterrorism, leading to strong procurement contracts. Hospitals and research organizations also adopt Anthrax vaccines as part of high-risk pathogen preparedness strategies. The segment benefits from continuous R&D investments to improve efficacy and reduce adverse effects, further enhancing adoption. In addition, Anthrax vaccines are integrated into stockpiling initiatives across North America and Europe, ensuring stable demand. Its well-established regulatory approval pathway and historical usage also make it a reliable segment for government-led programs.

The Botulism vaccine segment is anticipated to witness the fastest growth rate of 15.4% from 2026 to 2033, fueled by increasing bioterrorism concerns and the rising awareness of foodborne and laboratory-related Botulism risks. Advanced formulations and easier administration methods are enhancing adoption in hospitals and military research centers. Emerging economies are gradually investing in Botulism vaccine stockpiles due to rising public health awareness. Strategic collaborations between biotech companies and government agencies are also accelerating development and deployment. Moreover, Botulism vaccines are being included in broader biodefense initiatives targeting multi-threat preparedness, contributing to rapid growth.

- By Biothreat Detection Device

On the basis of biothreat detection device, the market is segmented into samplers, assays, identifiers, detectors/triggering devices, and others. The Detectors/Triggering Devices segment dominated the market in 2025 with the largest revenue share, driven by their ability to provide real-time alerts and automated response capabilities against biohazards. Detectors are widely deployed in hospitals, airports, military bases, and research laboratories to ensure rapid threat containment. Continuous technological upgrades, such as AI-enabled analytics and IoT connectivity, enhance detection accuracy and efficiency. The segment benefits from strong government contracts for homeland security and military applications. User-friendly interfaces and compatibility with integrated bio-surveillance networks further support adoption. Demand is also fueled by the increasing requirement for early-warning systems in urban and high-risk environments.

The Assays segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing need for rapid, high-sensitivity testing and pathogen identification. Assays are crucial in laboratories, hospitals, and field-testing scenarios, allowing for early intervention in outbreaks. Technological advancements, such as multiplex and point-of-care assays, are increasing throughput and usability. Expansion in research organization initiatives and government-funded diagnostic programs contributes to high adoption rates. Portable and cost-effective assay solutions are also being developed to cater to emerging economies. Growing public health awareness and regulatory support for rapid diagnostics further accelerate growth.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, military, ambulatory care centers, research organizations, and others. The Military segment dominated the market with the largest share in 2025, owing to its critical focus on biosecurity and bioterrorism prevention. Military agencies globally invest in vaccines, detection systems, and training programs for rapid threat mitigation. Government contracts for large-scale procurement and stockpiling drive substantial revenue in this segment. Integration of biodefense infrastructure with operational protocols ensures higher adoption. Military end-users also benefit from dedicated R&D initiatives and collaborations with biotech firms. The segment’s strategic importance and long-term procurement cycles make it a stable driver of market revenue.

The Hospitals segment is expected to witness the fastest growth rate from 2026 to 2033, propelled by rising awareness of infectious disease threats and the need for rapid detection and response capabilities. Hospitals are increasingly adopting vaccines and detection devices to protect staff and patients. Expansion of hospital networks in emerging economies and urban centers supports growth. Integration of detection devices with hospital information systems and electronic medical records improves operational efficiency. Public-private partnerships and government funding initiatives accelerate adoption. Technological advancements in user-friendly diagnostic and vaccine solutions further drive the growth of hospitals as a key end-user segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The Hospital Pharmacy segment dominated the market with the largest revenue share in 2025, driven by direct supply of vaccines and detection devices to healthcare facilities. Hospital pharmacies ensure controlled distribution, proper storage, and trained personnel for handling sensitive biodefense products. The segment benefits from strong relationships with government procurement agencies and long-term contracts. Hospitals prefer this channel for timely and regulated supply of critical vaccines. Adoption is also supported by compliance with stringent regulatory standards and biosecurity protocols. Continuous growth in hospital infrastructure across developed and developing regions ensures steady revenue generation.

The Online Pharmacy segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the increasing demand for convenient and remote access to vaccines and medical countermeasures. Digital platforms facilitate rapid ordering, inventory management, and delivery for both healthcare providers and research institutions. The segment benefits from improvements in cold-chain logistics and secure handling technologies. Rising public health awareness and government-backed digital initiatives promote adoption. Online pharmacies also allow smaller hospitals and clinics in remote areas to access specialized biodefense products efficiently. Integration with telehealth services further enhances the growth of this segment.

Biodefense Market Regional Analysis

- North America dominated the biodefense market with the largest revenue share of 43.4% in 2025, characterized by substantial government funding, advanced R&D infrastructure, and a strong presence of key biotech and defense companies, with the U.S. experiencing substantial growth in vaccine production, deployment of detection devices, and hospital preparedness programs

- Governments and institutions in the region prioritize biosecurity, pandemic preparedness, and military readiness, leading to widespread adoption of vaccines, biothreat detection devices, and integrated biosurveillance solutions

- This strong regional presence is further supported by advanced R&D infrastructure, high public health awareness, and the growing focus on AI-enabled threat detection and rapid response technologies, establishing North America as a leader in global biodefense preparedness for both civilian and military applications

U.S. Biodefense Market Insight

The U.S. biodefense market captured the largest revenue share of 38% in 2025 within North America, fueled by substantial government funding, strategic stockpiling of vaccines, and widespread deployment of biothreat detection devices. Institutions are increasingly prioritizing pandemic preparedness, national security, and rapid response capabilities against biological threats. The growing integration of AI-enabled detection systems, advanced diagnostics, and rapid vaccine development platforms further propels the market. In addition, the emphasis on hospital and military preparedness programs strengthens adoption. Public-private partnerships and large-scale federal contracts are also driving growth. The U.S. continues to lead in R&D for next-generation biodefense solutions, reinforcing its dominant position.

Europe Biodefense Market Insight

The Europe biodefense market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising governmental investment in public health security and preparedness against pandemics and bioterrorism. The increasing adoption of advanced detection systems, vaccines, and integrated biosurveillance networks is fostering market growth. European nations are focusing on pandemic response infrastructure, early-warning systems, and emergency stockpiling. The presence of well-established biotech companies and research institutions enhances technological adoption. The market is witnessing growth across hospitals, research organizations, and defense agencies. Strong regulatory frameworks and cross-border collaborations also support expansion.

U.K. Biodefense Market Insight

The U.K. biodefense market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government initiatives for biosecurity and public health emergency preparedness. The increasing awareness of bioterrorism risks and emerging infectious diseases encourages adoption of vaccines, detection devices, and rapid response solutions. Integration of biodefense systems with hospital networks and research organizations is gaining traction. The U.K.’s focus on technological innovation and strategic partnerships further stimulates growth. Emergency preparedness programs across both civilian and military sectors promote market expansion. Strong public health infrastructure supports efficient deployment of advanced biodefense measures.

Germany Biodefense Market Insight

The Germany biodefense market is expected to expand at a considerable CAGR during the forecast period, fueled by heightened awareness of biological threats and government-led preparedness initiatives. Germany’s emphasis on innovation, research, and technological adoption encourages deployment of vaccines, detection devices, and surveillance solutions. Hospitals, research centers, and military facilities are increasingly implementing integrated biosurveillance systems. The strong regulatory framework ensures safe and effective deployment of biodefense products. Germany’s public health and defense agencies actively collaborate with biotech firms to advance preparedness strategies. Demand for eco-conscious and high-efficiency biodefense technologies is also growing.

Asia-Pacific Biodefense Market Insight

The Asia-Pacific biodefense market is poised to grow at the fastest CAGR of 16% during 2026–2033, driven by rising public health investments, increasing awareness of infectious disease threats, and rapid urbanization in countries such as China, India, and Japan. Government initiatives to strengthen biosurveillance, pandemic preparedness, and rapid-response infrastructure are accelerating adoption. Technological advancements in AI-based detection devices and rapid vaccine deployment platforms support market expansion. The presence of research institutions and public-private collaborations enhances growth. Emerging economies are increasingly stockpiling vaccines and biothreat detection systems. Rising demand from hospitals, military, and research organizations contributes to market momentum.

Japan Biodefense Market Insight

The Japan biodefense market is gaining momentum due to the country’s focus on high-tech healthcare, urbanization, and preparedness against infectious disease outbreaks. Adoption of vaccines, advanced detection devices, and AI-enabled biosurveillance platforms is increasing across hospitals, research institutions, and defense facilities. Japan emphasizes rapid response infrastructure for both civilian and military applications. Integration with digital health and IoT-based monitoring systems enhances operational efficiency. Government initiatives promoting national biosecurity are accelerating growth. The aging population also drives demand for reliable and user-friendly biodefense solutions.

India Biodefense Market Insight

The India biodefense market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to expanding government funding, growing public health awareness, and rapid technological adoption. India is strengthening biosurveillance networks, emergency vaccine stockpiles, and rapid-response systems across hospitals, research centers, and military facilities. Public-private partnerships and domestic biotech manufacturers are contributing to market expansion. The push towards smart health infrastructure and pandemic preparedness further supports growth. Affordable biodefense solutions and local production capacity enhance accessibility. Rising investments in training and awareness programs are driving adoption across the country.

Biodefense Market Share

The Biodefense industry is primarily led by well-established companies, including:

- EMERGENT (U.S.)

- Dynavax Technologies (U.S.)

- SIGA Technologies (U.S.)

- Bavarian Nordic (Denmark)

- Ichor Medical Systems (U.S.)

- XOMA Royalty Corporation (U.S.)

- Altimmune (U.S.)

- Elusys (U.S.)

- DynPort Vaccine Company (U.S.)

- Cleveland BioLabs (U.S.)

- Ology Bioservices (U.S.)

- Alnylam Pharmaceuticals (U.S.)

- PharmAthene (U.S.)

- Soligenix (U.S.)

- Nanotherapeutics (U.S.)

- GSK plc (U.K.)

- Sanofi (France)

- Bio‑Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- Smiths Detection Group Ltd. (U.K.)

What are the Recent Developments in Global Biodefense Market?

- In July 2025, a new electrochemical biosensor technique for rapid detection of Bacillus anthracis (anthrax) spores was reported, capable of delivering a detection signal in under 15 minutes. The method based on a selective immune reaction on thiol‑modified electrodes offers fast on-site biohazard detection, strengthening rapid response capabilities against biothreats

- In June 2025, Portal Biotech a UK‑based biotech startup secured USD 35 million in Series A funding, co‑led by NATO Innovation Fund, to scale its AI‑powered portable protein‑sequencing sensors. The tools are designed to detect engineered pathogens at single‑molecule level in the field a significant boost to global biosecurity and biodefense readiness

- In January 2025, researchers at Rocky Mountain Laboratories (U.S.) announced a promising single‑dose vesicular stomatitis virus (VSV) based vaccine that provided full protection to mice against Crimean-Congo hemorrhagic fever virus (CCHFV), including genetically distinct strains marking a significant advance toward a broadly protective vaccine against a high-fatality, tick‑borne hemorrhagic fever that poses regional outbreak risks

- In November 2024, Oxford Nanopore Technologies partnered with UK health agencies including NHS England, Genomics England and UK Biobank to launch what is described as the world’s first real-time pandemic early‑warning system expanding its “Respiratory Metagenomics” programme to up to 30 NHS sites so that dangerous pathogens (viruses/bacteria) can be identified within six hours of sample collection

- In March 2024, Emergent BioSolutions announced fresh funding support from the U.S. health‑security agency (BARDA) to expand manufacturing capacity for anthrax and smallpox vaccines under emergency preparedness initiatives reinforcing national stockpiling efforts and boosting global biodefense supply readiness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.